加密进一步拥抱合规 Blast打破L2战局

作者:Mike;来源:Foresight Research

A. 市场观点

一、宏观流动性

货币流动性改善。11月以来,受美联储鸽派信息影响,市场情绪乐观。美国经济大概率在24年增速趋缓,实际利率带动下,10年期美债利率或趋势性跌至3.8%。美股强势上涨,加密货币的上涨速度更快。当流动性扩大时,加密货币的表现往往优于其他风险资产。

二、全市场行情

市值排名前100涨幅榜:

本周BTC强势震荡,山寨币普跌。美国司法部与BN交易所达成和解,消除了不确定性,长期利好行业去中心化。市场热点围绕POW、游戏和AI。POW矿币KAS、TAO、ZEPH等普涨,这轮POW代币普遍好于POS,主打公平。

1. BLUR:团队新做Blast的L2,基于OP技术。逻辑类似DYDX,都是ETH性能不能满足交易需要。BLUR质押的奖励是市场预期第三季空投Blast代币,流通量30%参与质押。Blast与Lido和Makerdao合作,提供ETH和U的流动性质押服务,TVL很快跃居L2的第二。

2. TAO:是POW的AI矿币。采用波卡技术,通过给矿工代币奖励,做机器学习的模型训练。代币经济模型结合了BTC和Helium。需要先买矿币再挖矿,形成庞氏飞轮。

3. ZEPH:是采用门罗币技术,POW的隐私稳定币。通过类似LUNA的庞氏模型,推出超额抵押的稳定币。近期大涨20多倍,吸引不少市场注意。

三、BTC行情

1)链上数据

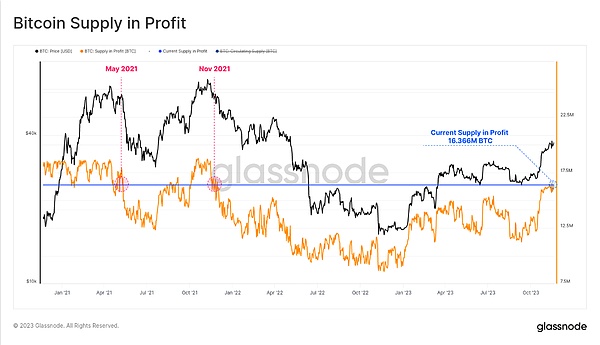

BTC持有者整体盈利。随着市场交易处于年度高点,超过84%的BTC持有者处于盈利状态,这是21年11月以来的最高水平。

稳定币市值连续几周上涨。市场活动正在上升,看涨情绪占据主导地位。

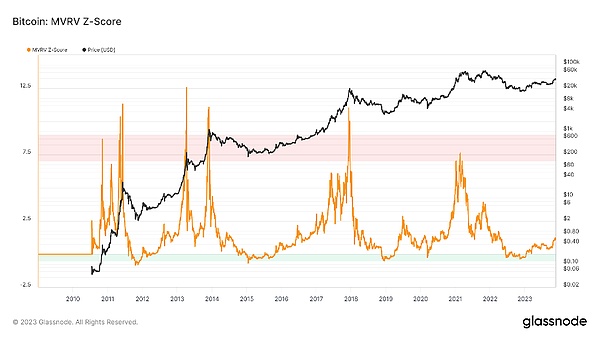

长期趋势指标MVRV-ZScore以市场总成本作为依据,反映市场总体盈利状态。当指标大于6时,是顶部区间;当指标小于2时,是底部区间。MVRV跌破关键水平1,持有者总体上处于亏损状态。当前指标为1.2,进入复苏阶段。

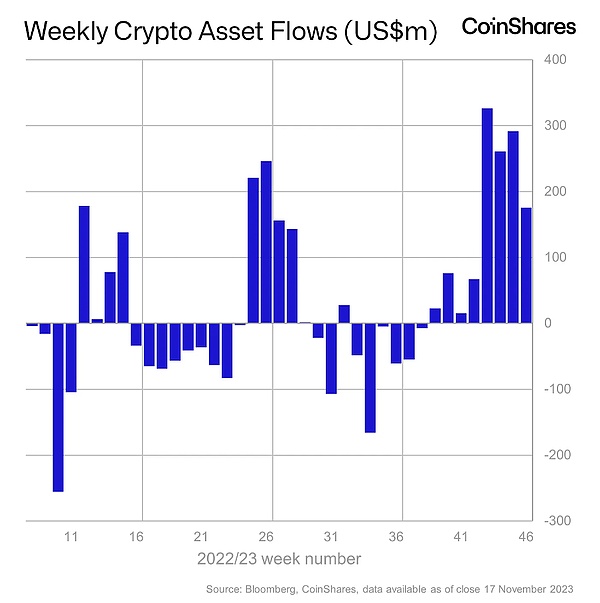

数字产品投资产品连续8周净流入。机构资金持续的积极情绪,与美国即将批准BTC现货ETF有关。

2)期货行情

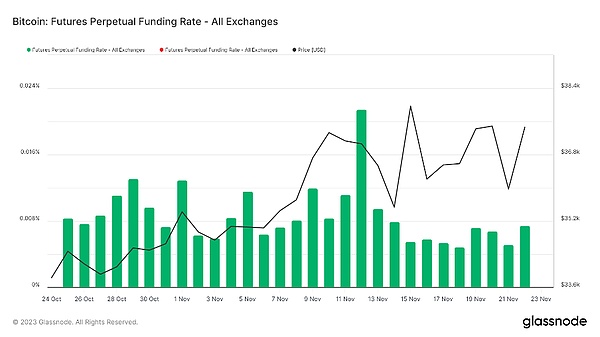

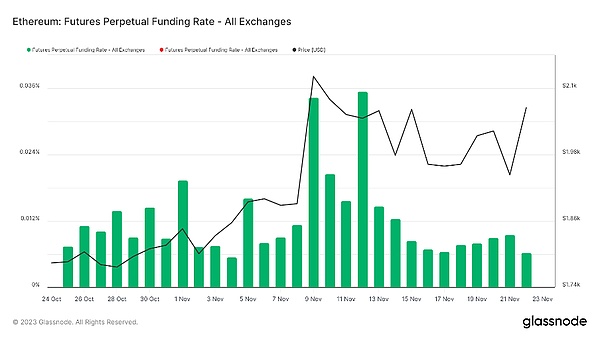

期货资金费率:本周费率为正,市场情绪正常。市场在BTC费率在11月12日创下今年来最高费率后开始调整。费率0.05-0.1%,多头杠杆较多,是市场短期顶部;费率-0.1-0%,空头杠杆较多,是市场短期底部。

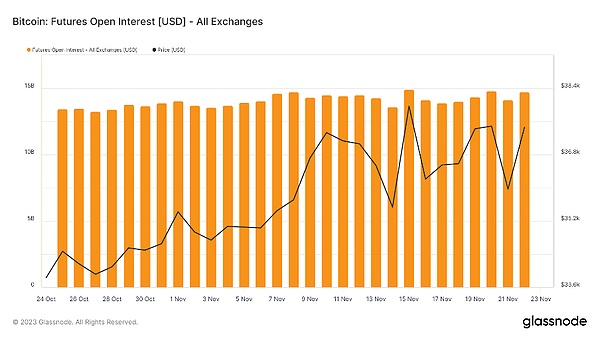

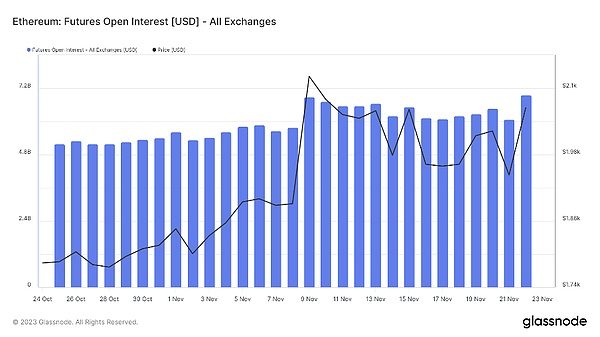

期货持仓量:本周BTC总持仓量震荡持平,基本同步价格波动。

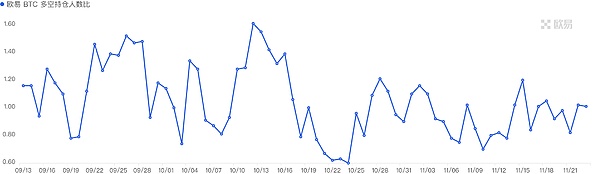

期货多空比:0.7。散户情绪偏空。散户情绪多为反向指标,0.7以下比较恐慌,2.0以上比较贪婪。多空比数据波动大,参考意义削弱。

3)现货行情

市场强势震荡。BTC现货ETF有所进展,SEC发表乐观评论。距离下一次减半还有大约150天,历史上在过去两次减半中都出现了反弹。市场正处于新一轮牛市的早期阶段,大部分预期涨幅仍在前方。

B. 市场数据

一、公链总锁仓量情况

The author's source market viewpoint-macro liquidity, currency liquidity improvement, has been influenced by the Fed's dovish information for months, and the market sentiment is optimistic. The US economy has a high probability that the annual growth rate will slow down, and the real interest rate will drive the one-year US bond interest rate to fall to the US stock market, and the cryptocurrency will rise strongly. When the liquidity expands, the cryptocurrency's performance is often better than other risky assets. Second, the market value of the whole market is ranked in the top increase list. This week, the cottage currency fluctuated strongly and fell. The US Department of Justice and the exchange reached a settlement. Eliminating the uncertainty and benefiting the industry for a long time, decentralizing the market hotspots, focusing on games and mining coins, etc. This round of tokens is generally better than the new ones made by the main fair team, which are similar based on technical logic, and the performance can not meet the needs of the transaction. The pledge is the market expectation. In the third quarter, the circulation of airdrop tokens participated in the pledge and the liquidity pledge service provided by cooperation quickly jumped to the second place. The mining coins adopted boca technology, and the model of machine learning was used to reward miners, and the token economy model was combined. In order to meet the need of buying mineral coins before mining to form Ponzi Flywheel, it is a private stable coin with Monroe coin technology. The over-mortgaged stable coin has been launched through a similar Ponzi model, which has recently soared many times, attracting a lot of market attention. The overall profit of data holders in the three-market chain is in a profitable state with market transactions at an annual high. This is the highest level since June. The market value of stable coins is rising for several weeks in a row, and bullish sentiment dominates the long-term trend indicators in the market. The total cost as a basis reflects the overall profitability of the market. When the index is greater than, it is the top range. When the index is less than, it is the bottom range that falls below the key level. The holders are generally in a state of loss. The current index is that the digital products have entered the recovery stage, and the net inflow of institutional funds for a continuous week continues to be positive. The spot is about to be approved by the United States. The rate of futures funds this week is positive. The market sentiment is normal. After the rate hit the highest rate this year, the market began to adjust the rate. More head leverage is the short-term top rate of the market, and more short-term bottom futures positions are the short-term bottom futures positions in the market. This week, the total positions fluctuated flat, and the price fluctuated basically synchronously. The futures were long and short, and the retail sentiment was short, which was mostly below the reverse indicator. More greedy and long than the data fluctuation, which weakened the strong shock of the spot market. The spot made an optimistic comment. There is still about a day before the next halving, and both of them rebounded in the past two times. The market is in the early stage of a new round of bull market, and most of the expected gains are still ahead of the market data 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

二、各公链TVL占比情况

本周TVL整体上涨约1.5亿美金,上涨3.3%左右。这周大盘高位区间震荡。BTC多次尝试突破38000均未成功。本周主流公链TVL全部下跌。ETH链下跌3.8%, SOLANA链在过去一段时间强势上涨之后也迎来了超过10%的下跌。BSC链下跌6%,POLYGON链下跌5%,ARB链,TRON链和OP链均下跌不到1%。

三、各链协议锁仓量情况

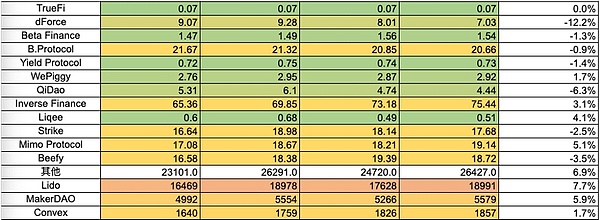

1) ETH锁仓量情况

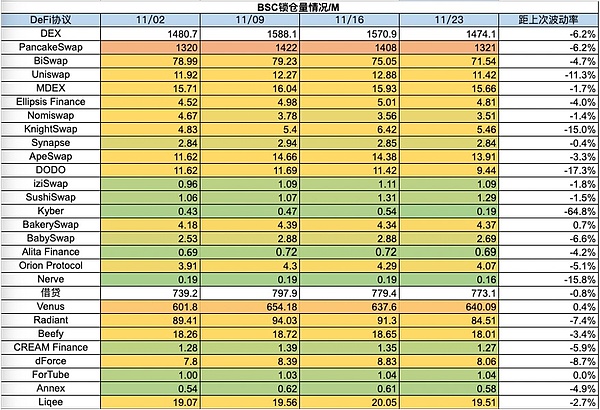

2) BSC锁仓量情况

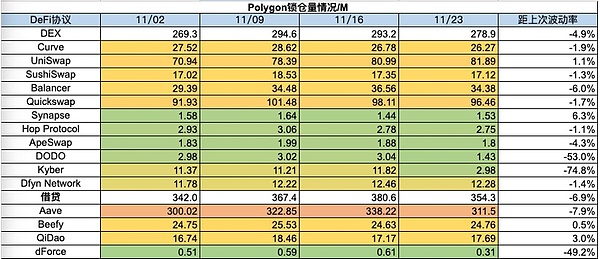

3) Polygon锁仓量情况

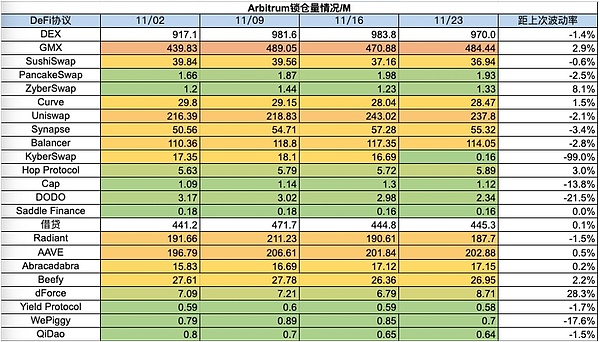

4)Arbitrum锁仓量情况

5) Optimism锁仓量情况

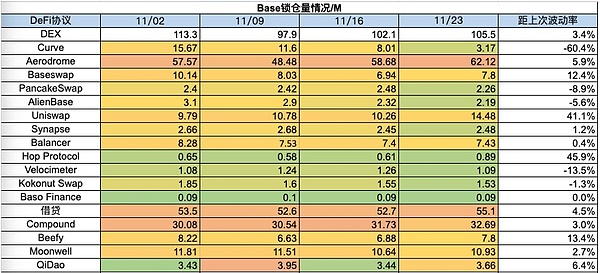

6) Base锁仓量情况

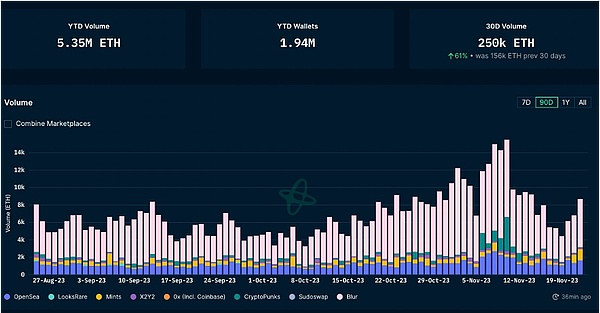

四、NFT市场数据变化

四、NFT市场数据变化

1)NFT-500指数

2)NFT市场情况

3)NFT交易市场占比

4)NFT买家分析

本周头部蓝筹项目地板价格有涨有跌,BAYC下跌0.9%,AOI Engine14%,CloneX上涨13%,The Captainzs下跌25%,Matr1x 2061上涨51%。过去一周NFT市场交易量小幅上涨,复购买家数量和首次购买NFT用户数量有一定幅度的增长。NFT市场在慢慢恢复,随着ERC-6551的发展,期待NFT赛道在下个牛市迎来可期的表现。

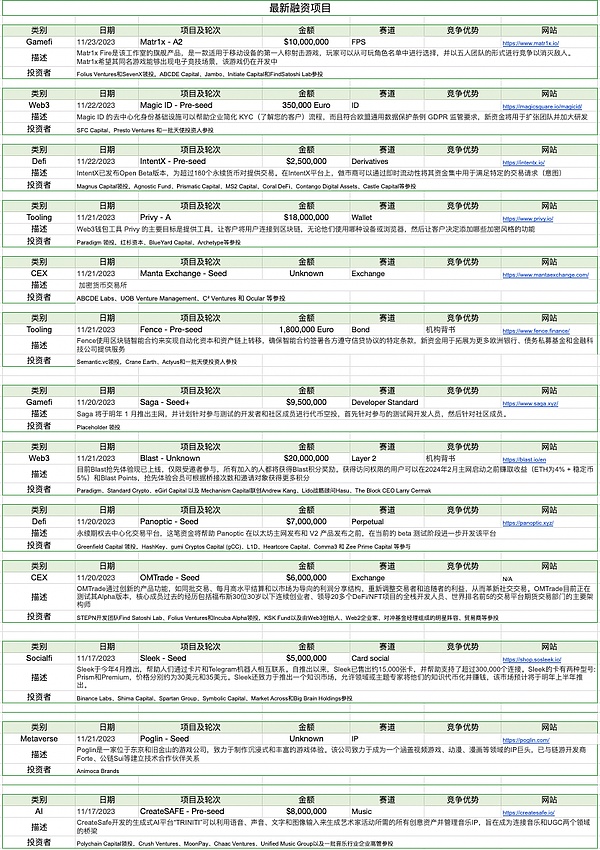

五、项目最新融资情况

六、投后动态

1)Mocaverse - NFT

Animoca Brands 发推称,旗下 NFT 系列 Mocaverse 与育碧战略创新实验室合作,支持并扩大该实验室的 Web3 计划,包括 PvP 角色扮演游戏 Champions Tactics™ Grimoria Chronicles 等

2)Colony Lab - Accelerator

Avalanche生态系统开发商和加速器 Colony Lab 表示,将投资 1000 万美元支持Avalanche网络的长期发展。

该公司表示,在过去的几个月里,它已经购买了 50 多万枚 AVAX 代币,价值 800 万美元,这些资金将用于建立一个使 AVAX 持有者受益的Validator计划。

3)Cradles - Gamefi

Bybit Launchpad 将上线 3A 级 Web3 链游 Cradles 代币 CRDS,11 月 16 日开始快照,11 月 22 日结束快照,并开始分发代币和上线 CRDS/USDT 现货交易对。此外,Cradles 于今日首发 Steam,成为 Steam 第一款完整上线的 3A Web3 游戏。

去年 2 月,Cradles 宣布完成 500 万美元私募融资,Animoca Brands 领投,Foresight Ventures、Sfermion、Spartan Group、HTX Ventures、Mirana Ventures 等参投。

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。