LD Capital:港股何时启动反弹?

作者:Lisa,LD Capital

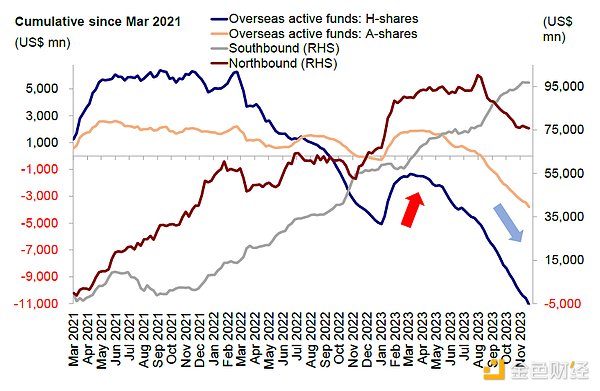

在美联储停止加息、全球主要区域基金对中资股均已降至低配以及国内出台刺激政策的背景下,港股仍未见外资回流迹象,恒指依旧弱势,结合历史情况判断基本面因素仍是主导资金走向的关键。

一、港股走势回顾

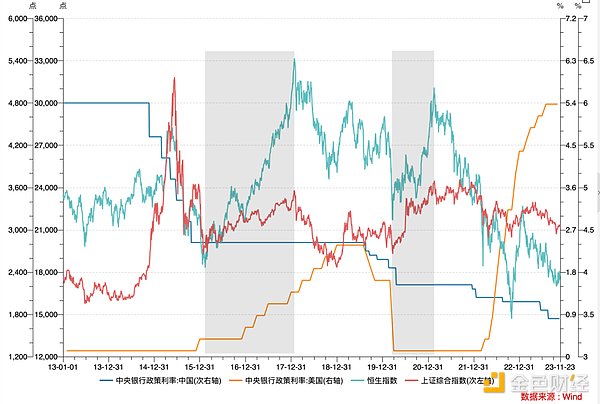

回顾港股过去十年的走势,恒指在2016年2月至2018年1月和2020年3月至2021年2月经历了两段主要的上涨行情。

第一段上涨行情正值美联储加息与缩表,然而港股市场并未受到外部流动性缩紧的制约持续上涨,原因在于2016年中央推行的供给侧改革与棚改推动国内投资与地产周期的开启,驱动国内经济的强劲增长。从这一波的行情中可以看出主导港股市场表现的核心因素是内部增长而非外部环境。

第二段上涨行情,在全球新冠疫情的大背景下财政发力,中央发行1万亿元抗疫特别国债,同时由于疫情对国内供应链扰动相对小外需和出口增加,经济实现了快速修复,股市表现强劲。

近1年以来恒生指数的走势先反弹后下跌。受益于中国疫情放开后的经济复苏预期和美联储边际转松,市场自2022年11月起触底反弹。恒生指数从2022年10月31日的15000点持续上至1月23日最高的22,700点,涨幅超过50%。

而后受国内增长不及预期与美国通胀仍具粘性等因素影响,市场结束反弹势头。港股今年以来在全球表现中垫底,跑输全球各主要指数,包括A股,与上涨36%和28%的纳指和日经指数相比弱势尤为明显,主要原因还是在于外资撤出和对国内增长修复的担忧。

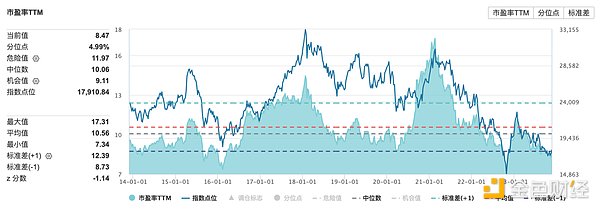

港股市盈率收缩至8.47倍,已经来到长期均值1倍标准差以下。

二、港股主要影响因素

1、外部环境

由于开放的金融市场属性,港股通常会更容易受外部环境的影响。美联储的货币政策通过流动性与估值(特别是互联网科技、生物医药等行业为代表的成长板块)影响港股市场。

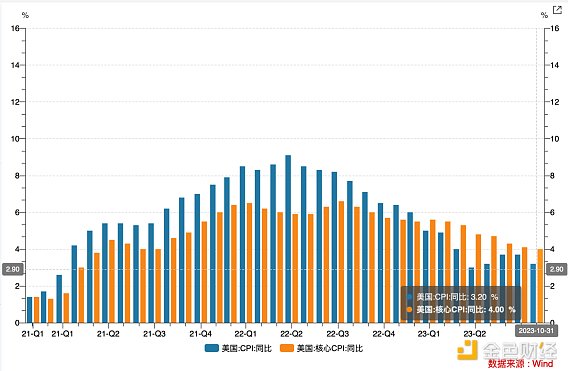

11月FOMC美联储再次暂停加息,加上10月经济数据表现偏弱和财政发债步伐放缓,引发市场普遍乐观预期,美债利率快速下行,自10月中旬5%的高位后持续回落低至4.4%左右。

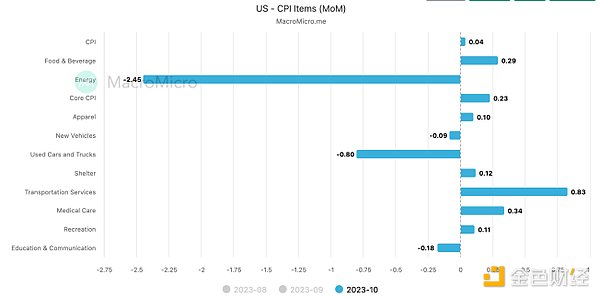

10月整体CPI和核心CPI超预期回落,美国10月CPI同比3.2%,核心CPI同比4.0%,低于市场预期。主因能源和二手车价格回落,随着对巴以冲突导致原油市场受到冲击的担忧缓解,原油价格回落,美国国内汽油价格下行。

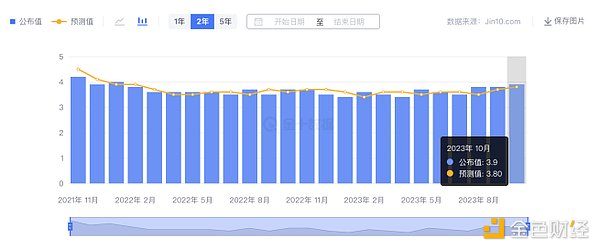

非农显著降温、失业率略有抬升。2023年11月3日,美国劳工部公布2023年10月美国非农数据,新增非农就业15.0万人,低于预期的18.0万人,仅为前值的一半。失业率小幅上升0.1个百分点至3.9%。

美国10月季调后非农就业人口(万人)

美国10月失业率

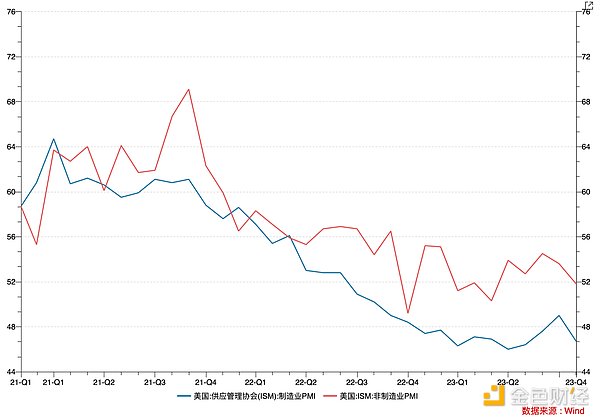

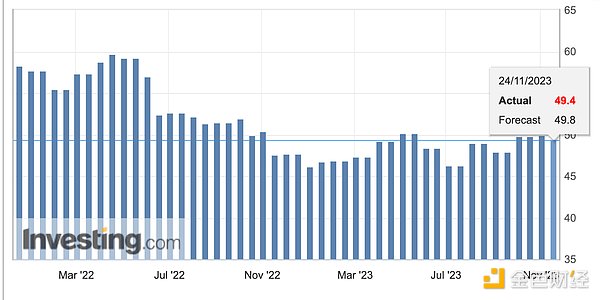

美国ISM制造业和非制造业PMI均有回落,分别录得46.7和56.8。Markit制造业PMI再度回落至收缩区间,服务业PMI小幅抬升。

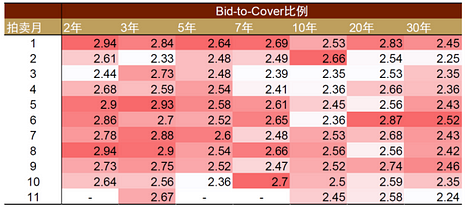

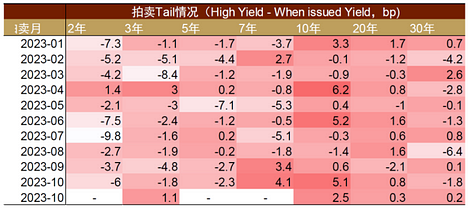

出于长债拍卖结果不理想和四季度美国财政赤字可能阶段性改善等原因,美国财政部在四季度再融资会议中放缓了美债发行节奏。财政部基于美国国债借贷咨询委员会(TBAC,Treasury Borrowing Advisory Committee )建议的四季度净发债规模为7760亿美元,较8月再融资会议中的预计规模下降760亿美元,剔除美联储的1710亿美元净赎回额后,四季度实际净发行预计降至6050亿美元。11月1日消息公布后,市场反应积极,10年期美债收益率下行明显。但11月国债拍卖实际情况依然体现出需求不足,财政压力仍未完全缓解。长债拍卖投标覆盖率(Bid-to-cover ratio)同步下行,3年、10年、20年和30年期美债拍卖最高利率(high yield)均高过当天市场利率(when-issued yield)。

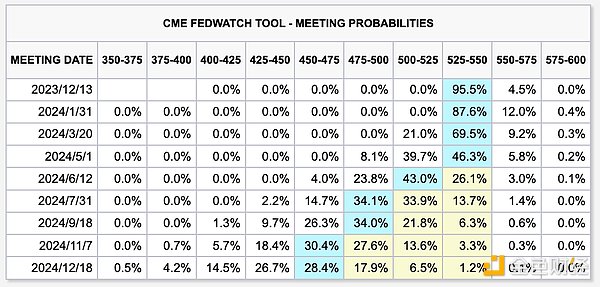

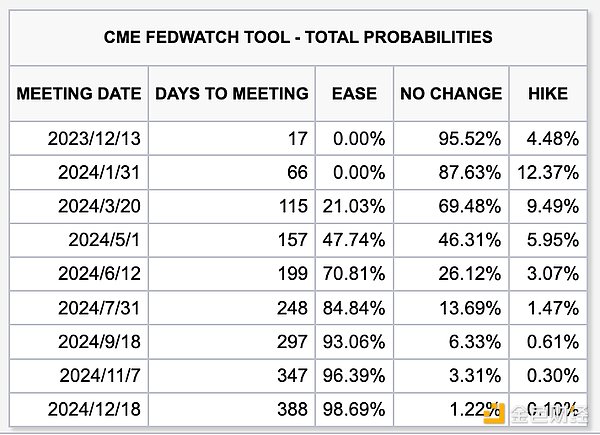

通胀回落、增长放缓以及对财政扩张担忧的部分缓解使得市场认为12月大概率停止加息,当前CME利率期货隐含12月不加息的概率为95.5%%。往前看美债利率下行是大势所趋,节奏上或呈阶梯式回落。

2、国内经济

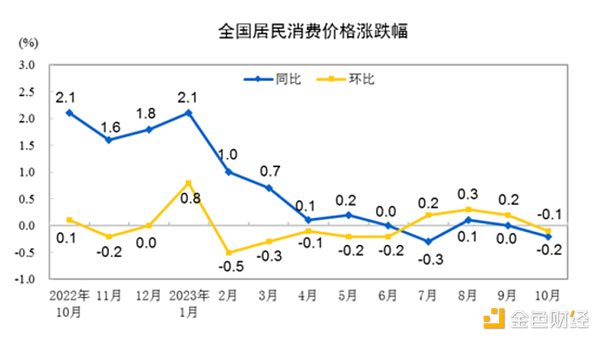

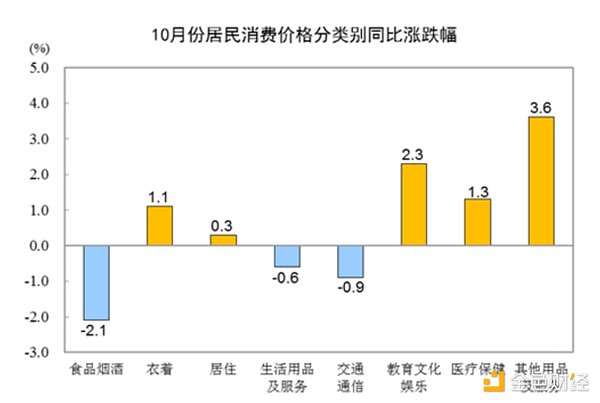

物价水平显示国内通胀回升动能整体偏弱。11月9日国家统计局公布2023年10月份物价数据,全国居民消费价格同比下降0.2%,环比下降0.1%。CPI回落主要受到食品价格主要是猪肉和节后消费需求回落的影响。畜肉类价格下降17.9%,影响CPI下降约0.66个百分点,其中的猪肉价格下降30.1%,影响CPI下降约0.55个百分点;蛋类价格下降5.0%,影响CPI下降约0.04个百分点;鲜菜价格下降3.8%,影响CPI下降约0.08个百分点。

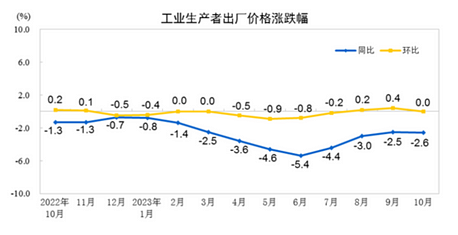

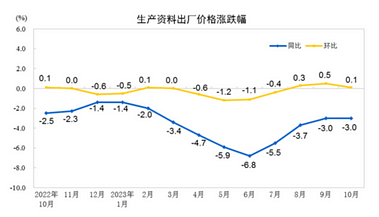

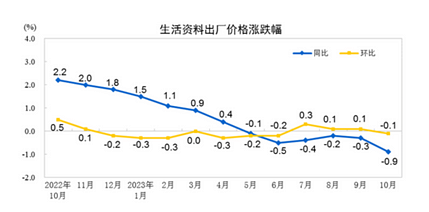

2023年10月份,全国工业生产者出厂价格同比下降2.6%,环比持平,主要受到生产资料拖累。同比而言,生产资料价格下降3.0%,影响工业生产者出厂价格总水平下降约2.35个百分点。其中,采掘工业价格下降6.2%,原材料工业价格下降2.3%,加工工业价格下降3.0%;生活资料价格下降0.9%,影响工业生产者出厂价格总水平下降约0.24个百分点。其中,食品价格下降1.2%,衣着和一般日用品价格均上涨0.4%,耐用消费品价格下降2.0%。

环比而言,生产资料价格上涨0.1%,影响工业生产者出厂价格总水平上涨约0.08个百分点。其中,采掘工业价格上涨2.4%,原材料工业价格上涨0.4%,加工工业价格下降0.2%。生活资料价格下降0.1%,影响工业生产者出厂价格总水平下降约0.04个百分点。其中,食品价格下降0.3%,衣着价格上涨0.1%,一般日用品价格持平,耐用消费品价格下降0.1%。

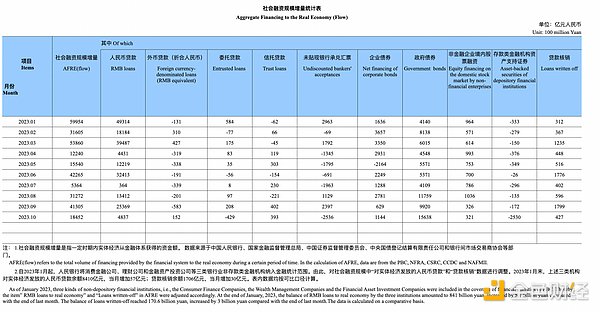

2023年10月末社会融资规模存量为374.17万亿元,同比增长9.3%。10月新增社融1.85万亿人民币,同比多增9,108亿元,其中居民和企业融资需求较弱,社融增长主要来源于政府部门融资,10月政府债券新增融资的1.56万亿占了新增社融总量1.86万亿的85%。其他细分项多有回落,人民币贷款余额235.33万亿元,同比增长10.9%,增速与上月末持平,比上年同期低0.3个百分点,人民币贷款新增处于相对历史低位。

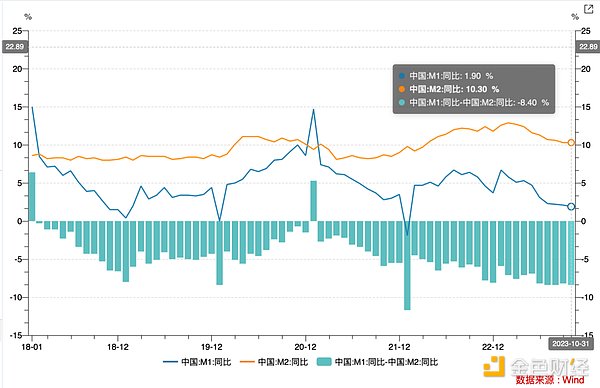

10月末,广义货币(M2)余额288.23万亿元,同比增长10.3%,增速与上月末持平,比上年同期低1.5个百分点。狭义货币(M1)余额67.47万亿元,同比增长1.9%,增速分别比上月末和上年同期低0.2个和3.9个百分点。流通中货币(M0)余额10.86万亿元,同比增长10.2%。当月净回笼现金688亿元。M1-M2剪刀差-8.4%,较9月下降0.2%,显示整体储蓄倾向并未得到缓解,资金活化程度依然处于较低位置、经济运行情况偏弱。

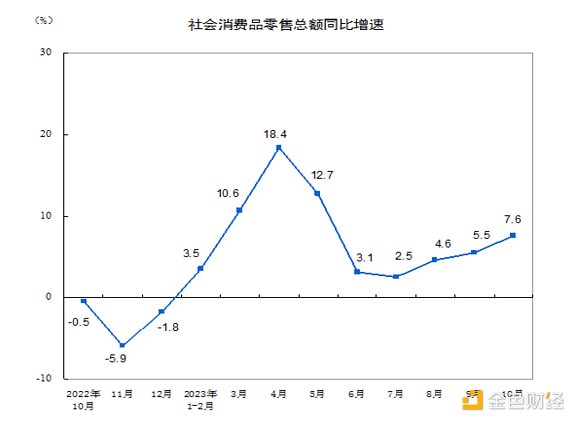

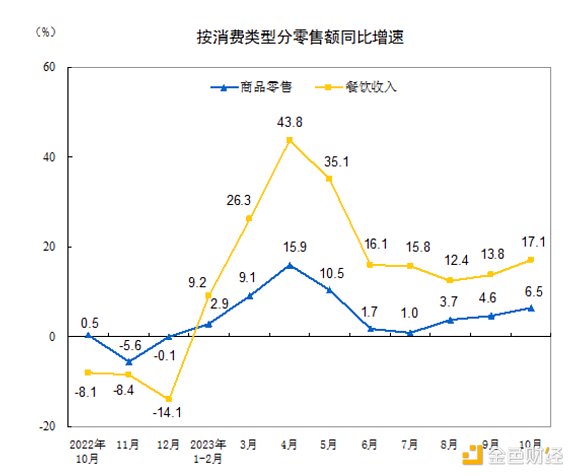

消费方面,10月社会消费品零售总额在低基数和双十一购物节前置等因素支撑下录得43333亿元,同比增长7.6%,增速较9月上升2.1%。按消费类型分,10月份商品零售38533亿元,同比增长6.5%;餐饮收入4800亿元,增长17.1%,主要与国庆假期、聚餐出行需求增多有关。

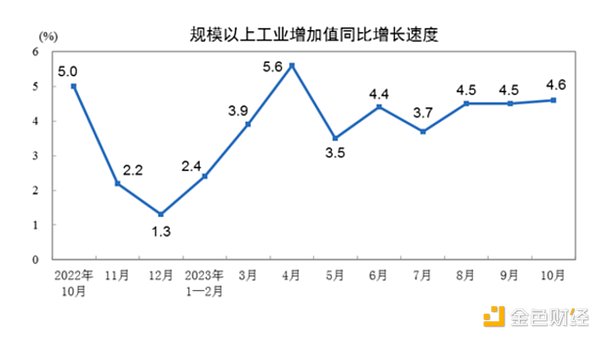

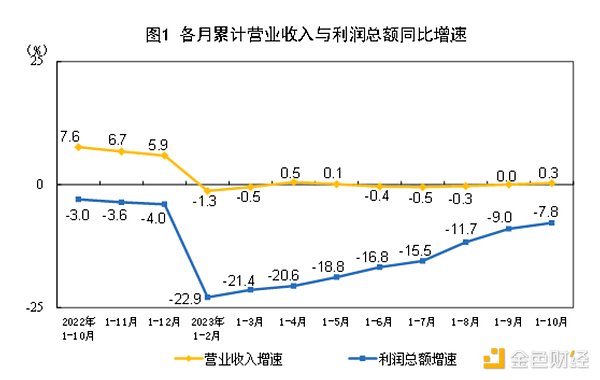

10月份,规模以上工业增加值同比实际增长4.6%,环比增长0.39%。1–10月份,全国规模以上工业企业实现利润总额61154.2亿元,同比下降7.8%,降幅比1–9月份收窄1.2个百分点,企业利润修复放缓。

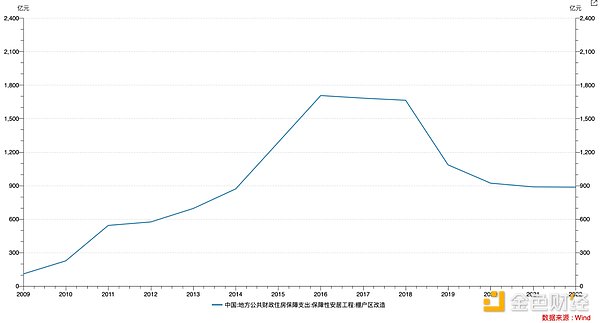

8月份以来认房不认贷、降低首付比例、存量首套房贷利率调整等措施频出,各省市政策端持续发力,近期亦有多项重要进展:

(1)11月17日,中国人民银行、金融监管总局、中国证监会联合召开金融机构座谈会,提出1、“三个不低于”,即各银行房地产贷款增速不低于银行平均增速,对非国有房企对公贷款增速不低于本行房地产增速,对非国有房企个人按揭增速不低于本行按揭增速。2、监管机构正在起草一份或含50家国有和民营房企的白名单,在列企业将获得包括信货、债权和股权融资等多方面支持,名单较年初范围有所扩大;3、拟修改开发贷、经营性物业贷、个人住房贷款办法等。(2)11月22日深圳官宣二套住房个人住房贷款最低首付款比例由原来的普通住房 70%、非普通住房80%统一调整为40%,并放宽普通住宅标准。(3)人民银行11月27日发布的2023年第三季度中国货币政策执行报告指出,完善房地产金融宏观审慎管理,一视同仁满足不同所有制房地产企业合理融资需求,对正常经营的房地产企业不惜贷、抽贷、断贷。

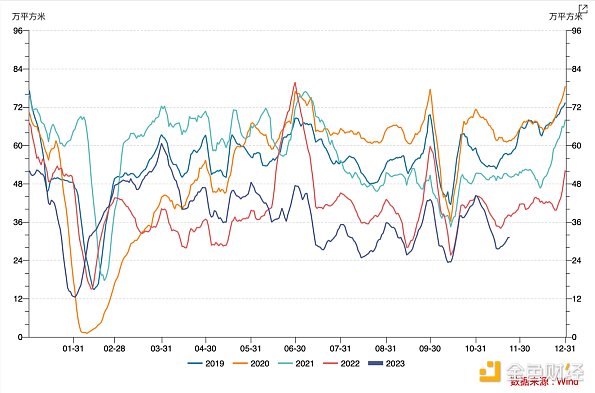

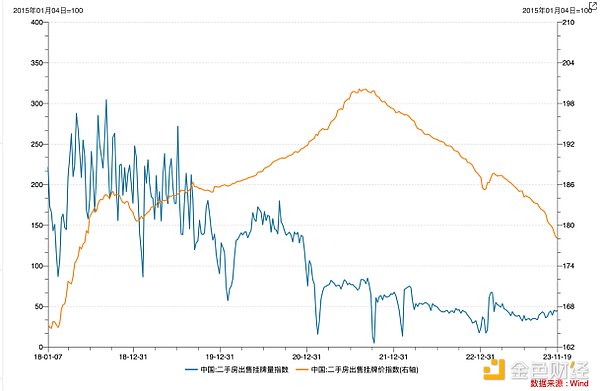

但在房价弱预期下,就目前数据而言未见明显改善,截至当下各地政策效果有限,30大中城市商品房成交面积位于近五年以来同时期的低位,近期二手房挂牌量企稳但挂牌价格指数持续下行。

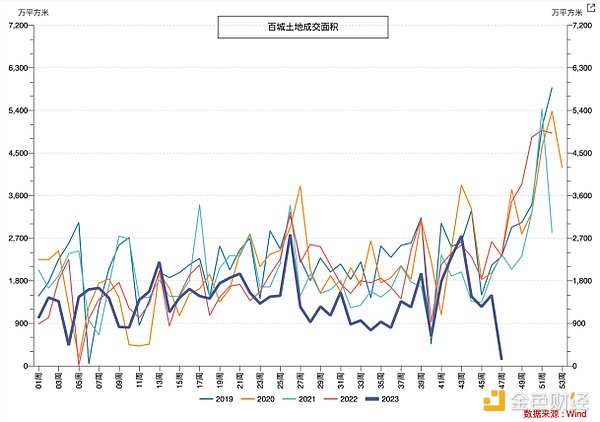

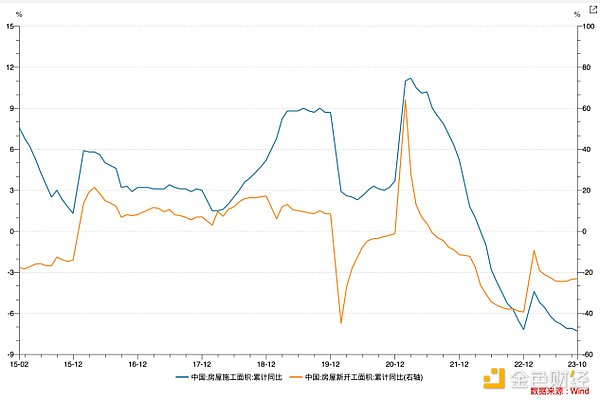

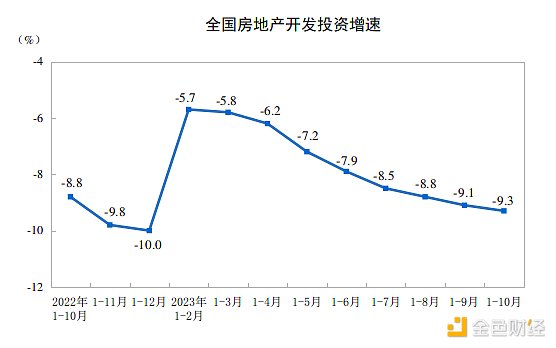

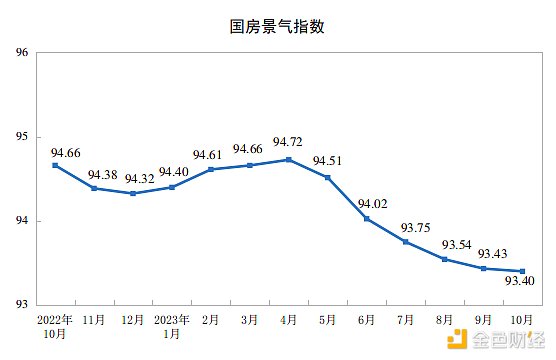

近年来销售和房企拿地意愿低迷,1–10月份,全国房地产开发投资95922亿元,同比下降9.3%,其中住宅投资72799亿元,下降8.8%。房屋施工面积同比2022年5月份以来持续负增长,截止10月份未有明显拐头信号。10月份,房地产开发景气指数(简称“国房景气指数”)为93.40,连续第六个月下滑。

中央财政将在今年四季度增发2023年国债10000亿元,增发的国债全部通过转移支付方式安排给地方,集中力量支持灾后恢复重建和弥补防灾减灾救灾短板,整体提升我国抵御自然灾害的能力。今年拟安排使用5000亿元,结转明年使用5000亿元,全国财政赤字将由38800亿元增加到48800亿元,预计赤字率由3%提高到3.8%左右。财政扩张有望成为带动企业和居民贷款提振市场的重要抓手。

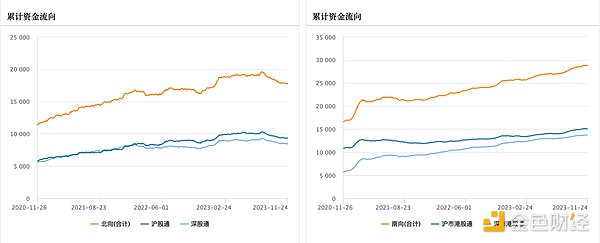

三、资金流向

南北向资金上周均为净流出。南向资金上周流出规模共计4.06亿元港币。

EPFR数据显示,海外主动型基金过去21周连续流出海外中资股市场。

四、总结

在美联储停止加息、全球主要区域基金对中资股均已降至低配以及国内出台刺激政策的背景下,港股仍未见外资回流迹象,恒指依旧弱势,结合历史情况判断基本面因素仍是主导资金走向的关键。在经济数据依然偏弱的情况下,整体上港股依旧出于处于逐步筑底的过程,大幅反弹有赖于对基本面改善的信心增强。当前各部门加杠杆意愿偏弱,复苏进程缓慢,宽货币向宽信用传导不畅。扭转颓势的关键还在于财政和货币政策的继续发力以推动信用周期开启,其中最主要的抓手可能还是楼市刺激和中央财政加杠杆,可以看到政府也正在朝着这个方向行进。拐点何时出现需要密切关注接下来基本面数据以及政策支持持续传导和加码的情况。

Against the background that the Federal Reserve stopped raising interest rates, and the major regional funds in the world have all reduced their allocation to Chinese stocks, and the domestic stimulus policies have been introduced, the Hang Seng Index still shows no signs of foreign capital return. Judging from the historical situation, fundamental factors are still the key to the direction of leading funds. Looking back on the trend of Hong Kong stocks in the past decade, the Hang Seng Index experienced two major rising markets from September to June and from September to June. When did Hong Kong stocks start to rebound? The first rising market was at the time of the Federal Reserve. However, the Hong Kong stock market has not been restricted by the external liquidity contraction. The reason for the continuous rise is that the supply-side reform and shed reform promoted by the central government in 2000 promoted the opening of the domestic investment and real estate cycle, driving the strong growth of the domestic economy. From this wave of market, we can see that the core factor that dominates the performance of the Hong Kong stock market is internal growth rather than external environment. When did Hong Kong stocks start to rebound? In the context of the global COVID-19 epidemic, the central government issued a trillion yuan of resistance. At the same time, the epidemic caused relatively little disturbance to the domestic supply chain, and the external demand and export increased, and the economy achieved rapid recovery. The stock market performed strongly in recent years. The Hang Seng Index rebounded first and then fell, benefiting from the economic recovery expectation after the China epidemic was released and the marginal loosening of the Federal Reserve market bottomed out since June. The Hang Seng Index continued to rise from the point on June to the highest point on June, and then the market rebounded due to factors such as domestic growth being less than expected and US inflation still being sticky. Momentum Hong Kong stocks have been underperforming at the bottom of global performance this year. The major indexes in the world, including stocks and rising stocks, are particularly weak compared with the Nasdaq and Nikkei. The main reason lies in the withdrawal of foreign capital and concerns about the repair of domestic growth. Macroscopically, when will Hong Kong stocks start to rebound? The P/E ratio of Hong Kong stocks has shrunk to times below the long-term average multiple standard deviation. Macroscopically, when will Hong Kong stocks start to rebound? Second, the external environment is more vulnerable because of the open financial market. The influence of the external environment, the Fed's monetary policy affects the Hong Kong stock market through liquidity and valuation, especially the growth sector represented by the Internet, technology, biomedicine and other industries. In addition, the Fed suspended interest rate hikes again in January, and the weak performance of monthly economic data and the slow pace of fiscal bond issuance triggered widespread optimism in the market. It is expected that the interest rate of US bonds will fall rapidly from the high level in the middle of the month, and it will continue to fall as low as expected to the whole and core around the month. The main reason for the year-on-year decline in the United States is the price of energy and used cars. Decline with the concern about the impact of the Palestinian-Israeli conflict on the crude oil market, ease the decline of crude oil prices. Macro-commentary on when Hong Kong stocks started to rebound. Macro-commentary on when Hong Kong stocks started to rebound. The unemployment rate rose slightly. The US Department of Labor announced the increase of non-agricultural employment of 10,000 people in the United States in October, which was only half of the previous value. The unemployment rate rose slightly to 10,000 people in non-agricultural employment in the United States. Macro-commentary on Hong Kong stocks? When did Hong Kong stocks rebound? When did Hong Kong stocks rebound? Both manufacturing and non-manufacturing industries in the United States fell back, respectively. The manufacturing industry fell back to the contraction zone, and the service industry rose slightly. When did Hong Kong stocks rebound? When did Hong Kong stocks rebound? Due to the unsatisfactory results of long-term debt auction and the possible gradual improvement of the US fiscal deficit in the fourth quarter, the US Treasury slowed down the pace of US debt issuance in the fourth quarter refinancing meeting. The Ministry of Finance borrowed based on US Treasury bonds. The scale of net bond issuance recommended by the Advisory Committee in the fourth quarter is $ billion, which is $ billion lower than the expected scale in the monthly refinancing meeting. After excluding the net redemption amount of $ billion from the Federal Reserve, the actual net issuance in the fourth quarter is expected to drop to $ billion. After the announcement of the news on January, the market responded positively, and the yield of one-year US treasury bonds declined obviously. However, the actual situation of the monthly treasury bond auction still shows insufficient demand, and the financial pressure has not been completely alleviated. The bidding coverage rate of the long-term bond auction has declined simultaneously. The highest interest rates of the annual and annual US treasury bond auctions are higher than Macro-time comment on market interest rate when Hong Kong stocks start to rebound Macro-time comment on when Hong Kong stocks start to rebound Source: Bloomberg Information The slowdown of inflation and the partial easing of concerns about fiscal expansion make the market think that there is a high probability of stopping raising interest rates in a month. The current interest rate futures imply that the probability of not raising interest rates in a month is to look forward. The downward trend of US bond interest rates is the trend of the times or in a step-by-step decline. Macro-time comment on when Hong Kong stocks start to rebound. Flat shows that the overall momentum of domestic inflation rebound is weak. On April, the National Bureau of Statistics released the annual and monthly price data. The national consumer price dropped year-on-year and month-on-month. The decline was mainly affected by the decline in food prices, mainly pork and post-holiday consumer demand. The decline in livestock meat prices was about percentage points, of which the decline in pork prices was about percentage points, the decline in egg prices was about percentage points, and the decline in fresh vegetable prices was about percentage points. When did Hong Kong stocks start to rebound? The ex-factory prices of industrial producers nationwide fell year-on-year in January, which was flat compared with the previous month. The decline in the prices of production materials affected the overall level of ex-factory prices of industrial producers by about percentage points, including the decline in the prices of mining industries, raw materials, processing industries and means of subsistence, which affected the overall level of ex-factory prices of industrial producers by about percentage points, including the decline in the prices of food, clothing and general daily necessities. Rising prices of durable consumer goods decreased. Compared with the previous month, the rising prices of means of production affected the total ex-factory price of industrial producers by about percentage points, among which the rising prices of mining industry, raw materials, processing industry and means of subsistence affected the total ex-factory price of industrial producers by about percentage points. Among them, the falling prices of food, clothing and general commodities were flat, while the falling prices of durable consumer goods were flat. At the end of the year, the stock of social financing scale was trillion yuan, which increased year-on-year. Among them, the financing demand of residents and enterprises was weak, and the growth of social financing mainly came from the financing of government departments, and the trillion yuan of new financing of government bonds accounted for trillion yuan of the total amount of new social financing. Most of the other sub-items fell back, and the growth rate of RMB loan balance was the same as that at the end of last month, which was 1 percentage point lower than that at the same period of last year. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。