特殊的牛市?第四次“减半”多项指标被打破

当前,比特币已经经历了它的第四次减半,这导致其供应通胀再次减少50%,而其通缩性则自然增加。在本文中,我们将会探讨比特币网络在价格表现和其在基本网络指标方面跨时代的演变。

Currently, Bitcoin has gone through its fourth halving, leading to another 50% reduction in its supply inflation and naturally increasing its deflationary nature. In this article, we will explore the evolution of the Bitcoin network in terms of price performance and its fundamental network indicators across eras.

摘要

最近,比特币已经经历了自问世以来的第四次减半,而比特币供应的年化通胀率则再次降低了50%,这也意味着它在发行的稀缺性方面完全地超越了黄金。

在衡量减半时期的比特币网络状况时,我们发现其多个重要指标的增长速度都有所放缓。但即便如此,其增长的趋势仍然不会停止,并且每一次都会创造出新的历史峰值。

现货价格上涨和价格历史峰值被大幅突破提振了投资者的盈利能力,而这也反过来扭转了开采者收入较年初下降50%的不利情况。

通缩性的供给

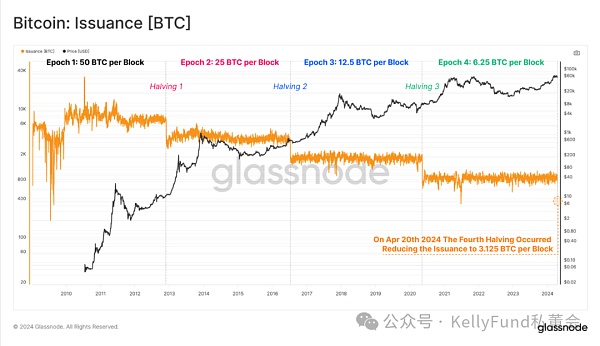

由于拥有被称为“自适应难度调整”的巧妙算法,比特币供应曲线是确定性的。该算法会不断地调整比特币开采过程的难度,这使得开采者无论应用多大算力的设备,比特币网络的平均出块间隔都保持在600秒(10分钟)左右。

比特币网络每经历210,000个区块高度(大约4年时间),就会发生预定的发行量减半,导致新铸造的比特币量减少50%。而第四次比特币的减半发生在上周末,区块补贴从每个区块6.25比特币下降到3.125比特币,这意味着全网每天约能铸造出450枚比特币(针对已开采的144个区块)。

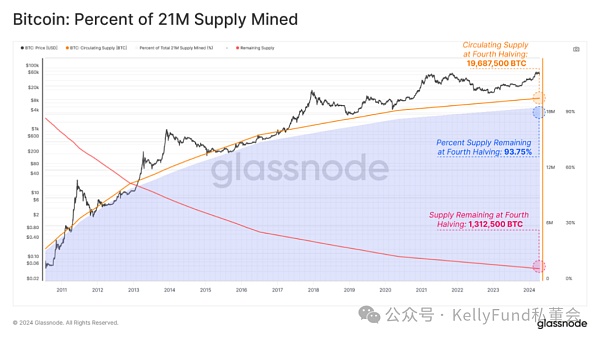

在比特币问世之后的前四个纪元中,共计有19,687,500枚比特币被开采出来,相当于预先设定的全网总供应量2100万枚的93.75%。因此,在未来126年中只剩下1,312,500枚比特币尚待发掘,其中当前纪元(第三次和第四次减半之间)共计发行了656,600枚比特币(占总量的3.125%)。有趣的是,每次减半都代表一个关键点:

剩余待开采量的百分比等于新的区块补贴(3.125比特币/区块 vs 剩余3.125%)。

剩余待开采量的50%(131.25万枚比特币)将在第四次减半和第五次减半之间被开采出来。

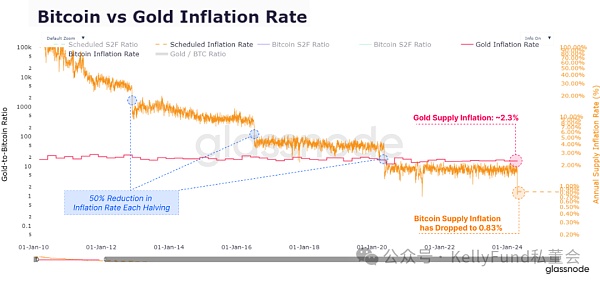

由于区块补贴每210,000个区块高度就减半一次,比特币的通货膨胀率也大约每4年就随之减半。这使得比特币供应量的最新年化通胀率为0.85%,低于上一时期的1.7%。

第四次减半也标志着在人们比较比特币与黄金这两类一般等价物时的一个重要里程碑,在历史上,比特币的稳态发行率(0.83%)首次低于黄金(~2.3%),这标志着“最稀缺资产”的头衔历史性地完成了从黄金向比特币的交接。

保持谨慎态度

然而我们必须指出的重要一点是,我们需要正确看待这次减半的规模。在评估减半对市场动态的相对影响时,我们必须看到与比特币生态系统内的全球交易量相比,减半之后新铸造出的比特币总量仍然非常小。在当前,减半后铸造的比特币总量仅占我们今天看到的链上转账量、现货交易量和衍生品量的一小部分,目前相当于任何一天转移和交易总资本的不到0.1%。

因此,比特币减半对可用交易供应量的影响在各个周期中都在减弱,这不仅是因为减半之后开采的比特币数量在不断减少,还因为围绕它的资产和生态系统规模仍在继续扩大。

合理期望

比特币的减半是一个重要且广为人知的事件,每次临近减半都自然会导致人们对其对价格走势影响的猜测加剧。而平衡我们的期望与历史先例的差异,并根据比特币过去的表现创建一个相对宽松的分析界限可能是一种更加明智的市场分析策略。

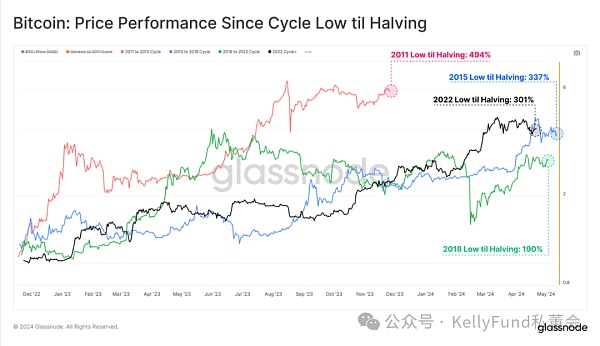

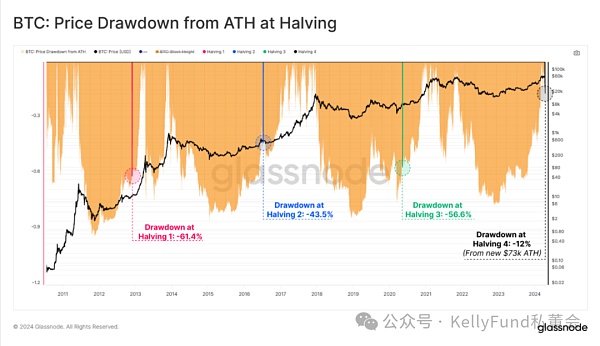

比特币在各个减半时期的价格表现差异很大,我们认为早期的减半时期与今天有很大的不同,过去的经验可能无法对当前我们的分析预判起到很大的指导作用。但随着时间的推移,我们确实看到了回报的递减和总回撤效应的减弱,这是市场规模不断扩大以及推动市场规模增长所需的流动资本规模扩张所引发的自然结果。

红色:第二纪元(Epoch 2)价格表现:+5,315%,最大回撤为-85%

蓝色:第三纪元(Epoch 3)价格表现:+1,336%,最大回撤为-83%

绿色:第四纪元(Epoch 4)价格表现:+569%,最大回撤为-77%

我们现在来评估自上个周期低点直至减半时比特币的价格表现,我们注意到2015年和2018年的情况与当前周期存在明显相似之处,它们均经历了约200%至约300%的增长。

然而,需要尤其着重指出的是,当前周期是有史以来唯一一个价格在减半事件之前即宣告突破前一个历史价格峰值的周期。

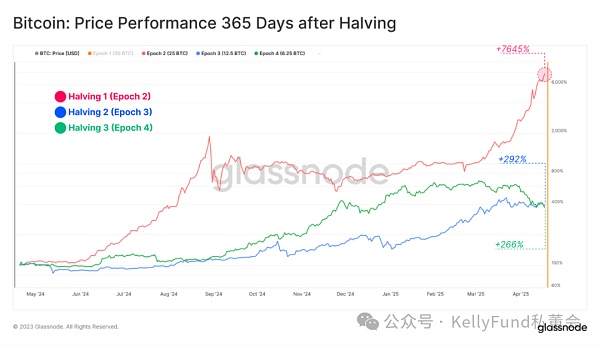

我们的另一个视角是考量每次减半后365天内比特币的市场表现。回顾历史,我们发现在第二纪元内,减半所带来的影响要大得多,但我们同时必须考虑到,当今市场的动态和格局相对于2011-2013年期间已经发生了显著变化,不能简单地将这两个不同时期的情况等量齐观。

也正是因此,我们发现最近的两个纪元(第三纪元和第四纪元)中的减半事件对资产规模的影响反而更加丰富且更堪解读。

红色:第二纪元(Epoch 2)价格表现:+7,258%,最大回撤为-69.4%

蓝色:第三纪元(Epoch 3)价格表现:+293%,最大回撤为-29.6%

绿色:第四纪元(Epoch 4)价格表现:+266%,最大回撤为-45.6%

虽然总的来说,在每一次减半事件之后的一年市场总体走势都很强劲,但此过程中,市场仍然会出现一些非常大幅度的回撤,其最大幅度从30%到70%不等。

历史的间歇性韵律

在2022年熊市期间,一个曾出现的广为流传的说法是不管比特币的价格如何下跌,它永远不会低于上一个周期的历史峰值(当时对应的历史峰值在2017年到达的2万美元)。但很遗憾,这条定律失效了,因为在 2022 年底广泛的去杠杆化过程中,比特币的价格相距2017年的周期高点下跌了25%以上。

同样的,近期也流传着类似的说法,即在减半发生之前,比特币价格无法突破当前周期的历史峰值。但今年3月,该“定律”也同样被打破。我们在当时看到的新的历史峰值被再次刷新这一事件源于历史上前所未有的供应紧张(我们在此前的文章中曾提到这一原因)和新上市的现货ETF带来的显著增长的需求兴趣。

但我们必须看到的是,此次比特币的价格上涨也对投资者持有的未实现利润产生了重大影响。在目前的比特币供应中,由投资者持有的未实现利润是历次减半事件以来最大的(以MVRV衡量)。

换句话说,截至减半之日,投资者持有相对于其成本而言最大的账面收益。在当前,MVRV比率为2.26,这意味着比特币的平均单位账面收益为+126%。

根本性增长

在上一部分中,我们评估了以减半为节点的各个历史周期中的比特币价格表现。而在本节中,我们将把重点转向比特币网络基本面的增长,这些基本面包括开采安全、开采者收入、资产流动性和减半时期的交易结算量。

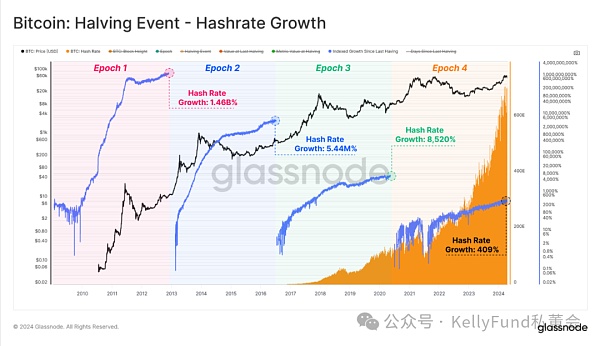

算力是一种网络统计数据,用于评估开采中们的集体“火力”。在减半时期,��力的增长速度已经��缓,但每秒的绝对哈希值仍在继续增长,目前为每秒620Exahash(这相当于地球上全部的80亿人每秒完成775亿次哈希运算)。

有趣的是,算力在每次减半事件中都处于或接近新的历史峰值,这表明当前可能会发生以下两种情况中的至少一种:

更多ASIC设备即将上线;

更高效的哈希ASIC硬件正在生产中。

从这两种情况得出的结论是,尽管发行量每次减半都会减少50%,但总体安全预算不仅足以维持当前的OPEX(运营费用)成本,而且还足以刺激CAPEX(资本支出)和OPEX领域的进一步投资。

现在我们以美元为单位计算开采者的收入,我们发现,当前收入的增长率虽然同样在下降,但绝对规模

At present, Bitcoin has experienced its fourth halving, which leads to a decrease in its supply inflation and a natural increase in its deflation. In this paper, we will discuss the price performance of Bitcoin network and its inter-generational evolution in basic network indicators. Recently, Bitcoin has experienced its fourth halving since its inception, and the annualized inflation rate of Bitcoin supply has decreased again, which means that it completely surpasses gold in measuring the scarcity of Bitcoin in the halving period. In the network situation, we found that the growth rate of many important indicators has slowed down, but even so, its growth trend will not stop, and every time it will create a new historical peak. The spot price increase and the historical peak price have been greatly broken, which has boosted the profitability of investors, which in turn reversed the unfavorable situation that the income of miners has decreased compared with the beginning of the year. The deflationary supply is deterministic because of the ingenious algorithm called adaptive difficulty adjustment. The law will constantly adjust the difficulty of the bitcoin mining process, which makes the average interval between blocks of the bitcoin network maintained at about seconds no matter how much computing power the miners apply. Every time the bitcoin network goes through a block height for about a year, the predetermined circulation will be halved, resulting in a decrease in the amount of newly minted bitcoin. The fourth halving of bitcoin occurred last weekend, and the block subsidy dropped from each block to bitcoin, which means that the whole network can cast about one bitcoin every day. In the first four eras after the advent of Bitcoin, a total of 10 bitcoins were mined, which is equivalent to the preset total supply of 10,000 bitcoins in the whole network. Therefore, only 10 bitcoins remain to be discovered in the next year. Among them, a total of 10 bitcoins were issued between the third and fourth halving in the current era, which is interesting. Each halving represents a key point, and the percentage of the remaining amount to be mined is equal to 10,000 bitcoins in the new block subsidy bitcoin block. It will be mined between the fourth halving and the fifth halving. Due to the block subsidy, the height of each block will be halved once, and the inflation rate of bitcoin will be halved about every year. This makes the latest annualized inflation rate of bitcoin supply lower than the fourth halving in the previous period, which also marks an important milestone when people compare bitcoin and gold. In history, the steady-state issuance rate of bitcoin is lower than that of gold for the first time, which marks the title history of the most scarce assets. We have successfully completed the handover from gold to bitcoin and remain cautious. However, we must point out that we need to correctly look at the scale of this halving. When evaluating the relative impact of halving on market dynamics, we must see that the total amount of newly minted bitcoin after halving is still very small compared with the global trading volume in the bitcoin ecosystem. The total amount of minted bitcoin after halving now accounts for only a small part of the online transfer volume, spot trading volume and derivative volume we see today. At present, it is less than the total capital transferred and traded on any day, so the impact of halving bitcoin on the available transaction supply is weakening in each cycle, not only because the amount of bitcoin mined after halving is decreasing, but also because the scale of assets and ecosystems around it is still expanding. It is reasonable to expect that halving bitcoin is an important and well-known event, which will naturally lead to increased speculation about its impact on price trends and balance our period. It may be a more sensible market analysis strategy to look at the difference from historical precedents and create a relatively loose analysis boundary according to the past performance of Bitcoin. The price performance of Bitcoin in each halving period is very different. We think that the early halving period is very different from today. Past experience may not be very instructive to our current analysis and prediction, but as time goes by, we do see the diminishing returns and the weakening of the total retracement effect. This is the market scale. The natural result caused by the continuous expansion and the expansion of the scale of working capital required to promote the growth of the market scale is that the price performance of the second era in red is the biggest retracement in blue, the price performance of the third era is the biggest retracement in green, and the price performance of the quaternary yuan is the biggest retracement. Now let's evaluate the price performance of Bitcoin from the low point of the last cycle until it is halved. We notice that there are obvious similarities between the situation in and the current cycle, and they have all experienced an increase of about to about. However, it needs to be emphasized in particular. However, the current cycle is the only cycle in history in which the price breaks through the previous historical peak before the halving event. Our other perspective is to consider the market performance of Bitcoin within the day after each halving. Looking back at the history, we find that the impact of halving in the second era is much greater, but at the same time, we must consider that the dynamics and pattern of today's market have changed significantly compared with the period of, and we cannot simply equate the situation in these two different periods. Therefore, we find that the impact of halving events in the last two eras, the third era and the quaternary yuan, on the asset scale is richer and more understandable. The biggest retracement of the price in the red second era is blue, the biggest retracement of the price in the third era is green, and the biggest retracement of the price in the quaternary yuan is green. Although the overall trend of the market is very strong in the year after each halving event, there will still be some very large retracements in the process, and the maximum range is from zero to zero. During the bear market in, there was a widespread saying that no matter how the price of bitcoin fell, it would never be lower than the historical peak of the previous cycle, when the corresponding historical peak reached $10,000 in. Unfortunately, this law failed because the price of bitcoin fell from the cycle peak of, in the process of extensive deleveraging at the end of the year. The same similar saying has also been circulating recently, that is, the price of bitcoin could not be broken before halving. The historical peak of the current cycle, but this month, the law was also broken. The new historical peak we saw at that time was refreshed again. This incident stems from the unprecedented supply shortage in history. We mentioned this reason and the significantly increased demand interest brought by the newly listed spot in the previous article, but we must see that the price increase of Bitcoin has also had a significant impact on the unrealized profits held by investors. In the current bitcoin supply, the unrealized profits held by investors are the largest since the previous halving events. In other words, as of the date of halving, investors hold the largest. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。