Ethena会像UST那样暴雷吗?我认为不会

作者:柳叶惊鸿

Ethena最近备受关注,不论是直接首发Binance的ENA,还是其稳定币USDe,都引起了极大的关注。尽管当前市场情绪低迷,Ethena的TVL仍然高达24亿美元。

很多人会将抵押代币发行稳定币的高收益产品模式与Terra的UST算法稳定币相提并论。在2021年至2022年,UST凭借着20%的收益率吸引了接近百亿美元的TVL,但随后随着Terra Luna的价格暴跌而崩盘。

有人可能会担心或怀疑Ethena是否是UST的仿盘,并且担心它是否会暴雷。但我要在这里做出一个结论:

Ethena的USDe不会暴雷,但随着市场规模增大,Ethena有可能出现USDe收益无限接近于零的情况。

USDe的发行逻辑

尽管USDe和UST一样,都是以主流加密货币作为抵押物,然后按照1美元的价格发行,但它们的资金运作逻辑却完全不同。

UST的资金运作非常简单,用户抵押多少价值的加密货币,就发行多少数量的UST。但最核心的一点是,UST与Luna有着深度的绑定关系,市场对UST的需求越高,对Luna产生的通缩作用就越大,推高价格。Luna价格越高,就能产生更多UST。

因此,UST的资金运作实质上是左右互搏,利用虚拟市值不断推高。随着Luna的增发,市场上出现了近乎无限数量的UST,最终导致百亿资金盘崩盘。

而USDe的资金运作复杂多样。

USDe的抵押与清算

首先,尽管USDe的抵押物是主流加密货币,但目前不接受普通用户直接存入ETH或BTC,只允许通过存入一系列稳定币资产(如USDT、USDC、DAI等)来购买USDe,这对普通用户来说没有清算风险。

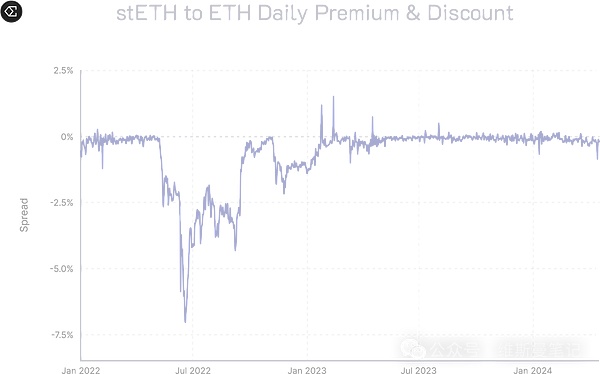

白名单用户(通常是机构、交易所、大户)可以存入LST资产(即stETH)来铸造USDe,因此白名单用户需要承担清算风险,不过由于Ethena进行对冲,实际上只需要承担ETH/stETH的价差风险。Ethena预测当这一价差风险达到65%时才会触发清算,而ETH/stETH的最大价差发生在2022年Terra暴雷时期,接近8%。

因此,在产品正常运营情况下,清算风险几乎不可能发生,换句话说:Ethena只有在Lido的stETH出现系统性风险时才会被清算。

此外,由于Ethena的杠杆率接近现货,即使发生清算,也不意味着Ethena会直接爆仓失去全部抵押物,而会根据相关头寸逐步清算。需要注意的是,Ethena并不是一个去中心化执行的产品,而是由中心化的资管团队全天候运作,并与大型交易所签订有合作协议。因此,Ethena在官方文档中说明了,一旦发生清算风险,资管团队将手动介入降低风险。

USDe的风险对冲

其次,Ethena吸纳资金后并不懈怠,而是采用中心化的资产管理,这在Web3中显得有些反直觉。

无论是来自普通用户的稳定币,还是白名单用户的LST资产,都会按照1美元的票面价值拆分,分别进行“持有现货的stETH”和“在合作交易所里开空仓的ETH”这两种操作。因此,得出了官方给出的价值等式:

1 USDe = 1美元ETH+ 1美元空头永续合约

因此,当以太坊上涨时,现货ETH的上涨会对冲空头ETH的亏损;当以太坊下跌时,空头ETH的盈利会对冲现货ETH的亏损。最终实现USDe稳定在1美元。

此外,Ethena的风险对冲完全依赖于中心化交易所,目前已与超过十家交易所合作,包括Binance、OKX、Bybit、Bitget等。因此,Ethena在资金安全上规避了Web3黑客攻击,并获得了比去中心化交易所更高的流动性和更低的操作费率。

USDe的收益来源

USDe的收益来源仅有两个:

-

质押资产获得的奖励;

-

从风险对冲中赚取的资金费率与基差;

质押资产获得的奖励很好理解,就是质押ETH获得的共识奖励。目前Ethena通过持有stETH来获取收益,当前年化利率约为3%左右。

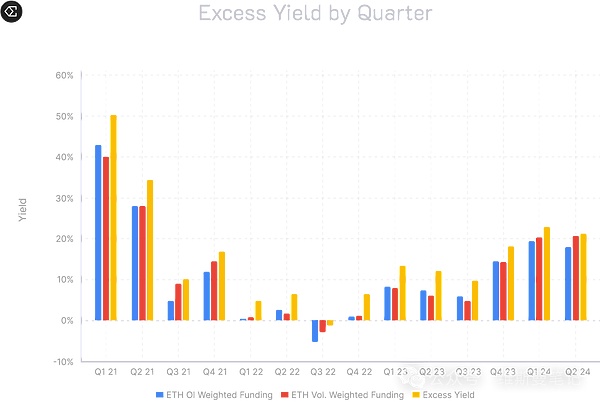

值得一提的是,从风险对冲中赚取的收益。基差实际上是成熟市场中的期限套利,资金费率是根据合约交易中多空双方的市场优势支付的费率。

根据Ethena的测算,2021年期限套利的收益率为18%,2022年为-0.6%,2023年为7%,2024年迄今为止为18%。尽管市场行情每年有所不同,但长期而言,收益率超过10%。

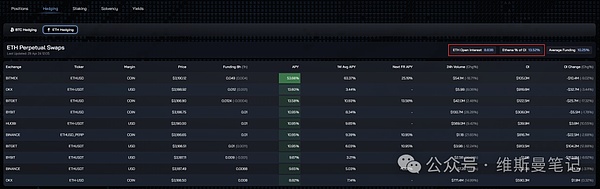

而资金费率则取决于市场牛熊。在比特币价格超过7万美元的横盘市场中,Binance的资金费率高达0.1%,因此将sUSDe的收益率直接提高至30%。

但需要注意的是,Ethena的对冲策略主要依赖于做空ETH,这意味着一旦市场走弱,Ethena需要支付做空费率。因此,在熊市中,Ethena可能会出现一段时间内收益率无限接近于零的情况。

不过值得乐观的是,Ethena根据数据回测发现,以太坊和比特币永续合约分别有19.1%和16.1%的负收益率天数,整体而言,以太坊的平均收益率为8.79%,比特币的平均收益率为7.63%。

最极端的情况是在2022年,由于以太坊PoW硬分叉套利导致市场出现季度平均负收益率。

因此,从年度视角来看,Ethena执行的策略长期而言是有利可图的。然而,对于加密货币市场来说,有些反人类,因为加密货币市场参与者通常会在熊市中持有稳定币存款,而在牛市中取出稳定币进行交易。然而,Ethena的收益曲线恰好相反,在牛市中收益率很高,在熊市中收益率很低。

USDe的风险与瓶颈

尽管在理论上,Ethena似乎十分完善,各种风险都考虑周全,但依然存在一些潜在的黑天鹅风险,并且我认为这不是遥不可及的。

交易所风险

目前,Ethena的风险对冲策略完全依赖于中心化交易所进行执行,但交易所本身就是一个风险点。例如,日常宕机、断网很可能会扩大价差,但这些问题可以通过赔付或回滚来解决。真正无法解决的是政策性和系统性风险。

美国对加密货币交易所的监管愈发严格,先有Binance的CZ质押挖矿,后又有各类交易所被SEC起诉。更甚者,是否会出现下一个FTX直接暴雷,导致Ethena遭受巨大损失。这些都是黑天鹅风险。

Lido系统性风险

Lido作为以太坊LST赛道的龙头,尽管至今没有发生重大的安全事故。但一旦发生,不仅会影响Ethena的抵押物,甚至会重创整个以太坊生态。不要忘记在两年前,以太坊在转PoS升级之前,stETH出现过大额脱锚的情况。

Ethena可能会成为市场上升的阻力

币圈有个段子,“做空合约就等于在做空自己的事业”。没错,Ethena就是在做这样的事。

这是来自Ethena的数据看板,市场中有86亿美元的未平仓ETH合约,而Ethena的仓位占了13.52%,即11.62亿美元。此外,值得注意的是,86亿美元的合约包括多空双方的仓位。考虑到Ethena只做空,那么做空资金应该是43亿美元。Ethena上线仅短短几个月,且市场低迷的情况下,就占据了整个ETH空头的27%。

如果市场进入上涨周期,Ethena的收益会增加,那么必然会有更多资金存入Ethena,导致其空头仓位更庞大。

由于Ethena的空头仓位增加,市场下行时需支付的触发费率也会增加,因此可能导致边际效应,收益趋近于零。

总结

简而言之,Ethena是一个设计精妙的产品,但它不是DeFi,更不是像UST那样的山寨产品。准确来说,Ethena是一个基于加密货币的基金产品。

它将传统金融的风险对冲策略应用到加密货币中,并从更剧烈的价格波动中获取收益。同时,因为区块链的无需许可特性,任何人都可以在不需要进行kyc和aml的情况下购买这样的基金产品。

The author Liu Ye Jinghong has recently attracted much attention, whether it is a direct launch or its stable currency. Although the current market sentiment is still as high as hundreds of millions of dollars, many people will compare the high-yield product model of issuing stable currency with the new algorithm. From to, it attracted nearly tens of billions of dollars with its yield, but then it collapsed with the sharp drop in prices. Some people may worry or doubt whether it is imitation and whether it will be thunderous, but I want to be here. The issue logic that draws a conclusion will not be thunderous, but with the increase of market scale, the income may be infinitely close to zero. Although both of them use mainstream cryptocurrencies as collateral and then issue them at the price of US dollars, their capital operation logic is completely different. The capital operation is very simple, and users can issue as many cryptocurrencies as they value, but the core point is that they are deeply bound to each other. The higher the market demand, the deflationary effect they have. The bigger the price is, the higher the price will be, so more funds will be generated. Therefore, the operation of funds is essentially a struggle between the left and the right, and the virtual market value is constantly pushed up. With the increase of the issuance market, there are almost unlimited mortgages and liquidation of funds that eventually lead to the collapse of the tens of billions of funds. First of all, although the collateral is the mainstream cryptocurrency, it is not acceptable for ordinary users to deposit directly or only allow them to purchase by depositing a series of stable currency assets, which has no liquidation risk for ordinary users. White-listed users are usually large institutional exchanges, which can deposit assets and cast them immediately, so white-listed users need to bear the liquidation risk. However, due to hedging, they only need to bear the spread risk prediction, which will trigger liquidation when the spread risk reaches, and the maximum spread occurs during the thunderstorm period, so the liquidation risk is almost impossible under the normal operation of products. In other words, it will only be liquidated when there is systemic risk. In addition, because the leverage ratio is close to the spot, Even if liquidation happens, it doesn't mean that it will directly explode and lose all collateral, but will gradually liquidate according to the relevant positions. It should be noted that it is not a decentralized product, but a centralized asset management team operates around the clock and has signed a cooperation agreement with a large exchange. Therefore, in the official document, it is stated that once liquidation risk occurs, the asset management team will manually intervene in risk hedging to reduce risks, and then it will not slack off but adopt centralized asset management after absorbing funds. Some counter-intuitive assets, whether stable coins from ordinary users or white-listed users, will be split according to the par value of the US dollar, and these two operations will be carried out separately, namely, holding the spot and opening short positions in the cooperative exchange. Therefore, the value equation given by the government is obtained. Therefore, when the Ethereum rises, the spot rise will hedge the losses of short positions, and when the Ethereum falls, the profits of short positions will hedge the losses of spot, and finally the risk hedging will be stabilized in the US dollar. At present, the centralized exchange has cooperated with more than ten exchanges, including, etc., so it has avoided hacker attacks in terms of capital security and obtained higher liquidity and lower operating rates than decentralized exchanges. The source of income is only two pledged assets, and the reward earned from risk hedging is well understood as the consensus reward obtained by pledge. At present, the current annualized interest rate is about worth it. It is mentioned that the basis of income earned from risk hedging is actually the term arbitrage fund rate in mature markets, which is the rate paid according to the market advantages of both long and short parties in contract transactions. According to the calculation, the yield of annual term arbitrage is years, so far, although the market conditions are different every year, the yield exceeds in the long run, and the capital rate depends on the capital rate of market bulls and bears in the sideways market where the bitcoin price exceeds 10,000 US dollars, so the yield is directly raised. However, it should be noted that the hedging strategy mainly depends on shorting, which means that once the market weakens, the short-selling rate will be paid, so the rate of return may be infinitely close to zero in a bear market for a period of time. However, it is optimistic that according to the data back-testing, it is found that Ethereum and Bitcoin perpetual contracts have negative rates of return respectively. On the whole, the average rate of return of Ethereum is that of Bitcoin, and the most extreme situation is that the market is caused by the hard fork arbitrage of Ethereum in. There is a quarterly average negative rate of return in the market, so the strategy implemented from an annual perspective is profitable in the long run. However, for the cryptocurrency market, some anti-human people take out the stable currency for trading in the bull market because the participants in the cryptocurrency market usually hold stable currency deposits in the bear market. However, the yield curve is just the opposite. In the bull market, the risk and bottleneck of high yield and low yield still exist, although all risks seem to be perfect in theory. In some potential black swan risks, and I don't think this is a distant exchange risk, the current risk hedging strategy is completely dependent on the centralized exchange, but the exchange itself is a risk point, such as daily downtime and disconnection, which is likely to widen the spread, but these problems can be solved by paying or rolling back. What is really unsolvable is the policy and systemic risk. The supervision of cryptocurrency exchanges in the United States is becoming stricter. First, pledge mining is carried out, and then various exchanges are sued. What's more, will there be the next direct thunderstorm, which will lead to huge losses? These are all black swan risks and systematic risks. As the leader of the Ethereum track, although there has been no major safety accident so far, once there is collateral that will not only affect it, it will even hit the entire Ethereum ecology. Don't forget that two years ago, before the Ethereum was upgraded, there was a large amount of anchor loss, which may become a resistance to the market's rise. A short contract in the currency circle is equivalent to shorting your own career. Yes. This is what we are doing. This is the data from the Kanban market. There are $100 million of open contracts, and the positions account for $100 million. It is also worth noting that the contracts of $100 million include the positions of both long and short parties. Considering that short positions are only short, the short funds should be $100 million, which will occupy the whole short position in just a few months and the market is in a downturn. If the market enters the rising cycle, the income will increase, which will inevitably lead to more short positions. As the short positions increase, the trigger rate to be paid when the market goes down will also increase, 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。