Coingecko:谁是顶级NFT借贷平台?

作者:Lim Yu Qian,Coingecko;编译:邓通,虚拟币交易所平台,数字货币,NFT

The author compiles digital currency, the platform of Deng Tong Virtual Currency Exchange. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

顶级 NFT 借贷平台是什么?

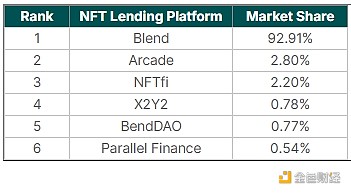

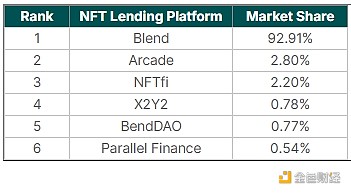

Blend是最大的NFT借贷平台,以92.9%的份额主导市场,2024年3月的月贷款额为5.6233亿美元。Blend于2023年5月推出,是领先的NFT市场Blur提供的借贷协议,并在同月立即占据了82.7%的市场份额。从那以后,Blend的月市场份额一直保持领先,从88.8%到96.5%不等。2024年第一季度,Blend的NFT贷款量环比增长49.2%,达到20.2亿美元的新高。

Arcade、NFTfi 在小型 NFT 借贷公司中处于领先地位

其次受欢迎的 NFT 借贷平台是 Arcade (ARCD),其市场份额为 2.8%,NFT 借贷量为 1,694 万美元;NFTfi (NFTFI) 为 2.2%,2024 年 3 月的交易量为 1,332 万美元。Arcade 和 NFTfi 是唯一的其他 NFT 借贷平台 自去年以来,这些平台的月度市场份额一直保持在 1.0% 以上。

今年第一季度,Arcade 的 NFT 借贷量也创下了季度新高,达到 3946 万美元,环比增长 37.1%。 同期,NFTfi 的借贷量环比增长 48.3%,达到 3588 万美元。 随着 Arcade 于 2024 年 4 月推出代币以及 NFTfi 即将推出代币,这对每个平台的 NFT 借贷量有何影响还有待观察。

剩下的 NFT 借贷平台是 X2Y2(X2Y2)和 BendDAO(BEND),均占有 0.8% 的市场份额,以及 Parallel Finance(原 ParaX),占有 0.5% 的市场份额。

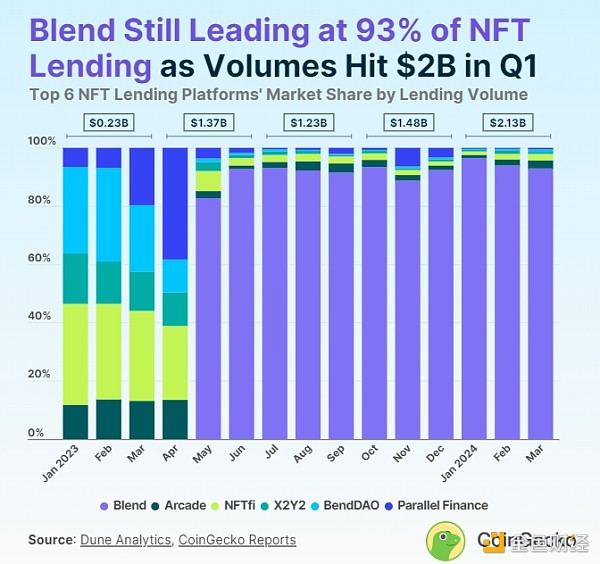

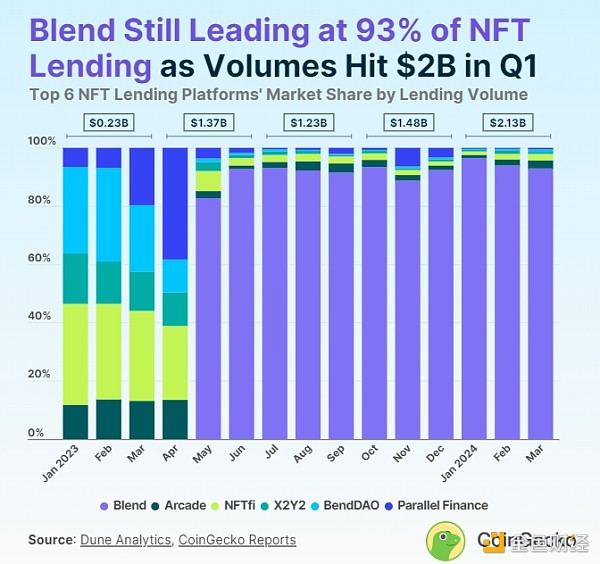

2024 年第一季度 NFT 借贷总量达到21亿美元高位

上季度 NFT 借贷总额达到 21.3 亿美元的季度新高,环比增长 43.6%,六大 NFT 借贷平台中有 5 家出现了较高的交易量。 特别是,2024 年 1 月 NFT 月度借贷总额创下历史新高,达到 9 亿美元,超过了 2023 年 6 月创下的 8.5 亿美元的历史高点。

鉴于由于 Blend 和 Blur 之间的协同作用,NFT 贷款发放仍以以太坊 NFT 集合为主,日益流行的比特币 Ordinals 对 NFT 贷款市场的影响可能值得关注。

按市场份额排名的顶级 NFT 借贷平台

截至 2024 年 3 月,按贷款量计算的六大 NFT 借贷平台的市场份额:

按月划分的 NFT 借贷量

排名前六的 NFT 借贷平台每月 NFT 借贷总量:

Author: Lim Yu Qian, Coingecko; Translation: Deng Tong, Jinse Finance

What are the top NFT lending platforms?

Blend is the largest NFT lending platform, dominating the market with a 92.9% share, with a monthly loan amount of 562.33 million USD in March 2024.Blend was launched in May 2023 and immediately captured 82.7% market share, provided by the leading NFT marketplace Blur. Since then, Blend's monthly market share has remained dominant, ranging from 88.8% to 96.5%. In the first quarter of 2024, Blend's NFT loan volume increased by 49.2% compared to the previous quarter, reaching a new high of $2.02 billion.

Arcade and NFTfi lead in small NFT lending companies

The next popular NFT lending platforms are Arcade (ARCD), with a market share of 2.8%, and an NFT lending volume of $16.94 million; NFTfi (NFTFI) with 2.2%, and a transaction volume of $13.32 million in March 2024.Arcade and NFTfi are the only other NFT lending platforms since last year, with monthly market shares consistently at or above 1.0%.

In the first quarter of this year, Arcade set a new quarterly high for NFT loans, reaching $39.46 million, an increase of 37.1% compared to the previous quarter. At the same time, NFTfi's lending volume increased by 48.3% to $35.88 million. With the launch of Arcade's token in April 2024 and NFTfi's upcoming token launch, the impact on the NFT loan volume of each platform remains to be seen.

The remaining NFT lending platforms are X2Y2 (X2Y2) and BendDAO (BEND), both with a market share of 0.8%, as well as Parallel Finance (formerly ParaX) with a market share of 0.5%.

NFT lending total reaches $2.1 billion in the first quarter of 2024

The total NFT lending amount in the last quarter reached a quarterly high of $2.13 billion, an increase of 43.6% compared to the previous quarter, with 5 of the 6 major NFT lending platforms experiencing higher transaction volumes. In particular, in January 2024, the monthly NFT lending total reached a record high of $900 million, surpassing the previous high of $850 million in June 2023.

Given the synergies between Blend and Blur, NFT loans are still primarily issued on Ethereum NFT collections, and the impact of the increasingly popular Bitcoin Ordinals on the NFT lending market may be worth noting.

Top NFT lending platforms ranked by market share

As of March 2024, the market share of the six major NFT lending platforms based on loan volume:

NFT lending volume divided by month

Monthly NFT lending volume for the top six NFT lending platforms:

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群