白话科普:设计跨链桥时都要考虑哪些事?

作者:0xKooKoo,极客Web3 & Moledao技术顾问, 前Bybit技术负责人

感谢0xmiddle在本文撰写过程中提供的帮助。

Introduction

自区块链行业建立以来,涌现出数不胜数的L1/L2,几乎每条公链都发展出了自己的DeFi生态。某些人只在特定公链上交互,更多人则希望在不同链上寻找交易、挖矿等收益机遇。在这之中,跨链资金转移成为了必不可少的刚需。

除了普通用户,很多项目方也有在不同链间转移资金的需求,在不同链上引导流动性,做到“一钱多用”。

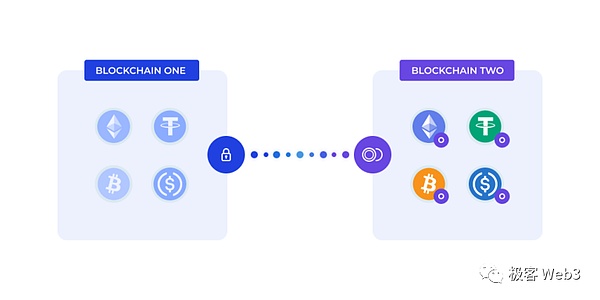

但不同的区块链是孤立的共识系统,资金没有办法从一条链直接跨到另一条链。资金跨链的本质,是跨链桥作为一个公共的交易对手方,在源链上接收用户资金,并在目标链上给用户打钱(发行映射资产,或从目标链储备的流动性池中为用户释放资金)。

到底怎么实现资金跨链才最好?最开始人们还比较信任中心化交易所,曾一度流传一句话:“中心化交易所就是最好的跨链桥。”但「充-换-提」的操作很繁琐,人们希望有一种纯链上方式,更直接的完成资金跨链。

而且,相比于中心化交易所,跨链桥可以完成更通用的跨链消息传递,不仅限于资金传递。例如,你如果使用一个跨链借贷dApp,从A链上提供抵押品,在B链上借出资产,就需要用到跨链消息传递。

如果考察跨链的历史来源,可以追溯到区块链技术发展的早期阶段。当时,不同公链的出现让人们意识到,链之间的互通性问题要被解决,否则会出现很多信息/资金孤岛。随着时间推移,人们提出了不同类型的跨链方法,逐渐形成了今天的通用跨链模式。

下面我们就来讲解一下跨链技术的一些发展。

Methodology

1. 自己寻找对手方

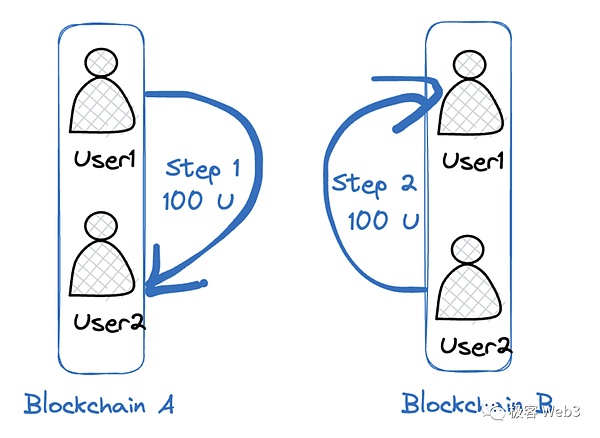

我们来想想,最符合直觉的跨链方法是什么?假如你在A链有100个USDT,你希望把它们转移到B链上。恰好有一个人在B链有100个USDT,他希望把USDT转移到A链去。你们俩一看这不刚好吗,于是一拍即合。

但当你把USDT在A链上转到对方的地址时,他却反悔了,没有在B链上将他的USDT转到你在B链的地址上。

因此,这种P2P交易的模式不是很靠谱,一来对方可能毁约,让你遭受损失,没有任何保障;二来,这个交易对手也不好找,你可能要等很久,才能碰到一个刚好和你要跨出去的金额匹配,但跨链方向相反的用户,甚至可能等到天长地久也等不到这样的对手方。

2. 公证人机制(Notary Schemes)

2.1 单个公证人

于是我们想到,既然对方可能违约,那我能不能找一个可信的第三方进行交易?我在源链上先把钱给他,然后他保证在目标链上把钱转给我。比如说,这个人同时在A链和B链上都有资产,然后他担保说,只要在A链收到我的100个USDT,就一定会从B链转给我100个USDT。

这比第一种P2P的链间资产交换好很多,因为有一个可信的公共对手方了,他手里掌握了一种神奇的东西,叫做「流动性」,你可以随时与它交易。

也就是说,你和他的交易变成了一种“点对池”的交易,而非“点对点”的交易。但你还是觉得不踏实,如果你和他交易100 USDT还好,倘若你要和他交易100万USDT呢?尽管他有比较好的信誉,但还卷款跑路。

说到底,这个公证人其实又是引入了一种中心化,依旧不是我们想要的Trustless 的跨链方式。

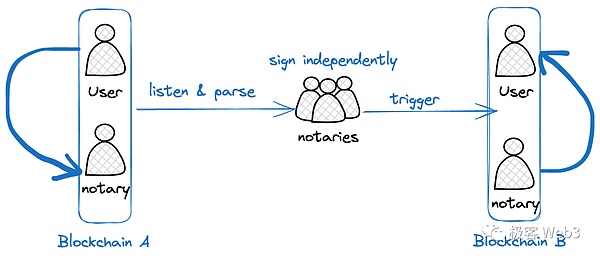

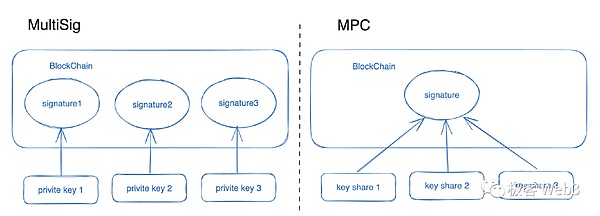

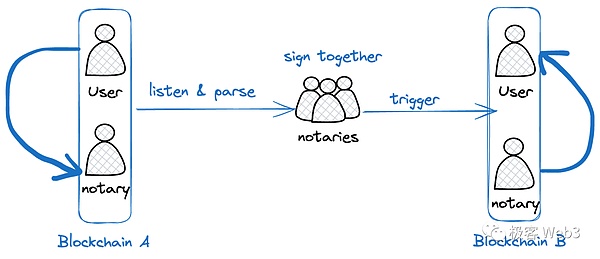

2.2 多个公证人(MultiSig)

那如果这个公证人不是一个人,而是一群人呢?我们可以建立一个共管账户,多个签名人共同管理该账户,他们要对一个消息进行签名,签名数达到阈值(一般是2/3),资金才会被转移。

这种情况下,如果其中少数人(不超过1/3)动了歪心思,想在源链上收我的款,又不想在目标链上给我打钱,或者离线了,也没有关系,其他诚实的公证人还是会签名,并把应给我的钱转出去。

这种方案比较靠谱了,弱化了中心化风险,安全性更高一些。比如一共有20个信誉良好的公证人,他们同时动歪心思的概率还是很低的。(这里不包括 Multichain那种20个节点实际上是一个人管理的情况,或是像Axie跨链桥那样被黑客盗取了2/3公证人的签名密钥。)

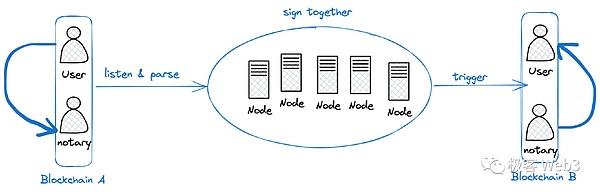

2.3 多个公证人(MPC)

但多签的账户管理方式,也有很多不方便的地方。

多签使得签名规则更容易暴露。如果是5/7的签名方案,多签钱包的智能合约代码会暴露到底有多少个签名方,黑客可以有的放矢的寻找这些签名方,伺机盗取私钥。

多签需要对不同的公链进行适配。比如有的公链不支持智能合约,你就得用该链特制化的密码学原语实现多签账户,如果这个也不支持,你这个多签钱包就搞不了。

多签的签名人定了就不能改。比如5/7的签名方案,你如果想改成6/8的方案,或者你想更换签名人,就得重新部署多签合约,而且还要把资金转移到新的多签合约中。

首个BTC衍生品tBTC的跨链方案,就是用了多签的方式,因为很蹩脚难用,已经被淘汰了。当前的跨链桥,大多采用了更先进的MPC的方式。

MPC全称Multi-Party-Computation(多方安全计算),是一种私钥分片技术。多签账户是多个私钥管理一个账户,而MPC账户则是一个私钥管理一个账户,该私钥被切分为多个碎片,多个签名人各持有一个私钥碎片,当签名人数达到阈值时才可以合成完整的签名,签名过程不会暴露完整私钥。

MPC账户有以下优势:

比普通多签钱包的保密性更强。当需要签名的时候,由例如5/7个私钥碎片各自去签名,多个子签名融合到一块构成最终的一个合法签名。这样一来,链上看到的是一个单一的、普通的签名,你无法分辨它是否来自MPC账户,更无法知道背后的签名人是谁,也无法知道私钥碎片的数量和具体的签名规则。

可以比多签钱包更好的适配大多数公链。MPC是一种签名技术,与链无关。MPC账户其实就是一个普通账户,不管一条公链是否支持智能合约,都可以通过MPC技术构建共管账户。

MPC更换签名机制更灵活。可以支持更灵活的签名规则调整,比如随时改变私钥碎片数量、签名阈值,也可以随时更换签名人,只需要把私钥进行重新分片(Re-share)即可。

3. 进一步的安全措施

3.1 冷热分离

公证人的托管账户收到了A链上我的100个USDT后,给我在B链的地址转过去100个USDT,这个行为的触发流程该怎么做?

假设说每个公证人成员都有一台机器在监听A链上的transaction,当他们发现我给跨链桥托管账户转了100个USDT,且这笔transaction里面声明了,我希望在链B上名为user2的地址接收这些USDT。

此时公证人集体进行联合签名,将B链上跨链桥账户中的100个USDT转给user2。这个过程肯定要写成代码,自动化运行,否则公证人都得实时在线,收到请求还得立刻操作,太不现实了。

这个自动化程序里会包含几个部分

1、监听程序:负责监听源链上的交易,为了过滤无关交易或无效交易,这一步可能会做一些基本的格式验证;

2、校验程序:这里会包含所支持区块链的轻节点客户端(也可能是全节点),负责验证源链上某笔与跨链桥合约产生交互关系的交易,真的被打包进区块并上链了;

3、签名程序:负责签名发起目标链上向用户的转账交易。

但自动化也带来一个问题,就是这个自动化程序有可能被黑客攻击和操纵。因此为了控制风险,跨链桥会采取冷热分离的措施。自动化程序控制的是热秘钥,转账的金额受到限制,遇到大额转账,则必须让公证人用冷秘钥进行手动签名。冷热分离的规则可以在MPC账户中实现。

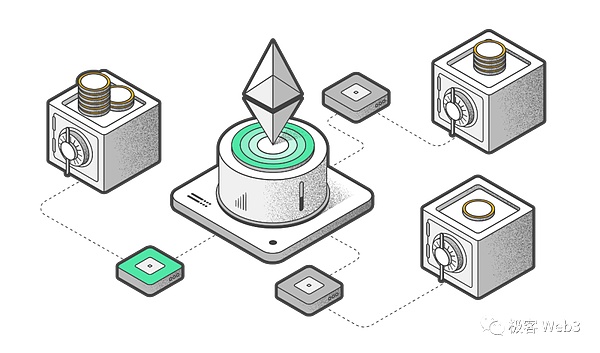

3.2 风险隔离

如果真的有bug,不要一次事故全部一锅端吧?因此要做好资金池的隔离,用多个托管账户来管理流动性资金,比如按照不同公链之间做隔离,例如A和B,B和C,C和D全都是独立开来的资金池。

3.3 TEE

公证人所运行的自动化监听和签名程序,可以运行在TEE设备中,这样可以大幅度提高黑客攻击的难度。TEE全称为可信执行环境(Trusted Execute Environment ),是给定设备上运行的与主操作系统隔离的计算环境,就像一块飞地(Encalve)。

这种隔离是通过硬件强制实现的,具有极高的安全性,因此TEE可以运行具有高安全性要求的应用程序,例如加密密钥管理、生物特征认证、安全支付处理等。

3.4 PoA向左,PoS向右

为了让跨链桥更加安全,在公证人的选择方面有两个方向:

一种是尽可能选择信誉良好的大公司、知名机构。对于这些机构而言,作恶的成本极高,可能会损失掉积累多年的商誉。此外,要尽可能让他们在地理分布上足够多元化(避免集中在同一司法辖区)。

比如跨链桥项目Wormhole就选择了这样的模式,它的19个节点背后都是体量庞大、资金雄厚的知名大机构,这就是PoA的方式。

另一种方式则是Permissionless的公证人准入,但要求他们做质押,如果行为不端,他们质押的资金就会被slash。这就是PoS的方式。ZetaChain用的便是这种。

两种方式谁优谁劣,不好直接武断的给结论。取决于跨链桥项目方在各自的方向上做的怎么样。

无论是PoA还是PoS,你可以把跨链桥直接做成一条公链,每个节点跑着相同的程序,所有跨链请求和处理的过程都会被记录到这条链上。这条链本身也可以承载应用,从而成为一个生态枢纽。

3.5 观察者

还有一种增强安全性的方法是,设置一个观察者的角色。该角色负责监控跨链行为,如果发现问题,可以在链上报告并中止交易。由于观察者需要一个窗口期来做出反应,因此跨链转移的到账时间可能被延迟,所以,只有大额交易或敏感跨链操作,用户接受转账延迟的情况下,观察者才会介入。

其他跨链方案

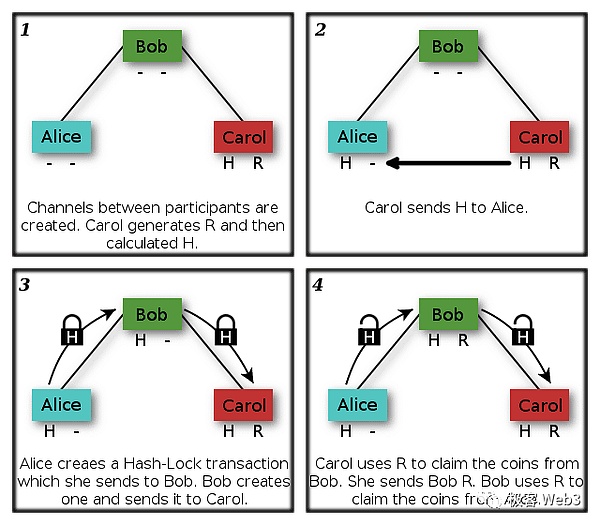

哈希锁定

回到本文所说的第一种方法:P2P的寻找跨链资产交换的对手方。如果我们害怕对手方赖账,那可以设置一套机制,一旦谁反悔了,另一方可以把钱拿回来,完璧归赵。

这就是哈希锁定,它巧妙地利用了哈希锁和时间锁,迫使资金的接收方必须在 deadline之前确定收款,并且产生源链上的收款证明,而打款方凭借这个收款证明,一定可以获取接收人在目标链上的等价资产,否则双方的资金都将原路返还。

但是这种方式只能进行资金的交换,无法完成通用的跨链信息转移。而且哪怕单从资金跨链转移的角度讲,哈希时间锁的用户体验也很不好:

如果币价的波动对交易对手(流动性提供方)不利,他可能理性地选择不成交;

为了完成一笔跨链交换,用户和交易对手都必须操作两次签名。

因此,哈希时间锁作为一种跨链解决方案,基本已被淘汰。早期使用这种方案的跨链桥(例如cBridge、Connext)都已经改弦更张了。

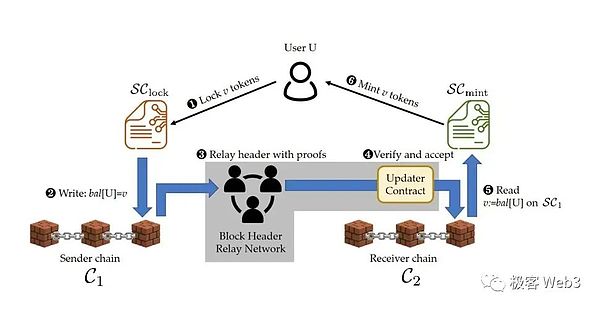

链上轻客户端

这种方式是直接在目标链上部署源链的轻客户端合约。如果你在一条链上部署了合约,那么这条链的所有节点都会运行你部署的合约代码。所以,链上轻客户端的方案,实际上是让目标链直接验证来自源链的交易。

这种方式具有极高的安全性,但也是最昂贵的。昂贵体现在以下几个方面:

目标链的轻客户端合约需要实时接收和验证来自源链的新区块头,这个过程非常耗Gas,即便用ZK来实现简洁证明,验证一个ZK证明的Gas消耗也不会低于40万Gas(EVM为例),而在MPC方案中,链上仅需验证的就是一个签名而已,Gas消耗只有2万出头,差了20倍!一个更安全,但是贵20倍的桥,你会用吗?

开发轻客户端合约的工程量巨大,而且为了让跨链桥兼容更多的异构链,你需要在不同链的完全不同的开发环境中,实现其他各个链的轻客户端合约,对开发人员简直是地狱级挑战。这就导致合约编写出现bug的概率变大,也就是说轻客户端桥的安全性仅仅是理论层面的,在工程实践方面,反而很不安全。

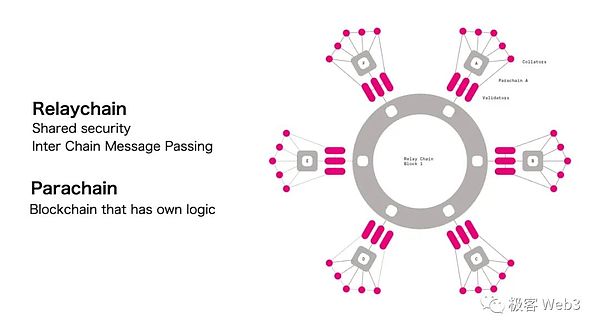

为了降低开发工程量,有一个可行的方案是引入一条中继链,让所有链与这条中继链互相建立轻客户端合约,这的确可以让曾经C(n,2)的工作量减少为 n,但依旧不会太小。原本从源链到目标链直接的跨链传递,也变成了源链→中继链→目标链的二阶传输,这会产生额外的gas消耗和时间消耗。

因此,轻客户端的技术方案,目前来看,无法被用于构建更普适的跨链桥。

End Game

首先,不同的公链有着不同的做法,背后也有不同的资源在支持,只要不服输,生态一定会存在,即使短期内发展不是很好,也说不定哪天做了一个升级就又活过来了。像这种底层infra的事情就是看谁坚持得久,看谁针对市场调整得快。

Bitcoin和Ethereum不能解决所有的应用场景,又或者说在某一个细分赛道,总有人不喜欢第一名,于是新造一个轮子,因此未来一定会是多链的。或者以后底层都不是链了,那未来一定是多生态的,多个生态之间的资金和消息怎么做传递呢,就一定需要有跨链/跨生态技术!

跨链这件事情上用户最关注什么呢?无非是以下几点:

速度:一笔跨链操作需要多久完成

费用:我需要为一笔跨链操作支付多少

安全:跨链桥是否安全,资金会不会丢失

流动性:是否有足够的流动性以支持我的交易以及可接受的price impact

连接范围:你支持多少条链,是否支持我的跨链操作中需要用到的链

体验:跨链操作是否方便,例如是否支持Gas代付、费用预估是否准确、是否支持进度查询和浏览器查看,出现失败的情况是否频繁,失败如何处理等等。

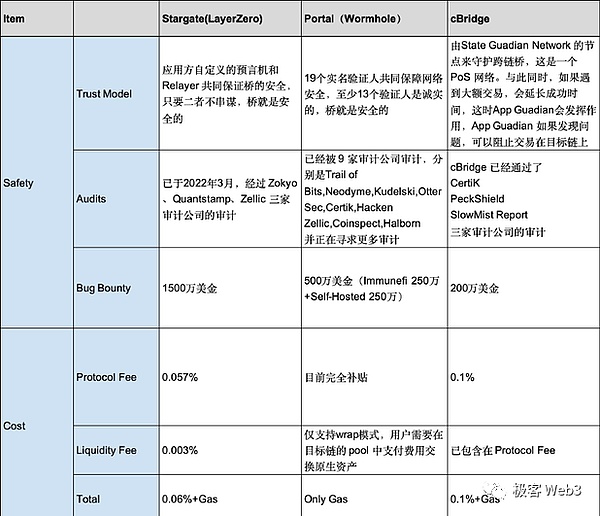

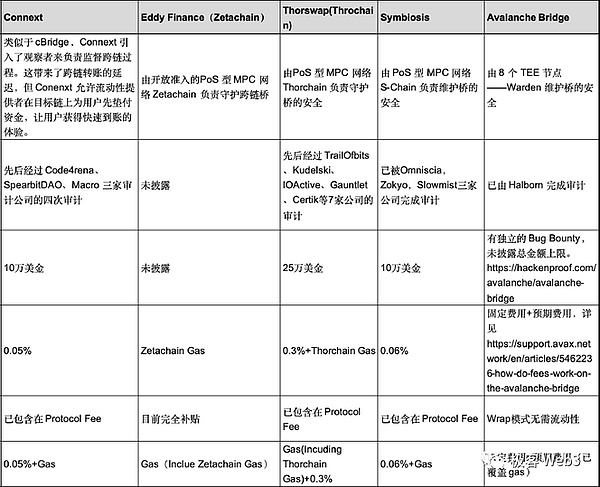

我们先从安全、费用、连接范围三个比较清晰的角度来概览一下一些项目的特性。

点击链接查看清晰表格(表格不断更新中):

https://docs.google.com/spreadsheets/d/1LKlbd5KJUnQIx3ZBTgyMADhxHtWVwBH9qDRm765tPMw/

为了完全说清楚跨链桥,其实还有很多维度的细节需要讨论,例如上面表格里面的所有维度和数据分析。那么你在跨链时,会在意哪些要素呢?你经常使用的跨链桥有哪几个?你认为跨链桥应该着重在哪些方面优化?如果你有你的想法,欢迎与作者交流。

The author, geek technical consultant and former technical director, thanked for the help provided during the writing of this article. Since the establishment of the blockchain industry, countless public chains have emerged, and almost every public chain has developed its own ecology. Some people only interact on specific public chains, and more people hope to find income opportunities such as trading and mining in different chains. In this process, cross-chain capital transfer has become an essential need. In addition to ordinary users, many project parties also have the need to transfer funds between different chains to guide the flow. It's a consensus that different blockchains are isolated, but there is no way for funds in the system to cross directly from one chain to another. The essence of the cross-chain of funds is that the cross-chain bridge, as a public counterparty, receives users' funds on the source chain and gives money to users on the target chain to issue mapping assets or release funds for users from the liquidity pool reserved in the target chain. How to realize the cross-chain of funds is the best? At first, people still trusted the centralized exchange. At one time, there was a saying that centralized exchange was circulated. Easy is the best cross-chain bridge, but the operation of charge and withdrawal is very complicated. People hope that there is a pure chain way to complete the cross-chain of funds more directly, and compared with the centralized exchange cross-chain bridge, it can complete more general cross-chain messaging, which is not limited to the transfer of funds. For example, if you use a cross-chain loan to provide collateral from the chain to lend assets on the chain, you need to use cross-chain messaging. If you look at the historical source of cross-chain, you can trace it back to the early stage of blockchain technology development at that time. The emergence of the Internet makes people realize that the problem of interoperability between chains should be solved, otherwise there will be many information capital islands. Over time, people have put forward different types of cross-chain methods and gradually formed today's general cross-chain model. Let's explain some developments of cross-chain technology and find our own opponents. Let's think about what the most intuitive cross-chain method is. If you have a person in the chain who wants to transfer them to the chain, there happens to be a person in the chain who wants to transfer them to you. The two of us hit it off at first sight, but when you transferred the chain to the other party's address, he went back on his word and didn't transfer his to your address in the chain, so the trading model is not very reliable. First, the other party may break the contract and make you suffer losses without any protection. Second, this counterparty is hard to find. You may have to wait a long time to meet a user who just matches the amount you want to cross but crosses the chain in the opposite direction, and may even wait forever. Counterparty notary mechanism single notary, so we thought that since the other party may breach the contract, can I find a credible third party to trade? I will give him the money first in the source chain, and then he promises to transfer the money to me in the target chain. For example, this person has assets in both chains, and then he promises that as long as he receives my name in the chain, he will definitely transfer it to me from the chain, which is much better than the first kind of inter-chain asset exchange, because there is a credible public counterparty who has mastered a magic in his hand. What is called liquidity is that you can trade with it at any time, that is to say, your transaction with him has become a point-to-point transaction rather than a point-to-point transaction, but you still feel insecure. If you trade well with him, what if you want to trade with him? Although he has a good reputation, he still runs away with money. In the end, this notary has actually introduced a centralized cross-chain way, which is still not what we want. What if this notary is not one person but a group of people? In order to establish a condominium account, a number of signers jointly manage the account. They have to sign a message, and the number of signatures reaches a threshold. Generally, the funds will be transferred. In this case, if a few of them don't want to pay my money on the source chain and don't want to pay me on the target chain or go offline, it doesn't matter that other honest notaries will still sign and transfer the money that should be given to me. This scheme is more reliable, which weakens the risk of centralization and is safer, for example, one. There are a total of notaries with good reputation, and the probability that they are inclined to think at the same time is still very low. This does not include the situation that the node is actually managed by one person or that the signature key of notaries has been stolen by hackers like a cross-chain bridge. However, there are many inconveniences in the account management method of multi-signing, which makes the signature rules more exposed. If it is a signature scheme, the smart contract code of multi-signing wallet will be exposed. How many signers can hackers look for it in a targeted way? These signers wait for opportunities to steal private keys, so they need to adapt to different public chains. For example, if some public chains don't support smart contracts, you have to use the special cryptographic primitive of the chain to realize multi-signature accounts. If this doesn't support your multi-signature wallet, you can't make a multi-signature signer, so you can't change the signature scheme. If you want to change the scheme or change the signer, you have to redeploy the multi-signature contract and transfer the funds to the cross-chain party of the first derivative in the new multi-signature contract. The case has been eliminated because it is very poor and difficult to use. Most of the current cross-chain bridges adopt a more advanced way. Multi-party security calculation is a private key fragmentation technology. A multi-signature account is managed by multiple private keys, while an account is managed by one private key. The private key is divided into multiple fragments, and multiple signers each hold a private key fragment. Only when the number of signers reaches a threshold can a complete signature be synthesized. The signing process will not expose the complete private key account. The following advantages are achieved. It is more confidential than ordinary multi-signature wallets. When signature is needed, for example, a private key fragment is used to sign each other, and multiple sub-signatures are fused together to form a final legal signature. In this way, you can't tell whether it comes from an account or not, and you can't know who the signer is behind it. The number of private key fragments and the specific signature rules can be better adapted than multi-signature wallets. Most public chains are a signature technology and have nothing to do with chain accounts. In fact, it is an ordinary account. Whether a public chain supports smart contracts or not, it can build a co-managed account through technology. The signature replacement mechanism is more flexible, and it can support more flexible adjustment of signature rules. For example, the number of private key fragments can be changed at any time, and the signature threshold can also be changed at any time. It is only necessary to re-slice the private key to further security measures. After receiving my account on the chain, the notary's escrow account will be transferred to my address in the chain. What should I do to trigger this behavior? Suppose that every notary member has a machine on the monitoring chain. When they find out that I have entrusted 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。