bitget投资BC科技 Web3市场将迎来怎样的变革?

OSL母公司获BGX战略投资7亿港元,香港加密交易所市场或进入白热化竞争

流传已久的OSL出售传言终于落地了。日前,OSL母公司BC科技集团获得BGX 7.1亿港元战略投资,BC科技第一大股东即将易主BGX。

接下来,香港虚拟资产交易所市场或将迎来新的格局。

OSL易主BGX

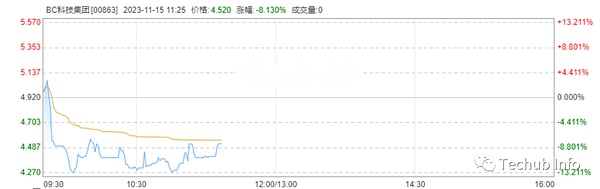

11月15日,在经过两天的停牌后,BC科技集团宣布复牌,开盘半个小时内,其股价跌幅超过10%,截至发稿,报价4.52港元。

11月14日,BC科技集团宣布已获得加密货币集团BGX战略投资7.1亿港元。11月13日,BC科技公告称,暂停公司股票买卖,以待发布一项内幕交易公告。

从股价的反应来看,股民对本次战略投资似乎并不看好。

据BC科技公告,本次战略投资中,BC科技向加密货币投资者Shawn Liu旗下BGX发1.876亿新股,每股作价3.8港元,相对于上周五收盘价4.92港元折让22.76 %。

BC科技集团是一家香港主要从事数字资产与区块链业务的上市公司,其旗下拥有香港持牌的数字资产交易所OSL。目前,香港持牌虚拟资产交易所只有2家(另一家是HashKey Exchange),而且,媒体在年初就传言BC科技将要出售OSL,因此引发行业关注。

此次获BGX战略投资后,OSL出售的传言终于落地。

BC科技CFO胡振邦对Techub News表示:“BGX战略投资强化了我们的资本实力,下一步,我们将继续做好本来就应该做的事,开拓机构市场,链接更多的银行券商和散户。另外,STO也非常让人期待,我们已经公布跟嘉实国际联合推出STO的基金产品,会在香港面对散户市场推广,之后类似的产品还会越来越多。”

据媒体报道,获得战略投资后,BC科技大股东、工业股壳王高振顺及卢建邦一方的East Harvest持股量,会由42.77%摊薄至29.96%,而BGX的Shawn Liu日后持股量则达29.97%,成为BC科技集团的第一大股东。Shawn Liu为内地股权投资公司深圳前海君创基金创办人以及加密货币投资机构Foresight Ventures的创办人。

BC科技公告称,Shawn Liu一方计划提名BGX & BitgetX CEO潘志勇及杨超为BC科技执董。

在此之前,11月13日,BitgetX发布了《关于BitgetX.hk关闭的公告》,要求用户于12月13日前提取该平台上的虚拟资产。

该公告称,BitgetX放弃申请香港虚拟资产交易平台牌照,www.BitgetX.hk将于12月13日起停止营运,Bitgetx.hk将永久退出香港市场。

加密交易所市场新格局

BGX的战略投资,标志着BC科技和OSL的发展将步入全新阶段。

近两年来,BC科技一直处于亏损状态,且净亏损持续扩大。由于加密行业持续的熊市,OSL的业绩出现下滑,在今年8月份获得虚拟资产交易平台牌照后,OSL也并未有太多的业务拓展。

据BC科技2023半年报显示,2023年上半年该公司净亏损为9470万港元,OSL数字交易平台总交易量为1126亿港元,同比减少47.5%,经纪交易量同比下降42%。

然而,OSL获得香港虚拟资产交易平台牌照需要很大的投入成本。此前,有行业人士预计初期成本3000万至4000万港元,每年运营成本2000万港元。

此前,BC科技CFO胡振邦在接受Techub News采访时也表示,OSL对此的投入金额具体数字难以确切给出,只能说并不低。

行业分析人士表示,由于BGX的进入,OSL将迎来生机,另外,一些正在申请牌照的平台也可能即将通过审批,香港加密市场即将进入白热化的竞争阶段,曾占领先发优势的Hashkey能否持续保持创新和快速发展占领市场呢,难以预测。

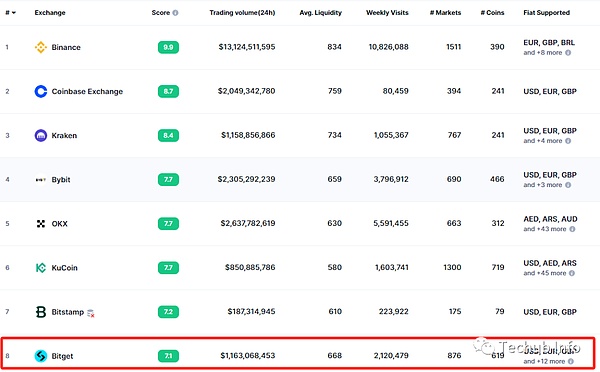

据公开报道,Bitget是BitgetX的母公司,成立于2018年,是全球最大的加密货币交易所之一,拥有超过 2000 万用户。根据 CoinMarketCap数据,Bitget综合排名从此前的14名上升至第8位,过去24小时现货交易量为11亿美元,周访问用户为212万人。

据香港证监会网站显示,正在申请虚拟资产交易平台牌照的公司目前有5家,包括BGE、HKbitEX、HKVAX、VDX(胜利数码科技)、Meex。

除此之外,香港虚拟资产行业还有瑞士SEBA、传统证劵牌照拥有方(老虎和富途)、币圈头部平台(OKX 和币安)和其他拥有1/4/7/9号牌照的平台等潜在竞争对手。

值得讨论的是,未来,谁会成为香港虚拟资产交易所的“头号玩家”呢?

The long-standing rumor that the parent company has gained a strategic investment of HK$ 100 million in the Hong Kong crypto exchange market or entered the fierce competition has finally landed. Recently, the parent company Science and Technology Group won a strategic investment of HK$ 100 million, and the largest shareholder of science and technology will soon change hands. Next, the market of Hong Kong Virtual Assets Exchange will usher in a new pattern. After a two-day suspension, Science and Technology Group announced the resumption of trading. Within half an hour, its share price fell more than the closing quotation of HK$ 100 million. On March, Science and Technology Group announced that it had obtained cryptocurrency. Group's strategic investment is HK$ 100 million. On March, Science and Technology announced that it would suspend the trading of the company's shares until an insider trading announcement was issued. Judging from the reaction of the stock price, investors seem to be not optimistic about this strategic investment. According to the science and technology announcement, in this strategic investment, Science and Technology issued HK$ 100 million new shares to cryptocurrency investors at a price of HK$ compared with last Friday's closing price. Science and Technology Group is a listed company mainly engaged in digital assets and blockchain business in Hong Kong. It owns a licensed digital assets exchange in Hong Kong. At present, there is only one licensed virtual asset exchange in Hong Kong, and the media rumored that technology will be sold at the beginning of the year, which caused the industry to pay attention to the rumor that it will be sold after the strategic investment. Hu Zhenbang said that the strategic investment has strengthened our capital strength. Next, we will continue to do what we should have done, open up institutional markets, link more banks, brokers and retail investors, and it is also very exciting to expect that we have announced that the fund products jointly launched with Harvest International will be fragrant. After the promotion of retail market in Hong Kong, there will be more and more similar products. According to media reports, after the strategic investment, the shareholding of Chunshun Ko and Lu Jianbang, the major shareholders of science and technology, will be diluted, but in the future, the largest shareholder of science and technology group will be the founder of Shenzhen Qianhai Junchuang Fund, a mainland equity investment company, and the founder of cryptocurrency investment institutions. The science and technology announcement said that one party plans to nominate Pan Zhiyong and Yang Chao as the executive directors of science and technology. Before this, it was released on March. The closed announcement requires users to withdraw the virtual assets on the platform before June. The announcement said that they would give up the application for the Hong Kong virtual assets trading platform license, and would stop operating on June, and would permanently withdraw from the Hong Kong market. The strategic investment in the new market structure of the encryption exchange indicates that the development of technology and technology will enter a new stage. In the past two years, technology has been losing money and the net loss has continued to expand. Due to the continuous decline in the performance of the encryption industry, after obtaining the virtual assets trading platform license in January this year, There is not much business expansion. According to the semi-annual report of science and technology, the company's net loss in the first half of last year was HK$ 10,000, and the total trading volume of digital trading platforms was HK$ 100 million. However, it takes a lot of investment to obtain the license of Hong Kong virtual asset trading platform. Previously, some people in the industry estimated that the initial cost would be HK$ 10,000 to HK$ 10,000, and the annual operating cost would be HK$ 10,000. Previously, Hu Zhenbang, a scientist, also said in an interview that it According to industry analysts, other platforms that are applying for licenses may soon pass the examination and approval, and Hong Kong's encryption market is about to enter a fierce competition stage. Can those who used to be the leading players continue to innovate and develop rapidly to occupy the market? It is difficult to predict. According to public reports, yes, the parent company was established in, and it is one of the largest cryptocurrency exchanges in the world with more than 10,000 users. According to the comprehensive ranking of data, the spot transaction volume in the past hour rose from the previous name to the first place. According to the website of the Hong Kong Securities Regulatory Commission, there are currently 10 companies applying for the license of the virtual assets trading platform, including Shengli Digital Technology. In addition, the virtual assets industry in Hong Kong also has potential competitors such as Tiger, the head platform of Futu Coin Circle and Coin Security and other platforms with license plates. It is worth discussing who will become the number one player of the virtual assets exchange in Hong Kong in the future. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。