跌幅超百倍 曾经的DeFi明星协议Olympus DAO发生了什么?

眼看他起朱楼,眼看他宴请宾客,眼看他楼塌了。

——《桃花扇》

Go2Mars做研究有两大爱好,一是搜刮优质高潜力的早期Alpha项目,寻找定位他们的优质创新点,这是学习;二是找找那些TVL潮起潮落的过气项目,刨析他们如何“起高楼”“宴宾客”最后到“楼塌了”,这是反思。

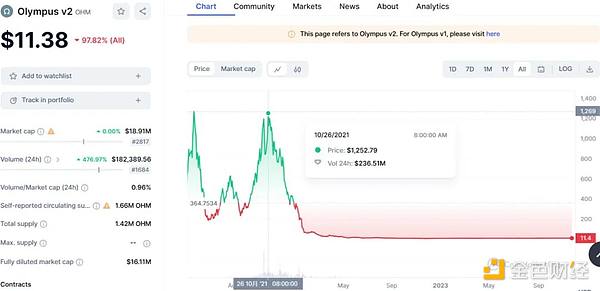

今日我们要讲的这位“宾客”名为Olympus DAO,它虽币价未归零,但相比于21年的超$1000U的最高点,未免还是显得有些落魄。百倍TVL起起落落,是什么成就了它的辉煌,又是什么注定了它的暴跌?

且听我慢慢道来~

前言

在深入分析 OlympusDAO 及其原生代币 OHM 的时候,一个关键的视角是理解其背后的相关机制及它们如何影响了这个代币的历史涨跌。OHM 的市场表现从最初的快速增值到随后的崩盘,揭示了其独特的经济架构在动态市场中的表现。本文聚焦于探讨 Olympus DAO 最初的核心机制,包括其staking、rebase以及 Bonding 策略,通过分析,我们可以更全面地理解 Olympus DAO 的运作原理和与其相似的协议的加密市场中所面临的挑战和机遇。

项目介绍

OHM为Olympus协议的原生代币,它的目的是成为一个价值稳定的储备货币,我们可以将OHM理解为一种算法非稳定币,相对于目的为将价格控制在$1 USD的算法稳定币(如algo stablecoin),或直接钉住美元的稳定币(如USDT),Olympus只承诺了一个OHM将得到1个DAI作为储备*,对价格并没有上限控制。它旨在通过维持稳定的购买力而非固定的兑换价值来实现稳定性,力求减少对传统市场和流动性提供者的依赖。

Olympus的相关机制

Bonding

Bonding理论上是对Price Floor的保护措施,通过 Bonding,协议增加了其储备资产,这些资产支持 OHM 的价值,并为价格提供了实际的支撑

用户将特定资产与 OlympusDAO 建立约束关系。这些资产被锁定在协议中,作为其储备。作为交换,用户获得 OHM 代币。Bonding实际上也就是超短期的零息债券, Bonding 允许用户以低于市场价的价格获得 OHM,获得的 OHM 代币不是立即全部发放给用户,而是在所谓的 "vesting period"(归属期)内逐渐释放。这种设计旨在平衡市场供应和价格稳定,通过这种方式,OlympusDAO 增加了其资产储备,有助于维持 OHM 的长期价值和协议的健康发展。

Staking 和 Rebase

Rebase 机制,理论上使得代币价值通过供给量的自动增加与减少而达到调整的目的,当与 Staking 联合使用时,Rebase 奖励通常分配给了 Staking 的用户,这意味着即使代币的总供应量增加,由于这些新增供应量主要分配给质押用户,所以流通中的供应量可能并不会增加。

对于OlympusDAO,质押者将他们的 OHM 质押在协议中,获得sOHM,并通过staking获得所谓的 "rebase rewards",如果OHM的市场价值高于目标价值,rebase 机制会增加OHM数量,将这些增加的OHM分配给Staking的参与者,这些reward的APY一度达到8000%以上。而这些reward的来源与Bonding有不可分割的关系。

当债券售出时,由于协议规定一个OHM仅需一个DAI做背书,购买者的付出储备资除去发放给购买者的OHM数量被视为协议的收入,当这些收入产生时,会根据这些收入铸造新的 OHM,然后协议将这些新铸造的 OHM 分发给质押者。例如,假设$100DAI能够购买到一个市场价值为$105的稳定币,则协议将获得$99的储备去增发99个OHM代币给到staker,这种机制旨在保护质押者免受债券发行的稀释影响,是 Olympus DAO 的主要价值积累和防稀释策略,这也意味着协议提供并控制了市场上大部分的流动性。

项目评析:关于Olympus DAO 的灵魂发问

为何只有1个DAI做背书的OHM单价能攀升到$1400以上?

从最简单的道理来看,大量抛售一种货币会使其价格下跌,而需求旺盛则使其相对升值。而从Bonding与Staking的机制来看,两者都不属于卖出的行为,即使是理论上能够使得OHM供应增加而贬值的rebase,也成为staking的reward;而因为没有人抛售,进而对价格没有太大影响,只有越来越多的人因为Staking所提供的疯狂的APY加入到协议的Staking游戏中,产生对OHM的大量需求,价格也就不断攀升。另外,OHM开始兴起的时候,所谓(3,3)博弈论策略的营销,也让staking变成了投资者天然的选择,成为价格攀升的助推。

什么导致了OHM的崩塌?

1.不可持续的超高APY与抛压。

超高的APY是天然吸引资金的因子,但也带来通货膨胀压力,一旦市场情绪变化或对协议可持续性的质疑,则会导致资金流出,引发崩盘。巨额抛售,使得OHM价格大幅下跌,而根据市场的经验,一旦从高点触底的算法币,在没有背后东家拉盘的情况下,很难再回到原来的水平。

2.Revised Game Theory for Olympus

尽管Olympus所展示出的博弈矩阵背后有许多假设前提,我们仍可以在其假设不变的情况下,对其参数进行简单修改,便可以看出其中的端倪,若Bonding的人没有参与staking,stakers理论上会获得更多的share,在这样的情况下,很容易得到与官方不同的答案:

当均衡不再是staking,投资者减少或停止质押 OHM,导致协议的质押总量下降,当投资者撤出 Staking,质押的 OHM 将返回市场,增加流通供应,这可能会对 OHM 的价格产生下行压力,同时大量投资者选择退出 Staking,可能会被市场解读为对 OHM 未来不够乐观的信号,进而影响其他投资者的行为。

总结

对于设计类似 Olympus DAO 这样类似庞氏的协议而言,短期内的成功基本包括以下策略:

1. 提供高额APY:这吸引了大量资本的参与,为协议提供了初步的资金推动力。

2. 通过相关机制控制代币供应,有效防止抛压:以OlymousDAO为例,Staking 通过锁定资产以换取高收益来减少市场上的代币流通量。同时,Bonding 通过延长资金释放周期,降低了市场上的售卖压力。

对于希望从这种协议中获利的参与者来说,策略可能包括:

1. 在协议启动早期加入:识别项目的潜力和风险,尽早参与以期获得较高回报。

2. 利用市场波动进行投资:在价格低点买入,但需注意这伴随着较高风险,尤其是依赖于大庄家行为的不确定性。

总的来说,这种协议的成功取决于其能否平衡吸引投资者的高回报承诺和维持长期可持续性的能力。参与者在涉足这类项目时需要谨慎评估潜在的风险和回报。

Seeing him rise from Zhu Lou, seeing him entertain guests, seeing his building collapse, there are two hobbies for peach blossom fans to do research. One is to search for early projects with high quality and high potential, and to find their high-quality innovations. The other is to find out how those outdated projects have ebbed and flowed, and to analyze how they got up from high-rise banquets. This is to reflect on what happened to the star agreement that fell by more than 100 times. Today, we are going to talk about this guest named it, although the currency price has not returned to zero, it still seems to be the highest point compared with 2008. Some ups and downs have made it brilliant, and what doomed it to plummet. Listen to me slowly. In the preface, a key perspective is to understand the relevant mechanisms behind it and how they have affected the historical ups and downs of this token. From the initial rapid appreciation to the subsequent crash, it reveals the performance of its unique economic structure in the dynamic market. This paper focuses on discussing the initial core mechanism, including its strategy adoption. Analyze the operation principle that we can understand more comprehensively and the challenges and opportunities faced by the encryption market of similar agreements. The project introduces what happened to the star agreement that fell by more than 100 times. It is the original token of the agreement. Its purpose is to become a reserve currency with stable value. We can understand it as an algorithm. Compared with the algorithm aimed at controlling the price, the stable currency such as or the stable currency directly pegged to the US dollar, if only one is promised, it will get a price as a reserve. There is no upper limit control. It aims to achieve stability by maintaining stable purchasing power rather than fixed exchange value, and strives to reduce dependence on traditional markets and liquidity providers. Theoretically, the relevant protection measures are right. Through agreements, the value supported by these assets has been increased, and the price has been provided with practical support. Users lock specific assets in the agreement and establish a binding relationship. These assets are locked in the agreement as their reserves as exchange users to obtain tokens, which is actually ultra-short-term. Zero coupon bond allows users to get the tokens at a price lower than the market price, not all of which are immediately distributed to users, but gradually released during the so-called ownership period. This design aims to balance the market supply and price stability, and in this way, it increases the long-term value of its asset reserve, which is helpful to maintain, and the healthy development and mechanism of the agreement theoretically make the token value adjust through the automatic increase and decrease of the supply. When it is used together, the reward is usually distributed to users. It means that even if the total supply of tokens increases, the supply in circulation may not increase because these new supplies are mainly distributed to pledge users. For the pledgees, they will obtain their pledges in the agreement and increase the number by obtaining the so-called if the market value is higher than the target value mechanism, and the sources of these increases will be inseparable. When the bonds are sold, because the agreement stipulates that only one needs to be endorsed. The buyer's contribution to the reserve fund, excluding the amount distributed to the buyer, is regarded as the income of the agreement. When these incomes are generated, new ones will be cast according to these incomes, and then these newly cast ones will be distributed to the pledgee according to the agreement. For example, assuming that a stable currency with a market value of 0 can be purchased, the agreement will issue another token to this mechanism to protect the pledgee from the dilution effect of bond issuance, which is the main value accumulation and anti-dilution strategy, which also means that the agreement provides and controls the market. Comments on most liquidity projects on the market ask why only one endorsement unit price can climb to the above level. From the simplest point of view, selling a currency in large quantities will make its price fall, while strong demand will make it appreciate relatively. From the mechanism of cooperation, neither of them belongs to selling, even if it can theoretically increase supply and depreciate, but because no one sells, it will not have much impact on the price. Only more and more people will increase because of the crazy price provided. In addition, when it started to rise, the marketing of the so-called game theory strategy also turned into a natural choice for investors, which helped the price rise. What caused the collapse? Unsustainably high and high selling pressure were natural factors that attracted funds, but they also brought inflationary pressure. Once the market sentiment changed or the sustainability of the agreement was questioned, it would lead to the outflow of funds, which led to a collapse, and huge selling led to a sharp drop in prices. According to the experience of the market, once the algorithm currency hits the bottom from the high point, it is difficult to return to the original level without the support of the owner behind it. Although there are many assumptions behind the displayed game matrix, we can still simply modify its parameters under the condition that its assumptions remain unchanged, and we can see the clues. If people do not participate, they will theoretically get more answers. Under such circumstances, it is easy to get answers that are different from the official ones. What happened to the previous star agreement when it was balanced? It is no longer that investors reduce or stop the pledge, which leads to the decrease of the total amount of pledge of the agreement. When investors withdraw from the pledge, they will return to the market to increase the circulation supply, which may put downward pressure on the price of the agreement. At the same time, a large number of investors choose to withdraw, which may be interpreted by the market as a signal that they are not optimistic about the future, thus affecting the behavior summary of other investors. For designing an agreement similar to Ponzi, the short-term success basically includes the following strategies to provide high amounts, which attract a lot of capital to participate in the agreement. It provides a preliminary capital impetus to control the supply of tokens through relevant mechanisms, effectively preventing selling pressure, for example, by locking assets in exchange for high returns, reducing the circulation of tokens in the market, and at the same time reducing the selling pressure in the market by extending the capital release period. For participants who want to benefit from this agreement, the strategy may include adding the potential and risks of identifying projects at the early stage of the agreement, participating as soon as possible in order to obtain higher returns, making use of market fluctuations to invest and buying at low prices. However, it should be noted that this is accompanied by high risks, especially the uncertainty of the behavior of big bankers. Generally speaking, the success of this agreement depends on whether it can balance the high-return commitment to attract investors and the ability to maintain long-term sustainability. Participants need to carefully evaluate the potential risks and returns when they set foot in such projects. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。