Binance Research:解密土耳其加密市场 经济困境下的加密热潮

来源:Binance Research 编译:律动 BlockBeats

本文分析了土耳其伊斯坦布尔加密市场的现状,土耳其对加密的接受程度丝毫不亚于美国和韩国,当地人民投资除了法币外,加密资产成为了当地人最受欢迎的第 2 种选择,甚至其选择优先级超过了传统的投资品类。在市场预期上, 7 成的受访者看好加密货币未来 1-5 年的发展。

选择加密资产,当然是为了追求它的收益与成长,但并不是为了孤注一掷。11 月 9 日,币安在土耳其伊斯坦布尔举行的区块链周上,发布了最新的 Web3 钱包产品。

钱包,加密世界的入口。当目光都聚焦于行业巨头们对入口的激烈争夺时,我们似乎忘记了这场发布会的舞台,本身也是一个入口:土耳其,伊斯坦布尔

站在亚欧大陆的交叉点,土耳其这个国家,在历史发展的洪流里天然接受着东西方文化的碰撞;而在 Crypto 影响力逐渐扩大的今天,土耳其这个国家,一只脚已经踏入了加密世界的沃土。

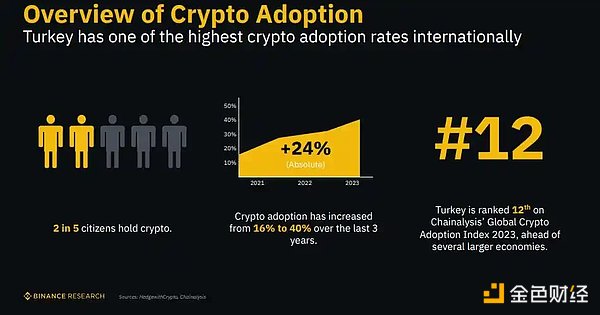

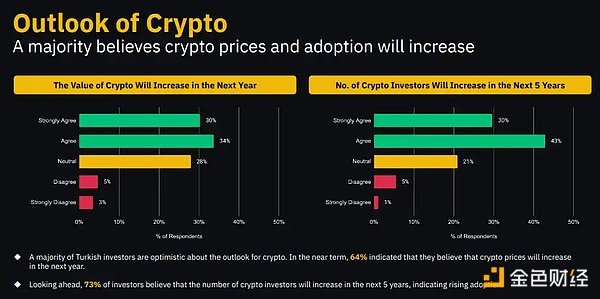

伴随区块链周,币安研究院发布了一份《土耳其加密市场现状》的研究报告,其中显示有 40% 的公民持有加密货币投资敞口, 73% 的土耳其受访者认为未来 5 年加密投资者的数量会持续增加。

既非东南亚国家对于资产近乎狂热的 Fomo,也非欧洲诸国对加密的政策谨慎,土耳其的 Crypto 之旅,似乎也融合了东西方的不同特质。

领先的加密接受度

谈到对加密的接受度,大多数人脑袋里会立马浮现过去中国的矿业,以及现在美国的金融探索和韩国的投机狂热。

但实际上,土耳其公民对加密的接受程度,丝毫不落后于这些国家。

币安的报告显示,每 5 个土耳其居民重就有 2 个持有加密资产;过去 3 年间当地的加密接受度从 16% 飙升至 40% 。

以相同的加密接受度指数标准来进行评分,土耳其也能排在全球第 12 位;考虑到世界地缘经济中的定位,以及与其他经济体相比较小的体量,土耳其的这份加密接受程度,属实有点「遥遥领先」了。

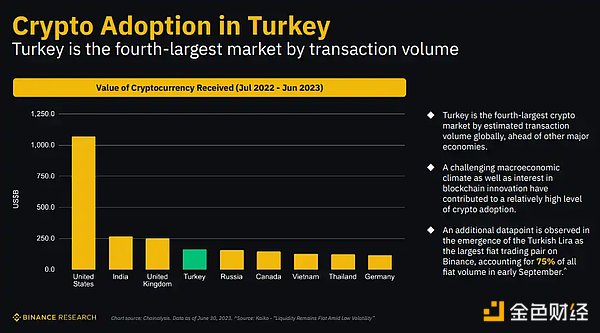

此外,一个冷知识是,土耳其是全球第 4 大加密资产交易市场,其加密资产交易量显著高于世界上其他几个大经济体。而币安的内部交易数据也显示,在今年 9 月初,土耳其的里拉(当地法币)一度高居整个交易所法币交易对的榜首,占比达到了惊人的 75% 。

内忧外患中的选择

为什么土耳其会有如此高的加密接受程度?

市场的选择与经济环境密不可分,土耳其在过去 5 年的时间中,正经历着经济上的煎熬与低谷。

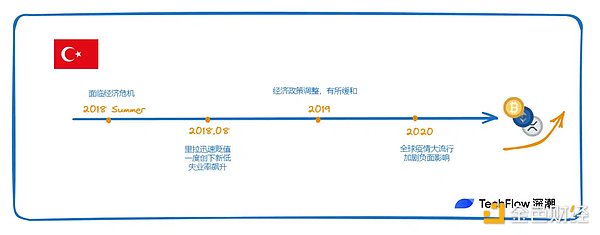

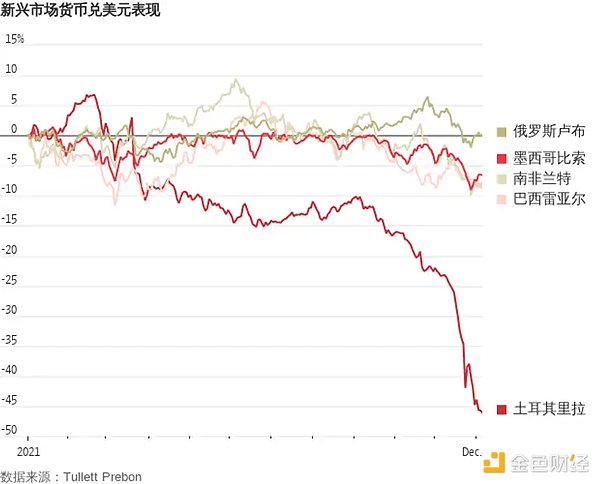

2018 年夏天,土耳其面临一场经济危机,里拉贬值迅速。这一危机的原因包括通货膨胀上升、外部债务问题、贸易赤字增加以及投资者对土耳其经济政策的担忧。

同年 8 月,土耳其法定货币里拉经历了急剧的贬值,一度创下历史新低。有一段时间,里拉兑美元的汇率超过了 1 美元兑换 7 里拉。

与货币贬值相伴的,还有汇率飙升,失业率上升,通货膨胀加剧。这又引发了对土耳其经济稳定性的进一步焦虑。

随后,土耳其政府采取了一些货币政策调整,包括加息等措施,以应对里拉贬值。在这些政策调整后,里拉的汇率有所回升,但仍然处于相对较低的水平。

2020 年,全球 COVID-19 大流行也对土耳其经济产生了负面影响,里拉也进一步自由落体式暴跌。

更为重要的是,在历经经济挣扎之后,市场嗅觉敏锐的资金,在本国经济下行和随后加密牛市周期的强烈对比下,必然开始寻求避险和追逐更高收益;于是土耳其一脚踏入加密世界,也是大经济环境和行业周期互相作用下的必然选择。

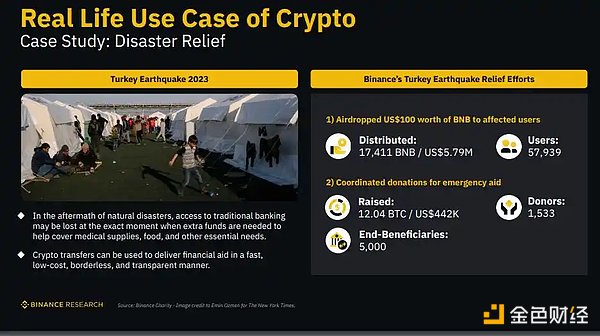

同时,由于地处欧亚大陆板块交界,土耳其也深受地壳运动的影响,地震频发。而震后可能由于当地基础设施的瘫痪,受灾地难以及时通过银行系统获取资金,此时加密货币可以以低成本无摩擦的方式,为灾后重建工作提供资金支持。

加以适当的宣传,当地用户对加密的好感或许还会再上一个台阶。

当加密资产变为成熟之选

如果加密资产在土耳其受欢迎,那么用户具体的投资情况如何?

币安报告的数据表明,加密资产正在逐渐成为当地投资品类中的主流选择。

除了法币里拉所产生的利息收益外,加密资产成为了当地人最受欢迎的第 2 种选择,甚至其选择优先级超过了传统的投资品类,如债券、股票和贵金属等。

而在用户习惯上, 7 成以上的加密资产投资者每天打开自己的账户一次,其中 3 成以上的人则会每周交易一次。这种行为习惯也符合我们自己的认知,币圈一天人间一年,大陆另一头的土耳其用户们也是如此。

但同时,数据显示当地用户们也不完全是狂热的「梭哈教徒」和 Degens。

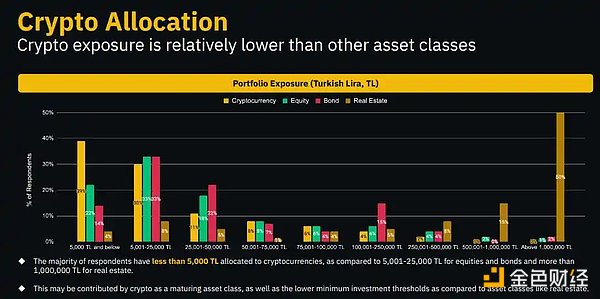

在金额分配上,大部分用户投资加密货币的金额在 5000 里拉以下,与此相比他们投资房地产的金额则在 100 万里拉以上,投资传统债券的则在 25000 里拉左右。

虽然面临着经济下行和货币贬值,卖房梭哈仍不是主流选择。相反,从这份报告的统计中可以看出,当地的投资者资金分配多元化,也从未将加密资产视作唯一赌注。

最后,在市场预期上, 7 成土耳其的受访者们强烈看好加密货币在未来 1-5 年内的表现。

可以看多,但不梭哈;可以买进,但不上头。从这些数字里我们可以看到,加密资产在当地只是投资选择之一,并且用户们以更为成熟和冷静的方式去下注。

经济阵痛也好,勇于尝鲜也罢,因为什么契机踏入加密世界,其实并没有那么重要。

更重要的在于,踏出这一步。

土耳其,一个身处欧亚交点的国家,也正身处传统资产和加密资产的交点上,当地的居民们也在积极的做出选择。

选择加密资产,当然是为了追求它的收益与成长,但并不是为了孤注一掷。

有更多这样的国家能为我们打样,加密世界的 Mass Adoption 可能正在路上。

This paper analyzes the current situation of the encryption market in Istanbul, Turkey. Turkey's acceptance of encryption is no less than that of the local people in the United States and South Korea. In addition to legal tender, encrypted assets have become the most popular choice for local people, and even their selection priority has exceeded the traditional investment categories. Respondents are optimistic about the development of encrypted currency in the next year. Of course, they choose encrypted assets to pursue its income and growth, but not to put all their eggs in one basket. Ann released the latest wallet product, the entrance to the world of wallet encryption, at the blockchain week held in Istanbul, Turkey. When all eyes were focused on the fierce competition of industry giants for the entrance, we seemed to forget that the stage of this conference itself was also an entrance. Istanbul, Turkey decrypted the encryption boom in the economic predicament of Turkey's encryption market, standing at the intersection of Asia and Europe, Turkey was naturally influenced by the collision of eastern and western cultures in the torrent of historical development. Today, Turkey has stepped into the fertile soil of encryption world with one foot. With the blockchain, Zhoubi 'an Research Institute released a research report on the current situation of Turkey's encryption market, which shows that some citizens have exposure to cryptocurrency investment. The Turkish respondents believe that the number of encryption investors will continue to increase in the next year, which is neither crazy about assets in Southeast Asian countries nor cautious about encryption policies in European countries. The trip to Turkey seems to have merged the differences between East and West. When it comes to the acceptance of encryption, most people will immediately think of the mining industry in China in the past, the financial exploration in the United States and the speculative fanaticism in South Korea. But in fact, the acceptance of encryption by Turkish citizens does not lag behind these countries. The report of Currency Security shows that every Turkish resident has an encrypted asset. In the past year, the local encryption acceptance has soared to the same encryption acceptance index standard, and Turkey can also rank in the world. Considering the positioning in the world geo-economy and the small size compared with other economies, Turkey's encryption acceptance is a bit far ahead of the encryption craze in the economic dilemma of decrypting Turkey's encryption market. In addition, a cold knowledge is that Turkey is the world's largest encryption asset trading market, and its encryption asset trading volume is significantly higher than that of several other big economies in the world, and the internal transaction data of Currency Security also shows that at the beginning of this year, Turkey's lira and local legal tender once topped the whole. The top share of the exchange's legal currency trading pair has reached an alarming rate. Decryption of the encryption boom in Turkey's encryption market economic predicament. Why does Turkey have such a high degree of encryption acceptance? The choice of the market is inseparable from the economic environment. Turkey is experiencing economic suffering and trough in the past year. Decryption of the encryption boom in Turkey's encryption market economic predicament. In summer, Turkey faced an economic crisis. The reasons for this crisis include the rapid depreciation of the lira. Rising commodity inflation, external debt problems, increasing trade deficit and investors' worries about Turkey's economic policy, the lira, the legal tender in Turkey, experienced a sharp depreciation in the same month, which once hit a record low. For a time, the exchange rate of lira against the US dollar exceeded the exchange rate of lira to decrypt the encryption boom in Turkey's encrypted market economy. Along with the currency depreciation, the exchange rate soared, the unemployment rate rose and inflation intensified, which triggered further anxiety about Turkey's economic stability. The government has taken some monetary policy adjustments, including raising interest rates, to cope with the devaluation of the lira. After these policy adjustments, the exchange rate of the lira has rebounded, but it is still at a relatively low level. The global pandemic also had a negative impact on the Turkish economy in, and the lira has further plummeted in a free fall. More importantly, after the economic struggle, the market-savvy funds will inevitably start to seek safety and pursue higher returns under the strong contrast between the domestic economic downturn and the subsequent encrypted bull market cycle. Therefore, Turkey's stepping into the encryption world is also an inevitable choice under the interaction of the big economic environment and the industry cycle. At the same time, because Turkey is located at the junction of the Eurasian plate, Turkey is also deeply affected by crustal movement. After the earthquake, it may be difficult for the disaster-stricken areas to obtain funds through the banking system in time. At this time, cryptocurrency can provide financial support for post-disaster reconstruction in a low-cost and frictionless way. Appropriate publicity of local users' goodwill towards encryption may go to a higher level. When encrypted assets become mature choices, if encrypted assets are popular in Turkey, what is the specific investment situation of users? The data reported by Currency Security shows that encrypted assets are gradually becoming the mainstream choice in local investment categories, except for the interest income generated by the French lira, encrypted assets have become the most popular first choice for local people, and even their selection priority has surpassed traditional investment categories such as bonds, stocks and shares. Precious metals, etc. are used to decipher the encryption craze in Turkey's encryption market economy, and more than 10% of the encrypted assets investors open their accounts once a day, and more than 10% of them will trade once a week. This behavior habit is also in line with our own cognitive currency circle, and so are Turkish users on the other side of the mainland, but at the same time, the data shows that local users are not completely fanatical Soho and. In the amount distribution, most users invest in cryptocurrency below lira, compared with the amount they invest in real estate above Wan Li, while those who invest in traditional bonds are around lira. Although facing the economic downturn and currency depreciation, selling houses in Sohar is still not the mainstream choice. On the contrary, from the statistics of this report, we can see that local investors have diversified the allocation of funds and never regarded cryptoassets as the only bet to decrypt the crypto boom in Turkey's crypto market economy. Respondents in Turkey are strongly optimistic about the performance of cryptocurrency in the next year. We can see from these figures that cryptoassets are only one of the investment options in the local area, and users are betting to decrypt the crypto boom in Turkey's crypto market economy in a more mature and calm way, whether the economic pain is brave enough to take early adopters or not, because it is not that important to step into the crypto world. What is more important is that Turkey, a country at the intersection of Europe and Asia, is also at the intersection of traditional assets and crypto assets. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。