Bankless:BTC 会追随 TradFi 的涨幅吗?

作者:Jack Inabinet 来源:Bankless 翻译:善欧巴,金色财经

近日,标准普尔500指数强势反弹,自上周四的低点起上涨了3.7%,并在本周继续攀升。随着传统金融市场的反弹,加密货币市场本周开始或许会平稳,但这是否预示着未来将迎来新的收益呢?

尽管周一比特币未随着股市上涨,但仍比上周四的部分低点上涨了12%,目前正试图突破50日指数移动平均线(EMA)。而这一技术阻力位正是传统金融指数在4月底难以突破的水平。

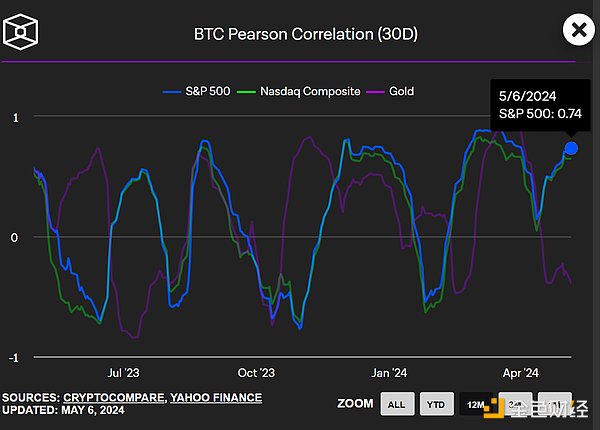

最近几周,比特币和主要指数之间的相关性增强,表明这些不同资产类别的价格变动可能朝着同一方向发展。如果指数持续上涨,并且相关性得以保持,那么比特币价格很快就可能会开始上涨。

突破50日均线可能意味着什么?

一旦成功突破50日均线,比特币将有望突破自4月中旬以来一直阻碍多头的6.5万美元阻力位,将价格完全推高至区间中值以上,并为再次测试7.2万美元区间顶部铺平道路!

比特币永续掉期合约:看涨还是看跌?

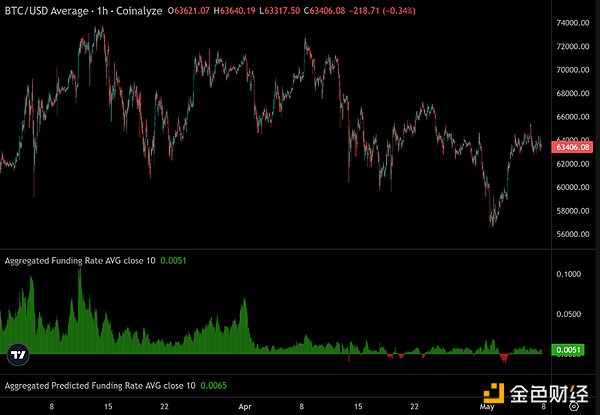

周四,比特币永续掉期合约出现了今年以来最长、最深度的负资金费率期(即融券方支付给融币方),这与近期对杠杆的需求出现了异常背离。尽管资金费率已再次转为正值,但对多头来说,这并不像3月底那样成为问题,因为维持多头仓位的费用水平仍然在“健康”范围内。

较低的资金费率减少了基于时间的强制平仓风险,并可能增加了对多头仓位的需求。然而,整个4月份资金费率的持续压缩以及最近一次下跌的负幅度加大,表明我们可能正在过渡到结构性较低资金费率的时期。这种转变可能会伴随价格的下跌。

总结

毫无疑问,如果我们希望维持自2022年熊市末期以来一直支撑价格上涨趋势,市场价格就应该反弹。然而,值得注意的是,在创下新的历史新高之前,可能会出现一次回调,这将确认我们已经进入市场的另一个阶段……

Recently, the Standard & Poor's index rebounded strongly from last Thursday's low point and continued to climb this week. With the rebound of the traditional financial market, the cryptocurrency market may start to be stable this week, but does this indicate that new profits will be ushered in in the future? Although Bitcoin did not rise with the stock market on Monday, it still rose from some of last Thursday's low points. At present, it is trying to break through the moving average of the daily index, which is the technical resistance level that the traditional financial index is difficult to achieve at the end of the month. The level of breakthrough The increase in correlation between Bitcoin and major indexes in recent weeks indicates that the price changes of these different asset classes may develop in the same direction. If the indexes continue to rise and the correlation is maintained, the price of Bitcoin may soon start to rise. What does it mean for Bitcoin to break through the moving average? Once it successfully breaks through the moving average, Bitcoin is expected to break through the resistance level of $10,000, which has been hindering bulls since the middle of the month, pushing the price completely above the middle of the range and Re-test paving the way at the top of the $10,000 range. Is the bitcoin perpetual swap contract bullish or bearish? On Thursday, the bitcoin perpetual swap contract showed the longest and deepest negative capital rate period this year, that is, the securities lender paid the money lender, which was an abnormal departure from the recent demand for leverage. Although the capital rate has turned positive again, it is not a problem for bulls as it was at the end of the month, because the cost level of maintaining long positions is still in a healthy range, and the lower capital rate has been reduced based on. The risk of forced liquidation in time may also increase the demand for long positions. However, the continuous compression of the capital rate throughout the month and the increase of the negative rate of the latest decline indicate that we may be in a period of transition to a structurally low capital rate, which may be accompanied by a decline in prices. To sum up Bitcoin, there is no doubt that if we want to maintain the upward trend of prices since the end of the bear market in, the market price should rebound. However, it is worth noting that there may be a callback before hitting a new historical high, which will confirm that we have entered another stage of the market. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。