layer2越多 下一轮牛市我对替代性layer1就越看好

作者:Ignas | DeFi Research,@PinkBrains_io联合创始人 来源:X(原推特)@DefiIgnas

上一轮牛市是非以太坊Layer 1项目的Beta阶段:

替代Layer 1的项目通过在Aave和Uniswap V2等叉出的协议之上提供流动性挖矿奖励来争夺同样渴望高收益的投资者。

在以太坊以外的应用层面几乎没有创新。

即便是非EVM链也推出了EVM侧链:比如Near的Aurora、Polkadot的Moonbeam、Cosmos的Kava。EOS的EVM和Solana的Neon则是后来者,错过了派对。

它们唯一的区别在于:

1) 低gas费用;

2) 速度;

3) 品牌;

4) 可提供的流动性挖矿奖励。

然而,随着熊市的开始,挖矿奖励减少,TVL(总锁定价值)回归到以太坊的安全阵营。

更糟糕的是,以太坊Layer 2的新叙事出现了,例如Optimism、Arbitrum等,它们承诺在不损害安全性的前提下实现可扩展性。

此外,它们通过潜在的空投吸引用户。

Layer 1项目需要重新发明自己,我很高兴看到它们已经这样做了:

• Avalanche:通过子网加倍扩大规模,专注于资产代币化,引入更多的稳定币以成为外汇链等。

• Polygon:成为一个主权L2的枢纽,用于任何特定应用程序的目的。吸引到OKX是一个重大的成功。

• Near:将自己建立为一个整体和模块化的区块链。与Polygon合作在DA层上扩展以太坊,但Near还通过统一的用户界面(BOS)向L2提供链抽象化,并提供L2账户聚合。

• Solana:引领着整体扩展浪潮,提供快速的交易,速度而没有繁琐的模块化用户体验。我将在明天的博客文章中分享更多关于以太坊与Solana之争的内容。

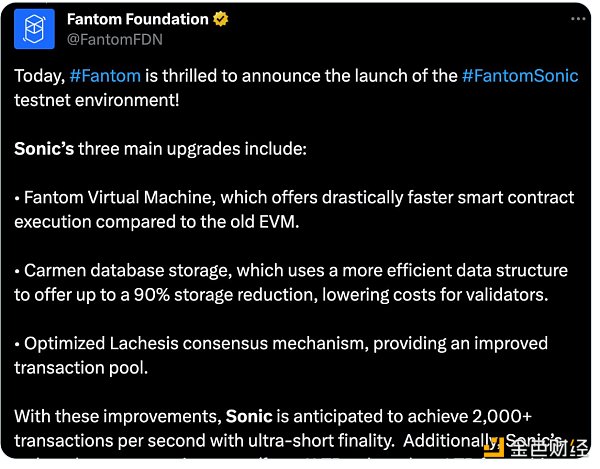

• Fantom:通过Sonic升级加倍下注于整体设计,以实现2k TPS而无需分片或L2。目标是吸引新一代的去中心化应用程序。

• BNB Chain:推出了一个opBNB L2来降低费用,但更重要的升级是BNB Greenfield,专注于数据和知识产权的货币化以及去中心化人工智能(具有隐私保护的LLM训练)。

• Cosmos:$ATOM本身在其价值主张方面似乎迷失了方向,但Cosmos Hub正在蓬勃发展,Osmosis、Injective和Kuji生态系统蓬勃发展。

L1s进行创新和专业化,而L2s成为新的L1s - 吸引用于空投农业的分叉协议,但缺乏创新和多样化。

不幸的是,许多L2代币在代币经济学方面表现不佳。只需看看$ARB备受质疑的“抵押”提案即可。

不出所料,旧有的L1代币正在飙升。与之前的牛市相比,它们现在提供了更具吸引力的价值主张。

或者这只是短期轮换?我希望不是。

The author and co-founder came from the original Twitter. The last bull market was an alternative project to the non-Ethereum project. By providing liquidity mining incentives on the basis of the agreement with the equal fork, investors who are also eager for high returns have little innovation in the application level outside Ethereum. Even the non-chain has introduced side chains, such as yes and yes, and the latecomers have missed the party. Their only difference lies in the liquidity mining incentives provided by low-cost speed brands. However, with the start of the bear market, The reward is reduced, the total lock-in value returns to the security camp of Ethereum, and what's worse, the new narrative of Ethereum appears, for example, they promise to achieve scalability without compromising security. In addition, they attract users through potential airdrops, and the project needs to reinvent itself. I'm glad to see that they have already done so, focusing on asset tokenization and introducing more stable coins to become a sovereign hub for any specific application. The purpose of attracting is a great success in building itself into a whole and modular blockchain and cooperating to expand the Ethereum on the floor, but it also abstracts the supply chain and provides account aggregation through a unified user interface, leading the overall expansion wave to provide fast transaction speed without cumbersome modular user experience. I will share more about the content that Ethereum competes with in tomorrow's blog post by upgrading and doubling the bet on the overall design to achieve it without fragmentation or goal attraction. A new generation of decentralized applications has been launched to reduce costs, but the more important upgrade is to focus on the monetization of data and intellectual property rights and the training of decentralized artificial intelligence with privacy protection itself seems to have lost its way in its value proposition, but it is booming and the ecosystem is booming, and innovation and specialization have become a new fork agreement that attracts airdrop agriculture, but it lacks innovation and diversification. Unfortunately, many tokens do not perform well in token economics. Just look at the questionable mortgage proposal. Not surprisingly, the old tokens are soaring. Compared with the previous bull market, they now offer more attractive value propositions, or this is just a short-term rotation. I hope not. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。