为什么资产通证化是不可避免的?

作者:L1 的机构业务主管Mehdi Brahimi, Miguel Kudry,CoinDesk;编译:陶朱,虚拟币交易所平台,数字货币,NFT

The author's institutional business director compiled digital currency, a platform of Taozhu Virtual Coin Exchange. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

随着代币化的出现,金融市场正在经历一场变革。 这一运动不仅仅是科技爱好者的投机趋势,而且是全球资产管理和交易方式的根本性转变。

现实世界资产的代币化(RWA)不仅是一种新兴趋势,而且是一种新兴趋势。 它正在为资产管理的新时代奠定基础。

加密原生代币和代币化 RWA 之间的区别至关重要。 加密货币原生代币,例如比特币和以太坊,是纯数字的,既可以作为投机投资、价值储存,也可以作为其自身生态系统中的实用工具。 另一方面,代币化的 RWA 连接了数字和传统金融世界,有效地带来了流动性和分散化,以提高以前“流动性较差”的资产的可及性。

3 月 20 日,贝莱德推出首支代币化基金 BUIDL(私募短期国债基金),标志着代币化的一个重要里程碑。 BUIDL 不仅在第一个月就吸引了近 3 亿美元的资产,而且最大的资产管理公司贝莱德也表示代币化将成为“市场的下一代”。 代币化政府国库券已经是一个价值 12 亿美元的赛道,其中包括富兰克林邓普顿 (Franklin Templeton) 发行的 BENJI、贝莱德 (BlackRock) 的 BUIDL 和 Ondo Finance 的 USDY 等产品,自去年 1 月以来,该产品已实现 10 倍的快速增长。

目前,链上 RWA 代表着 75 亿美元的市场。 虽然相对于传统管理的价值数十万亿美元的资产来说,这似乎微不足道,但增长速度和代币化资产范围的不断扩大(包括国债、大宗商品、私募股权、房地产、私人信贷等)表明 一个转折点。 波士顿咨询集团 2022 年的一份报告估计,到 2030 年,代币化资产市场可能增长到 16 万亿美元,这将极大地促进迎合这些资产的 DeFi 协议在借贷、流动性池、期货和衍生品以及其他市场上开发全新的金融生态系统 。

链上创造了数万亿美元的新财富。 这是一个新的投资者群体,他们希望通过自己的钱包访问金融产品和服务并与之互动。 这些加密货币原生投资者受益于24x7运行的生态系统,其进入门槛比传统金融、围墙花园和营业时间更低,有时甚至领先于传统市场。

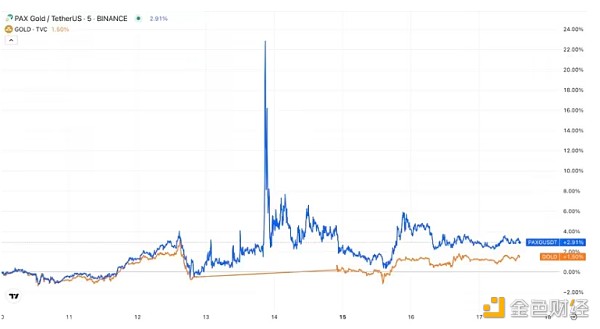

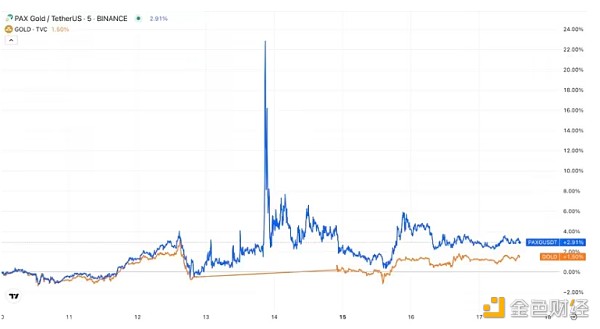

X 用户 @kaledora 于 2024 年 4 月 13 日分析了最近的一个例子,随着伊朗和���色列之间的地缘政治紧张局势加剧,PAXG(一种代币化黄金)的交易价格较 4 月 12 日的收盘价溢价 20%,其成交量 4 月 14 日星期日收盘时达到顶峰。这与黄金市场于美国东部时间下午 5 点开盘一致,这表明对传统市场至关重要的资产安全基本原则也适用于数字资产。

L1 机构业务主管 Mehdi Brahimi 表示,链上现实世界资产和钱包基础设施的集成将取代中介机构,并成为现代资产管理生命周期的标准。

“自带钱包”(BYOW)的概念概括了区块链为个人投资者带来的自主权和权力转移。 BYOW消除了对资产托管中介机构的依赖,使投资者能够不受传统中介机构的限制和延迟结算的影响来管理和访问其资产。

随着越来越多的资产进入链上,资产管理公司可能会采取一些策略,使他们能够利用新的流动性来源,并在链上和链下市场之间进行套利。 这种演变将熟悉的领域带入链上,为资产管理者提供了他们习惯的传统框架,使他们能够应用基本的投资组合构建原则并在数字资产环境中管理投资策略,从而为加密货币原生投资者提供分配机会。

展望未来,资产类别的代币化和加密原生投资原则的整合可能会成为现代资产管理生命周期的标准。 这种转变不仅是不可避免的,而且是不可避免的。 这显然正在进行中。 接受这一变革的资产管理者和配置者将建立与新一代投资者保持一致的新一代公司。 这一代人自带钱包。

Author: Mehdi Brahimi, institution business director of L1, Miguel Kudry, CoinDesk; Translation: Tao Zhu, Golden Finance

With the emergence of tokenization, the financial market is undergoing a transformation. This movement is not just a speculative trend for tech enthusiasts, but a fundamental change in global asset management and trading methods.

The tokenization of real-world assets (RWA) is not just an emerging trend, but a groundbreaking one. It is laying the foundation for a new era of asset management.

The difference between native crypto tokens and tokenized RWAs is crucial. Native crypto tokens, such as Bitcoin and Ethereum, are purely digital and can serve as speculative investments, store of value, and practical tools within their own ecosystems. On the other hand, tokenized RWAs bridge the digital and traditional financial worlds, effectively bringing liquidity and decentralization to improve accessibility for assets that were previously "illiquid."

On March 20, BlackRock launched the first tokenized fund, BUIDL (private short-term treasury bond fund), marking a significant milestone in tokenization. BUIDL not only attracted nearly $3 billion in assets in its first month, but the largest asset management company, BlackRock, also indicated that tokenization will become the "next generation" of the market. Tokenized government treasury bonds have become a $12 billion market, including products like BENJI issued by Franklin Templeton, BUIDL by BlackRock, and USDY by Ondo Finance. Since January last year, these products have seen rapid growth, increasing tenfold.

Currently, on-chain RWAs represent a $75 billion market. While this may seem insignificant compared to the trillions of dollars worth of assets managed traditionally, the rapid growth and expanding range of tokenized assets (including government bonds, commodities, private equity, real estate, private credit, etc.) indicate a turning point. A report by Boston Consulting Group in 2022 estimated that by 2030, the tokenized asset market could grow to $16 trillion, greatly promoting the development of new financial ecosystems in DeFi protocols catering to these assets in lending, liquidity pools, futures, derivatives, and other markets.

On-chain has created trillions of dollars in new wealth. This is a new group of investors who want to access financial products and services through their own wallets and interact with them. These native crypto investors benefit from a 24x7 operating ecosystem with lower entry barriers than traditional finance, walled gardens, and business hours, sometimes even ahead of traditional markets.

X User @kaledora analyzed a recent example on April 13, 2024, where amidst escalating geopolitical tensions between Iran and Israel, the trading price of PAXG (a tokenized gold) had a 20% premium over the closing price of April 12, with its volume peaking on Sunday, April 14. This aligns with the opening of the gold market at 5 pm Eastern Time, indicating that the fundamental asset security principles essential to traditional markets also apply to digital assets.

Mehdi Brahimi, institution business director of L1, stated that the integration of on-chain real-world assets and wallet infrastructure will replace intermediary institutions and become the standard for the modern asset management lifecycle.

The concept of "Bring Your Own Wallet" (BYOW) encapsulates the empowerment and transfer of power that blockchain brings to individual investors. BYOW eliminates the reliance on asset custody intermediaries, allowing investors to manage and access their assets without the restrictions and settlement delays imposed by traditional intermediaries.

As more assets enter the chain, asset management companies may adopt strategies that allow them to leverage new sources of liquidity and arbitrage between on-chain and off-chain markets. This evolution brings familiar territories onto the chain, providing asset managers with traditional frameworks they are accustomed to, enabling them to apply basic portfolio construction principles and manage investment strategies in the digital asset environment, offering allocation opportunities to native crypto investors.

Looking ahead, the integration of asset class tokenization and principles of native crypto investments may become the standard for the modern asset management lifecycle. This shift is not only inevitable, but already underway. Asset managers and allocators embracing this transformation will establish companies aligned with the new generation of investors. This generation brings their own wallet.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群