嘉实入局代币化基金 传统金融迈入香港Web3创新时代

作者:Jason Jiang

各类金融机构对传统金融工具代币化的兴趣正日渐浓厚。

据彭博社11月23日报道,嘉实国际正与Meta Lab合作,对嘉实国际旗下的一支基金产品进行代币化,并已完成向香港证券监管机构的通知。这是中资金融机构在亚洲推出的首支代币化基金,也是香港证监会发布代币化通函后业界的又一次重要实践。

本文将从目标群体、投资对象和技术特征等三个角度拆解嘉实国际推出的代币化基金,并将结合香港证监会最新发布的通函分析香港代币化证券的监管趋势。

代币化基金不限于专业投资者?

此次嘉实国际与Meta Lab合作推出的是一支面向专业投资者的代币化基金。“仅向专业投资者发售,且投资于美债等成熟金融产品,代币化基金获证监会许可的概率和效率会高很多”,一位参与代币化实践的知情人士表示。

由于监管合规限制,全球范围内的代币化基金目前少有直接向零售投资者发售:要么基于私有链或许可联盟链在特定范围内进行发售,即便是公有链上的代币化基金,也多通过白名单地址对特定人群或专业投资者开放。嘉实国际此次推出的就是基于公有链、但仅面向专业投资者的代币化基金。

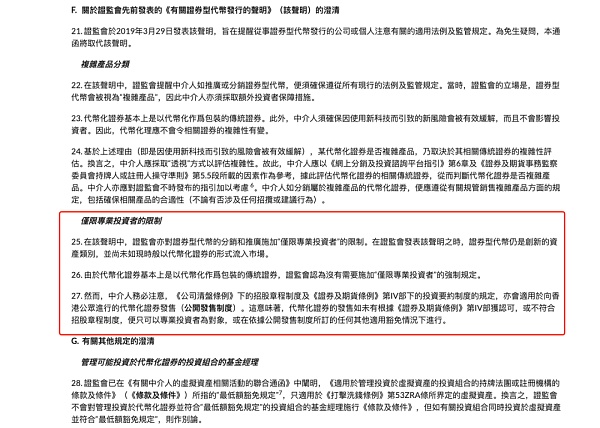

不过,11月初香港证监会发布的《有关中介机构从事代币化证券相关活动的通函》释放出了积极信号,即代币化证券的发售不仅限于专业投资者。这意味着在满足监管要求的前提下,香港现阶段是允许代币化基金等产品公开面向零售投资者发售的。

但据知情人士透露,考虑到投资者保护以及风险控制等因素,香港短期内不会出现面向零售投资者的代币化基金。虽然代币化可以提高流动性,但这有赖于充分的市场需求、有效的价格发现机制和频繁的交易。而目前市场对代币化认知并不高,代币流动性和市场操纵等方面也面临挑战,所以“代币化基金很多没有二级市场,也很难获准在虚拟资产交易平台进行交易。”

从长远看,我们认为香港还是会适当时机推出面向零售投资者的代币化基金。这个时机的重要标准就是中介机构能在满足传统证券监管的基础上,有效应对代币化所带来的所有权、技术网络安全以及反洗钱等风险。

正如香港证监会行政总裁梁凤仪此前所说的,“使用新技术一定有新的风险,所以要尽量让风险减到最低,要具备能够应对新风险的新工具,才能够享受新技术给金融服务带来的好处。”

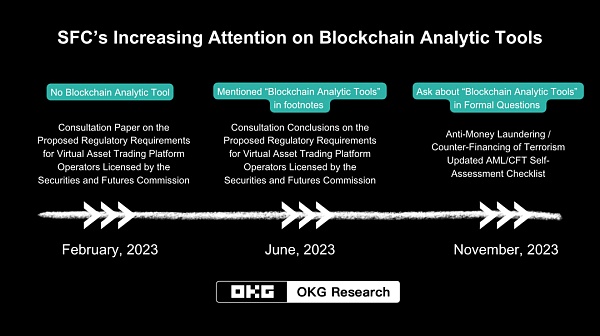

香港证监会此前多次强调区块链分析工具在虚拟资产领域的重要性。在代币化证券合规监管过程中,区块链分析工具等合规科技产品同样能发挥价值:相关机构能快速追踪链上地址及交易活动,并通过分析交易模式、地址关联和资金流动,及时发现异常交易和识别潜在风险,从而为监管机构和代币化服务提供方提供线索和决策支持。

代币化基金的投资对象是什么?

在代币化基金市场,美债是最常见的投资对象之一。此次嘉实国际推出的代币化基金主要投资于投资级美债。

美债是目前全球代币化进展最快的领域之一,市场体量超7.7亿美金,并仍以每月10%左右的增速扩大规模。但在合规条件下,无论是传统基金公司还是DeFi协议均无法直接将美债代币化,大都要通过对持有美债的基金份额或对持有美债的SPV(特殊目的公司)债务代币化,将美债收益引入到链上。Franklin Templeton、Superstate、WisdomTree以及Ondo Finance等都是通过基金份额代币化的方式将美债引入到链上世界。

根据公开信息,目前尚不清楚嘉实国际此次是通过美债基金份额还是直接持有美债来实现代币化,也不知道究竟在哪些环节使用了DLT及相关技术。因为根据通函,只要基金在发行、认购、赎回、交易、转让、结算等任何阶段使用了区块链等技术就属于代币化基金,会落入代币化证券的监管范畴。

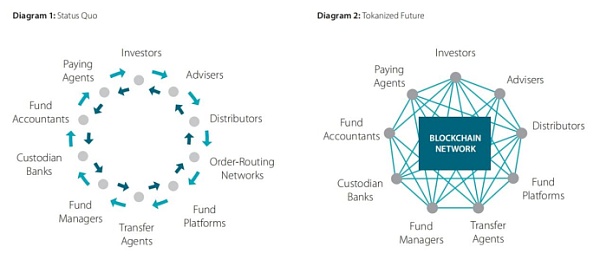

但相较于传统基金,代币化基金的优势不外乎:

(1)简化发行与分销流程,改变基金交易与结算模式,实现7*24全天候交易和原子结算;

(2)提供更低的运营成本,Franklin 代币化基金的成本据悉仅为传统基金成本的 1/10。

(3)增加透明度,基金交易记录及其他关键信息记录在区块链中且难以篡改,并可供相关主体及时获取;

(4)降低投资门槛,并为基金市场和Web3世界引入更多资产,比如美债等。

“穿透”技术,代币化不改基金“本色”

通过“透视”的方式审视代币化产品,穿透技术壁垒是促进代币化证券创新的关键。

香港证监会通函指出,代币化证券的本质是以代币化作为“包装”(Tokenisation wrappe)的传统证券。鉴于这一定性,香港证监会将根据代币化证券的底层资产定位施加监管,适用于传统证券及相关活动的现有法律及监管规定同样适用于代币化证券。

这意味着,在香港发行代币化基金首先要满足对传统基金的监管要求,其次要根据通函去满足更多代币化方案相关的风险把控、信息披露和投资者保护等方面的要求。

“虚拟资产监管难点之一在于其属性难以界定,但代币化产品的底层资产属性是相对明确的,并能在现行法律体系中找到相应的监管规则。所以代币化证券监管的核心在于破开‘代币化’的壳,发掘底层资产的实质特征”,一位拥有多年合规经验的律师与欧科云链研究院交流时表示。

欧科云链研究院也曾提出类似观点:“对金融及监管部门来说,代币化的关键不在于技术,而在于底层资产。”这一方面是因为技术现阶段并不是代币化的门槛,底层资产的丰富度才是限制其长期发展的关键因素,另一方面更是因为代币化资产如何运营以及受到怎样的监管,最终也都取决于其底层资产的种类。

随着传统金融工具代币化程度的加深,市场对于区块链分析工具等合规科技解决方案的需求也将更加强烈。正如欧科云链研究院此前反复强调的,Web3时代不仅要数据上链、资产上链,更要合规上链。只有合规上链,才能安全放心地进行数据上链和资产上链。

The author's various financial institutions are increasingly interested in the tokenization of traditional financial instruments. According to a report by Bloomberg on May, Harvest International is cooperating with Harvest International to tokenize a fund product and has completed the notice to the Hong Kong securities regulatory authorities. This is the first tokenized fund launched by Chinese financial institutions in Asia and another important practice of the industry after the Hong Kong Securities Regulatory Commission issued a circular on tokenization. This paper will dismantle Harvest International from three aspects: the target group, the investment target and the technical characteristics. The token fund launched will be combined with the latest circular issued by the Hong Kong Securities Regulatory Commission to analyze the regulatory trend of token securities in Hong Kong. The token fund is not limited to professional investors. Harvest International and its cooperation have launched a token fund for professional investors only, and the probability and efficiency of the token fund investing in mature financial products such as US debt will be much higher. An insider who participated in the token practice said that due to regulatory compliance, it is limited worldwide. At present, few token funds are directly sold to retail investors, or are sold within a specific range based on private chain or licensed alliance chain. Even token funds on public chain are mostly open to specific people or professional investors through whitelist addresses. Harvest International launched token funds based on public chain but only for professional investors. However, the circular issued by the Hong Kong Securities Regulatory Commission earlier this month on intermediary agencies engaged in activities related to token securities released a positive signal. The sale of monetized securities is not limited to professional investors, which means that under the premise of meeting the regulatory requirements, products such as token funds are allowed to be publicly sold to retail investors in Hong Kong at this stage. However, according to informed sources, considering investor protection and risk control, token funds for retail investors will not appear in Hong Kong in the short term. Although token can improve liquidity, it depends on sufficient market demand, effective price discovery mechanism and frequent transactions. The awareness of tokenization is not high, and the liquidity and market manipulation of tokens are also facing challenges. Therefore, it is difficult for many token funds to be allowed to trade on the virtual asset trading platform without the secondary market. In the long run, we believe that Hong Kong will launch token funds for retail investors at an appropriate time. The important criterion of this opportunity is that intermediaries can effectively deal with the risks of ownership technology, network security and anti-money laundering brought about by tokenization on the basis of meeting the traditional securities supervision. Liang Fengyi, the chief executive of the Hong Kong Securities Regulatory Commission, said earlier that there must be new risks in using new technologies, so it is necessary to minimize the risks as much as possible. Only by having new tools that can cope with new risks can we enjoy the benefits brought by new technologies to financial services. The Hong Kong Securities Regulatory Commission has repeatedly emphasized the importance of blockchain analysis tools in the field of virtual assets. In the process of compliance supervision of token securities, compliance technology products such as blockchain analysis tools can also play a role, and relevant institutions can quickly track addresses and transactions on the chain. Activities and through the analysis of transaction patterns, address correlation and capital flow, we can find abnormal transactions and identify potential risks in time, so as to provide clues and decision support for regulators and token service providers. What are the investment targets of token funds? In the token fund market, US debt is one of the most common investment targets. The token fund launched by Harvest International is mainly invested in investment-grade US debt, which is one of the fastest-growing areas in the world at present, and the market volume is over 100 million US dollars, and it is still left every month. The right growth rate expands the scale, but under the compliance conditions, neither the traditional fund company nor the agreement can directly tokenize the US debt. Most of them will introduce the US debt income into the chain by tokenizing the fund share or the special purpose company debt holding the US debt, and so on. According to the public information, it is not clear whether Harvest International will tokenize the US debt through the fund share or directly hold the US debt. I don't know exactly which links and related technologies are used, because according to the circular, as long as the fund uses blockchain and other technologies at any stage such as issuance, subscription, redemption, transfer and settlement, it belongs to the token fund and falls into the supervision category of token securities, but compared with the traditional fund token fund, its advantages are nothing more than simplifying the issuance and distribution process, changing the fund transaction and settlement mode, realizing all-weather trading and atomic settlement, and providing lower operating costs. The transparency of the increase in the cost of gold, fund transaction records and other key information are recorded in the blockchain, which is difficult to tamper with and can be obtained by relevant entities in time. It reduces the investment threshold and introduces more assets to the fund market and the world, such as American debt. Tokenization does not change the true nature of the fund. It is the key to promote the innovation of token securities by examining token products through perspective. The circular of the Hong Kong Securities Regulatory Commission pointed out that the essence of token securities is traditional securities packaged by token. Certain Hong Kong Securities Regulatory Commission will exercise supervision according to the positioning of the underlying assets of token securities. The existing laws and regulations applicable to traditional securities and related activities are also applicable to token securities, which means that issuing token funds in Hong Kong must first meet the regulatory requirements for traditional funds, and then meet more requirements for risk control, information disclosure and investor protection related to token schemes according to circular letters. One of the difficulties in the supervision of virtual assets is that its attributes are difficult to define but it is token. The underlying asset attributes of products are relatively clear, and the corresponding regulatory rules can be found in the current legal system. Therefore, the core of the supervision of tokenized securities lies in breaking the shell of tokenized securities and discovering the essential characteristics of underlying assets. A lawyer with many years of compliance experience said when communicating with Ou Ke Yunlian Research Institute that Ou Ke Yunlian Research Institute also put forward similar views. For financial and regulatory departments, the key to tokenization lies not in technology, but in underlying assets, because technology is not replaced at this stage. The threshold of monetization, the richness of the underlying assets is the key factor limiting its long-term development. On the other hand, how to operate and how to be supervised by the token assets ultimately depends on the types of the underlying assets. With the deepening of the token degree of traditional financial instruments, the market demand for compliance technology solutions such as blockchain analysis tools will become stronger, just as Ou Ke Cloud Chain Research Institute has repeatedly emphasized that in the era, not only data should be wound up, but also assets should be wound up in compliance. Only in compliance can data and assets be wound up safely and securely. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。