币安和解后 加密货币迎来监管新时代

作者:Luke Nolan,CoinShares 翻译:善欧巴,比特币买卖交易网

介绍

经过对全球最大的加密货币交易所进行多年调查后,币安与司法部、商品期货交易委员会和财政部于 2023 年 11 月 21 日达成和解。

赵长鹏(CZ)已辞去币安首席执行官职务,并承认违反美国反洗钱法,包括违反制裁和汇款立法。这导致币安被罚款 43 亿美元,个人被罚款 5000 万美元。

为了应对这些事态发展,币安本周出现了超过 10 亿美元的资金外流,并任命前区域市场主管 Richard Teng 为新任首席执行官。最后,作为和解的一部分,独立合规监察员将监督币安的运营。

系统性风险

币安事件的旷日持久引发了更广泛的加密货币行业的焦虑,人们担心该交易所是否会出现假设性的崩溃(类似于去年年底 FTX 的崩溃)。从和解细节公布后市场反应基本平淡来看,大家都松了口气,因为币安显然没有陷入任何财务困境,用户资产也很安全。43 亿美元的罚款很可能很容易处理,而且我们已经看到如此规模的资金在币安钱包中转移,这可能是预料到的。

但币安会带来多大的系统性风险呢?

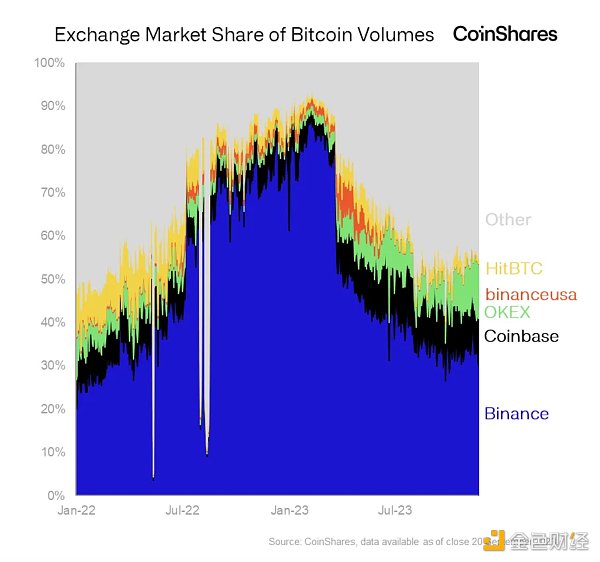

就比特币交易量(和总交易量)而言,币安目前在所有主要交易所中拥有最大的市场份额。然而,这一数字较 2023 年 1 月的峰值已大幅下降,从约 83% 降至目前的约 31%。不用说,币安是加密市场中非常重要的参与者,在用户资金不安全或必须支付巨额罚款从而影响其偿付能力的情况下,肯定会带来某种形式的系统性风险。作为参考,在其巅峰时期,FTX 约占加密货币交易所总市场份额的 24%²,其崩溃造成的后果是显着的:从用户资金损失(89 亿美元)到对行业的普遍不信任,导致了一个相当长的加密冬天(注意宏观经济因素疲软和全球流动性收缩)。

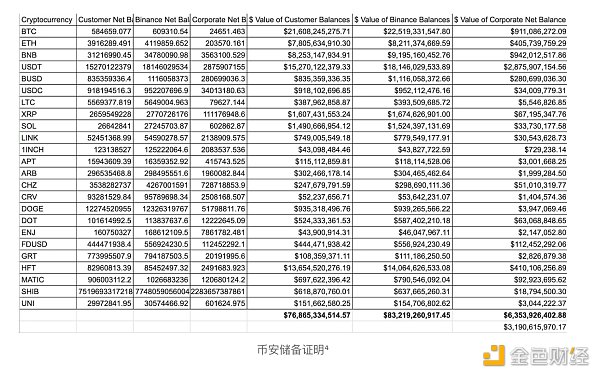

值得注意的是,FTX 崩溃后,币安自行提高了用户资金和加密资产余额的透明度。2022 年 11 月,他们发布了准备金证明,试图证明他们拥有足够的资产来支付客户余额。截至 2023 年 11 月 21 日,它们大致如下:

尽管此储备证明不包括币安可能持有的链下负债,但它表明他们很可能能够在没有任何重大问题的情况下偿还罚款:他们持有约 63 亿美元的非客户资金资产,包括约 30 亿美元的稳定币。

总体而言,目前币安似乎完全具备偿付能力,并且面临着全面崩溃的微小风险(除非未来可能提出任何新的进展或指控)。因此,虽然鉴于币安作为市场领导者的主导地位,整个调查构成了潜在的系统性风险,但许多交易所交易量多元化的趋势以及相对积极的结果已经全面缓解了人们的担忧。

这对行业前景意味着什么

涉及币安的和解标志着加密货币交易行业内加强合规性和责任感的新时代的开始。接受严格的监管标准是加密货币未来的重大而积极的一步,使其与其他公认的金融资产类别保持一致。

随着世界各地的监管机构采用更强大的框架,这种发展是有益的,可以提高透明度并最终保护客户。

尽管未来的旅程可能会带来挑战,包括针对中心化交易所可能采取的进一步措施,但这些步骤预计将大大增强投资者的信心并确保加密货币市场的长期稳定。

After years of investigation on the world's largest cryptocurrency exchange, Bi 'an reached a settlement with the Commodity Futures Trading Commission of the Ministry of Justice and the Ministry of Finance on January. Zhao Changpeng resigned as the CEO of Bi 'an and admitted that he violated the anti-money laundering laws of the United States, including sanctions and remittance legislation, which led to a fine of US$ 100 million for Bi 'an and a fine of US$ 10,000 for individuals. In response to these developments, Bi 'an experienced an outflow of more than US$ 100 million this week. In the end, as part of the settlement, the independent compliance inspector will supervise the operation of the currency security. The protracted currency security incident has aroused the anxiety of the wider cryptocurrency industry. People are worried about whether there will be a hypothetical collapse of the exchange, similar to the collapse at the end of last year. After the details of the settlement are announced, the market reaction is basically dull, because the currency security is obviously not in any financial difficulties, and the user assets are also very safe. The fine of RMB yuan is likely to be easy to handle, and we have seen such a large amount of funds transferred in the wallet of Coin Security, which may be expected, but how much systemic risk will Coin Security bring? In terms of bitcoin transaction volume and total transaction volume, Coin Security currently has the largest market share in all major exchanges, but this figure has dropped sharply from about to about now, needless to say, Coin Security is a very important participant in the encryption market, and users' funds are unsafe or have to pay. The case of huge fines that affect its solvency will definitely bring some form of systemic risk. As a reference, the consequences of its collapse, which accounts for about the total market share of cryptocurrency exchanges at its peak, are remarkable, from the loss of users' funds to the general distrust of the industry, which has led to a long encryption winter. Pay attention to the weak macroeconomic factors and the contraction of global liquidity. It is worth noting that after the collapse, Coin' an has improved the transparency of users' funds and the balance of encrypted assets by itself. In June, they issued a reserve certificate, trying to prove that they have enough assets to pay the customer's balance. As of June, they are roughly as follows. Although this reserve certificate does not include the off-chain liabilities that Qian An may hold, it shows that they are likely to be able to repay the fine without any major problems. They hold about $100 million in non-customer capital assets, including about $100 million in stable currency. Generally speaking, Qian An seems to be fully solvent at present and faces a slight risk of total collapse, except. Any new progress or accusation may be made in the future. Therefore, although the whole investigation constitutes a potential systemic risk in view of the dominant position of Coin Security as a market leader, the trend of diversification of trading volume and relatively positive results in many exchanges have fully alleviated people's concerns. What does this mean for the industry prospects? The reconciliation involving Coin Security marks the beginning of a new era of strengthening compliance and responsibility in the cryptocurrency trading industry. Accepting strict regulatory standards is the focus of cryptocurrency in the future. A big and positive step to make it consistent with other recognized financial assets, with the adoption of a stronger framework by regulators around the world, this development is beneficial, which can improve transparency and ultimately protect customers. Although the future journey may bring challenges, including possible further measures for centralized exchanges, these steps are expected to greatly enhance investors' confidence and ensure the long-term stability of the cryptocurrency market. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。