比特币减半深度解析:对投资者影响的全面评估

来源:xWhale

source 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

一、引言

比特币和其独特性质

比特币,作为第一种和最著名的加密货币,自2009年由神秘人物中本聪创立以来,已经引起了全球的广泛关注。比特币的核心特性是其去中心化的性质,不依赖于任何中央权威机构,而是通过一个公开的账本——区块链来记录交易。这种设计不仅保证了系统的透明性,还增强了安全性,因为修改任何已经记录的信息需要网络大部分算力的同意。此外,比特币的全球性使其不受特定国家或政策的直接影响,从而成为一种独特的国际货币。

Bitcoin, as the first and most famous cryptocurrency, has attracted widespread attention globally since it was created by the mysterious figure Satoshi Nakamoto in 2009. The core feature of Bitcoin is its decentralized nature, not relying on any central authority but recording transactions through a public ledger - the blockchain. This design not only ensures the transparency of the system but also enhances security, as modifying any recorded information requires the consensus of most of the network's computing power. In addition, Bitcoin's global nature makes it immune to the direct influence of specific countries or policies, making it a unique international currency.

比特币减半

比特币减半是指比特币网络中产生比特币的奖励每四年减半一次的事件。这是比特币协议中一个预先设定的规则,目的是控制比特币的供应,模仿黄金的稀缺性。每产生210,000个区块,矿工获得的新比特币数量就会减半。从最初的每个区块奖励50比特币开始,到现在2024年的3.125比特币。这种周期性的供应减少,理论上会在需求不变的情况下推高价格,从而对市场产生重要影响。

Bitcoin halving refers to the event where the reward for creating bitcoins in the Bitcoin network is halved every four years. This is a pre-set rule in the Bitcoin protocol aimed at controlling the supply of Bitcoin and mimicking the scarcity of gold. Every 210,000 blocks generated, the amount of new bitcoins rewarded to miners is halved. It started from the initial reward of 50 bitcoins per block and is now at 3.125 bitcoins in 2024. This periodic reduction in supply is theoretically expected to drive up prices in the market if demand remains constant, thereby having a significant impact on the market.

二、比特币减半机制解析

比特币减半的定义与历史回顾

比特币减半是指在比特币网络中,新生成区块的比特币奖励每产生210,000个区块减少一半的事件,大约每四年一次。这是比特币算法的核心部分,旨在控制通货膨胀和模仿稀有资源(如黄金)的开采速度逐渐减慢。自2009年比特币网络运行以来,从最初的每个区块奖励50比特币开始,到现在2024年的3.125比特币。每次减半后,挖矿奖励都会减少50%,这直接影响了矿工的收益和整个比特币经济。

Bitcoin halving refers to the event where the reward for creating bitcoins in the Bitcoin network is halved every four years after every approximately 210,000 blocks. This is a crucial part of the Bitcoin algorithm designed to control inflation and slow down the rate of production of bitcoins, mimicking the scarcity of precious resources like gold. Since the inception of the Bitcoin network in 2009 with an initial block reward of 50 bitcoins, it has now reduced to 3.125 bitcoins in 2024. After each halving, mining rewards decrease by 50%, directly impacting the earnings of miners and the entire Bitcoin economy.

矿商的角色及对减半的响应

In the Bitcoin network, miners play a crucial role in maintaining blockchain security and processing transactions. Every time a halving occurs, mining rewards decrease, and many less efficient mining operations may be forced to exit the market due to reduced profits. In response to halving, miners usually seek more efficient mining equipment and lower-cost electricity supply to remain competitive and profitable.

减半对矿业经济性的影响分析

The halving event often leads to a significant reassessment of mining costs versus market value. The profitability of mining is directly affected because a reduction in rewards means that the same mining effort would generate less income if the Bitcoin price does not rise. This prompts mining companies to evaluate their operational efficiency, invest in more advanced technology, or seek cost-effective energy solutions globally.

矿商策略的调整,如设备升级与地理分布的变化

To adapt to the challenges brought by the halving, miners usually employ various strategies, including upgrading hardware, optimizing mining algorithms, and migrating to regions with cheaper electricity. For example, many miners have moved from China to Central Asia, Northern Europe, or even North America to take advantage of lower energy costs and more stable policy environments.

三、减半对比特币供应的影响

The halving directly affects the new supply speed of Bitcoin, and in the long run, this reduced supply may drive up prices if demand remains stable. In this way, the halving event impacts the economic model of Bitcoin, making it more like a "digital gold."

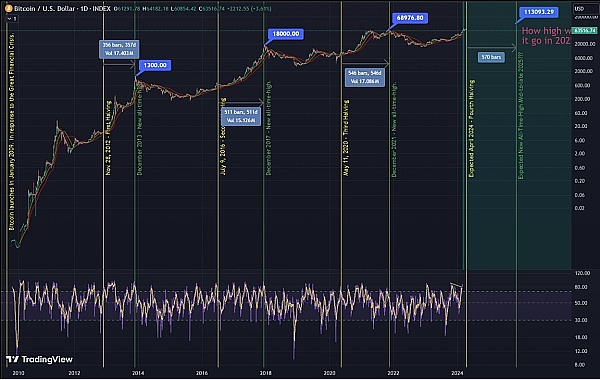

Source: https://www.tradingview.com/chart/BTCUSD/zDs32rdu-BTC-Halving-Cycle-Top-Analysis-2021-2022/

减半前后比特币价格表现:

2012 年减半: 比特币价格从 12 美元上涨至 1,300 美元,涨幅超过 100 倍,中间需时357天。

2016 年减半: 比特币价格从 650 美元上涨至 18,000 美元,涨幅超过 27 倍,中间需时511天。

2020 年减半: 比特币价格从 9,000 美元上涨至 69,000 美元,涨幅超过 7 倍,中间需时546天。

Short-term fluctuations: After the past three halvings, Bitcoin prices have experienced fluctuations within a month of the halving, but then surged significantly over the following year. This phenomenon indicates that the market needs time to digest the impact of the halving, but will eventually respond to the reduced supply brought about by the halving.

Long-term growth: Despite short-term fluctuations, historical data shows that Bitcoin has experienced significant increases in price in the long term after each halving. This is because the halving mechanism continues to reduce the supply of Bitcoin, and with a total supply of only 21 million Bitcoins, Bitcoin becomes a scarce asset.

减半前后比特币价格表现

2012 年首次减半: 减半后一个月,比特币价格上涨了 9%。在接下来的一年中,比特币价格飙升了 8,839%。

2016 年第二次减半: 减半后一个月,比特币价格下跌了 9%。在接下来的一年中,比特币价格飙升了 285%。

2020 年第三次减半: 减半后一个月,比特币价格上涨了 6%。在接下来的一年中,比特币价格飙升了 548%。

Miner selling pressure: Miners may sell Bitcoin after the halving, which could put pressure on prices in the short term. However, it is important to consider that miner selling behavior is often influenced by market demand. If market demand is strong, miner selling may be absorbed without significantly affecting prices.

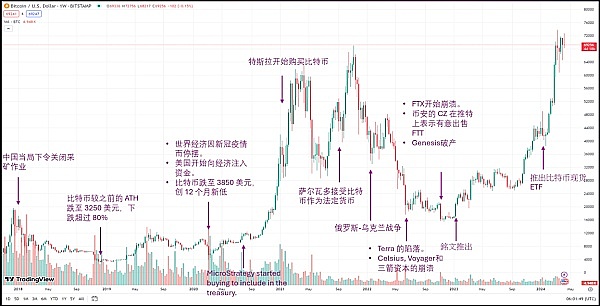

比特币的主要事件和价格影响 (2018 – 2024)

BTC 现货 ETF 的推出

In January 2024, the first Bitcoin spot ETF was listed in the United States, marking institutional recognition of digital assets in the traditional financial markets. This will further drive institutional investors into the cryptocurrency market, increasing Bitcoin's liquidity and market depth, thereby having a positive impact on prices.

四、比特币作为投资资产的优势

比特币与传统资产(如黄金、股票)的比较

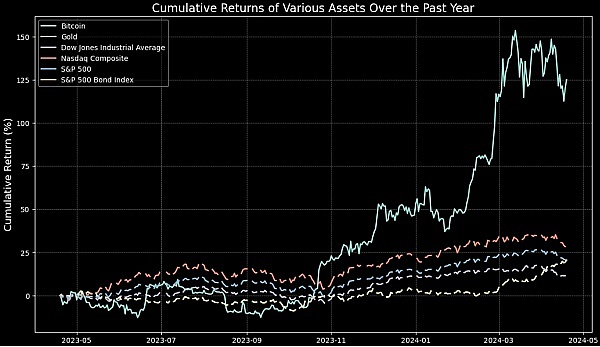

Bitcoin is often referred to as "digital gold," showing similar characteristics of non-governmental control and scarcity as gold. However, it demonstrates different advantages compared to traditional assets like gold and stocks in several aspects. First, Bitcoin's global nature and ease of trading provide an advantage beyond geographical limitations. Relative to gold, Bitcoin's storage and transfer are more convenient and cost-effective. Secondly, compared to the stock market, the Bitcoin market operates nearly 24/7, offering higher liquidity and trading flexibility. Additionally, Bitcoin's price is not directly influenced by company performance or economic policies, providing investors with a potential hedge. In times of increasing global economic uncertainty, Bitcoin may exhibit asynchronous characteristics compared to traditional markets.

As shown in the figure, over the past year, the cumulative return of Bitcoin has exhibited a significant difference compared to other traditional assets. The chart clearly demonstrates Bitcoin's performance relative to gold, the Dow Jones Industrial Average, the Nasdaq Composite Index, the S&P 500 Index, and the S&P 500 Bond Index. It can be observed that Bitcoin experienced a significant growth period in October 2023, with its cumulative return rapidly soaring, far exceeding other assets.

This rapid growth highlights Bitcoin's potential as an investment tool and its volatility, while the growth of traditional assets such as stock and bond indices remains relatively stable. Additionally, gold, as a traditional safe-haven asset, exhibits mild growth and volatility, consistent with the performance of stock and bond indices. Analyzing the returns of these different assets, Bitcoin's uniqueness and high volatility provide investors seeking non-traditional growth opportunities with a different path.

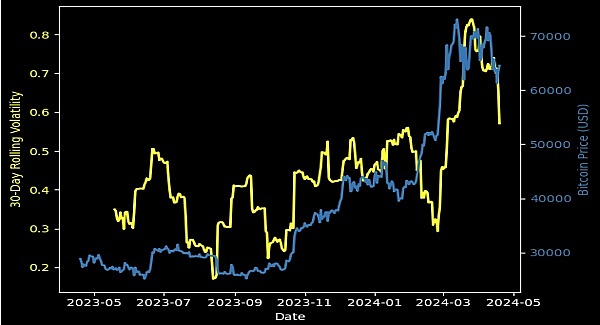

As depicted in the figure, there is a significant correlation between Bitcoin price and its 30-day rolling volatility. In most time periods, we can see Bitcoin price increases accompanying an increase in volatility. Particularly in early 2024, marked on the chart, Bitcoin's price reached a peak, and simultaneously, volatility significantly increased, indicating sharp price fluctuations and increased market volatility in response to market uncertainty. However, in March 2024, Bitcoin's price experienced a sharp decline, also reflected in the steep rise in volatility, indicating that volatility is an important indicator of market uncertainty and changes in investor sentiment during rapid price fluctuations. In the cryptocurrency market, volatility serves as a measure of risk closely connected with price and should be considered in asset allocation.

比特币的市场接受度与增长潜力

In recent years, Bitcoin's market acceptance has significantly increased, with more financial institutions and tech companies beginning to support Bitcoin trading or accept Bitcoin as a payment method. The entry of international payment giants like PayPal and Square in the early years has mainstreamed Bitcoin, providing convenient investment and usage avenues for regular investors. Furthermore, with the development of blockchain technology and gradual improvement of digital currency regulatory environments, Bitcoin's long-term growth potential is widely recognized. As a borderless currency, Bitcoin's potential role in the global economy is gradually expanding, and its growth potential is acknowledged by many investors.

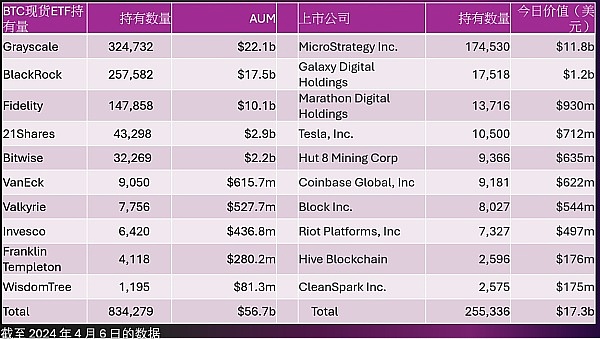

As of April 6, 2024, several well-known ETFs and publicly listed companies hold significant amounts of Bitcoin, reflecting the market's acceptance of Bitcoin and optimism about its growth potential. Large asset management institutions like Grayscale, BlackRock, and Fidelity hold hundreds of thousands of units of Bitcoin through Bitcoin spot ETFs, with total assets under management exceeding 50 billion USD. This data not only demonstrates the positive attitude of institutional investors towards Bitcoin investment but also implies the potential significance of Bitcoin as an emerging asset class, gradually gaining recognition from more participants in traditional financial markets.

Moreover, in publicly listed companies, MicroStrategy, Galaxy Digital Holdings, Marathon Digital Holdings, among others, hold a considerable amount of Bitcoin totaling over 250,000 units, valued at over 17 billion USD. The participation of multinational tech companies like Tesla further affirms the mainstream business sector's affirmation and expectation of Bitcoin's future value.

Overall, whether in the asset management industry or major publicly listed companies, the substantial holdings of Bitcoin highlight market confidence in its potential and the importance of Bitcoin as an investment tool and store of value in global asset allocation. This trend indicates the maturation of the cryptocurrency market and broader market acceptance in the future.

五、未来展望与投资机会

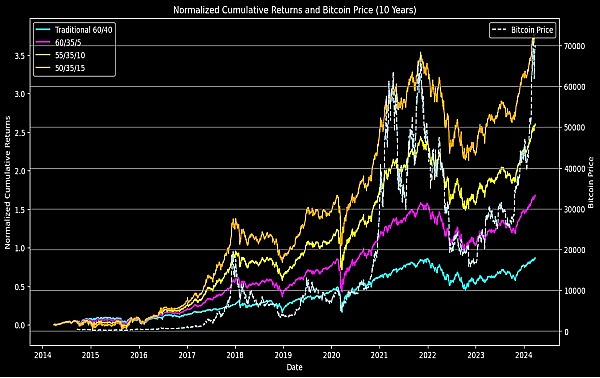

比特币投资与传统投��组合的多样化效应

Incorporating Bitcoin into traditional investment portfolios can provide significant diversification benefits. Due to the low correlation between Bitcoin and traditional financial assets, it offers a means of risk diversification to investment portfolios. In times of global economic instability or inflation, Bitcoin even demonstrates safe-haven asset characteristics. By analyzing Bitcoin's performance in different market conditions, investors can better understand how to utilize this digital asset to optimize the risk-return ratio of their investment portfolios.

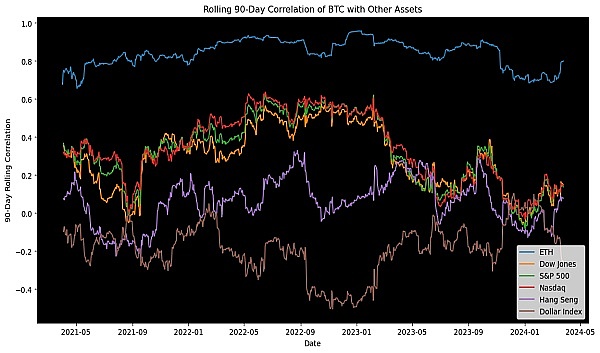

This chart reveals the low correlation characteristics between Bitcoin and traditional assets. Except for the high correlation with Ethereum, BTC shows low correlations with mainstream assets such as the Dow Jones, S&P 500, Nasdaq, and Hang Seng Index. This low correlation demonstrates Bitcoin's advantages as a diversification tool in portfolios, aiding in mitigating systematic risks in the portfolio. Particularly during turbulent times in traditional markets or under downward pressure, Bitcoin's properties may provide investors with a certain level of protection, reducing overall portfolio volatility. Therefore, the inclusion of Bitcoin can be viewed as a strategic allocation aiming to improve the risk-adjusted return of the investment portfolio.

This chart illustrates the standardized 12-month rolling Sharpe ratios of Bitcoin compared to various assets. The Sharpe ratio measures the excess return of one unit of risk, with a higher Sharpe ratio indicating higher risk-adjusted return. From the figure, it can be seen that Bitcoin has significantly higher Sharpe ratios than other assets during some periods, meaning it

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。