企业区块链计划改变TradFi面貌 Fnality 和摩根大通如何重新定义金融

作者:Conor 来源:medium 翻译:善欧巴,比特币买卖交易网

几周前,我们看到企业发布了一些关于区块链计划的重大公告。这些正在改变 TradFi 的面貌。

首先,我们让Fnality 完成了由高盛和法国巴黎银行牵头的7770 万英镑融资。随后,摩根大通宣布了 MAS 项目的最新里程碑,他们与另类资产管理公司Apollo Global合作对基金进行代币化。

这两项公告都表明企业区块链计划没有显示出减弱的迹象。这两家公司在该领域正在进行的工作对TradFi 中的区块链具有重大影响,两者都值得更多讨论。

Fnality 如何构建批发支付的新轨道

Fnality 是运行时间最长的企业区块链计划之一。该项目是由世界领先银行组成的财团于 2015 年构思的。它最初被命名为公用事业结算币或 USC 项目,并于 2019 年分拆为自己的专门公司 Fnality。

Fnality 的目标始终是成为多种世界领先货币的实时批发支付系统,包括英镑、欧元、美元、日元和加元。

自成立以来,Fnality 的重点一直是推出英镑支付平台。目前,英镑支付预计将于 2023 年底前上线。这些英镑支付代表受监管金融实体之间的批发支付。

这实际上是英格兰银行持有的受监管银行账户之间的付款。

Fnality在英格兰银行有一种特殊类型的账户,称为综合账户。

综合账户用于代表 Fnality 网络上的资金,该网络使用私有以太坊部署,其中英镑表示为可替代的 ERC-20 风格代币。

如果它听起来与 CBDC 类似,那么你是对的。Fnality 支付系统被认为是一个合成的 CBDC。

这项最新投资 7770 万英镑是 Fnality 的第二轮重大融资。它于 2019 年 6 月完成了 5500 万英镑的 A 轮融资。

当您查看最新一轮的投资者名单时,您就可以清楚地看出他们的产品对机构的吸引力有多么重要。此轮融资由高盛和法国巴黎银行牵头,DTCC、Euroclear、野村证券和 WisdomTree 跟投。A 轮投资者桑坦德银行、纽约梅隆银行、巴克莱银行、加拿大帝国商业银行、德国商业银行、荷兰国际集团、劳埃德银行集团、纳斯达克风险投资公司、道富银行、三井住友银行和瑞银集团也进行了额外投资。

对于一个已经运行了 8 年、筹集了超过 1.3 亿英镑资金的项目来说,仍然没有启动可能会令人大吃一惊。然而,这些数字说明了将基于区块链的系统引入高度监管的金融市场是多么具有挑战性。

Fnality 的技术自诞生以来就已经可用。从那时起,它已经有所改善,但运行私有以太坊网络和开发英镑代币化版本的能力并不是主要挑战所在。

它属于运营网络所需的法律框架。Fnality 的很大一部分投资将用于与监管机构合作,以使支付网络能够运行。英格兰银行设立综合账户就是这样的一个例子。毫无疑问还有更多。

批发支付系统对中央银行至关重要。引入新型支付系统需要以高度规避风险的方式进行。考虑到这一点,该项目花了这么长时间才上线也就不足为奇了。

然而,Fnality 的投资者将会意识到这一点以及它迄今为止所取得的成就的重要性。这就是他们继续支持该项目的原因。

摩根大通和阿波罗是代币化基金

就在 Fnality 宣布这一消息的一天后,摩根大通宣布他们已经利用代币化基金进行了概念验证活动。

作为新加坡金融管理局 (MAS)“守护者计划”的一部分,与 Apollo Global 合作,资金被代币化并在多个不同的区块链之间转移。

该项目是摩根大通作为 MAS 守护者计划的一部分推出的第二个项目。去年,他们与星展银行合作,使用 Polygon 网络进行了受监管的 DeFi 交易。

Project Guardian的目标是利用跨行业试点来建立受监管 DeFi 的政策指南和框架。核心关注领域包括互操作性、代币化和建立信任锚。

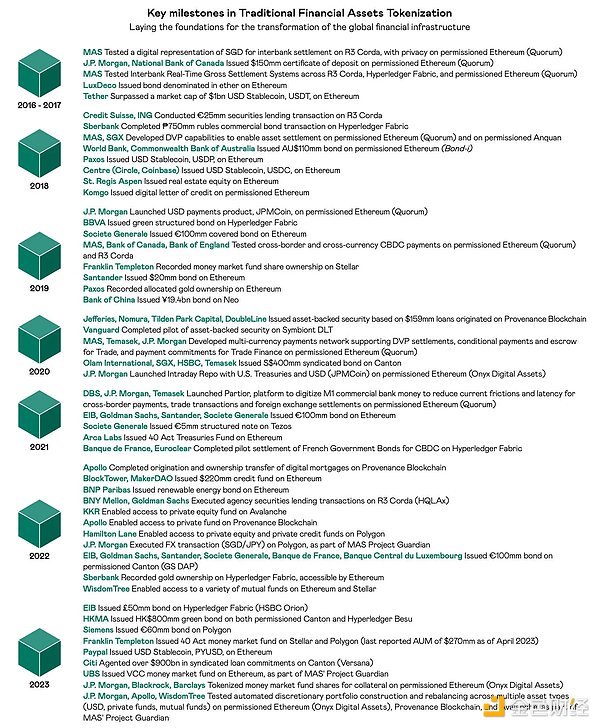

摩根大通和阿波罗的报告包含了这个奇妙的时间表

在这一最新举措中,重点是如何通过利用区块链上的代币化资产,该技术可以使投资组合经理无缝管理大量的全权委托投资组合,其中包括跨不同区块链的一系列代币化传统和另类投资,同时保留独特的投资者级账户定制。

摩根大通私人银行、Apollo 和 Wisdom Tree 的基金工具在多个获得许可的区块链网络上进行了代币化。

看到摩根大通与如此多的其他参与者在这个项目上合作,我们感到很惊讶。他们不是简单地要求在自己的 Onyx 数字资产网络上完成所有事情,而是使用了使用 Cosmos 和 Avalanche Supernet 的私有 Provenance 区块链。

Axelar 和 Layer Zero 的互操作性解决方案也用于在区块链之间转移资产。

这种将代币化资产与智能合约结合使用的方法可以大大简化投资组合管理流程,并为另类资产带来更大的流动性。报告所述的数字包括:

它可以为另类基金经理创造 4 亿美元的收入机会,并增加在更传统的投资组合中进行另类投资的机会。

机会的重新平衡可以从包含 3000 个步骤的过程变为只需点击几下。

通过实时结算,大多数投资组合中 3% 的现金需求几乎可以完全减少。

这些数字令人印象深刻,而将基金和投资组合代币化的想法对于区块链技术来说是一个显而易见的机会。

然而,重要的是要记住,使用的所有区块链网络都是私有许可网络,并且这是概念证明。从长远来看,公共网络可能会适用于 TradFi 的部分内容,但这将取决于被代币化的资产类型以及最终用户是谁。

稳定币和原生加密资产将保留在公共网络上,但明确监管管辖范围内的大型批发交易很可能保留在私有网络上。

未来的路还很长

摩根大通的这一最新概念验证是他们在过去 7 年中进行的众多项目之一。虽然它们将有助于推动该领域的发展,但重要的是要记住,这些技术还有很长的路要走。

Fnality 是在 2015 年开始的概念验证练习的基础上构建的,即将在 8 年后上线。监管需要调整和改变以支持这些项目。虽然金管局等监管机构与摩根大通和其他机构合作固然很棒,但为未来的漫长道路做好准备也很重要。

受监管的金融不会被公共区块链网络取代,但会有多种方式可以利用它们。这需要时间和努力,但如果说这些最新的公告表明了两件事的话,首先,以区块链技术为基础的金融服务的提供正在发生变化,其次,它不乏机会提高整个行业的效率。这个行业,只是需要时间。

A few weeks ago, we saw that the enterprise issued some major announcements about the blockchain plan. These are changing faces. First, we completed the 10,000-pound financing led by Goldman Sachs and BNP Paribas, and then JPMorgan Chase announced the latest milestone of the project. They cooperated with alternative asset management companies to token the fund. Both of these announcements show that the enterprise blockchain plan shows no signs of weakening. These two companies are in this field. The ongoing work has a great impact on the blockchain in China, and both of them deserve more discussion on how to build a new track for wholesale payment. It is one of the longest-running enterprise blockchain plans. The project was conceived by a consortium composed of world-leading banks in 2000. It was originally named as a public utility settlement currency or project and split into its own specialized companies in 2000. The goal has always been to become a real-time wholesale payment system for many world-leading currencies, including pounds, euros, dollars, Japanese yen and Canadian dollars. The focus has always been on the introduction of the GBP payment platform. At present, GBP payment is expected to go online before the end of the year. These GBP payments represent wholesale payments between regulated financial entities. This is actually the payment between regulated bank accounts held by the Bank of England. In the Bank of England, there is a special type of account called comprehensive account, which is used to represent funds on the network. The network uses private ethereum to deploy GBP as an alternative style token. If it sounds similar, then you are. The right payment system is considered as a synthesis. This latest investment of £ 10,000 is the second round of major financing. It completed a round of financing of £ 10,000 in June. When you look at the latest round of investors' list, you can clearly see how important their products are to institutions. This round of financing is led by Goldman Sachs and BNP Paribas, Nomura Securities and Santander Bank, New York Mellon Bank, Barclays Bank, Imperial Commercial Bank of Canada, German Commercial Bank Holland International Group. Group Lloyd's Bank Group, Nasdaq Venture Capital Company, State Street Bank, sumitomo mitsui banking corporation and UBS Group AG have also made additional investments. It may be surprising that a project that has been running for more than 100 million pounds a year has not yet started. However, these figures show how challenging it is to introduce a blockchain-based system into a highly regulated financial market. The technology has been available since its birth. Since then, it has been improved, but it runs a private Ethernet network. The ability to network and develop a token version of sterling is not the main challenge. It belongs to the legal framework needed to operate the network. A large part of the investment will be used to cooperate with the regulatory authorities to make the payment network run. The Bank of England has set up a comprehensive account, which is one such example. Undoubtedly, there are more wholesale payment systems that are crucial to the central bank. Considering this, the introduction of a new payment system needs to be carried out in a highly risk-free way. It took so long for the project to go online. It is not surprising, however, that investors will realize this and the importance of its achievements so far, which is why they continue to support the project. JPMorgan Chase and Apollo are token funds. Just one day after the announcement, JPMorgan Chase announced that they have used token funds to carry out concept verification activities. As part of the monetary authority of singapore Guardian program, the cooperative funds were token and transferred between different blockchains. The project is Morgan. Chase launched the second project as part of the Guardian Program. Last year, they cooperated with DBS Bank to conduct regulated transactions on the Internet. The goal was to establish a regulated policy guide and framework through cross-industry pilots. The core areas of concern included interoperability tokenization and building trust anchors. The reports of JPMorgan Chase and Apollo included this wonderful timetable. In this latest initiative, the focus was on how to make the portfolio through the use of tokenized assets in the blockchain. Manage a large number of discretionary portfolios seamlessly, including a series of token traditional and alternative investments across different blockchains, while retaining unique investor-level accounts, customizing JPMorgan Chase private banks and new fund instruments, and token them on several licensed blockchain networks. We were surprised to see that JPMorgan Chase cooperated with so many other participants on this project. They did not simply ask to complete everything on their own digital asset networks, but used them. The interoperability solution of private blockchain and is also used to transfer assets between blockchains. This method of combining token assets with smart contracts can greatly simplify the portfolio management process and bring greater liquidity to alternative assets. The figures mentioned in the report include that it can create billions of dollars in income opportunities for alternative fund managers and increase the opportunities for alternative investments in more traditional portfolios. Rebalancing can be changed from a process involving two steps to one. With just a few clicks, the cash demand in most portfolios can be almost completely reduced by real-time settlement. These figures are impressive, and the idea of tokenizing funds and portfolios is an obvious opportunity for blockchain technology. However, it is important to remember that all blockchain networks used are privately licensed networks, and this is part of the proof of concept that public networks may be applicable in the long run, but it will depend on the types of assets that are tokenized and ultimately. Who are the users? The stable currency and the original encrypted assets will remain on the public network, but the large-scale wholesale transactions within the clear supervision jurisdiction are likely to remain on the private network. There is still a long way to go in the future. This latest proof of concept of JPMorgan Chase is one of the many projects they have carried out in the past year. Although they will help promote the development of this field, it is important to remember that these technologies still have a long way to go. They were built on the basis of the proof of concept exercise that began in 2000 and will be put into online supervision after 2000. Although it is great for the HKMA and other regulatory agencies to cooperate with JPMorgan Chase and other institutions to support these projects, it is also important to prepare for the long road ahead. The regulated finance will not be replaced by the public blockchain network, but there will be many ways to use them, which will take time and effort. But if these latest announcements show two things, firstly, the provision of financial services based on blockchain technology is changing, and secondly, there are many opportunities to improve the efficiency of the whole industry. This industry just needs time. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。