PSE Trading:无清算协议到底是不是庞氏骗局

作者:Daniel 花,PSE Trading Analyst 来源:mirror

区块链发展至今,DeFi 板块发展的最为成熟,而其中借贷便是其核心之一。在牛市中,借贷往往是开启行情的发动机投资者往往会抵押 BTC,借出 USDT,在去购买 BTC,推动行情上涨的同时也能获得更多超额收益,但随着加密货币市场热潮的褪去,BTC 价格的下跌也往往导致连环清算,BTC 价格跌入冰点。为了达到「永恒牛市」的目标,市场上推出了许多「无清算」的协议,让投资者享受超额收益的同时,不会面临「清算」风险,本文将会对市场上几种常见的「无清算」协议进行梳理,先说结论,所谓的无清算本质上是将风险转移,但羊毛出在羊身上投资者获利的同时,就得有人去承担风险。

1.无清算协议的区别

1.1 用其他抵押资产提前「清算」

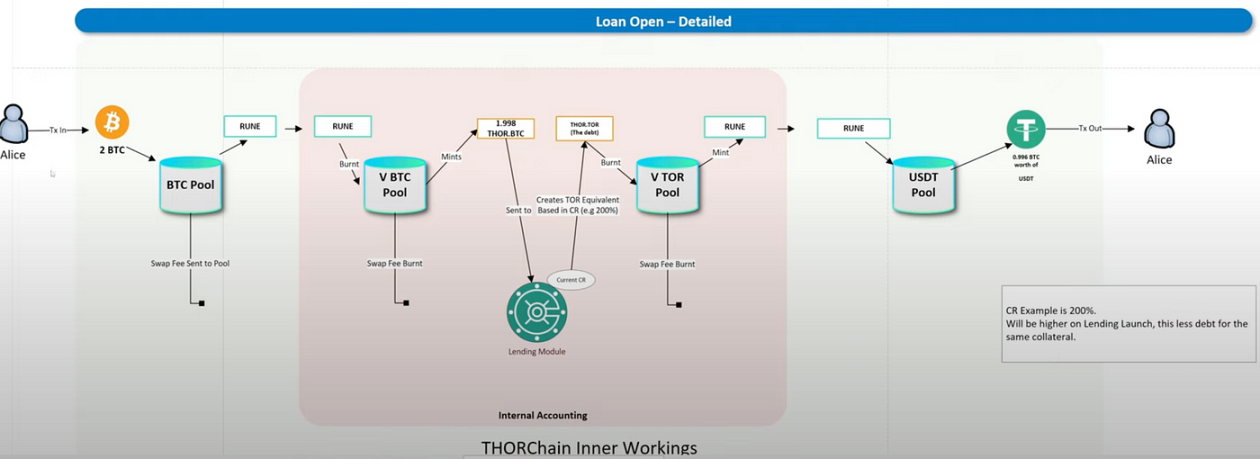

Thorchain 为其中的一个典型代表,Thorchain 是一个跨链协议,会在各条链上建立各种资产池子如 BTC/RUNE(Rune 为平台币)等,当用户需要跨资产时,需要将 Arb 链的 BTC 换成 Rune, 再将 Rune 换成 OP 链的 ETH。在借贷过程中,需要将 BTC 换成 Rune > Rune 燃烧生成 Thor BTC(合成资产 ) > Thor BTC 换成 Thor TOR(官方稳定币)在 燃烧 Mint 成 Rune > Rune 最后在换成 USDT。在此过程中,Rune 最终会通缩,因为燃烧生成 USDT,且用户需要支付每一次的 Swap 费用给 LP,因此借贷不收取利息,另外不同于传统的借贷协议,最终用户是「抵押」 USDT 借出 USDT,所以不需要在意 BTC 的涨幅,永不「清算」,或者说已经提前进行了「清算」。

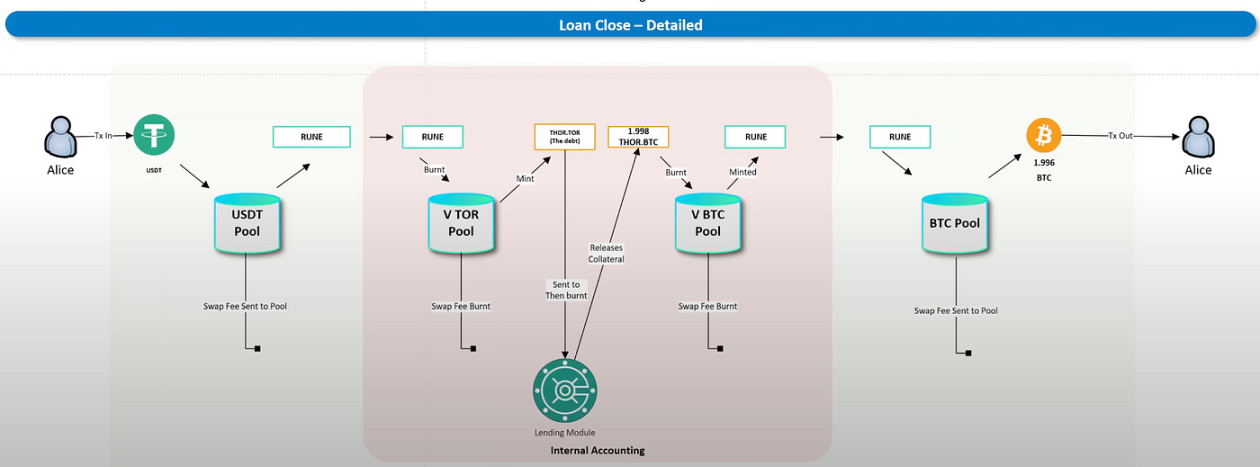

如果协议无「清算」且无利息,贷款人则可以永不还钱,但也出现一个极端情况,当牛市行情来临时,贷款人会因为 BTC 价格的上涨而想去还款,拿回更多收益的 BTC。流程如下:USDT 换成 Rune > Rune 燃烧 Mint 成 Thor TOR,Thor TOR 换成 Thor BTC 后燃烧生成 Rune,最后再将 Rune swap 成 BTC 还给客户。在这个流程中,会发现 Rune 成为最大的变量,Mint Rune 去拿回抵押的 BTC,如果还款的人数过多,就会铸造出「无限量」的 Rune,最终导致崩盘。

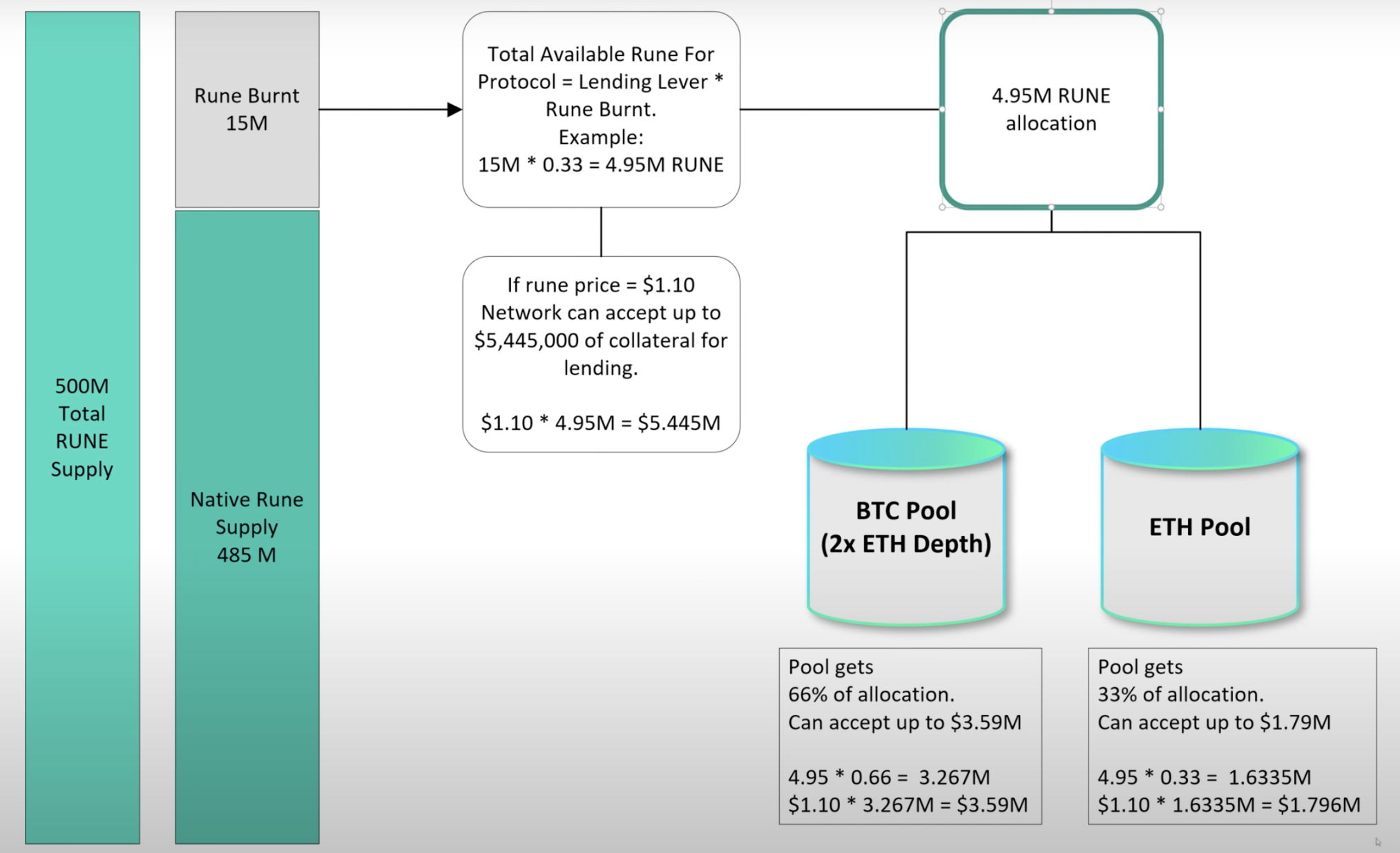

因此 Thorchain 设置了最多 Mint 的数量,也就是债务上限,目前上限是 500M,原生的 Rune 为 485M,也就是做多能 Mint 15M 数量的 Rune。Thorchain 会设定 Lending Level 的数值最终相乘等于能被燃烧掉 Rune 的数量,根据当前 Rune 的价格,可以得出能被贷款的 USDT 价值。

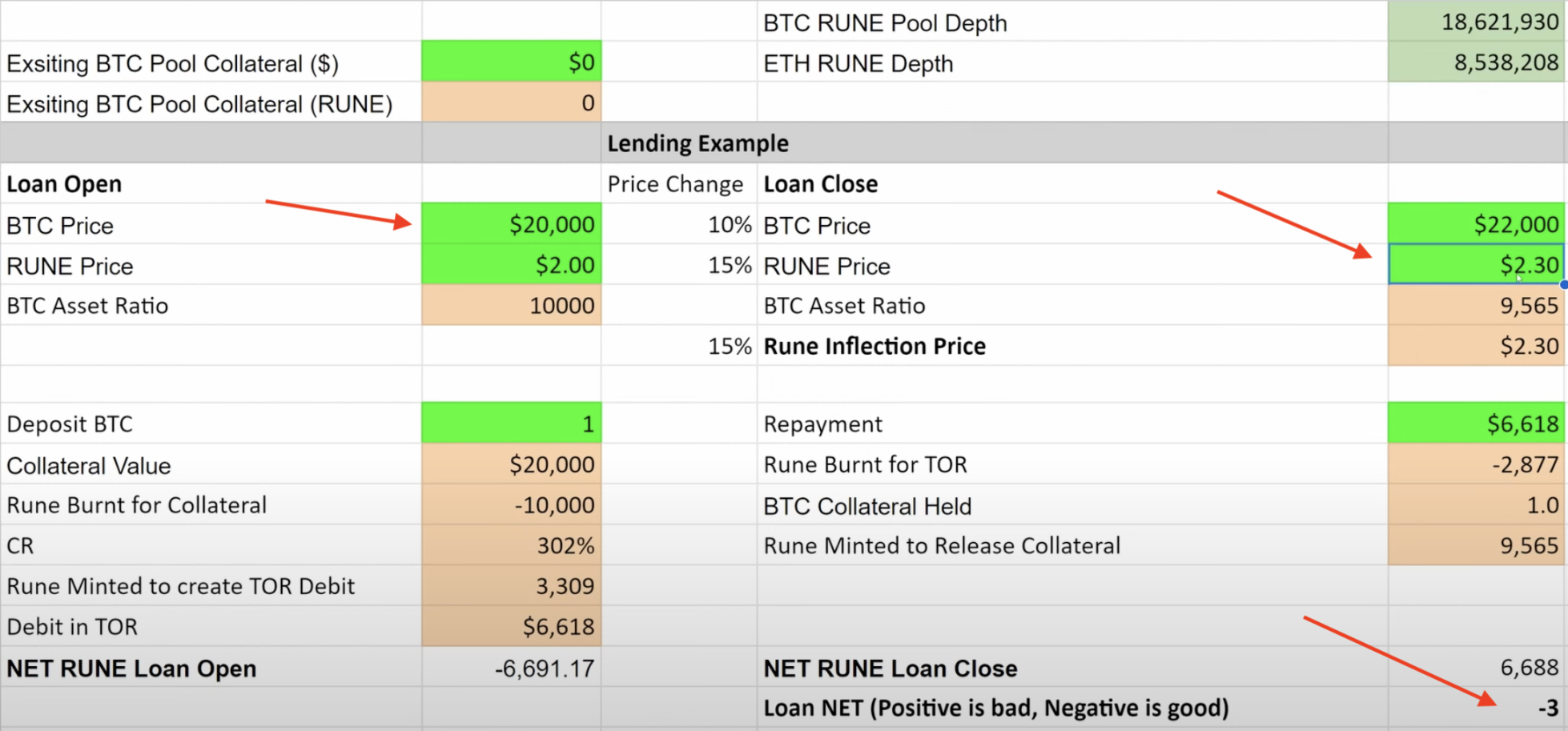

另外,Rune 价格比上 BTC 的价格也是协议能否成功的关键,下面两张图可以看出,当 BTC 和 Rune 的价格同时上涨 20% 的时候,用户还款会多 Mint 出 301 个 Rune,相比于贷款时燃烧掉的 Rune,但当 Rune 的价格上涨 30% 的时候,还款时反而不会 Mint 出 Rune,协议还是处于尽通缩的状态,相反,如果 BTC 的价格上涨远超过 Rune 的上涨价格,协议就会 Mint 出更多的 Rune,从而导致机制崩盘,一但 Mint 的数量将要达到上线,协议会提高 Collateral ratio 到最高 500%,迫使用户不在借出更多 USDT,假设达到 500M Rune 的上线,协议也会终止一切贷款还款行为,直到 BTC 价格回落,不用铸造出更多 Rune 为止。

不难看出,只有当协议一直借款时,对于协议本身才是利好(Rune 的通缩),但也经不起大规模还款(Rune 的通胀),所以 Thorchain 这种模式本事就注定做不大,如果要规模那就是 Luna 2.0 的悲剧。其次,因为还通过 collateral ratio 来控制贷款数量,所以平台的 CR 为 200%-500%,远高于 AAVE 等传统借贷平台的 120-150%,资金利用率过低,也不利于成熟市场的借贷需求。

1.2 将清算风险转嫁给 Lender

Cruise.Fi 是一家抵押借贷平台,其抵押物为 stETH,通过把清算线外包给其他 Lenders 去承受,只要一直有用户「接盘」,理论上不会爆仓,对于贷款用户来说:爆仓风险减少,可以扛单的空间变多,对于「接盘」用户可以获得更多收益(基本借贷收益 +ETH 额外奖励)。

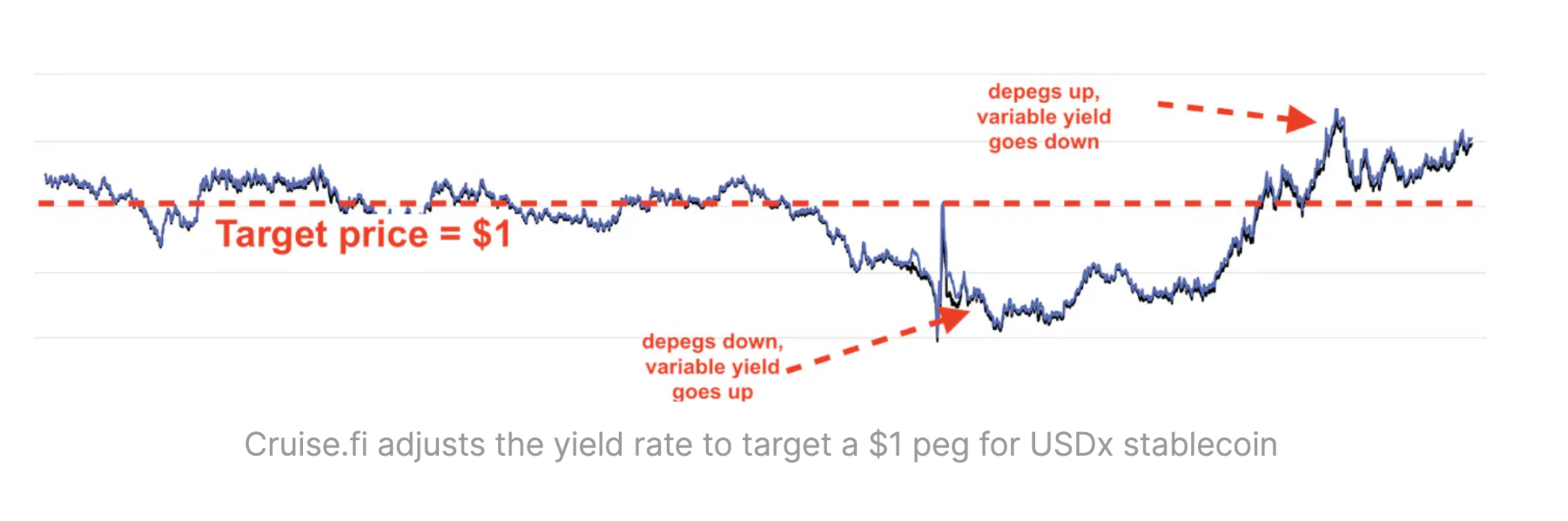

借款流程:当用户抵押 stETH 后,会生成 USDx,用户可以拿 USDx 去 Curve 池最终换成 USDC,而 stETH 生成的利息最终会给到 Lender。有两种方法去维持住 USDx 的价格

1: 当 USDx 价格过高时,会把 stETH 一部分的收益给到 Borrower,补贴他们借贷成本过高 2: 当 USDx 价格过低时,会把一部分 stETH 转换为借入成本,补贴给 Lender。

那么项目如何达成不清算呢?这里假设抵押的 ETH 为 1500 美元,清算价格为 1000 美元。当清算发生时,平台首先会把抵押物(stETH)锁定, 然后将 stETH 的质押收益给到 Borrower,通过 stETH 的质押收益去保留一部分原本的仓位,超过 stETH 收益部分的仓位会被暂停,但这么做的坏处是 ETH 质押率上去后,会影响 stETH 的收益,导致可保留的仓位变小。

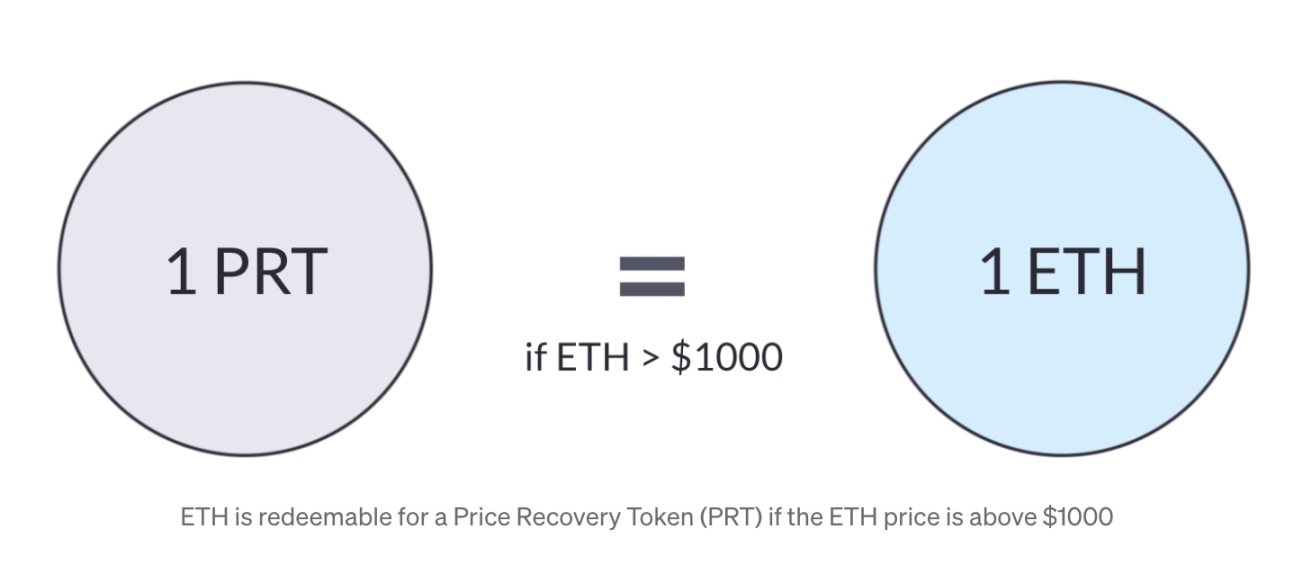

关于原本要被清算的仓位,平台会生成 Price Recovery Token,当 ETH 重新回到清算线以上的时候,Lender 可以拿着这部分 PRT 1:1 兑换成 ETH,这样相比于传统的借贷平台,多了一层 ETH 的超额收益,而不仅仅是借贷利息。当然如果说 Lender 不认为 ETH 将会上涨到 1000 美元以上,Lender 也可以在二级市场去销售 PRT,该项目还处于早期阶段,很多数据以及二级市场还未完善,作者也做一个大胆的预测,如果说 Lender 将 PRT 放到二级市场销售,那 Borrower 也可以已更低的价格「接回」自己仓位的同时(相比于补仓),还能获得 ETH 未来的超额收益。

但该项目也有一个弊端,项目只能在牛市中发展(即使大回调发生,也会有「信仰」 ETH 的 holder 来提供流通性),倘若熊市来临,市场情绪降至冰点,流动性就会枯竭,对于平台也就会造成不小的威胁,且愿意来平台当 Lender 的用户或许不会很多,因为本身该协议就是将风险全部转移到 Lender 身上。

1.3 利息覆盖借款利率

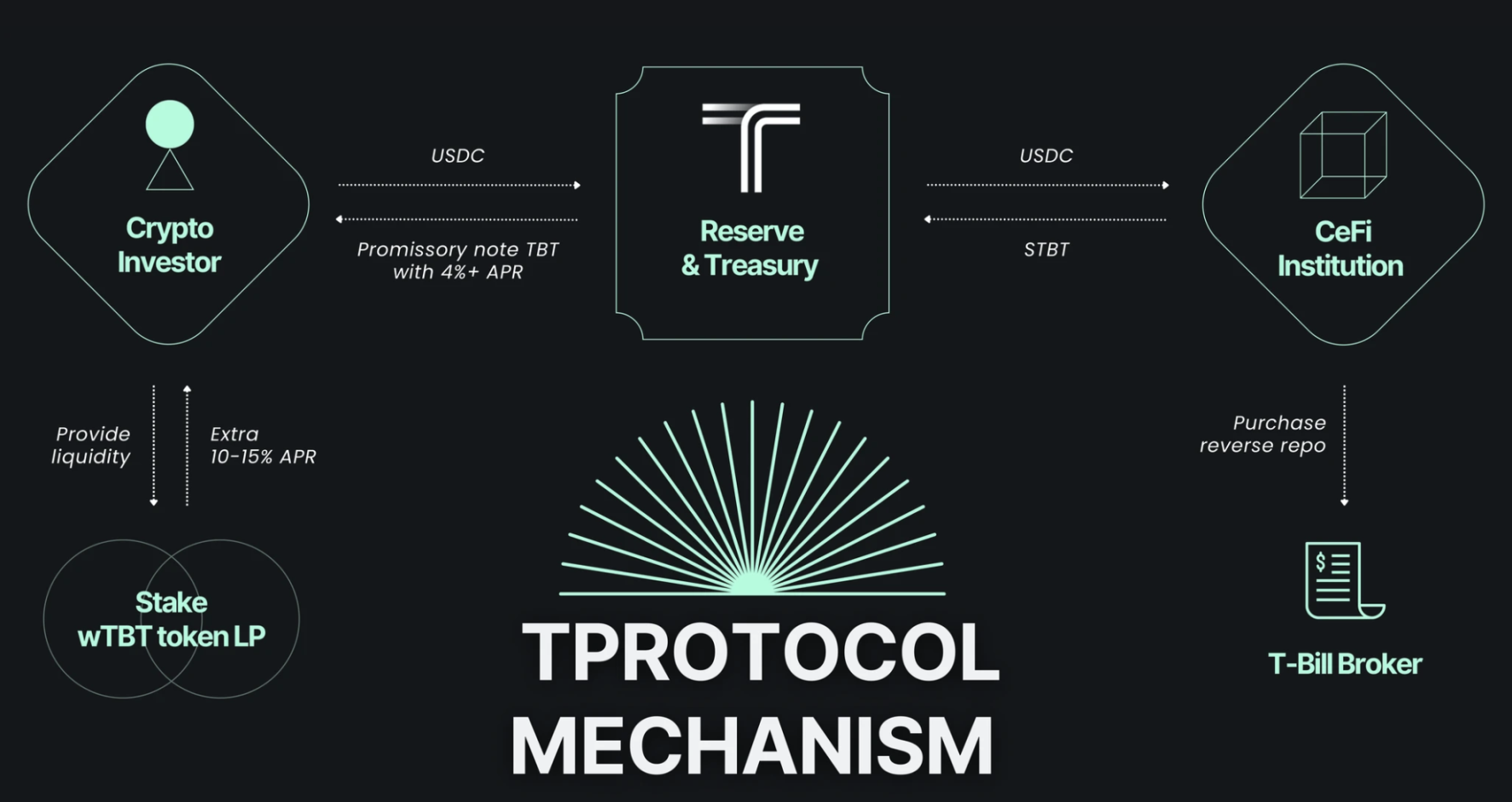

美联储的加息浪潮也带领了一批 RWA 「无清算」协议,最值得关注也是规模最大是 T Protocol,STBT 为 MatrixDock 美国机构发行的美债封装代币,和美债收益率 1:1 铆钉,TBT 则为 T Protocol 发行的 STBT 封装版本,采用 rebase 方式发放美债收益给平台使用者用户仅需打入 USDC 便可以铸造 TBT 从而享受美债收益。

最大亮点是平台收取的利息始终小于美债收益率,假设美债收益率为 5%,那平台收取利息大约为 4.5% 发放给 Lender,其中的 0.5% 作为手续费,这样 MatrixDock 可以抵押美债封装代币无息借款,但是怎么解决不清算的问题呢?本质上该平台也采用抵押美元借出美元的逻辑,不受 BTC 等资产的影响。目前 LTV 为 100%,当 MatrixDock 抵押一百万美元的美债时,可以借出一百万美元的稳定币,当用户想要回自己的稳定币时,MatrixDock 则会清算掉自己拥有的美债,等额支付给用户,大额用户需要等待三个工作日完成对付。

但也存在危险点,当 MatrixDock 拿到借款后,如果进行高危投资等行为,用户是存在不能刚兑美债的风险的,所有的信任都依靠平台和美债机构,存在监管盲点和不透明性,也因此 T Protocol 寻求其他美债机构合作的进程也变的异常缓慢,天花板是有局限性的。其次,伴随着未来宏观货币政策宽松,美债收益率便会开始下降,利息变少时,用户也就没必要在该平台存款,转向其他借贷平台。

2.总结与思考

作者认为目前为止,大部分无清算协议都是「伪无清算」,其实就是把风险从 Borrower 身上转移到别处,比如 Thorchain 把风险转移到协议本身和持有 Rune 代币者,Cruise.Fi 将风险转移到了 Lender,T Protocol 把风险转移到了不透明的监管上。不难看出,这几种协议都存在一个痛点:很难达到规模效应,因为借款的本身就是对某一方不公平的,而这种不公平所带来的短期「高额」收益却又很难持续,对于使用者来说不稳定。用户最终还是会使用 AAVE 这样的传统借贷平台,接受清算的同时拥抱公平。清算的本质是资不抵债,任何资产都会有波动的时候,世界上根本就不存在无风险投资,只要有波动,就存在资不抵债的时刻,传统金融从诞生发展到至今没有「设计」出完美的无风险投资,加密货币世界的高波动属性更不会有。「无清算」协议或许会以相对「稳定」的方式再次出现大众视野中,但羊毛出在羊身上,最终的某一方会接受惨痛的代价。

The author's flower source blockchain has developed to the most mature stage so far, and lending is one of its cores. In a bull market, lending is often the engine that starts the market. Investors tend to mortgage and lend, and at the same time, they can get more excess income. However, with the fading of the cryptocurrency market boom, the price drop often leads to the freezing point of serial clearing prices. In order to achieve the goal of an eternal bull market, many non-clearing agreements have been launched in the market to allow investors to enjoy excess income. At the same time, it will not face the risk of liquidation. This paper will sort out several common non-liquidation agreements in the market, and draw the conclusion first. The so-called non-liquidation is essentially to transfer the risk, but the wool is on the sheep. At the same time, investors have to bear the risk. The difference between non-liquidation agreements is that clearing in advance with other mortgaged assets is a typical example. A cross-chain agreement will establish various asset pools on various chains, such as platform currency. When users need to cross assets, they need to change the chain into another one. In the process of lending, it is necessary to change the synthetic assets generated by combustion into official stable currency, and in the process of changing into official stable currency, it will eventually deflate because of combustion and the user needs to pay every fee, so the loan does not charge interest. In addition, unlike the traditional loan agreement, the end user is mortgaged, so he does not need to pay attention to the increase, and he has never been liquidated or has been liquidated in advance. Who is paying for the risk without a settlement agreement if the agreement is not liquidated and there is no interest-free loan? The borrower can never pay back the money, but there is also an extreme situation. When the bull market comes, the lender will want to repay the money and get back more income because of the price increase. The process is as follows: change it into burning, and then burn it, and then it will be returned to the customer. In this process, it will be found that it will become the biggest variable to get back the mortgage. If there are too many people who repay the money, it will eventually lead to collapse. Therefore, the maximum amount is set, that is, the debt ceiling. At present, the upper limit is original, that is to say, the number that can be set is multiplied by the number that can be burned. According to the current price, we can get the value that can be loaned. Who is paying for the risk of no settlement agreement? In addition, the price ratio is also the key to the success of the agreement. The following two figures show that when the price of sum rises at the same time, the user will pay more than when the loan is burned, but when the price rises, the agreement will not be repaid. On the contrary, in the state of deflation, if the price rises far more than the rising price, more price agreements will be issued, which will lead to the collapse of the mechanism. Once the number of online agreements will reach the maximum, users will be forced not to lend more, and the assumed online agreements will also terminate all loan repayment behaviors until the price falls without casting more. It is not difficult to see who is paying for the risk without a settlement agreement. Only when the agreement keeps borrowing, it is not difficult to see the agreement itself. It is good deflation, but it can't stand the inflation of large-scale repayment, so this model is doomed to be small. If it wants to scale, it will be a tragedy. Secondly, because it also controls the amount of loans, the platform is much higher than other traditional lending platforms, and the low capital utilization rate is not conducive to the loan demand in mature markets. It is a mortgage lending platform, and its collateral is to be borne by outsourcing the clearing line to others. As long as there are always users taking over, it will not explode the position theoretically. For users, the risk of warehouse explosion is reduced, and there is more room to carry bills. For users who take over, they can get more income. The basic loan income is additional incentive. The loan process will be generated when the user mortgages, and the interest generated when the user can take it to the pool will eventually be given to the price that there are two ways to maintain. When the price is too high, part of the income will be given to subsidies. When the price is too low, part of it will be converted into borrowing cost subsidies. Who is paying for the risk without settlement agreement? So how can the project not be liquidated? It is assumed that the mortgage is in US dollars, and the liquidation price is in US dollars. When the liquidation occurs, the platform will first lock the collateral and then give the pledged income to the pledged income, so as to reserve a part of the original positions that exceed the income. However, the disadvantage of doing so is that the income that will be affected after the pledge rate goes up will lead to the decrease of the reserved positions. The platform will generate positions that were originally to be liquidated, and you can hold this when you return to the liquidation line. Part of it is converted into this way, compared with the traditional lending platform, there is an extra layer of excess income, not just loan interest. Of course, if you don't think it will rise to more than US dollars, you can also sell it in the secondary market. Many data and the secondary market are still in the early stage, and the author also makes a bold prediction. If you say it will be sold in the secondary market, you can get back your position at a lower price, and at the same time, you can get future excess income compared with covering positions. The risk of the agreement pays the bill, but the project also has a drawback. The project can only be developed in a bull market. Even if there is a big correction, there will be faith to provide liquidity. If the bear market comes, the market sentiment will drop to freezing point, and liquidity will dry up, which will also pose a big threat to the platform, and there may not be many users who are willing to come to the platform, because the agreement itself is to transfer all the risks to the body, and the interest will cover the loan interest rate. The Fed's interest rate hike wave has also led a number of non-clearing agreements, which is the most noteworthy and regulated. The biggest model is the US debt package tokens issued by American institutions, and the US debt yield rivets are used to distribute the US debt income to platform users for the packaged version of the issue. Users can cast the US debt income by simply entering it, so they can enjoy the US debt income. The biggest highlight is that the interest charged by the platform is always less than the US debt yield. Assuming that the US debt yield is the platform, the interest will be paid as a handling fee, which can mortgage the US debt package tokens to borrow interest-free but How to solve the problem of non-liquidation? In essence, the platform also adopts the logic of mortgaging US dollars and lending US dollars, which is not affected by other assets. At present, when mortgaging US debt of US$ 1 million, it can lend stable currency of US$ 1 million. When users want to get their own stable currency back, they will liquidate their own US debt and pay the same amount to users. Large users need to wait for three working days to deal with it, but there are also dangers. When they get the loan, if they make high-risk investments, they are at risk of not just redeeming US debt. All trust depends on the platform 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。