美联储逐渐失控 对加密行情有何影响?

Author: Jack Inabinet, Bankless; Translation: Tao Zhu, Jinse Finance

Concerning economic data in the United States indicate that the Federal Reserve has lost control. What do these figures show? How does the market react?

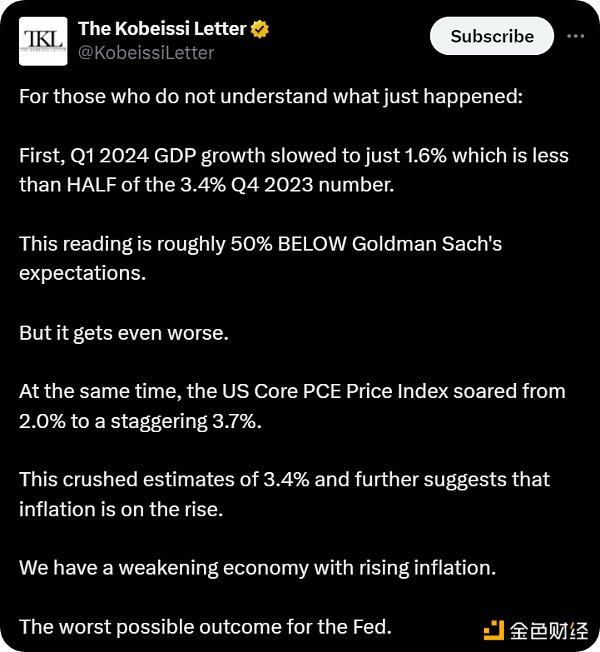

Gross Domestic Product (GDP) in the United States is an important indicator of economic growth that measures the value of goods and services produced. The annual growth rate for the first quarter of 2024 was 1.6%, driven mainly by non-discretionary fixed investment and government spending, far below the widely expected 2.4%.

At the same time, a key inflation variable, the Personal Consumption Expenditure (PCE) Price Index for the first quarter, had an annualized rate of 3.4%, higher than the expected 3.4%, and skyrocketed from 2.0% in the previous quarter.

Risk assets have soared since the market bottomed out in October 2022, as people believed the central bank could suppress inflation while maintaining relatively high employment and some degree of economic growth, but this optimistic outlook is now clearly becoming less likely.

We have been led to believe that the Federal Reserve can at least ensure a “soft landing” for the U.S. economy through careful manipulation of short-term rates, characterized by growth and returns that are below trend (but not a recession) and reaching the 2% inflation target.

Unfortunately, the mismatch between economic growth and inflation indicates that the Fed has lost control of the situation...

Despite doubts about the impact of rate manipulation, as demonstrated by the fact that the Federal Reserve has cut rates several times in modern history during economic recessions, the market still has hope that rate cuts can stimulate the economy; however, intensifying inflation makes such cuts increasingly difficult to sustain.

As market participants are forced to further delay their expectations for rate cuts, risk assets were sold off this morning and yield curves rose by about 1.4% to their highest levels in 2024.

If economic growth continues to decline, inflation may plummet dramatically with falling demand. However, it is not certain that lower rates are sufficient to stabilize the global economy heading toward a recession.

Cryptocurrencies offer investors huge returns; Bitcoin has been the best-performing asset of the past decade, but it is well-known that this asset class exhibits massive volatility and does not exist in long periods of economic downturn.

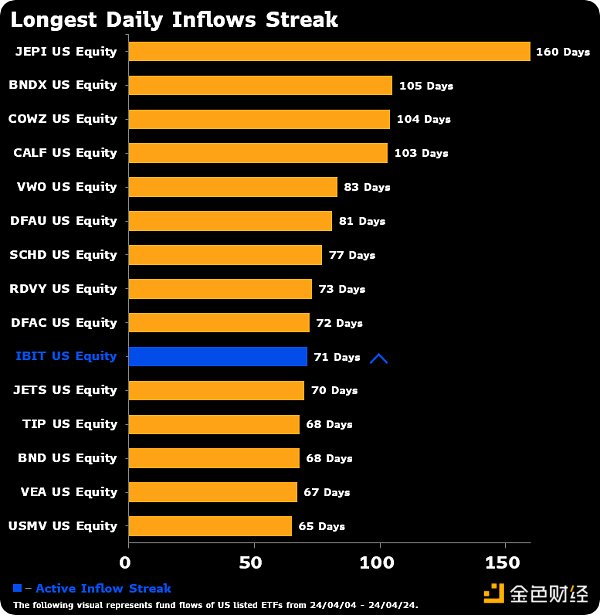

Yesterday, the BlackRock IBIT spot BTC ETF ended 71 consecutive days of inflows, and although inflows into these instruments have been a key narrative in promoting excitement around BTC, the risk of outflows is high as the economy continues to decline.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。