MT Capital 研报:Chainflip 原生跨链交换市场的新锐竞争者

作者:Severin,MT Capital

TL;DR

Chainflip 能够实现原生的链间价值转换,具有更高的去中心化程度、安全性和可组合性。

$FLIP 代币短期内仍会保持通胀状态,我们预计短期内交易量带来的代币回购销毁不足以使得 $FLIP 进入通缩。

Chainflip 相比 Thorchain 拥有更好的产品体验和设计,但 Thorchain 本身具有先发优势,例如高市场知名度和市场占有率。因此,我们预测 Chainflip 很难在短期内完全替代 Thorchain。

Chainflip 的市值约为 90M,全稀市值约为 460M。Thorchain 的市值为 2.1B,全稀市值为 3B。从可比估值的角度看,$FLIP 仍有接近 8x 的想象空间。但 Thorchain 的市值依托于其 68B 的总交易量,及近期日均 100M+ 的交易量的支撑,而 Chainflip 尚未产生任何交易。

我们对 $FLIP 的后续走势总体上只会保持谨慎看好,并会特别留意 Chainflip 近期主网上线的激励计划是否能带动交易量的大幅增长。

Chainflip: 去中心化的跨链流动性网络

原生链间价值转换

不同于使用包装资产或是需要在中间过程中 Mint/Burn 资产的跨链解决方案,Chainflip 选择采用原生的链间价值转换方式。

这就意味着,在每一条 Chainflip 所支持的链上,都有一个流动性原生资产池,从而形成链间通用的结算层,以满足用户对于链间资产转换的需求。原生链间的价值转换能够带来的优势如下:

价值转换与链无关、与钱包无关,Chainflip 支持用户使用普通钱包进行任意链上的价值转换。

价值转换不涉及任何包装资产、合成资产等其他资产,用户只需提交一笔普通交易来进行交换,交换完成后用户不会面临任何其他的资产风险。

Chainflip 不需要额外在特定的链上部署或执行其他协议,拥有更高的兼容性和通用性,并尽可能多地把计算过程放在链下,减少用户的 Gas 消耗。

Chainflip 的原生链间价值转换方式能够降低用户的操作门槛,减少用户的风险敞口,为用户带来更好的使用体验。

图片来源 : Momentum Capital

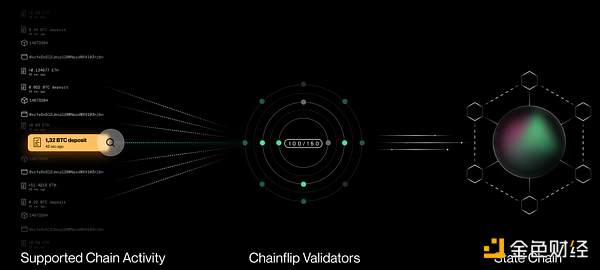

去中心化

相比其他解决方案,Chainflip 的另一大优势在于其更高的去中心化程度。Chainflip 的验证网络由最高 150 个验证节点组成。验证节点将维护网络安全、参与共识、监听外部链上事件、共同控制系统资金。成为验证节点的过程也是无需许可的,用户仅需质押足够的 $FLIP,并在拍卖中价高胜出便可成为其中的一员。Chainflip 思想的核心是使用 MPC(多方计算),特别是 TSS(阈值签名方案)来创建由 150 个验证者组成的无许可网络持有的聚合密钥。Chainflip 中所有的操作、状态变更都需要获得超 2/3 的节点共识确认,以此来保证更高的安全性。对比中心化交易所的跨链价值交换和部分中心化程度较高的跨链桥,用户无需担心中心化交易所的作恶风险以及跨链桥中心化服务器的作恶风险。Chainflip 通过更高的去中心化程度避免单个节点的单点故障和作恶风险,从而大幅提升系统整体的安全性。

图片来源 : Momentum Capital

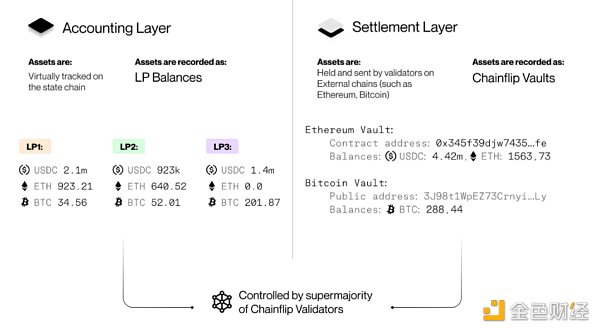

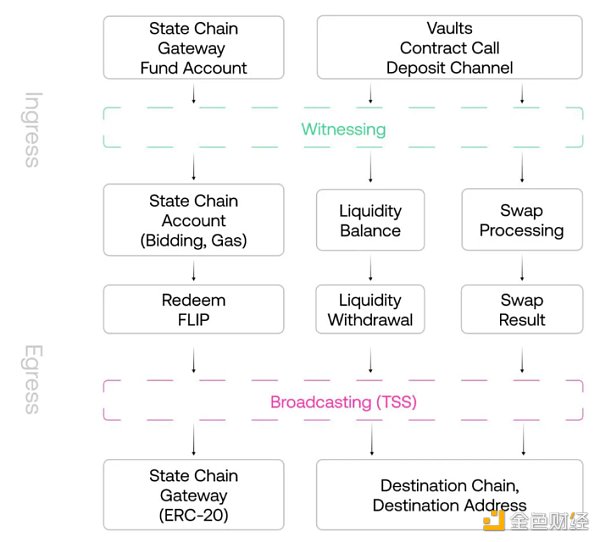

JIT AMM

链间价值转换的计算过程由 Chainflip 基于 Substrate 构建的状态链上的 Just In Time AMM(JIT AMM)来完成。JIT AMM 基于 Uni V3 构建,不同的是,JIT AMM 不是一系列在不同链上的智能合约集,而仅在状态链上针对价值转换进行虚拟计算。即 Chainflip 的记账和计算功能都被剥离在状态链上完成,而底层的结算则依靠 Chainflip 在各个链上设置的金库实现。**这一工作流极大地简化了在不同链上执行链间价值交换计算、记账和结算的操作复杂性,能够有效地降低用户的 Gas 成本。并且,Chainflip 的状态链也能过支持 JIT AMM 更多的定制化需求。**例如 Chainflip 支持 LP 针对传入的订单报价进行及时、动态的限价单更新,通过 LP 竞争的方式防止 MEV 机器人抢先交易,提高 LP 的资金使用效率,使得用户能够以更低的滑点获得更优的市场价格。

图片来源 : Momentum Capital

可组合性

相比现有的跨链桥,Chainflip 也有更好的可组合性。开发人员可以通过 Chainflip SDK 轻松地将 Chainflip 原生链间价值交换的功能集成到现有的协议或产品中。就像 Uniswap 的 Swap 功能被 DeFi 用例所广泛集成一样,更高的可组合性会给 Chainflip 带来更多的用例。随着目前以全链游戏为代表的高可组合性用例的迸发,当应用层的乐高积木不断堆叠时,也必将激发用户对于多链间底层资产流动性的需求。而目前的现状却是L1 与 L2 的流动性割裂愈趋严重,以 Chainflip 为代表的原生链间价值交换或将成为多链项目必不可少的内嵌功能。

团队背景

Chainflip 的团队由 26 名经验丰富的全球化人才组成。Simon Harman 是 Chainflip 的创始人兼首席执行官,他还是 Oxen Foundation 的董事会成员。在 Chainflip 之前,Simon 曾领导团队打造的产品包括基于 Signal 协议的消息传递应用程序 Session。CTO Martin 此前曾是 Covariant Labs 创始人和 Finoa 的 CTO 和 CSO。Chainfllip 团队拥有丰富的 Crypto 背景经历,接近 60% 的人员都是开发人员,整体团队构成比较优质。

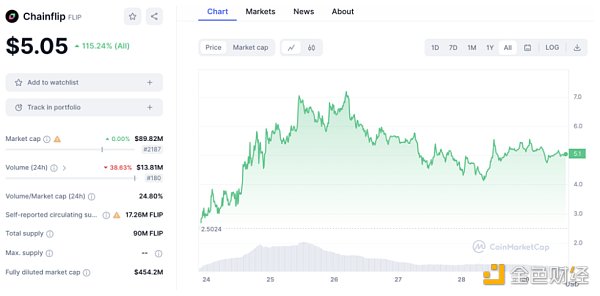

代币经济模型

2023 年 11 月 23 日,Chainflip 宣布主网启动并发行 $FLIP 代币。$FLIP 发行后便迅速受到了市场的热捧,目前价格为 5 美金左右,距离 $1.83 的 ICO 价格已经有接近 2.7x 的涨幅。

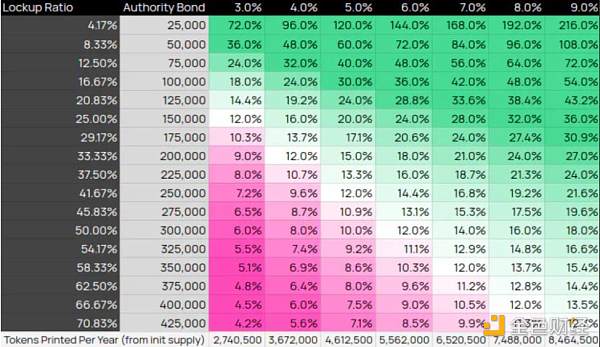

$FLIP 是 Chainflip 的 ERC-20 原生代币,初始供应量为 90M,遵循动态的代币供给模型。目前,Chainflip 预计会有年化 8% 的代币通胀,用于激励验证节点。此外,Chainflip 的交易手续费也会回购并燃烧 $FLIP,使得 $FLIP 也有可能会呈现通缩的状态。$FLIP 的代币赋能主要体现在被用于质押验证以及协议的价值捕获。

图片来源 : Momentum Capital

FLIP 质押验证

与大多数验证网络类似,由于 150 个 Chainflip 节点将掌控系统的所有资金和操作,因此,为了避免节点作恶,节点必须质押足额的 $FLIP 作为罚没惩罚才能参与验证。$FLIP 质押越多的节点,有更高的几率成为权威验证节点,从而获得额外的验证奖励。

目前预计将有年化 7% 的代币奖励会在权威验证节点中平分。而普通的备份验证节点,也会按照质押 $FLIP 的比例分配年化 1% 的代币奖励。因此,不难发现,**$FLIP 的质押数量会显著影响验证节点的验证奖励,这会放大节点对于持有和质押 $FLIP 代币的需求。**Chainflip 也预计 $FLIP 的质押率会占总供应量的 37%-66%,大幅的代币质押有利于保持代币价格的稳定,减少市场抛压。

图片来源 : Momentum Capital

FLIP 价值捕获

对于每一笔通过 Chainflip 进行的代币交换,Chainflip 都会收取 0.1% 的手续费。该手续费将以 USDC 的形式收取,并用于购买 $FLIP 。所购买的 $FLIP 代币将会被直接燃烧。同样,状态链上的 Gas 费也会用于购买 $FLIP 并燃烧。Chainflip 旨在通过代币回购燃烧的机制使得协议产生的价值能够动态地反映在 $FLIP 价格上,回馈 $FLIP 持有人,增强 $FLIP 的价值捕获能力。当然,由于 $FLIP 本身存在代币通胀,因此 Chainflip 也需要获得足够多的日交易量,其代币回购燃烧才能带动 $FLIP 价格的上涨。

未来预期

潜在市场

随着大量的 L1、L2 的陆续推出,链与链间的流动性割裂问题也日趋严重。据 DeFiLlama 数据显示,TVL 在 10M 以上的链总计共有 71 条。Rollup as a Service 与应用链的兴起也会进一步加剧流动性割裂的问题。黑客问题频发的传统跨链桥已经不再是用户解决跨链流动性的第一选择,以 Thorchain 和 Chainflip 为代表的原生链间代币交换方案或许会走向主流。目前跨链桥上累计的价值约为 12B,而 Thorchain 的 TVL 才仅约 300M,原生链间代币交换方案仍有数十倍计的市场空间。

对比 Thorchain

从整体上来看,Chainflip 的市场定位和 Thorchain 比较类似,但二者也有些许产品使用体验以及产品设计上的不同:

产品体验:Thorchain 需要单独的多链钱包,而 Chainflip 仅需普通的链上钱包即可使用,用户体验更加便捷。当然,Thorchain 目前也在对主流的钱包进行兼容以逐步缝合钱包体验差距。

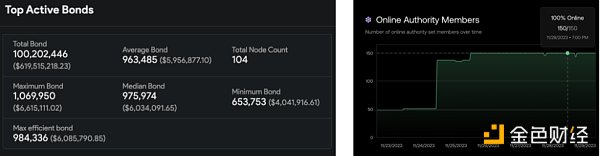

去中心化程度:Thorchain 目前共有 104 个节点维护链上金库的安全,Chainflip 的去中心化验证网络则由 150 个节点组成。从节点数量上来看,Chainflip 的去中心化程度会相对更高,但二者间并无明显差距。

产品设计:Thorchain 的资金池组建以及代币交换都依赖 $RUNE 作为中间媒介,而 Chainflip 不会依赖某个特定的代币。因此,Chainflip 的资金池和代币交换过程不会暴露在某个特定代币的风险敞口之下,安全度相对更高。

图片来源 : Momentum Capital

综上所述,目前 Chainflip 的使用体验、去中心化程度和安全性会略好于 Thorchain,但 Thorchain 本身的先发优势,市场知名度和市场占有率也是其重要的竞争优势。因此,**我们预测 Chainflip 很难在短期内完全替代 Thorchain。**更可能如 Thorchain 官推所言,Chainflip 会和 Thorchain 一起不断侵蚀跨链桥的市场份额。

图片来源 : Momentum Capital

目前,Chainflip 的市值约为 90M,全稀市值约为 460M。Thorchain 的市值为 2.1B,全稀市值为 3B。从可比估值的角度看,$FLIP 仍有接近 8x 的想象空间。但 Thorchain 的市值依托于其 68B 的总交易量,及近期日均 100M+ 的交易量的支撑,而 Chainflip 尚未产生任何交易。因此,我们对 $FLIP 的后续走势总体上只会保持谨慎看好,并会特别留意 Chainflip 近期主网上线的激励计划是否能带动交易量的大幅增长。

The author can realize the original inter-chain value conversion, which has a higher degree of decentralization, security and composability. Tokens will remain in an inflationary state in the short term. We expect that the repurchase and destruction of tokens brought about by trading volume in the short term will not be enough to make them have a better product experience and design than entering deflation, but they have their own first-Mover advantages, such as high market awareness and market share. Therefore, we predict that the market value that is difficult to completely replace in the short term is about full dilution, about full dilution and about comparable market value. From the perspective of valuation, there is still room for imagination, but its market value is supported by its total transaction volume and recent average daily transaction volume, but no transaction has yet been generated. Generally, we will only be cautious and optimistic about the follow-up trend, and will pay special attention to whether the incentive plan of the main online line can drive the substantial increase of transaction volume in the near future. The value conversion between the original chains of decentralized cross-chain liquidity networks is different from the use of packaged assets or the cross-chain solution of assets in the middle process. This means that each supported chain has a pool of liquid original assets, thus forming a general settlement layer between chains to meet the needs of users for asset conversion between chains. The advantages that the value conversion between original chains can bring are as follows: the value conversion has nothing to do with the chain, and it has nothing to do with the wallet. Users can use ordinary wallets to carry out value conversion on any chain, and the value conversion does not involve any packaging assets, synthetic assets and other assets. Users only need to submit an ordinary transaction. After the exchange is completed, users will not face any other asset risks, do not need to deploy or implement other protocols on a specific chain, have higher compatibility and universality, and put the calculation process under the chain as much as possible to reduce users' consumption. The native inter-chain value conversion method can lower users' operating threshold, reduce users' risk exposure and bring users a better use experience. Compared with other solutions, the new competitors in the native cross-chain exchange market are decentralized. Another great advantage of the resolution scheme is that the authentication network with a higher degree of decentralization is composed of the highest authentication nodes, and the authentication nodes will maintain network security, participate in consensus monitoring of events on the external chain, and jointly control the system funds to become authentication nodes. It is also a process that users without permission only need to pledge enough and win the auction at the highest price to become one of them. The core of the idea is to use multi-party computing, especially threshold signature scheme, to create a collection held by an unlicensed network composed of verifiers. All operation state changes in the key need to be confirmed by the super-node consensus, so as to ensure higher security. Compared with the cross-chain value exchange of centralized exchange and the cross-chain bridge users with higher degree of centralization, users do not need to worry about the evil risk of centralized exchange and the evil risk of cross-chain bridge centralized server, so as to greatly improve the overall security of the system by avoiding the single point of failure and evil risk of a single node through a higher degree of decentralization. The calculation process is completed on the state chain based on construction. Based on the construction, whether it is a series of intelligent contract sets on different chains, but only on the state chain for virtual calculation of value conversion, that is, the bookkeeping and calculation functions are stripped off from the state chain, while the bottom settlement is realized by the vaults set on each chain. This workflow greatly simplifies the operation complexity of performing value exchange calculation, bookkeeping and settlement on different chains and can effectively reduce the cost of users. Moreover, the state chain can also support more customization requirements, such as supporting the timely and dynamic update of limit orders for incoming order quotations, preventing robots from preempting transactions through competition, and improving the efficiency of capital use, so that users can obtain better market price research reports with lower slip points, and the image sources of emerging competitors in the native cross-chain exchange market can be combined better than the existing cross-chain bridge. Developers can easily exchange values between native chains. The integration of functions into existing protocols or products is just like the extensive integration of functions by use cases. Higher composability will bring more use cases. With the generate of high composability use cases represented by full-chain games, when Lego bricks in the application layer are constantly stacked, it will certainly stimulate users' demand for the liquidity of the underlying assets between multiple chains. However, the current situation is that the liquidity is becoming more and more serious, which means that the value exchange between original chains will become indispensable for multi-chain projects. The team with embedded functional team background is composed of an experienced global talent. He is the founder and CEO, and he is also a member of the board of directors. Before that, he led the team to build products, including protocol-based messaging applications. Previously, he was the founder and the people close to the team had rich background and experience, and all of them were developers. The overall team formed a relatively high-quality token economic model. After the announcement of the launch of the main network and the issuance of tokens, it quickly won the current price in the market. The price with a distance of about US dollars has increased nearly. Yes, the initial supply of native tokens follows a dynamic token supply model. At present, it is expected that there will be annualized token inflation to stimulate the verification node. In addition, the transaction fee will also be repurchased and burned, which makes it possible to present a deflationary token empowerment, which is mainly reflected in the value capture research report used for pledge verification and agreement, the emerging competitors in the native cross-chain exchange market, the image source pledge verification and most verification networks. It seems that because each node will control all the funds and operations of the system, in order to avoid node evil, the node must pledge the full amount as a penalty to participate in the verification. The more nodes pledged, the higher the probability of becoming authoritative verification nodes, thus obtaining additional verification rewards. At present, it is expected that the annualized token rewards will be divided equally among authoritative verification nodes, and ordinary backup verification nodes will also distribute the annualized token rewards according to the proportion of pledge, so it is not difficult to find that the number of pledges will significantly affect the verification. The verification reward of the certificate node will enlarge the demand of the node for holding and pledging tokens, and the expected pledge rate will account for a large proportion of the total supply. Token pledge is conducive to maintaining the stability of token prices and reducing the market selling pressure. The new competitors in the original cross-chain exchange market are captured by the image source value. The handling fee will be collected in the form of and used to purchase the purchased tokens, and the fees in the same state chain will also be used to purchase and burn, aiming at enabling the value generated by the agreement to be dynamically reflected in the price through the mechanism of token repurchase and burning. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。