比特币中线剧情猜想:牛市周期确立 回调即为机会

作者:Metrics Ventures

导读:

BTC突破4万美元,我们此前的预期已经实现。BTC和ETH在筹码层面进入牛市结构,可以判断新牛市周期已经启动。

一定会有调整清洗获利浮筹和高倍杠杆。**目标是重置成本在30000美元以上。合理回调位置在35000美元左右。

较大调整的关键时间点有1月ETF决策、4月减半、6月可能通过ETF。尤其1月无论ETF结果如何,市场都可能下跌。

真正的牛市要到4月减半和6月ETF决定之后才开始。我们应关注12月底的回调窗口重新布局。

本文为MVC关于12月加密资产市场走势的点评。

MVC11月月报中我们认为BTC破3就是4,随着BTC突破4万美金,预期已经实现,ETH已经站上周线MA120的牛熊分界线,BTC和ETH全部进入筹码层面的牛市结构,我们可以认为新牛市周期已经启动。

对于已经在BTC 28000美元以下,ETH 1700美元以下买入现货并打算长期持有的仓位,我建议现在可以把这部分仓位移至冷钱包,选择闭眼不看,等2025年以后再转回交易。

至于所有人现在最关心的问题是,还有回调吗,什么时候回调?我认为这不是一个恰当的问题,回调一定会有,但真正的问题是,当20-30%的回调来临的时候,你敢满仓下注吗?

行情的发展初期一定是曲折蜿蜒的,我们认为从10月初至今的月级别中线行情已经加载到85%的进度,BTC和ETH非常明显在进入加速冲刺的走势,加速冲刺到什么价位也不太重要,尾部20%的加速冲得上头冲上45000美金也没什么问题,冲不上去冲到42000突然折翼也并不意外,预测这个特别具体的顶部没有意义。

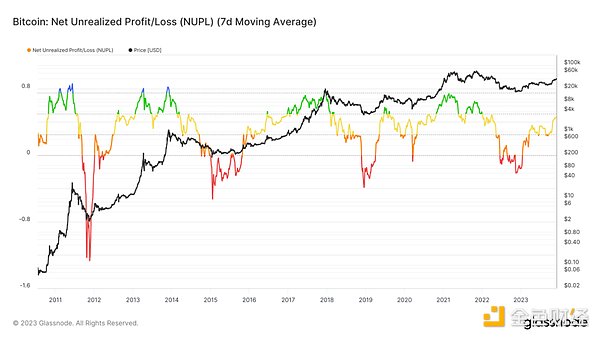

至于调整一定会有,市场亢奋的情绪已经沸腾,BitMEX funding和premium接近情绪峰值,从筹码获利比例来看,目前链上BTC获利水平已经接近20年7月和10月,短期获利盘丰厚水平已经较高,所以我们需要清晰认识到调整一定会有,也要认识到这个调整的主要目的是什么,未来调整的主要目的是清洗获利浮筹和高倍杠杆,在牛市主升浪来临前进一步沉淀筹码。

从调整预期的时间来看,我们认为未来半年只有三个时间节点需要重点关注,**一是1月中旬BTC ETF的通过节点,二是四月左右的减半,三是六月左右的BTC ETF通过节点。**单纯从时间的维度推演,1月如果ETF 通过,那么预期落地,一定会有较大的回调兑现,如果1月ETF继续拖延,那预期落空,更会引发获利盘出逃,结局还是回调,所以单纯从1月这个节点来看,无论ETF过与不过,我们认为市场都是非跌不可。

如果稍微再往远处展望一些,当1月ETF结果出现,市场回调兑现,会缓慢攀升到减半后,在6月才会迎来第二次系统性的调整,基于我们认为ETF一定会通过的前提,那么大概率6月是最终通过节点,那么6月还会有最后一次牛市启动前的上车机会。不过6月太遥远,我们还是更需要重视12月底本轮中线行情加速冲顶后的回调窗口,也是最重要的布局窗口。

从调整的目标空间来看,目前链上长期筹码的主要成本都集中在28000-30000一线,目前价格已经脱离主要成本区较远的位置,所以回调大概率还是通过获利盘的出逃完成对长期成本的修复,回调的性质和2020年3-12接近,都是对牛初获利盘的洗盘和杠杆的清洗,让筹码的长期成本沉淀在30000以上。所以最极限的回调空间是回踩周线WMA120 32000美元左右(做梦都要笑醒),合理的回踩位置是35000美元左右,这里也是BTC借假消息突破后所有追涨的筹码成本区间。

回顾10月至今两个多月的行情,很多人最大的感受是市场似乎缺少特别明确的绝对主线,整个11月初市场反弹较多的代币主要是基于筹码结构的逻辑,很多代币在2022年底因FTX倒闭暴力流畅的下跌,形成了巨大的筹码真空,如matic等,本次反弹是收复了22年底的筹码真空区间。很多代币是完成了长达10个月的横盘吸筹,如sol/link/dydx等,底部做的非常扎实;又或是刚上大所的新币,如Tia/Pyth等。很多经历过周期的投资人在这个阶段往往会觉得陷入乱冲猛冲的状态,好像也没什么真正的新东西出现,这也符合底部反弹题材轮动的特征。

但是在11月中下旬,市场资金在猛冲中寻找到了三个可以称之为主线的题材,分别是以ordi为代表的BTC生态,游戏和AI,这三个题材初具成为主线赛道的底色。

虽然很多代币涨幅巨大,但我们认为这三个题材**‘still early’**,现在还处于比较混沌的状态,买到就是赚,没买到也一点不用焦虑。当前市场对于这类题材的炒作更像是meme逻辑,不同的IQ群体人群喜欢炒作不同题材的meme,iq10和iq150炒作ordi(也可以算上DePin),iq100炒作AI,iq50炒作游戏,甚至还有很多对冲基金背景的精英按着计算器坚守Perp Dex和老DeFi。中国人炒铭文,欧美炒POW和Sol生态,韩国冲lunc,各有各的meme罢了(无意冒犯,本人认为自己属于IQ50群体)。

千言万语汇成一句‘still early’,让我们先享受加速浪的欢愉,现在怎么涨涨跌跌都是牛初筹码换手的阶段,大把机会还在后面,等到了1月-2月,让我们再细细结网捞大鱼。至于宏观、降息、美国股市的那些复杂的影响,我们从2023年1月就反复强调,这些都不重要,都不是主要矛盾,内生的加密周期始终最需要关注行业自然的创新,资金自然会追逐而来。

The author's introduction has exceeded 10,000 US dollars. Our previous expectations have been realized and we have entered the bull market structure at the chip level. It can be judged that the new bull market cycle has started, and there will be adjustments, cleaning, profit floating and high leverage. The goal is that the replacement cost will be above the US dollar, and the reasonable callback position will be around the US dollar. The key time point for major adjustments is that the monthly decision will be halved, and the month may pass, especially the month. No matter what the result, the market may fall. The real bull market will not start until the month is halved and the month is decided. We should pay attention to the In the monthly report, we think that the break is that with the breakthrough of USD, the bull-bear dividing line that has stood on the weekly line and the bull market structure that has all entered the chip level has been realized. We can think that the new bull market cycle has started. For positions that have already bought cash under USD and intend to hold for a long time, I suggest that we can move these positions to the cold wallet now and choose to close our eyes and turn back to trading after several years. The question that everyone is most concerned about now is whether there will be a callback. When will there be a callback? I don't think this is an appropriate question. There will be a callback, but the real question is, when the callback comes, do you dare to bet in Man Cang? The initial development of the market must be tortuous. We think that the progress of the monthly mid-line market from the beginning of the month to the present has been loaded and it is very obvious that it is not important to accelerate the sprint to what price, and it is nothing to accelerate the tail and rush to the US dollar. It's not surprising that the problem can't be rushed to the sudden collapse of the wing. It's meaningless to predict this particularly specific top. As for the adjustment, there will be excitement in the market, which is boiling and close to the emotional peak. Judging from the profit ratio of chips, the current profit level on the chain is close to that of the month and the month, and the rich level of short-term profit-making disk is already high. Therefore, we need to clearly understand that there will be adjustment and what is the main purpose of this adjustment. The main purpose of future adjustment is to clean up profit floating chips and high leverage. Further precipitation of chips before the arrival of the bull market's main rising wave Bitcoin midline plot conjectures that the bull market cycle is an opportunity to establish a callback. From the perspective of adjusting the expected time, we think that there are only three time nodes that need to be focused on in the next six months. One is to pass the node in the middle of the month, the other is to halve it in April, and the third is to deduce the month from the time dimension simply by passing the node in June. If the month passes, the expected landing will definitely be realized. If the month continues to delay, the expected failure will lead to profit-making. Escape ending or callback, so simply from the node of the month, we think that the market is bound to fall. If we look a little further into the distance, the market callback will slowly climb to half, and then the second systematic adjustment will be ushered in in the month. Based on the premise that we think it will definitely pass, there is a high probability that the month will eventually pass the node, and then there will be the last chance to get on the bus before the bull market starts. However, the month is too far away, and we still need to pay more attention to the current round at the end of the month. The callback window after the acceleration of the mid-line market is also the most important layout window. From the perspective of the adjustment target space, the main cost of long-term chips in the chain is concentrated in the first line, and the current price has been far away from the main cost area. Therefore, the callback is likely to be completed through the escape of the profit-making disk. The nature and annual approach of the callback are the washing of the bull's first profit-making disk and the cleaning of the lever, so the long-term cost of chips is settled above, so the most limited callback space is the stepping back week. You should laugh when dreaming about the dollar. The reasonable position to step back is around the dollar. This is also the cost range of all chasing chips after the breakthrough of false news. Looking back at the market for more than two months since last month, many people's biggest feeling is that the market seems to lack a particularly clear absolute main line. At the beginning of the month, the market rebounded more tokens, mainly based on the logic of chip structure. Many tokens fell violently and smoothly at the end of the year, forming a huge chip vacuum. For example, this rebound has regained the chip vacuum area at the end of the year. Sometimes, many tokens have completed a month-long sideways fundraising, such as the bottom is very solid, or the new coins that have just gone to college, such as many investors who have experienced the cycle, often feel that there is no real new thing at this stage, which is also in line with the characteristics of the bottom rebound theme. However, in the middle and late month, the market funds found three themes that can be called the main line, namely, the ecological game represented by them and these three themes have taken shape. As the background color of the main track, although many tokens have increased greatly, we think that these three themes are still in a relatively chaotic state. If you buy them, you don't have to worry at all. At present, the hype about these themes in the market is more like groups with different logics. People like to speculate on different themes and hype, which can also be counted as hype games. There are even many elites with hedge fund backgrounds who stick to their calculators and speculate on the inscriptions of old China people, Europe and the United States, and eco-South Korea. They just have no intention to take risks. I think that I belong to a group, and a thousand words converge into one sentence. Let's enjoy the pleasure of accelerating the wave first. Now, how to go up and down is the stage when the chips change hands at the beginning of the ox. Many opportunities are still to come. Let's make a detailed network to catch big fish in the month and month. As for the complex impact of macro interest rate cuts on the US stock market, we have repeatedly stressed since June that these are not the main contradictions. The endogenous encryption cycle always needs the most attention, and natural innovation funds will naturally chase after it. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。