为什么美国的打压可能会推迟下一次加密货币牛市的到来?

作者:David Thomas,beincrypto 翻译:善欧巴,比特币买卖交易网

摘要

美国司法部的打击行动揭露了Binance在赵长鹏领导下涉嫌参与的一些不法活动。

其中一些指控,如为儿童虐待和受制裁地区提供资金渠道,可能会抑制加密货币活动并推迟新的牛市。

投资者也可能认为加密货币在法律上风险过高,而选择投资于高度监管的传统金融工具。

最近美国司法部对币安及其前首席执行官赵长鹏(CZ)的打击,玷污了加密货币作为洗钱和性虐待工具的声誉。然而,它在不法活动中的所谓使用是否会导致投资者抛售,从而推迟下一波牛市的到来呢?

上周,美国司法部宣布对币安前首席执行官赵长鹏采取执法行动,指控其允许币安被用于为受制裁实体和儿童虐待者转移资金。这位前加密行业老板已经认罪,将支付5000万美元罚款,并于2月接受判决。

币安交易量下降可能会推迟加密货币牛市

与司法部达成的协议的一部分包括在三年内加强对币安运营的监控。与美国财政部达成的一项协议需要五年的监控。美国证券交易委员会 (SEC) 前互联网执法主管约翰·里德·斯塔克 (John Reed Stark) 表示,币安涉嫌参与恐怖主义融资和虐待儿童的事件并非小事。些类型的违法行为实际上已经成为人们生死攸关的问题,而不仅仅是盗窃或欺诈的问题。

CZ的下台导致Binance流出了6.5亿美元,同时该交易所的BNB代币下跌了15%。范德比尔特大学教授Yesha Yadav表示,“Binance 2.0”可能无法像以前那样吸引同样的交易量。

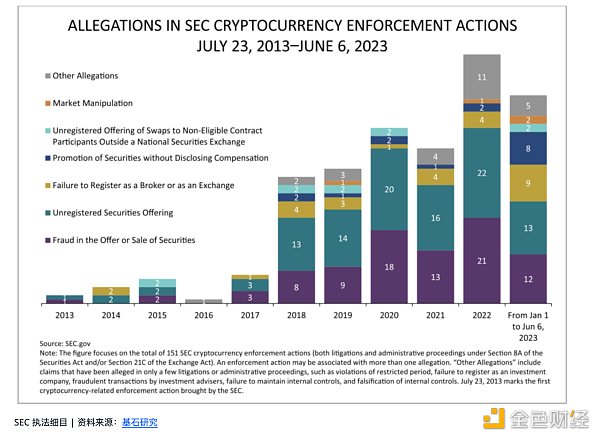

美国证券交易委员会的过度干预可能会令加密货币投资者望而却步

它在加密货币市场中的主导地位可能会导致未来几个月的交易活动下降。这些指控还引发了关于加密货币效用的道德问题,可能会延迟任何预期的市场转机。

投资者希望由高调执法行动引起的所谓加密货币寒冬将很快让位于下一个牛市。比特币的价值已经上涨了一倍多,超过了年初的水平。大型投资公司申请推出加密货币现货ETF的消息使投资者感到乐观。

然而,前FTX首席执行官山姆·班克曼-弗里德(Sam Bankman-Fried)被定罪,美国司法部对Terra Luna联合创始人杜钧(Do Kwon)、Celsius前首席执行官亚历克斯·马辛斯基(Alex Mashinsky)以及新加坡Three Arrows Capital高管苏竹(Su Zhu)的打击行动,使得加密货币在过去18个月里的声誉受到了重创。此外,还有其他几位加密货币高管面临民事诉讼。

美国证券交易委员会(SEC)起诉TRON的创始人Justin Sun提供未经注册的证券,而美国商品期货交易委员会和美国联邦贸易委员会则将目标对准了Voyager Digital首席执行官斯蒂芬·埃利希(Stephen Ehrlich)。数字金融集团的巴里·西尔伯特(Barry Silbert)被纽约总检察长指控故意欺骗投资者并隐瞒超过10亿美元的亏损。

所有这些指控都将加剧对为美国客户提供服务的交易所的审查,并增加合规负担。交易所可能会将这些成本转嫁给客户,而客户可以选择传统投资途径,以降低法律风险。成功的执法行动最终可能会导致加密货币被监管出局。

The crackdown by the U.S. Department of Justice has exposed some illegal activities under the leadership of Zhao Changpeng. Some of the allegations, such as providing funding channels for child abuse and sanctioned areas, may inhibit cryptocurrency activities and postpone a new bull market. Investors may also choose to invest in highly regulated traditional financial instruments because cryptocurrency is too risky in law. It has tarnished the reputation of cryptocurrency as a tool for money laundering and sexual abuse. However, will its so-called use in illegal activities lead investors to sell and delay the arrival of the next bull market? Last week, the US Department of Justice announced that it would take enforcement action against Zhao Changpeng, the former CEO of Coin Security, accusing him of allowing Coin Security to be used to transfer funds for sanctioned entities and child abusers. The former boss of cryptocurrency industry has pleaded guilty and will pay a fine of $10,000, and he will be sentenced in May that the decline in the transaction volume of Coin Security may delay the increase. Part of the agreement reached between the secret currency bull market and the Ministry of Justice includes strengthening the monitoring of the operation of the secret currency within three years, and an agreement reached with the US Treasury Department requires five years of monitoring. John Reid Stark, former head of Internet law enforcement at the US Securities and Exchange Commission, said that the incident of the secret currency bull market's involvement in terrorist financing and child abuse is not trivial, and the illegal acts of various types have actually become a matter of life and death, not just theft or fraud, resulting in the outflow of hundreds of millions of dollars. At the same time, the exchange's tokens fell, and a professor at Vanderbilt University said that it may not be able to attract the same trading volume as before. The excessive intervention of the US Securities and Exchange Commission may discourage cryptocurrency investors, and its dominant position in the cryptocurrency market may lead to a decline in trading activities in the next few months. These allegations have also raised ethical questions about the effectiveness of cryptocurrency, which may delay any expected market turnaround. Investors hope that it will be caused by high-profile law enforcement actions. The so-called cryptocurrency winter will soon give way to the next bull market. The value of Bitcoin has more than doubled, exceeding the level at the beginning of the year. The news that large investment companies have applied to launch cryptocurrency spot has made investors optimistic. However, the former CEO Sam Bankmann Fried was convicted. The US Department of Justice's crackdown on Alex Masinsky, the former CEO of Du Jun, and Su Zhu, a Singaporean executive, has caused the reputation of cryptocurrency to suffer heavy losses in the past month. Several other cryptocurrency executives are facing civil lawsuits. The US Securities and Exchange Commission sued the founder for providing unregistered securities, while the US Commodity Futures Trading Commission and the US Federal Trade Commission targeted the CEO Stephen ehrlich, and Barry Silbert of Digital Finance Group was accused by the Attorney General of new york of deliberately deceiving investors and concealing losses of more than 100 million US dollars. All these allegations will intensify the examination and increase of exchanges serving American customers. The compliance burden exchange may pass these costs on to customers, and customers can choose traditional investment channels to reduce legal risks. Successful law enforcement actions may eventually lead to the supervision of cryptocurrencies. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。