从旁氏三盘理论看MEME币崛起

作者:CaptainZ 来源:X,@hiCaptainZ

三盘理论是加密韦陀(@thecryptoskanda)提出的一种关于旁氏的认知模型,本文基于此理论来探索三次牛市的原因:MEME币是互助盘,DeFi是分红盘,ICO是拆分盘。

什么是三盘理论

加密韦陀认为,Crypto最大价值之一是首次实现庞氏民主化与可交易化。

人人都能发,还能交易盘子。抛开外部因素,Crypto每轮牛市都由庞氏的根本创新驱动研究庞氏,你就能根据庞氏创新所需第一性,在市场中找到大趋势级别alpha。

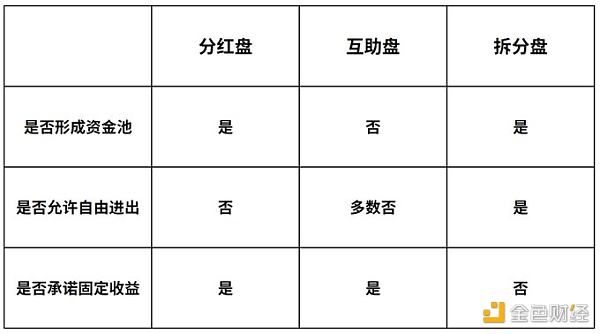

庞氏虽然眼花缭乱,但是归根结底只有三种模型: 分红盘、互助盘、拆分盘。一切庞氏,都是这三种模型的组合。基于这个逻辑的分析方法,他将其称为《三盘模型》。三盘可以单独出现也可组合,每种都有自身优缺点,对应相应的起盘、操盘和崩盘逻辑。

- 分红盘:一次性投入一整笔资金,随时间线性分红获得收益

- 互助盘:A给B打钱,B给C打,C给A打从而形成流水错配,按笔结算收益

- 拆分盘: 将一个资产标的不断拆分成新的标的。通过新低价标的吸引增量资金。收益通过标的增值实现

在逻辑设计上, 三盘特点如下:

MEME是互助盘

传统互助盘的核心在于资金的流水错配。这种模式通常涉及多个参与者按顺序互相转账,形成一个资金循环。一般来说某个用户,他收到下家转来的钱要高于他给出上家的钱要多,如此赚取比他们原始投入更多的钱。项目方一般通过每笔转账的抽水来赚取回报。

这种旁氏模型在三个模型中是最为去中心化的一种模式,因为规则一旦制定好,后面是无需”管理方“介入的,因为抽水本质上就是抽税。

传统互助盘是一种空间尺度上的资金错配,所以它不需要形成资金池,大部分也不能自由进出款项,但必然要承诺高额收益。那为什么说MEME币是互助盘呢?

我们一般认为MEME币有两个最重要的属性:

公平发射:人人皆可参与(人人皆可互助)

全流通:不需要项目方预留

所谓的“文化属性”和“总量特别大”并不是必需的。

MEME币其实是一种时间尺度上的资金错配。我们假设在某个牛市语境下,某个MEME币一直强势上涨,那么其实是,今天高价买币的打钱给昨天买币的,昨天买币的打钱给前天最低价买币的。而因为时间本身的唯一性,又形成了“被动锁仓”(人不可能永远跨入同一条河流)。所以我们就有了下图的对比:

DeFi是分红盘

DeFi是上一轮牛市的核心叙事(2020年),在技术上就是把金融规则写入智能合约(区块链技术和某一领域结合的一种方式),从代币经济学来说,是以流动性挖矿的方式来分发协议代币:把钱存进

The author's source three-disk theory is a cognitive model about Ponzi proposed by Wei Tuo. Based on this theory, this paper explores the causes of three bull markets: mutual aid disk, dividend disk and split disk. What is the three-disk theory encryption? Wei Tuo believes that one of the greatest values is to realize Ponzi democratization and tradeability for the first time. Everyone can return the trading disk, and every bull market is driven by Ponzi's fundamental innovation. You can find the big trend level in the market according to the firstness required by Ponzi's innovation. Although Bieponzi is dazzled, in the final analysis, there are only three models: dividend-sharing disk, mutual aid disk and split disk. All Ponzi models are a combination of these three models. Based on this logical analysis method, he calls them three-disk models. Three disks can appear separately or be combined, each of which has its own advantages and disadvantages, corresponding to the corresponding starting operation and collapse logic. Dividend disk will invest a whole sum of money at one time to make a linear dividend over time to obtain income. Mutual aid disk will give money to play, thus forming a mismatch between lines, and the income will be settled by pen. An asset target is constantly split into new targets, attracting incremental capital gains through new low-priced targets, and realizing value-added through targets. In logical design, the characteristics of the three sets are as follows: the core of the traditional mutual aid disk is the mismatch of funds. This model usually involves multiple participants transferring money to each other in sequence to form a capital cycle. Generally speaking, a user receives more money from his next home than he gives from his last home, so he earns more money than they originally invested. The Ponzi model is the most decentralized model among the three models, because once the rules are formulated, there is no need for management intervention, because pumping is essentially a tax collection, and the traditional mutual aid disk is a mismatch of funds on a spatial scale, so it does not need to form a pool of funds, and most of them can't freely enter and leave the funds, but they must promise high returns. Then why is it said that money is a mutual aid disk? We generally think that money has two most important attributes, and everyone is fair to launch. Everyone can help each other in full circulation, and it is not necessary for the project party to reserve the so-called cultural attributes and the total amount is particularly large. The currency is actually a mismatch of funds on the time scale. We assume that a currency has been rising strongly in the context of a bull market, so it is actually the high-priced one who bought the currency today, the one who bought the currency yesterday, and the one who bought the currency the day before yesterday. Because of the uniqueness of time itself, it has formed a passive warehouse lock, so we have it. The contrast in the following figure is that the dividend distribution is the core narrative year of the last bull market. Technically, it is a way to write financial rules into smart contracts, blockchain technology and a certain field. From the perspective of token economics, it is to distribute agreement tokens and deposit money in the way of liquidity mining. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。