探索以太坊的流动质押格局

作者:Pedro M. Negron,IntoTheBlock分析师 翻译:善欧巴,比特币买卖交易网

流动质押代币(LST)使用户能够从权益证明区块链获得奖励,而无需锁定其资本。这一想法已经发展成为加密货币领域最重要的子行业之一,截至 2023 年 11 月,通过以太坊 LST 质押的资金约为 200 亿美元。由于质押市场规模巨大,许多参与者都参与到了以太坊流动性中。质押行业。Lido 的 stETH 仍然是领先的流动质押代币,但其他协议也取得了显着的扩张和进展,特别是在 2023 年 4 月 Shapella 升级引入质押提款之后。

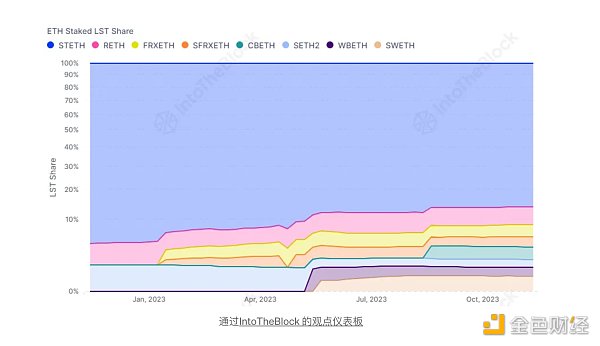

随着流动质押协议进入市场,许多协议引入了独特的机制来获得竞争优势,并使自己与现有选项区分开来。Lido 在以太坊生态系统的流动质押格局中发挥了核心作用,依靠机构节点运营商实现了巨大的规模。在Shapella升级之前,它占据了主导市场份额,占流动质押代币市场90%以上。随着Shapella分叉的推出以及投资者对持有流动性质押代币的信心不断增强,新替代方案的市场份额有所增加,达到目前15%的水平。

另类流动质押代币产品以多种方式脱颖而出,例如 Rocket Pool,其 rETH 代币拥有第二大市场份额。Rocket Pool 以其对去中心化的坚定承诺而闻名。该协议的主要目标是培育去中心化验证者社区,确保验证者权力不会集中在少数个人或实体手中。

流动质押代币模型的不同方法包括双代币系统,由 Frax 协议及其 frxETH 和 sfrxETH 代币实现。在这种双代币模型中,一种代币在 DeFi 生态系统中受到大力激励,而持有另一种代币的个人则获得两种代币的综合质押奖励。

此外,尽管 Lido 及其 stETH 代币主导了当前市场,但其他各种代币中的指标表明它们的稳健性和长期存在于市场的潜力。

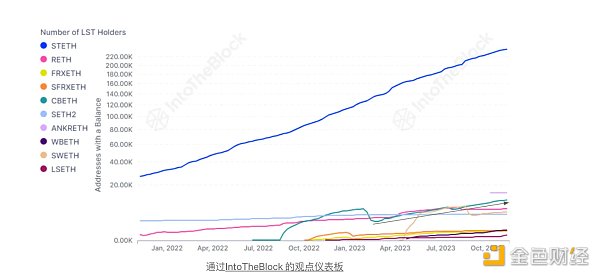

目前,通过 Lido 的 stETH 质押的金额高达 183 亿美元,而且该协议也是市场上拥有最多持有者的代币,令人印象深刻的 238,600 个唯一地址持有该代币。继 stETH 之后,ankrETH 以 1.49 万持有者位居第二,这表明前两名的代币持有者数量存在显着差异。

除了 stETH 之外,另一个值得注意的趋势是 cbETH 的持有者数量不断增加,cbETH 是 Coinbase 的以太坊质押代币,该代币于一年多前推出。随着时间的推移,该代币的持有者数量持续增长。这表明对该代币的需求积极且不断增长,并通过 Coinbase 更广泛地进行质押。虽然 cbETH 的持有者数量可能不是最多,但它的发展已经成功超过了行业中的其他竞争对手,目前拥有 10,800 个唯一持有者。

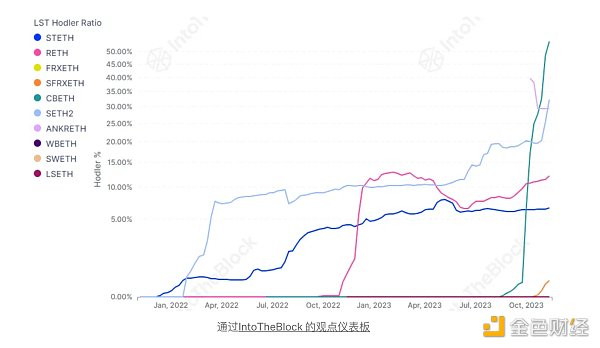

此外,随着 cbETH 的扩张,其代币健康状况的另一个令人鼓舞的迹象是,它在所有流动质押代币中拥有最高比例的 Hodler 用户。

持有 cbETH 的所有地址中,有 54.26% 的持仓时间已超过一年,这显示了持有者的坚定承诺和长远眼光。大量的 Hodler 地址代表了一个积极的指标,因为它表明用户信任代币和底层协议。在这种情况下,它表现出了对其部署者 Coinbase 的高度信任。

这一观察结果可能归因于 Coinbase 组织代币冷存储的方式。具体来说,如果代币代表集中交易所内的客户账户,这可以解释代币之间缺乏流动的原因。即使这种情况成立,总体而言仍然是一个积极的迹象。这是因为,如果代币的需求减少,交易所将不断进行重新安排,因为代币可能会被出售或销毁。

最后,主要持有者的集中度是衡量去中心化程度的函数。这有助于发现持有者过度集中可能会给生态系统带来不利条件的代币。大持有者可能会给其他代币持有者带来额外的风险,因此这些信息对于评估其对市场的潜在影响很有价值。

虽然该指标确实强调了 Liquid Stake 代币生态系统中的大多数代币都高度集中在大持有者中,但值得注意的是 Lido 开发中明显的持续去中心化过程。在过去的一年里,作为 Lido 治理代币的 LDO 代币中鲸鱼的集中度有所下降。这一浓度下降了10%以上,从67.8%下降到56.4%。

这一趋势也可以作为代币成熟度的指标,较低的集中度意味着代币持有者的分布更广泛,意味着更大的去中心化和个人持有者影响力的减少,这通常被认为是一个积极的发展。新推出的代币在大持有者中表现出高度集中是很常见的。因此,考虑到 Lido 的 stETH 代币的既定采用率和规模,其治理代币主要持有者的集中度随着时间的推移而下降是合乎逻辑的。

总之,以太坊生态系统内的流动质押市场呈现出一个动态的格局,以各种代币为特征,每种代币都有其独特的功能和用户群。虽然 Lido 的 stETH 代币历来占据主导地位,但最近的趋势表明选择日益多样化,竞争格局不断变化。值得注意的是,像 cbETH 这样的代币已经吸引了大量持有者,凸显了它们的吸引力和长期潜力。Hodler 用户的百分比和大持有者的集中度是代币健康和生态系统去中心化的关键指标。此外,治理代币(例如 Lido 的 LDO)中鲸鱼集中度的下降反映了这些代币的成熟及其朝着更大程度的去中心化迈进。

The idea that mobile pledge tokens enable users to get rewards from the blockchain of proof of rights without locking their capital has developed into one of the most important sub-sectors in the field of cryptocurrency. As of June, the capital pledged through Ethereum was about US$ 100 million. Due to the huge scale of the pledge market, many participants participated in the liquidity of Ethereum, and the pledge industry is still the leading mobile pledge token, but other agreements have also made significant expansion. And progress, especially after the introduction of pledge withdrawal in the upgrade in October, with the introduction of mobile pledge agreements, many agreements have introduced unique mechanisms to gain competitive advantages and distinguish themselves from existing options, and played a core role in the mobile pledge pattern of the Ethereum ecosystem, relying on institutional node operators to achieve a huge scale. Before the upgrade, it occupied a dominant market share and occupied the mobile pledge token market. With the introduction of bifurcation and investors' interest in holding mobile pledge tokens, The confidence of new alternatives has been increasing, and the market share of new alternatives has increased to the current level. Alternative mobile pledge token products stand out in many ways, for example, their tokens have the second largest market share and are famous for their firm commitment to decentralization. The main goal of the agreement is to cultivate a decentralized verifier community to ensure that the verifier's power will not be concentrated in the hands of a few individuals or entities. The different methods of the mobile pledge token model include the dual token system, which is realized by the agreement and its tokens. In the token model, one token is strongly encouraged in the ecosystem, and the individual who holds another token gets the comprehensive pledge reward of the two tokens. In addition, although other tokens dominate the current market, the indicators in other tokens show their robustness and long-term potential in the market. The amount of pledge currently passed is as high as hundreds of millions of dollars, and the agreement is also an impressive unique address for the token with the most holders in the market. Ranked second, which shows that there is a significant difference in the number of the top two token holders. In addition, another noteworthy trend is that the number of holders is increasing. Yes, Ethereum pledged the token more than a year ago. As time goes by, the number of holders of the token continues to increase, which shows that the demand for the token is positive and growing, and through wider pledge, although the number of holders may not be the largest, its development has successfully surpassed other competitive pairs in the industry. At present, Shoushou has a unique holder. In addition, with the expansion of its token health, another encouraging sign is that it has the highest proportion of all mobile pledge tokens, and some addresses held by users have been held for more than one year. This shows the holder's firm commitment and long-term vision. A large number of addresses represent a positive indicator because it shows that users trust tokens and underlying agreements. In this case, it shows the observation that they have high trust in their deployers. It may be attributed to the way of organizing the cold storage of tokens. Specifically, if tokens represent customer accounts in a centralized exchange, this can explain the lack of flow between tokens. Even if this situation is established, it is still a positive sign on the whole. This is because if the demand for tokens decreases, the exchange will continue to rearrange them, because the concentration of tokens may be sold or destroyed, which is a function of measuring the degree of decentralization, which helps to find that excessive concentration of holders may The large holders of tokens that bring unfavorable conditions to the ecosystem may bring additional risks to other token holders, so this information is very valuable for evaluating its potential impact on the market. Although this indicator does emphasize that most tokens in the token ecosystem are highly concentrated in large holders, it is worth noting that the obvious continuous decentralization process in development has decreased in the past year as a token for managing tokens, and this concentration has dropped by more than one. The decline to this trend can also be used as an indicator of the maturity of tokens. The lower concentration means that the distribution of token holders is wider, which means greater decentralization and the reduction of the influence of individual holders. This is usually considered as a positive development. It is very common for newly launched tokens to show a high concentration among large holders. Therefore, considering the established adoption rate and scale of tokens, it is logical to control the decline of the concentration of the main holders of tokens over time. The mobile pledge market in Fang ecosystem presents a dynamic pattern, characterized by various tokens, each of which has its unique functions and user groups. Although tokens have always dominated, the recent trend shows that the selection is increasingly diversified, and the competition pattern is constantly changing. It is worth noting that tokens like this have attracted a large number of holders, highlighting their attraction and long-term potential. The percentage of users and the concentration of large holders are the key indicators for the health of tokens and the decentralization of ecosystems. In addition, the decline in the concentration of governance tokens, such as Chinese whales, reflects the maturity of these tokens and their move towards greater decentralization. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。