美联储突显鹰派 加密行情戛然而止?

近期市场普遍预计美国紧缩货币政策转向,美联储主席鲍威尔于上周周末就美国货币政策的表态再次令这一预期充满了变数。鲍威尔表示,在对抗高通胀方面,美联储可能还有更多工作要做。“联邦公开市场委员会(FOMC)致力于实现充分限制性的货币政策立场,以便随着时间的推移将通货膨胀率降至2%;我们对已经达到这一点并没有信心。”

这几日市场也在纷纷消化“鹰派消息”,从货币政策调控来说,美联储若继续加息,直接影响将会提高美元利率,使美元资产更具吸引力。与此同时,比特币价格在11月10日达到高点后出现下降。

美元作为全球主要的外汇储备货币以及美国在全球经济中的主导地位,加上许多资产以美元计价,赋予了美联储在全球金融市场上的影响力,尤其是海外发达国家市场对联储政策的反应和美股高度相似。然而,美联储内部对策略的不一致导致市场在今年6到8月期间产生了误判。一些市场参与者错误地认为美联储已经达到加息周期的顶点,结果风险市场出现了较大幅度的反弹。

那随着机构入场,合规加持,包含比特币在内的加密市场将会不容忽视,那比特币与美联储的相关性又如何?这个“小众市场”是否还继续拥有小众市场的独特避险性?

链上链下连通,加密市场更敏感

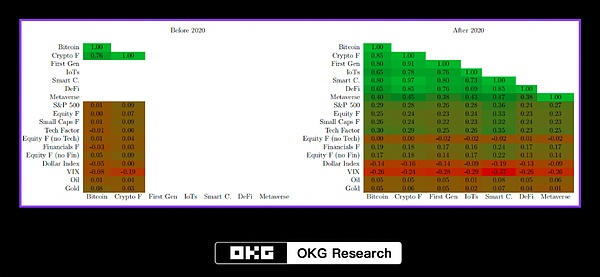

比特币等加密资产作为小众资产虽然在2020年之后与例如S&P500和全球海外发达国家股票市场等金融市场的相关联性越来越强。我们可以看到在全球主要股票市场(Equity F)的关联性上,是可以看出之前的0关联变成了0.25,仅低于S&P500的相关性0.29。在金融因素(Financials F)的关联性上,从-0.03变为0.19。

Source: IMF

Note: Smart C. = Smart Contract, F = Factor

根据IMF工作论文的测算结果,美国货币政策对加密货币周期的影响与对全球股票周期的影响几乎一致,这与加密资产在对冲市场风险方面的潜力形成了鲜明对比。当美联储的货币政策利率(SFFR)上升一个百分点时,加密货币因子在随后的15天持续下降约是股票因子下降的150%影响力,这意味着加密市场对美联储的货币政策变化更为敏感。

不过对于美联储内部,投资者还需注意的是,目前市场与美联储之间存在分歧,市场普遍认为美国正处于经济循环的高点或者普通的通货膨胀阶段。然而,美联储此前虽坚称美国面临的是经济循环的高点或普通的通货膨胀,但其实际行动和采取的措施却更为激进。因此,市场对美联储“心口不一”的立场产生了一定的疑虑。

无论是合规加持和机构加速接纳等频频利好尽出,还是数据上的结论,我们都十分明确地可以看出链上的加密市场已不再小众,加密市场已融入全球金融周期。

机构进场冲击,加密投资者更需宏观视野

随着机构资金涌入加密市场,市场的成熟度将提升。同时,专业投资者通常会更加关注宏观经济因素和货币政策的变化,机构投资者参与度的增加加强了货币政策对加密货币市场的传导效应。这就会令美联储的货币政策对市场的影响增大。

Arthur Hayes在他最新的文章《Bad Gurl》中也指出,加密市场的牛市可能会随着美元流动性的增加而到来,而美元流动性与美元的货币政策直接相关。因此,从实体经济和全球金融周期的角度来预测,尤其是提前预测美联储的行动即管理“管理市场的预期”将成为未来市场投资者最重要的衡量标准之一。

除了内部美联储存在“心口不一”的立场让市场产生疑虑,我们还需关注美联储的货币政策的外部有效性。投资者需要有更广阔的宏观格局,例如参考实体经济周期动态以及全球金融运行的大环境。考虑到美元国际地位相对下降、人民币国际化进程,以及美国GDP规模相对欧盟整体而言并无明显优势等因素,学界例如Scott Sumner教授在探讨有关于美国的货币政策对世界名义经济有着不成比例的影响,提出了“名义超级大国”和“实际超级大国”的影响区别。

比特币等加密资产正在迈向一个全新的阶段。随着各方重要利益相关者的参与,从机构投资者到监管机构,加密市场正在以前所未有的速度积累规模和影响力。与此同时,其价格走势似乎愈发难以独善其身。短中期来看,即使加密市场拥有科技的加持,独立行情已成过去。与股市投资者相比,加密投资者也需要关注更为宏观视角下的通胀、金融稳定和经济复苏多重困难下制定货币政策的走势。

Recently, the market generally expects the US to tighten monetary policy and turn to US monetary policy. Federal Reserve Chairman Powell's statement on US monetary policy last weekend once again makes this expectation full of variables. Powell said that the Fed may have more work to do in fighting high inflation, and the Federal Open Market Committee is committed to achieving a fully restrictive monetary policy stance in order to reduce the inflation rate over time. We are not confident that this has been achieved. These days, the market is also digesting hawks. From the perspective of monetary policy regulation, if the Fed continues to raise interest rates, it will directly affect the interest rate of the US dollar, making the assets of the US dollar more attractive. At the same time, the price of Bitcoin will drop after reaching a high point on January. As the world's major foreign exchange reserve currency and the dominant position of the United States in the global economy, many assets are denominated in US dollars, which gives the Fed influence in the global financial market, especially in overseas developed countries. The response to the Fed policy is highly similar to that of the US stock market. Inconsistency in internal strategies led to misjudgment in the market during the period from January to this year. Some market participants mistakenly thought that the Fed had reached the peak of the interest rate hike cycle, and as a result, the risk market rebounded greatly. With the admission of institutions and compliance, the encryption market including Bitcoin will not be ignored. How about the correlation between Bitcoin and the Fed? Does this niche market continue to have the unique risk aversion of niche markets? Chain-to-chain connectivity encryption markets are more sensitive to Bitcoin, etc. As a niche asset, encrypted assets have become more and more closely related to financial markets such as the stock markets of overseas developed countries. We can see that the previous correlation has become only lower than the correlation of financial factors. According to the calculation results of working papers, the impact of US monetary policy on encrypted currency cycle is almost the same as that on global stock cycle, which is similar to that of encrypted assets in hedging market. The potential of market risk is in sharp contrast. When the interest rate of the Federal Reserve's monetary policy rises by one percentage point, the cryptocurrency factor continues to decline in the following day, which means that the cryptocurrency market is more sensitive to the changes of the Federal Reserve's monetary policy. However, it should be noted that there are differences between the market and the Federal Reserve at present. It is generally believed that the United States is at the high point of the economic cycle or in the ordinary inflation stage. However, the Federal Reserve is this. Although the former insists that the United States is facing the high point of economic cycle or ordinary inflation, its actual actions and measures are more radical, so the market has some doubts about the Fed's inconsistent position, whether it is compliance blessing and accelerated acceptance of institutions, we can clearly see that the encryption market in the chain is no longer niche, and the encryption market has been integrated into the global financial cycle. Institutions enter the market and impact encryption investors with the opportunity. At the same time, professional investors usually pay more attention to the changes of macroeconomic factors and monetary policy, and the increase of institutional investors' participation strengthens the transmission effect of monetary policy on the cryptocurrency market, which will increase the impact of the Fed's monetary policy on the market. In his latest article, he also pointed out that the bull market in the cryptocurrency market may come with the increase of dollar liquidity, and dollar liquidity is directly related to dollar monetary policy. Predicting from the perspective of the real economy and the global financial cycle, especially predicting the Fed's actions in advance, that is, managing and managing the market's expectations, will become one of the most important criteria for future market investors. In addition to the internal position of the Fed, which makes the market doubt, we also need to pay attention to the external effectiveness of the Fed's monetary policy. Investors need to have a broader macro pattern, such as referring to the dynamics of the real economy cycle and the overall environment of global financial operation, taking into account the international status of the US dollar. For example, professors in academic circles are discussing about the disproportionate influence of American monetary policy on the world nominal economy, and put forward the difference between the nominal superpower and the actual superpower. Cryptographic assets such as Bitcoin are moving towards a brand-new stage. With the participation of important stakeholders, from institutional investors to regulatory agencies, the crypto market is accumulating regulations at an unprecedented speed. Mode and influence at the same time, its price trend seems to be increasingly difficult to be independent. In the medium term, even if the encryption market has the blessing of science and technology, the independent market has become a thing of the past. Compared with stock market investors, encryption investors need to pay attention to the trend of formulating monetary policy under the multiple difficulties of inflation, financial stability and economic recovery from a more macro perspective. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。