LD Capital:中国股市成为香饽饽 温和的发债计划或带来乐观主义

上周的大企业财报、GDP数据以及美联储关注的通胀指标等经济信息成为投资者的关注点,考虑到信息的海量涌入,市场的资产也不断被重新定价,因此出现了较大的波动。总体而言,市场整体呈N形走势,最终走高,特别是在科技股(微软、谷歌财报喜人)的带动下,股市已经收复了4月份跌幅的一半。在上周下跌5.4%后,本周纳斯达克100指数反弹了4%,标普小盘股罗素2000 都涨超2%,只有道指涨了不到1%。

市场的主要叙事并未发生根本性变化 — — 经济增长放缓,通胀压力较高,地缘政治紧张以及利率小幅上升。但以下几点依然值得关注:

就业市场数据持续强劲

当前的市场环境处在再通胀进程而非衰退

全球制造业的复苏还存在一定的基础

刚公布的GDP数据中个人消费支出仍以相对健康的2.5%速度增长,

企业设备支出在近一年来首次增加,住宅投资三年多以来最快增速

因此,从中期角度看,风险资产投资仍然是有利的。

图:上周所有标普板块都收涨

据悉,有七家巨头公司的利润预计第一季度将同比增长47%,轻松超过标普500 指数2%的预期盈利增长率。上周公布业绩的四家公司中,有三家股价上涨(特斯拉、Alphabet、微软),其中 Alphabet 表现突出并首次宣布派息。然而,之前一直表现强势的 Meta 股价下跌,因为该公司公布了低于预期的收入预测,并同时瞄准了更高的资本支出来支持人工智能。

此外,投资者更关注大科技公司未来的投资和支出计划,而不仅仅是它们目前的盈利情况。Meta 宣布今年将增加高达100亿美元的AI基础设施投资,这样大手笔的支出吓坏投资人,让股价一度跳水15%。Meta、微软、特斯拉和谷歌在第一季度末的现金余额合计高达2750亿美元。公司如果利用其巨额现金进行有战略意义的收购,获得直接的回报,这会让投资人感到欣喜。他们不希望看到公司在那些不知何时才能盈利的项目上花费大量资金。投资者现在对高估值科技股的耐心有限,他们期待快速回报。

一个插曲:

据知情人士透露,如果字节跳动最终败诉,该公司更倾向于将其整个软件重新美国关闭。一方面,TikTok 对字节来说仍然是亏损的,营收占比很小,关闭对公司业绩影响不大。另一方面, APP 里面底层的算法属于字节的商业秘密,不可能出售。如果 TikTok 如果最终被关掉,最大的受益者肯定是 Meta,然而这样的消息也没能阻止 Meta 在盘后暴跌,但如果发生了我们大概率见到Meta跳涨。

中国股市成为香饽饽

近期,先是大摩、瑞银、高盛等海外投行纷纷上调了中国股市评级。政策制定者暗示PBoC可能会在债的二级市场逐步增加其积极交易,这可能增强了市场流动性,提升了投资者情绪。

上周北向资金净流入创历史新高,CSI300指数上涨1.2%,MXCN(MSCI中国概念股指数)和恒生指数分别上涨8.0%和8.8%,这是自2022年12月以来的最佳周回报率,由科技板块领涨(+13.4%)。分析认为,目前A股市场低估值的吸引力正在逐步显现,随着国内经济增长政策的持续落地,影响A股市场定价的盈利水平和流动性因子可能会得到边际改善,外资净流入势头或将进一步加大。

另外积极的迹象就是房地产市场,如上海豪宅销售火爆,带动新房房价指数上涨,深圳楼市也呈现复苏迹象,二手房成交套数明显增加。曾在2021年初首位对中国恒大给出了“卖出”评级的分析师John Lam表示,在经历了调整之后,中国房地产行业正准备缓慢复苏,预计中国今年的房地产行业销量和价格不会上涨,但降幅会有所缓解。他认为,按面积计算,今年国内住宅销售可能会下降7%,低于2022年创纪录的27%跌幅。新屋开工率可能下降7%,较2022年39%的降幅收窄。一旦房价稳定下来,被压抑的需求将会回归,因为过去三年的房地产价格下跌周期导致人们推迟购买。

利率方面,上周10年期国债利率收在4.66%,逐渐接近5%,2年期国债利率收在了5%,本周市场总共吸收了1830亿美元的新国债。2年期国债发行需求强劲,5年期和7年期的国债也表现还不错。

利率的的高企通常不利于股市走强:

上周,石油出现反弹,上涨1.92%。WTI 原油收于83.64美元,美元基本平稳DXY 收于106.09。随着对中东冲突升级的担忧消退,黄金跌了2%,收于2337美元。工业金属指数微跌1.2%。

加密货币缺乏新催化剂

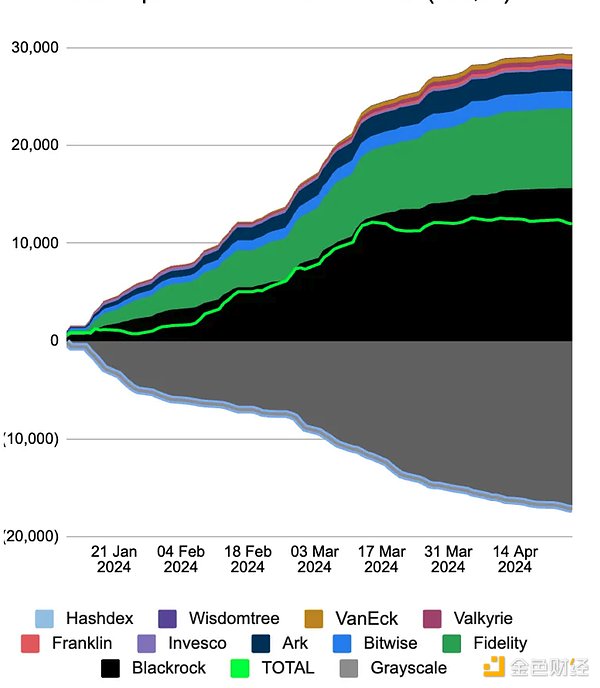

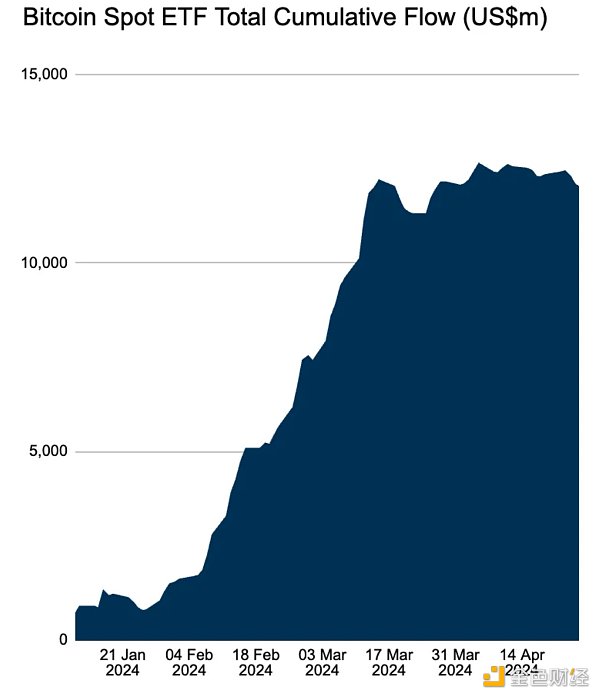

由于缺乏新的催化剂,有利的宏观市场情绪反弹未能带动加密货币,BTC现货ETF连续第三周净流出(-3.28亿),IBIT连续三个交易日没有流入,是问世以来首次。

之前在伊朗和以色列的冲突好转+比特币顺利减半后,加密市场有所回升,BTC一度升至超过67000美元。随着香港首个现货ETH的ETF即将在周二上市,ETH在周末出现超过7%的涨幅。另外,以太坊开发公司Consensys以监管越权为由对SEC提起诉讼,为反击4月10日收到的Wells通知(表明SEC正准备提起诉讼),这对以太坊来说也是对冲了监管压力。

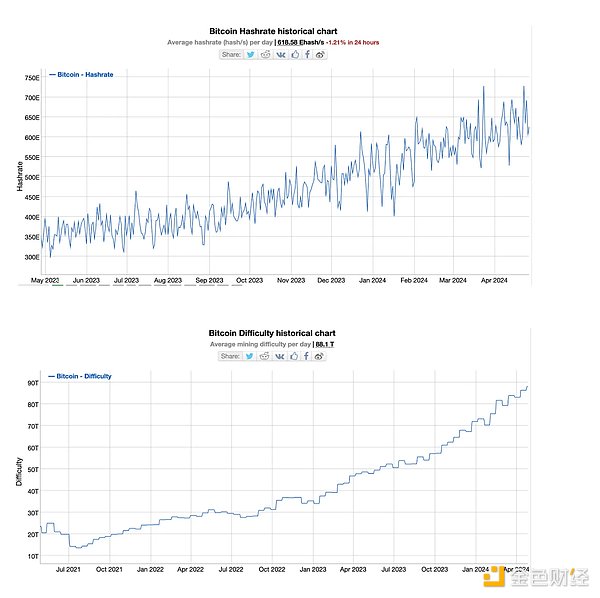

减版后BTC网络算力保持高位没有明显下降,反而挖矿难度上升:

特郎普与宽松货币政策绑定更紧密

华尔街日报发表了一篇重磅文章讲述特朗普团队密谋上台后操控美联储,提出的计划包括让利率政策与总统协商,以及让财政部审核美联储的监管措施。特朗普希望美联储主席能与他沟通,推动符合他意愿的货币政策。尽管存在担忧,但实际操作中特朗普影响美联储存在障碍,如FOMC没有空缺,且市场对美联储独立性的信心至关重要。这些讨论和计划只有在特朗普再次当选后才值得进一步考虑,但从中可以加强市场的一种信心 — — 即特郎普胜选概率上升=更宽松的货币政策,更高的长期通胀。

Market dynamics weekly last week's financial report data of large enterprises and the inflation indicators concerned by the Federal Reserve have become the focus of investors' attention. Considering the massive influx of information, the assets in the market have been constantly re-priced, so there have been great fluctuations. Generally speaking, the overall market trend has finally risen, especially driven by the gratifying financial report of Microsoft and Google, the stock market has recovered half of its monthly decline. After last week's decline, the Nasdaq index rebounded this week, and Russell, a small-cap stock in S&P, both rose more than one. Only the Dow Jones industrial average has not risen, and the main narrative of the market has not changed fundamentally. Economic growth has slowed down, inflationary pressure is high, geopolitical tension and interest rates have risen slightly, but the following points are still worthy of attention. The current market environment is in the process of reflation rather than recession, and there is still a certain foundation for the recovery of global manufacturing. In the data just released, personal consumption expenditure is still growing at a relatively healthy rate, and enterprise equipment expenditure has increased residential investment for the first time in the past year for more than three years. It is reported that the profits of seven giant companies are expected to increase year-on-year in the first quarter, easily exceeding the expected profit growth rate of the S&P index. Three of the four companies that announced their results last week saw their share prices rise, among which Tesla Microsoft made outstanding performance and announced dividends for the first time. However, its share price, which had been strong before, fell because the company announced a lower-than-expected income forecast and aimed at it at the same time. In order to support artificial intelligence with higher capital expenditure, in addition, investors are more concerned about the future investment and expenditure plans of large technology companies than just their current profitability. It is announced that infrastructure investment will increase by as much as billion dollars this year. Such a large amount of expenditure scares investors and makes their stock prices plummet. The total cash balance of Microsoft Tesla and Google at the end of the first quarter is as high as billion dollars. If companies use their huge cash to make strategic acquisitions, they will get direct returns, which will make investors. They are glad that they don't want to see the company spend a lot of money on projects that don't know when they can make profits. Investors have limited patience with high-value technology stocks now. They expect a quick return to an episode. According to informed sources, if ByteDance finally loses, the company is more inclined to shut down its entire software in the United States. On the one hand, the revenue that is still a loss for bytes accounts for a small proportion. On the other hand, the closure has little impact on the company's performance. On the other hand, the underlying algorithm belongs to the trade secret of bytes. It may be sold. If it is finally shut down, the biggest beneficiary will definitely be. However, such news has not stopped the after-hours plunge. However, if it happens, we have a high probability of seeing the China stock market jump and become a beacon. Recently, Morgan Stanley, UBS, Goldman Sachs and other overseas investment banks have upgraded the rating of China stock market. Policymakers have hinted that it may gradually increase its active trading in the secondary market of bonds, which may enhance market liquidity and enhance investor sentiment. Last week, the net inflow of funds northward hit a record high index. China's concept stock index and Hang Seng Index rose respectively, and this is the best weekly rate of return since January. The analysis shows that the attraction of low valuation of the stock market is gradually emerging. With the continuous impact of domestic economic growth policies, the profitability and liquidity factors of stock market pricing may be marginally improved, and the net inflow of foreign capital will further increase. Another positive sign is that the real estate market, such as Shanghai luxury home sales, has driven the new house price index to rise deeply. Shenzhen property market also shows signs of recovery. The number of second-hand housing transactions has increased significantly. At the beginning of the year, the first analyst who gave a selling rating to China Evergrande said that after the adjustment, the real estate industry in China is preparing for a slow recovery. It is expected that the sales volume and price of the real estate industry in China will not rise this year, but the decline will be eased. He believes that the domestic residential sales may fall below the record decline in 2008 by area, and the decline in new housing starts may be narrowed once the house prices stabilize. Depressed demand will return, because the falling cycle of real estate prices in the past three years has caused people to postpone buying interest rates. Last year, the interest rate of annual treasury bonds closed gradually close to that of annual treasury bonds. This week, the market absorbed a total of billion dollars of new treasury bonds. The demand for annual treasury bonds is strong, and the high interest rate is usually not conducive to the stock market's strength. Last week, oil rebounded and rose, and crude oil closed in US dollars, which basically closed steadily with concerns about the escalation of the Middle East conflict. The subsided gold fell to close at the dollar, and the industrial metal index fell slightly. Cryptographic currency lacked a new catalyst. Due to the lack of a new catalyst, the favorable macro-market sentiment rebound failed to drive the spot of cryptocurrency to flow out for the third consecutive week, and there was no inflow for three consecutive trading days. It was the first time since its inception. After the conflict between Iran and Israel improved smoothly, Bitcoin halved, and the cryptographic market once rose to more than the dollar. With the listing of the first spot in Hong Kong on Tuesday, there was an increase over the weekend. Ethereum Development Company retaliated by filing a lawsuit on the grounds of ultra vires supervision. The notice received on March indicated that it was preparing to file a lawsuit, which was also a blow to Ethereum. After the revision, the network computing power remained at a high level, but the difficulty of mining increased. Trump was more closely bound to loose monetary policy. The Wall Street Journal published a heavy article about Trump's team plotting to manipulate the Fed's plan after taking office, including letting the interest rate policy negotiate with the President and letting the Ministry of Finance review the United States. Trump hopes that the chairman of the Federal Reserve can communicate with him to promote the monetary policy in line with his wishes. Although there are concerns, there are obstacles in Trump's influence on the Fed in practice, such as there are no vacancies and the market's confidence in the independence of the Fed is crucial. These discussions and plans are worthy of further consideration only after Trump is re-elected, but they can strengthen the market's confidence that Trump's probability of winning the election will rise, monetary policy will be looser, and long-term inflation will be higher. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。