当你们忙着打铭文的时候 RWA代币早就悄悄起飞了

本月要是不知道打铭文,基本就算没混进华人加密圈。

但各个RWA项目的代币也在差不多同一时间起飞了~

目前华人和欧美的加密圈简直是两个平行世界,真有意思。

加密货币领域最近的价格波动主要核心动力是受到比特币现货ETF相关进度的影响。

比特币的价格受此影响逐步走高。

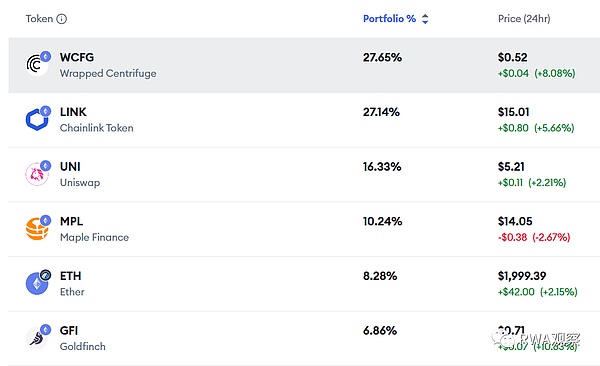

笔者在开始写本公众号的时候,为了保持对业内的敏感度,配置了一些RWA代币,主要持仓比例是这样的:

没想到主营业务和公众号都没开始赚钱呢,这些代币也差不多都起飞了

我来和大家聊一下我持仓逻辑吧~

资产上链头部玩家Centrifuge

如果搞RWA不知道Centrifuge也算是没入行了,目前Makerdao还有很多链上defi项目的资产包,都是Centrifuge打包的。

Centrifuge自己有一个Centrifuge Chain,是一个基于Substrate的POS链。CFG的作用是为Centrifuge提供激励,$CFG的持有者可以通过链上治理参与Centrifuge的发展。

由于传统资产上链的过程极其复杂,在现有监管条件不发生大的变化的情况下,可能美元资产上链,很多都需要通过Centrifuge的通道。

关于资产上链,可以详见:RWA未来天王山之战:革资产证券化的命

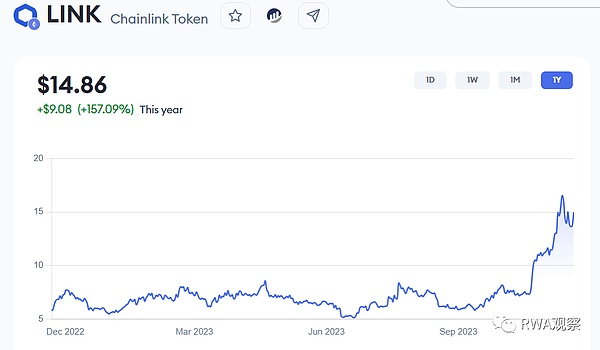

跨链方案巨头Chainlink

按照官方的介绍,Chainlink是一个去中心化的预言机网络,旨在将区块链智能合约安全可靠地连接至链下系统。

Link是运行于ChainLink系统的原生代币。

之所以关注到Chainlink,是因为在传统金融系统中,结算是原中心化系统的核心节点。而在Swift提出用于实现链上结算的RLN中,竟然拉上了Chainlink的CCIP做跨链解决方案,详见:美帝的阳谋?详解美联储和Swift的代币化方案

去中心化交易所No.1: Uniswap

其实在我过往的文章中,并没有专门提到交易所。

不过认为RWA资产,可能更多会通过去中心化的方式进行交易,具体可能是这样的:

各个司法管辖区会推出自己的DLT或者RLN许可网络方案,强制要求金融资产通过CBDC或者其他的方式结算。

同时支持各个接入许可网络的节点方,通过跨链的方式将RWA资产引入公链。

虽然从十月份我买入开始有20%的涨幅,但整体看Uni的表现和其他项目差距还是比较大。

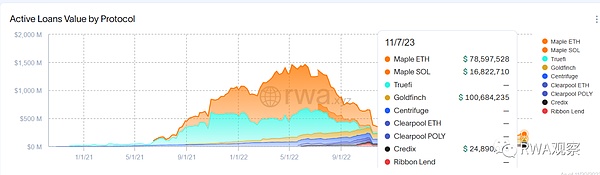

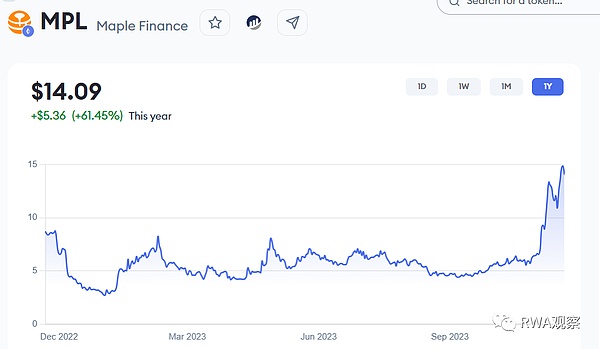

Defi巨头Maple

Maple Finance是一个创立于2021年5月的加密借贷协议。利用Maple Finance(下文简称Maple),机构投资者无需足额抵押即可通过该协议借入资金,用户则可以投资固定利率取得产品收益。

Maple和RWA的交集是链上加密生态由于熊市借款需求减少,于是发力私人信贷(Private Debt),可以认为是链上P2P。

自从10月份配置后,现在大概涨了有三倍。

说实话我自己其实不是很看到短期链上P2P的发展,也不知道为什么短期涨势这么猛。

关于这类边缘资产,可以参考关于RWA的6点不靠谱观察

Defi另一个巨头Goldfinch

相比于Maple,Goldfinch今年可谓多灾多难。

Goldfinch 的定位为去中心化的借贷协议。2021 年来,Goldfinch 曾完成过总额高达 3700 万美元的三轮融资(100 万美元、1100 万美元、2500 万美元),其中后两轮均由 a16z 领投。

与Aave、Compound 等传统借贷协议不同,Goldfinch 主要服务于真实世界的商业信贷需求。

今年Goldfinch连续出现了两起坏账事故,8月份被非洲的摩托车租赁公司Tugenden产生500万美元坏账,10月份又爆出700万美金的坏账。

考虑到大部分借款还在还息阶段,到期还本可能出现的坏账会更多。

虽然每次爆出坏账都有一波降幅,但是不影响10月份之后涨回去了。

放弃偏见,也不要鄙视价值

貌似搞价值的一直在加密圈抬不起头。

这波比特币现货ETF的肥皂剧大概率还是会上演很长时间,之后还会有其他代币现货ETF的续集。

反正我这个持仓准备一年不动了,一年后再看

If you don't know the inscription this month, even if you don't get into the Chinese encryption circle, the tokens of various projects will take off at about the same time. At present, the encryption circles of Chinese and Europe and the United States are simply two parallel worlds. It's interesting that the main core driving force of the recent price fluctuation in the cryptocurrency field is affected by the progress of bitcoin spot, and the price of bitcoin is gradually rising. When I started writing this WeChat official account, I configured some token main positions to maintain the sensitivity to the industry. Well, I didn't expect that the main business and WeChat official account didn't start to make money. These tokens have almost all taken off. Let me talk to you about my position logic. If the head player of the asset winding doesn't know it, it's considered to be out of business. At present, there are still many asset packages of chain projects that are packaged. One of them is based on the chain, which is used to provide incentives for holders to participate in the development through chain governance. Because the process of traditional asset winding is extremely complicated, it does not happen under the existing regulatory conditions. In the case of great changes, there may be many channels that need to be passed in the winding of US dollar assets. For details about the winding of assets, please refer to the battle of Tianwangshan in the future. According to the official introduction, the giant is a decentralized Oracle network aimed at connecting the blockchain smart contract to the offline system safely and reliably. The reason why it is concerned is that settlement is the core node of the original centralized system in the traditional financial system and it is proposed to realize the chain. In fact, in my past articles, I didn't specifically mention the exchange, but I think that assets may be traded in the past centralized way. Specifically, it may be that each jurisdiction will launch its own or licensing network scheme, forcing financial assets to settle through or other means, and supporting all nodes accessing the licensing network. Introducing assets into the public chain by means of cross-chain, although there has been an increase since I bought it in October, the overall performance is still quite different from other projects. The giant is an encrypted lending agreement founded in June, which is hereinafter referred to as institutional investors can borrow funds through without full mortgage, and users can invest in a fixed interest rate to obtain product income. The intersection of the sum is the encrypted ecology on the chain. As the demand for borrowing in the bear market decreases, private credit can be considered to be allocated on the chain since January. To tell the truth, I don't really see the development in the short-term chain, and I don't know why the short-term rise is so fierce. For this kind of marginal assets, you can refer to the unreliable observation. Compared with this year, another giant has been positioned as a decentralized loan agreement. In recent years, it has completed three rounds of financing with a total amount of US$ 10,000, of which the last two rounds are different from traditional loan agreements, mainly serving the real world. There have been two consecutive bad debt accidents in the demand for commercial credit this year. The bad debts of US$ 10,000 were generated by motorcycle rental companies in Africa in January, and the bad debts of US$ 10,000 broke out in the month. Considering that most of the loans are still in the repayment stage, there may be more bad debts. Although there is a wave of decline every time the bad debts break out, it will not affect the rise after the month. Give up prejudice and don't despise the value. It seems that the soap opera of Bitcoin has been unable to hold its head in the encryption circle. There is a high probability that there will be a sequel to other tokens in stock after a long time 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。