Base 向上 BSC 向下

CapitalismLab报道 来源:X,@NintendoDoomed

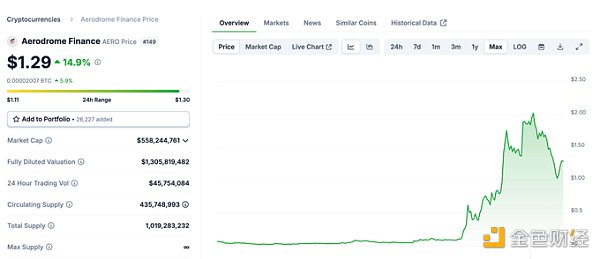

Aerdrome价格已经经历了一轮上涨,Base以其独特力量支持了一种市值高达10亿美元,全球排名前百的代币,展现了其实力。这不仅展示了其强大的实力,而且带来的正面外部影响也进一步激活了Base的生态系统。

相比之下,BSC在这一轮中即使风声落地也没有什么动静,究竟差距在哪里?本文将以此为切入点,深入探讨本轮两个中心化交易所在链上所展现的差距。

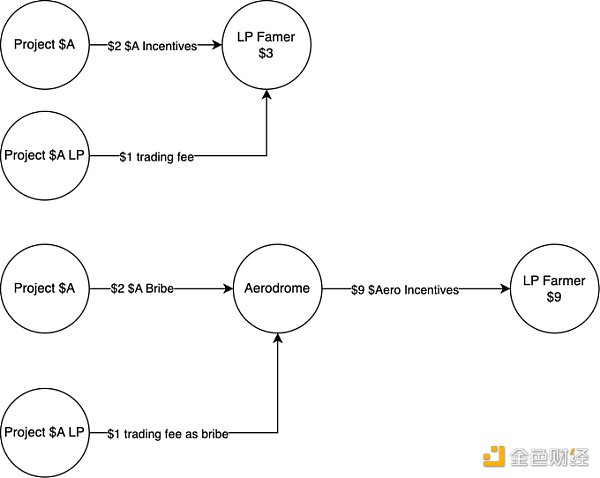

Coinbase之所以选择支持Aero,原因非常简单,就如下图所示。在过去,项目直接激励DeFi矿工,例如一个价值2美元的项目代币,矿工可能会额外从DEX交易费中再获得1美元,总共获得3美元。

然而,在Aero这样的Ve(3,3) DEX体系下,这3美元被用来贿赂veAero,veAERO将Aero代币(价值更高,例如9美元)分配给矿工。

最终,项目方仍然支付了3美元,veAero(Aero锁定)获得了3美元的实际收益,而矿工则获得了9美元的激励,激励翻了一番。

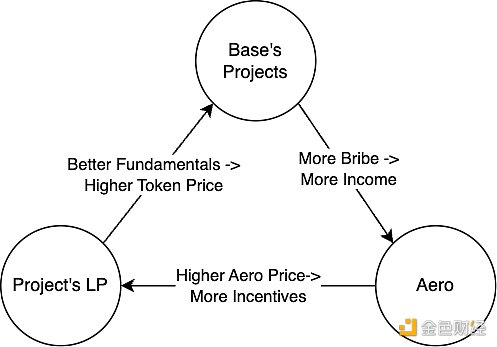

Aero价格越高,发放的激励价值就越高,Base生态项目能够享受的激励也越高,生态项目的基本面也随之增强。给Aero的贿赂代币价值也越高,Aero的收入也越高,价格也更具看好性,形成了正向循环。

此外,如果Base直接激励链上项目,一方面容易变成链下关系,另一方面也不便公开激励那些土狗和模因项目,而这些项目具有流量。通过支持Aero,实现了链上生态的无许可激励,因为任何项目都可以通过Aero进一步放大激励效果,这种做法给普通开发者带来的收益是官方激励无法比拟的。

回头看BSC,是否有类似的产品?答案是肯定的,并且从开发者和产品层面来看都可以说比Base更强一筹。

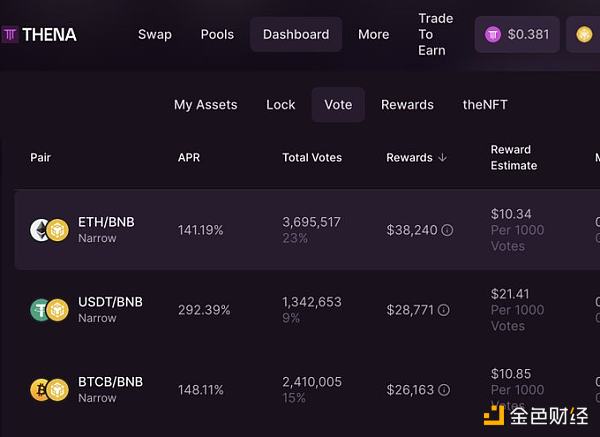

Thena可以看作是Aerodrome的增强版,支持V3集中流动性。

Pancake + Cakepie的双轮驱动更能发挥更强的正向循环效应,其天花板也更高。

尽管过去我们批评了 Cake War 组织不如 Pendle War(涉嫌自吹自擂),而 Pancake 的更新也相对缓慢,迟迟未能完成搭建飞轮。再加上不先进的 ve(3,3) 交易费分配给选民,反而让团队通过手动干预获取了一部分投票权(权力的诱惑,谁舍得放手呢)。

但横向比较,虽略有不足,却远胜下层。比如 ARB 的领头羊 Camelot,在呼喊了一年后仍未在投票规模上进行分配激励。

Cakepie/Magpie 团队在 BSC 上的能力十分罕见,在其他链的 subDAO 上也非常成功。虽然 Thena 在其他链上尚未证明自身,但从产品角度来看,速度和质量都超过了 Velo/Aero 系列。

既然在 BSC 上这些产品和开发者基础更强,为何却没有达到类似于 Base 的成就?甚至这一轮 Mantle 的 ve(3,3) DEX Moe 都能搅动一些波澜,而 BSC 却无动于衷?

只要稍加研究,就会惊讶地发现,币安对此支持不是零,而是负面的… 是负面的…

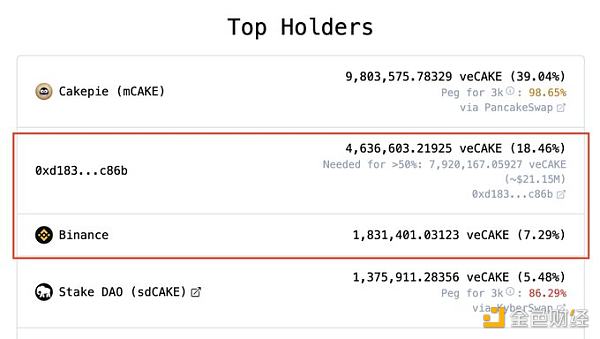

没错,一方面上述项目没有像 Aero 那样获得投资和上币的支持,另一方面如图所示,明显带有币安标记的地址和另一个被推测为币安的地址(根据 Cake 社区的猜测)共同锁定了 26% 的 veCAKE,直接与生态项目争夺利益。毕竟每轮的分红和激励都是有限的,币安手中所持的增多,生态项目手中的就会减少。

Pancake 团队拿走一大半的投票权,币安再拿走另一部分,效果立即大打折扣。通常情况下这些都是用于支持生态项目的,但现在不但没有支持生态,反而直接与生态项目抢夺利润,币安难道还缺少 Pancake 的收入分红吗…