EigenLayer 重塑收益:再质押的模式与收益

作者:Siddharth Rao, IOSG Ventures

“再质押” 部分

EigenLayer 简介

大约在一年前,EigenLayer 开启了一段旨在帮助新范式的网络安全理解的新征程,“再质押”的概念应运而生。总而言之,ETH 验证器现在可以保护多个网络的安全,包括 DA 层等基础层、计算网络等,以及共享定序器等中间件。从本质上讲,任何网络都需要某种形式的共识,而不需要启动资金来保证安全。这些网络在 EigenLayer 上被称为主动验证服务(Actively Validated Services: AVS)。

如果没有 EigenLayer,任何想要成为某个系统(例如 DA)的运营商都需要投资相关硬件,以及初始质押。这使得需要验证器集合的项目不得不以非常高(有时不合理)的估值发行代币,以获取高通货膨胀的奖励。这可能导致大规模的投机性抛售,对验证器运营商非常不利。

诚然,存在单一运营商的杠杆减仓风险,但总会有表现好的验证器想要借此获得一些额外的收益。

EigenLayer允许通过创建 EigenPods 或使用类似 stETH、rETH 和 cbETH 等流动质押代币(LSTs)来进行以太坊的本地再质押,从而保障 AVS 网络的安全。拥有 LST 的任何人实际上都是以太坊的安全性和去中心化的贡献者,并从以太坊网络中获得奖励。流动质押代币 (LSTs) 的进一步质押是为 AVS 网络提供安全性,以换取 AVS 收益。因此,LST 再质押者将有资格获得网络奖励(扣除运营商费用)。

既然质押和再质押是有益的,那为什么它是流动的?

如果你相信以太坊的流动质押,那么你也会认可流动的再质押。以太坊的流动质押实际上涉及两方:Lido 和零售参与者。零售参与者可能会说,我没有足够的ETH、硬件,或者甚至没有时间去运营一个验证器,但想让我的ETH收益更高。质押公司则会说,我可以帮你;我收取部分回报作为运营费用,并以完全透明的方式进行。

这消除了公众的五个开销:硬件成本、硬件维护、时间、精力、思维空间。

对于 EigenLayer 来说,除了上述相关的开销之外,还有额外的委托开销。在以太坊中,由运营商运行的每个节点都是“可替代的”,即网络将每个节点视为相同,无论是在 bare-metal 基础设施、云端还是其他地方运行。

对于 EigenLayer,有一个网络用于保障其他网络,网络中的每个运营商都可以选择希望验证哪些其它网络。这基本上意味着不存在相同的两个运营商。因此,经验丰富的团队或协会明智地选择具有良好策略的运营商,以便解决零售参与者的后顾之忧~

“流动” 部分

全年都有机会获得比以太坊上的任何质押协议都高的ETH收益。

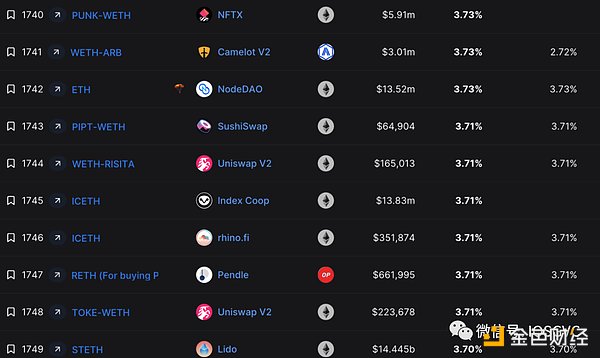

如果只关注收益,大约有 1748 种方式让你的ETH获得更高的收益。

真正的价值在于几乎“无风险”收益率,指风险最小的赚取ETH方式。对于流动代币,风险越小,该 LST 被列入其他协议的可能性越大,组合性越强,对 LST 的需求越大。所有这一切都是从信任开始的,即最低的风险。

对于 LST 来说,风险评估不是那么困难。你有基于运营商的风险(运营商关闭验证器,运营商质量,硬件质量等)以及基于网络的风险(智能合约风险)。所有风险的共识机制相同,对所有运营商的最低硬件要求也相同。

在再质押中,有更多因素需要考虑,主要包括硬件要求(是否需要扩展)、AVS 的安全审计、新型共识机制的实战测试、AVS 本身的经济模型以及AVS所获得的支持者(投资者、合作伙伴等)的类型等较小的因素,如 AVS 所获得的支持者类型(投资者、合作伙伴等)。仅仅在 EigenLayer 上运行的 15 个 AVS ,就有 32,767 种可能策略。我们不能指望散户投资者做出有教育意义的决定。

零售参与者不会这样做,如果他们简单地模仿任何运营商策略并被减仓,将导致信任丧失,从而影响网络的流动性。如果运营商推出自己的 LST,将导致在初期出现过多的碎片化或过多的质押集中。即使多个运营商使用相同的策略,但有不同的 Liquid“重新质押”代币(LRTs),也会导致不必要的碎片化。一个具有统一策略和运营商去中心化的共同 LRT 对 EigenLayer 的成功至关重要。

这确保了“最低风险”的正向反馈循环,可以看作是:

最佳风险管理 → 更多流动性 → 最多被列入白名单 → 最多使用 → 最多流动性 → 最受欢迎 → 最低风险

之所以是最低风险,是因为从 100,000 个验证器中被减仓的 1 ETH 比从 1 个验证器中丢失的 1 ETH 风险要小得多。这就是为什么人们仍然选择与 Lido 进行质押。Lido 最近经历了一次减仓事件,其中有 20 多个验证器每个减仓约 1.1 ETH(总计约 20 ETH)。虽然他们的基础设施合作伙伴已经承担了损失,但相对于 Lido 的 8.83 百万质押的 ETH 来说,这是非常微不足道的。这表明了拥有可信赖的合作伙伴的重要性。

流动再质押是如何工作的?

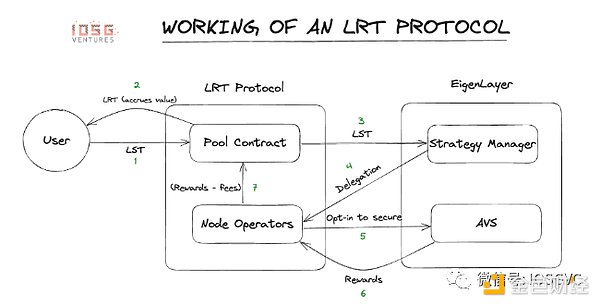

用户将他们的 LSTs/ETH 发送到流动再质押平台的资金池合同中。再质押者将获得等值的 LRT(流动性重质押代币)。然后,该合同将这些 tokens分配给 EigenLayer 协议中的策略管理合同。策略管理合同将这些 Tokens 委托给节点运营商,并确保节点运营商坚守策略。LRT 的治理可以选择特定的策略。运营商验证底层 AVS,保留一部分奖励。其余的然后转给 LRT 协议,该协议会抽取一部分,最终将其余分配给再质押者。这明显比 LST (流动性质押代币)更具提取性,但工作量和维护要消耗更多资源。

收益率有多吸引人?

我们不知道 AVS(主动验证服务)激励将如何分配,也不清楚每种共识机制将如何运作。但基于一些基础的书面的数学计算,下面是对计算 EigenLayer 收益率有参考价值的几种可能情景。

在考虑 FDV(完全稀释估值)的情况下,参考项目的最后的已知 FDV 数据,那些项目代币可能会以更高的估值启动,使得收益率显著更具吸引力。保守估计,我们假设 EigenLayer 生态系统页面上宣布的所有合作伙伴的 FDV值是他们最后一轮筹资的估值。截至10月19日,Eigen Layer 的 TVL(总锁仓价值)约为 172k ETH,Lido 的基础收益率约为 3%,根据我们的计算,大约有6200万美元的排放(二者都受 TGE 价格和排放影响,是比较保守的数字,即2.5%的代币供应和 FDV),大致相当于平均9%的 APY 增强收益,可能总计达到12%。

在更激进的情景中,Boosted 的收益 APY 可能高达15%。当然这些是基于假设的,如果讨论深入计算方式,可以在Twitter上私信我 (@Rao_Sidd)。

LRT生态系统

Ion Protocol:一个借贷协议,可以用LSTs和LRTs借贷资产;

Renzo:专门做流动性再质押的平台。接受所有EL LSTs(EigenLayer Liquid Staking Tokens) 和ETH,以换取他们的 LRT ezETH (Liquid Restaking Token ezETH);

Rio:专门做流动性再质押的平台。接受所有EL LSTs和ETH,以换取平台的LRT reETH;

Puffer Finance:基于 DVT 的 LRT 协议;

Inception LRT:专注于确保 L2s 安全的LRT协议;

Swell:LST协议,也在创建自己的LRT。Swell的LST也被列入EigenLayer再质押的 JokerAce 竞赛的候选名单;

Stader Labs:Stader Labs也有自己的LST ETHx,并且也在创建自己的LRT;

Genesis LRT:提供定制的LRT,允许每个客户根据他们所需的风险配置创建自己的LRT,主要面向进入这个领域的大客户和机构;

Astrid Finance:使用 rebase 模型,用户根据在资金池中质押的内容和用户的余额获得rstETH、rrETH或rcbETH,随着奖励的累积,用户的余额会自动调整;

KelpDAO:与Renzo和Rio的模型类似;

Ether.Fi:允许用户只将ETH存入资金池,以换取平台的LRT eETH。

未来空间可能如何演变?

在这个空间中,想成为真正的赢家,要从建立最高信任开始。LRTs也将遵循与 LST 相同的正向反馈循环。风险管理是吸引再质押者、流动性提供者和合作伙伴的最重要因素。

在未来的某个时候(时间线未确定),收益可能会比ETH的收益略微更高,但这将取决于底层 AVS 的经济模型的设计和使用情况。AVS 的使用,或将成为用户在以太坊上获得的最低风险收益的选择,这是以太坊的共识奖励和 AVS 收益率的结合。

Mantle 最近从 BitDAO 的资金中质押了 40,000 ETH 给 Lido,在可预见的将来,这意味着他们将获得大量的 stETH,可能会在 Mantle 上列出,且一部分也会再质押在 EigenLayer 上(在 LST 的供应上限提高时)。例如,如果Mantle 选择使用 EigenDA 作为 DA 层,在这种情况下,他们将极大的偏向选择最低风险的策略,因为这些 AVS 在保护资金库的同时,也支持 Mantle 的整体策略和目标。

Mantle 还可以鼓励使用他们平台的 LST: mntETH,并建立与之匹配的 LRT(流动性再质押代币)。这将有助于 Mantle 有效利用其资金,同时帮助确保他们承诺的 DA 层的安全。赚取的费用可以作为 Gas 回馈给他们的用户。

由于竞争环境,幂律会发挥一定的作用(市场的竞争格局倾向于"赢家通吃"的模式),前1-2个协议最终可能会控制市场的 80-90%。我认为,只有那些完全专注于开发这个市场的协议才有望跑出来,因为这个市场需要高度集中的投入。还有可能一些大型 LST 协议可能会像 Swell 那样向供应链上游整合,但目前还没有更多迹象。

LRT 协议在市场第一天就可用也是非常关键的。零售市场最大的信任来自于 TVL(总锁仓价值)。在 EigenLayer 启动的第一天或第二天就能吸引到良好 TVL 的项目,可能会成为可预见未来的领导者。

总会有人追求高收益,尤其是高风险投资者。随着LRT协议的更广泛采用,将有更多的 DeFi 整合,许多策略将呈指数级解锁,或将创造一个积极的飞轮效应。

我们认为随着时间的推移,所有运营商都将选择使用更相似的策略,并获得最低的收益。这将主要取决于底层 AVS 及其经济模型的新旧设计。为了避免太多的 LST 大鲸鱼和流动质押协议控制 EigenLayer,协议层面存在控制。如果再质押收益越来越不具风险,流动质押协议将成为以太坊生态系统中的权力中心。这可以通过早期采用 Jon Charbonneau 概念中的“治理证明”的版本来缓解。

About a year ago, the author started a new journey to help the new paradigm of network security understanding. The concept of re-pledge came into being. In a word, verifiers can now protect the security of multiple networks, including layers, basic layers, computing networks, and middleware such as shared sequencers. Essentially, any network needs some form of consensus and does not need start-up funds to ensure security. These networks are called active authentication services in the world. If no one wants to become a certain department, Generally, all operators need to invest in related hardware and initial pledge, which makes the projects that need a set of verifiers have to issue tokens at a very high and sometimes unreasonable valuation in order to obtain high inflation rewards, which may lead to large-scale speculative selling, which is very unfavorable to the verifier operators. Although there is a risk of leverage lightening of a single operator, there will always be verifiers with good performance who want to gain some additional benefits by creating or using similar and equal mobile pledge tokens. The local re-pledge of Ethereum ensures the security of the network. Anyone who owns it is actually a contributor to the security and decentralization of Ethereum, and gets rewards from the Ethereum network. The further pledge of the mobile pledge token provides security for the network in exchange for income, so the re-pledge person will be entitled to the network reward and deduct the operator's fee. Since the pledge and re-pledge are beneficial, why is it mobile? If you believe in the mobile pledge of Ethereum, then you will also recognize the mobile. The mobile pledge of re-pledging Ethereum actually involves two parties and retail participants. Retail participants may say that I don't have enough hardware or even time to operate a verifier, but they want to make my income higher. The pledge company will say that I can help you collect part of the return as operating expenses and conduct it in a completely transparent way, which eliminates the five expenses of the public: hardware cost, hardware maintenance time, energy and thinking space. For me, there are additional commissions besides the above-mentioned related expenses. The cost of each node operated by operators in Ethereum is replaceable, that is, the network regards each node as the same, whether it is running in the infrastructure cloud or other places. For a network to protect other networks, each operator can choose which other networks he wants to verify, which basically means that there are no identical two operators, so experienced teams or associations wisely choose operators with good strategies to solve the problem of retail participants' hesitation. Worrying about the current part has the opportunity to get higher income than any pledge agreement on the Ethereum all year round. How to start the income flywheel again? If you only pay attention to the income, there are about one way to get higher income. The real value lies in the almost risk-free rate of return, which means the earning method with the least risk. The less the risk, the greater the possibility of being included in other agreements, the stronger the combination, and the greater the demand. All this starts with trust, that is, the lowest risk for me. Evaluation is not so difficult. You have risks based on operators, operators closing verifiers, operators quality, hardware quality, and network-based risks. The consensus mechanism of all risks is the same, and the minimum hardware requirements for all operators are the same. There are more factors to consider in the re-pledge, including whether the hardware requirements need to be expanded, the actual combat test of the new consensus mechanism of security audit, the economic model of itself and the types of supporters, investors and partners obtained. Small factors, such as the types of supporters, investors, partners, etc., have a possible strategy just running on the internet. We can't expect retail investors to make educational decisions. Retail participants will not do so. If they simply imitate any operator's strategy and are lightened, it will lead to loss of trust, thus affecting the liquidity of the network. If operators launch their own, it will lead to excessive fragmentation or excessive pledge concentration in the initial stage, even if multiple operators use the same strategy. However, different re-pledged tokens will also lead to unnecessary fragmentation. The success of a common pair with a unified strategy and decentralized operators is very important, which ensures that the positive feedback cycle with the lowest risk can be regarded as the best risk management. More liquidity is whitelisted at most, used at most, and most popular. The reason why the lowest risk is the lowest risk is because the risk of being lightened from one verifier is much smaller than that of being lost from another, which is why people still do it. However, the selection and pledge has recently experienced a lightening event, in which there are multiple verifiers, and each lightening event totals about. Although their infrastructure partners have already borne the losses, this is very insignificant compared with the million pledges, which shows the importance of having reliable partners. How does the mobile re-pledge work? Let's talk about how to open the income flywheel. Users will send their money to the fund pool contract of the mobile re-pledge platform, and the re-pledge will get the equivalent value. Liquidity re-pledges tokens, and then the contract allocates these to the strategy management contract in the agreement. The strategy management contract entrusts these to the node operators and ensures that the node operators adhere to the governance of the strategy. You can choose a specific strategy operator to verify that the bottom layer reserves a part of the rewards and then transfer it to the agreement. The agreement will extract a part and eventually allocate the rest to the re-pledger, which is obviously more extractive than the liquidity pledge tokens, but the workload and maintenance will consume more resources. How attractive is the rate of return? People, we don't know how the incentive of active verification service will be distributed, and we don't know how each consensus mechanism will work, but based on some basic written mathematical calculations, the following are several possible scenarios that are of reference value for calculating the rate of return. Considering the completely diluted valuation, refer to the last known data of the project, and those project tokens may start at a higher valuation, making the rate of return significantly more attractive. Conservative estimation, we assume that the values of all partners announced on the ecosystem page are The valuation of their last round of fund-raising is about the basic rate of return, which is about 10 thousand dollars according to our calculation. Both of them are affected by price and emissions, which is a conservative figure, that is, the supply of tokens and the enhanced income which is roughly equivalent to the average may total up to a higher income in a more radical scenario. Of course, these are based on assumptions. If we discuss the in-depth calculation method, we can believe that a lending agreement can be used to accept all sums with a platform dedicated to liquidity re-pledge of lending assets in exchange for their acceptance by a platform dedicated to liquidity re-pledge. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。