PSE Trading宏观时评:比特币现货 ETF 的到来已势不可挡

作者:PSE Trading Intern @JohnHol

在近几年 SEC 拒绝多项比特币现货 ETF 申请后,今年 8 月 SEC 与灰度就 GBTC 转换为比特币现货 ETF 被拒一案败诉。同时,全球最大资产管理机构贝莱德与另外几家机构同时向 SEC 提交了比特币现货 ETF 的申请。比特币现货 ETF 正在势不可挡地来临。

什么是比特币现货 ETF

加密资产交易所交易基金 (ETF) 是指通过投资加密资产或相关工具来追踪一种或多种加密资产价格的交易所交易基金。目前被广泛讨论的比特币 ETF 就是一种追踪比特币价格的 ETF,其中主要包括比特币期货 ETF 与比特币现货 ETF。其主要区别在于,投资者购买的比特币期货 ETF 份额对应的标的资产是比特币期货合约,而比特币现货 ETF 份额对应的标的资产是比特币。

ETF 与普通的公共基金相比最大的特点是它可以像交易股票一样在传统证券交易所交易基金份额,这意味着如果比特币现货 ETF 通过,那么投资者无需经过复杂的流程——例如下载钱包插件、创建公私钥对或是通过中心化交易所交易——而是直接购买 ETF 份额,就能直接享受比特币的收益率。这些流程对于熟悉的人来说是没有难度的,但对于完全不了解加密资产的投资者来说仍然存在门槛,而比特币现货 ETF 则降低了这个门槛,并给了这些投资者,尤其是机构投资者熟悉的金融工具,以及有法律保护的安全感。

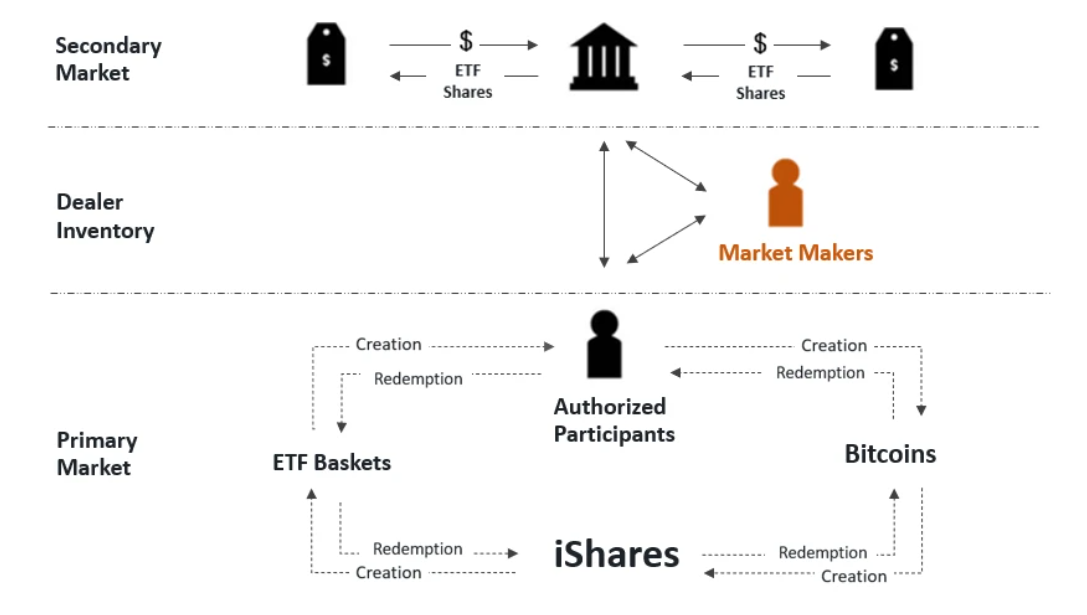

比特币 ETF 如何运作,以比特币现货 ETF 为例,首先发行机构会购买比特币资产,或通过向比特币持有者直接购买,或通过中心化交易所。这些资产存放在有着多重防护措施的比特币钱包里,例如冷钱包。其次,发行机构创造基金份额,这些份额的价值紧紧跟随比特币的价格波动。在这个过程中,授权参与者 (Authorized Participants) 负责基金份额的创建与赎回,它们通常是大型金融机构,往往也充当着二级市场做市商。投资者可以在传统证券交易所买入或卖出基金份额,就像交易股票一样。此外,授权交易者还需要在基金份额存在溢价或折价时套利价差,以确保基金份额价格与比特币成本的一致。

第一个比特币 ETF 是 ProShares Bitcoin Strategy ETF(BITO),一个比特币期货 ETF,于 2021 年 10 月在芝加哥商品交易所交易。然而,目前 SEC 还没有通过任何比特币现货 ETF。

首个以比特币为标的创建份额的金融工具是灰度比特币信托基金 (Grayscale Bitcoin Trust , GBTC),于 2013 年首次亮相,并于 2015 年正式公开交易,2020 年 1 月 GBTC 经 SEC 批准注册通过,成为首个符合 SEC 标准的加密资产投资工具。然而 GBTC 不是一种交易所交易基金,而是一种封闭式基金,通过场外交易所交易。虽然 GBTC 基金份额可以让投资者在不直接持有比特币的情况下获得比特币的收益,但是 GBTC 作为一种封闭式基金,其基金份额的价格取决于二级市场的供需关系,而不与基金持仓比特币对应。因此 GBTC 份额价值往往与持仓比特币价值存在价差。

GBTC 一直在积极地与 SEC 沟通,希望能转换为比特币现货 ETF,但一直没有通过。直到 2023 年 8 月事情迎来转机,华盛顿特区巡回上诉法院裁定 SEC 拒绝 GBTC 转换为 ETF 的申请是错误的,SEC 需重新审查该申请,而 SEC 并未对此裁定提起上诉。这样的裁定并不意味着 SEC 必须批准 GBTC 的申请,但向市场传达了极其正面的消息。

SEC 的审批流程

简单来说,一家机构向 SEC 提交 ETF 申请的相关材料,SEC 确认后在联邦公报上发布 19b-4 文件,此后 SEC 会进入一个为期 240 天的审批流程,并在第 45 天、第 90 天、第 180 天或第 240 天公开回复申请结果或是宣布推迟到下个日期公布。

SEC 长期以来一直对加密货币市场缺乏监管表示担忧,这也是其拒绝加密资产 ETF 申请的主要原因。在以往的拒绝理由中,SEC 坚持认为由于加密货币市场缺乏监管和监督,缺乏必要的信息透明,资产安全性难以保证等因素,导致「对潜在欺诈和操纵行为的担忧」,并强调市场需要充分的信息共享与监督。

在 SEC 败诉灰度后,法院裁决结果使得 SEC 不得再使用「潜在欺诈与操纵行为」作为理由拒绝比特币现货 ETF 的通过,但 SEC 依然可能找到其他理由来拒绝比特币现货 ETF 的通过。

比特币现货 ETF 的申请现状

除了一直在申请的灰度以外,2023 年有多家机构向 SEC 申请了比特币现货 ETF。例如贝莱德 (BlackRock) 申请的 iShares Bitcoin Trust、Fidelity 申请的 Wise Origin Bitcoin Trust、Ark Invest 申请的 ARK 21Shares Bitcoin ETF 等等。值得注意的是,这些机构大多数不是第一次向 SEC 申请,它们在与 SEC 数年的博弈后,在今年几乎同一时间再次向 SEC 提交了比特币现货 ETF 申请,而这其中包括第一次申请的贝莱德。贝莱德以发行指数追踪基金闻名,其王牌产品 iShares 在美国 ETF 市场有近五成的市占率,它申请 ETF 的成功率接近 100%。这也是市场认为明年比特币现货 ETF 会通过的一个重要因素。

并且,以贝莱德为代表的这些机构充分调整了自己的策略,为了减轻 SEC 的担忧,贝莱德等机构提出了监督共享协议 (Surveillance-Sharing Agreements),这是一种减轻市场操纵和欺诈风险的方法。监督共享协议是加密货币交易所与市场监管机构之间的协议,该协议允许双方共享交易数据和信息对交易进行监控。如果出现可疑的交易数据或信息,这些信息会被同时推送给监管机构、ETF 发行商和加密货币交易所。贝莱德与 Ark Invest 都选择了 Coinbase Custody Trust Company 作为自己的比特币托管人,以及纽约梅隆银行作为自己的现金托管人。

从以往情况来看,SEC 对比特币现货 ETF 的审批通常不会提前批准,都是选择在最终审批日期公布结果,目前离最终审批日期最近的是 Ark Invest 申请的 ARK 21Shares Bitcoin ETF,将于 2024 年 1 月 10 日给出结果,贝莱德与其余几家机构的最终审批日期在 2024 年 3 月 15 日。据路透社援引消息人士透露,SEC 与申请比特币现货 ETF 的资产管理机构之间的讨论已经深入到关键技术细节,包括监管安排、申购和赎回机制。这表明 SEC 可能很快就会批准这些产品。我们可能最早在明年 1 月 10 日就能看到比特币现货 ETF 通过。

比特币现货 ETF 的市场影响

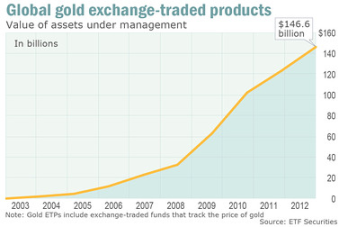

以黄金现货 ETF 为鉴,2003 年 3 月 28 日,第一个黄金现货 ETF,ETFS Physical Gold 于澳大利亚获批通过,之后于 2004 年 11 月 18 日,全球最大的黄金现货 ETF,SPDR Gold Trust 于美国获批通过。这对全球黄金市场有着巨大的影响力。在此后十年间,黄金价格从 332 美元 / 盎司升至 1600 美元 / 盎司。

在黄金现货 ETF 推出前,投资者难以直接投资黄金,投资者往往只能通过购买金条获得对黄金的敞口,但是这样的低流动性与效率让很多投资者望而却步。黄金现货 ETF 的通过让投资者可以不持有黄金也能获得对黄金的敞口,并且可以像交易股票一样轻松交易。通过黄金现货 ETF,众多资产管理机构将黄金纳入资产组合,这为黄金市场注入巨量流动性,造就了黄金价格在此后十年的快速攀升。

从某种意义上讲,被称为数字黄金的比特币与黄金有诸多相似之处,比特币被主流金融市场视为具有对冲属性、避险属性与多元化熟悉的资产,因此即便考虑其波动性也有大量资产管理机构愿意将比特币纳入资产组合中。但是受限于合规性和审批流程的限制,主流资产管理机构不能直接持有比特币。市场迫切需要的就是一种合规的金融工具帮助投资者克服这些困难,这也是比特币现货 ETF 一直被推动的本质原因。

比特币现货 ETF 将会成为连接规模约 50 万亿美元的主流资产管理机构与市值不足 1 万亿美元的比特币的最大桥梁,它将为比特币注入万亿级别的流动性。比特币现货 ETF 存在以下潜在的市场影响:

增加对比特币的直接投资:比特币现货 ETF 会吸引金融市场的主流投资者。一直以来比特币受到高昂学习成本与缺乏金融工具的限制,使得主流资产管理行业缺乏有效的投资渠道投资比特币,这类机构投资者由于合规性和审批流程的限制,无法为客户提供直接投资比特币或其他加密货币的服务。比特币现货 ETF 的到来使得主流投资者,尤其是机构投资者有了熟悉的金融工具可以获得对比特币的敞口。

提升比特币的法律认同:比特币现货 ETF 将进一步提升比特币在主流金融体系的地位。传统资产管理机构往往出于法律方面的因素,不能直接持有比特币或是从中心化交易所买入。比特币现货 ETF 可以解决这一问题,因为通过比特币现货 ETF,资产管理机构将可以为投资者提供受到法律保护的资产。这可以促进主流市场对比特币的法律认同并增强主流市场对比特币的信心。

扩充资产管理机构资产组合:比特币现货 ETF 会为资产管理机构提供更多元化的资产组合。相较于已有比特币期货 ETF 与信托机构所提供的金融工具,比特币现货 ETF 一方面能提供对比特币直接的敞口,另一方面能减少份额价值与储备比特币的价差。这对于希望参与比特币市场的资产管理机构来说是一种更好的金融工具。

展望比特币的未来

历经十余年的发展,比特币在主流金融市场的认可度不断提升。在投资者与资产机构的不断推动下,监管机构尽管不情愿,但依旧需要在法律层面上承认像比特币这样加密资产的价值,从而为主流资产管理机构打开通往比特币的大门。

比特币现货 ETF 的通过仅仅是主流金融市场进入加密市场的开端,自今年以来全球监管部门正在积极建立对加密市场的监管框架,需要注意的是监管部门的行动并不会影响加密资产的抗审查性,这是由密码学与加密资产的去中心化程度决定的。反而监管部门的行动能为投资者剔除加密市场中伪装在技术外表下的骗局,并为主流金融机构进入加密市场扫清障碍,建立规范。

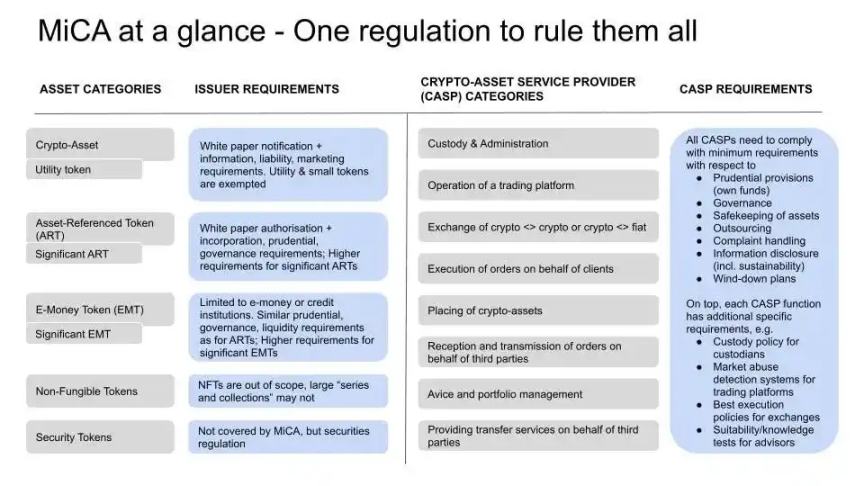

欧盟今年在建立加密行业监管框架上有了长足进展,欧盟委员会自 2018 年起就在着手建立加密行业的监管框架,并于今年 4 月 20 日投票通过了 MICA(Markets in Crypto-Assets Regulation),目前全球范围内最全面的加密行业监管框架。欧盟希望趁美国加密市场监管真空期间建立完善的监管框架,为大型科技公司与资产管理机构进入加密市场创建法律确定性,从而在全球范围内监管加密货币方面发挥主导作用。

相较于比特币现货 ETF 旨在创造一种投资比特币的金融工具,MICA 更为宏大,它的目标是为所有机构直接投资或参与加密市场铺平道路。

市场普遍预期随着面比特币现货 ETF 的落地与比特币减半,再加上美联储加息周期的结束,比特币市值将迎来前所未有的涨幅。但从长远的目光来看这或许仅仅是个开始,比特币现货 ETF 的通过无疑会是比特币乃至于世界金融史上的重大转折点,在将来我们会看到全球范围内的监管框架不断落地,比特币将与主流金融市场深度融合,成为所有人共识的数字黄金。

参考链接

https://www.investopedia.com/spot-bitcoin-etfs-8358373

https://www.msn.com/en-us/money/savingandinvesting/bitcoin-jumps-amid-new-wave-of-bullishness-on-crypto-etf-approvals/ar-AA1ihqin

https://www.washingtonpost.com/business/2023/10/17/spot-bitcoin-etf-what-to-know-about-grayscale-blackrock-ishares-funds/12ca3ba0-6d17-11ee-b01a-f593caa04363_story.html

https://cn.tokeninsight.com/zh/tokenwiki/all/bitcoin-spot-etf-when-will-be-the-approval-date

https://www.odaily.news/post/5190473

https://www.odaily.news/post/5190823

After rejecting several applications for bitcoin spot in recent years, the author lost the case that the gray scale was converted into bitcoin spot in this month. At the same time, BlackRock, the world's largest asset management institution, and several other institutions submitted applications for bitcoin spot at the same time. Bitcoin spot is coming inexorably. What is bitcoin spot encrypted assets? Exchange traded funds refer to exchange traded funds that track the prices of one or more encrypted assets by investing in encrypted assets or related tools. At present, they are widely discussed. Bitcoin is a kind of tracking bitcoin price, which mainly includes bitcoin futures and bitcoin spot. The main difference is that the underlying asset corresponding to the bitcoin futures share purchased by investors is bitcoin futures contract, while the underlying asset corresponding to the bitcoin spot share is bitcoin. Compared with ordinary public funds, the biggest feature is that it can trade fund shares on traditional stock exchanges like stocks, which means that if bitcoin spot passes, investors do not need to go through the complex. Miscellaneous processes, such as downloading wallet plug-ins to create public and private key pairs, or trading through centralized exchanges, can directly enjoy the yield of bitcoin by purchasing shares. These processes are not difficult for familiar people, but there is still a threshold for investors who don't know encrypted assets at all, while bitcoin spot lowers this threshold and gives these investors, especially institutional investors, a familiar financial tool and a sense of security with legal protection. Take the spot currency as an example. First, issuers will buy bitcoin assets, either directly from bitcoin holders or through centralized exchanges. These assets are stored in bitcoin wallets with multiple protective measures, such as cold wallets. Second, issuers will create fund shares, and the value of these shares will closely follow the price fluctuation of bitcoin. In this process, participants are authorized to be responsible for the creation and redemption of fund shares. They are usually large financial institutions and often act as market makers in the secondary market. In order to buy or sell fund shares on traditional stock exchanges, it is just like trading stocks. In addition, authorized traders need to arbitrage the price difference when there is a premium or discount of fund shares to ensure the consistency between the price of fund shares and the cost of bitcoin. The arrival of bitcoin spot is unstoppable. The first bitcoin is a bitcoin futures traded on the Chicago Mercantile Exchange in June, but it has not yet passed any bitcoin spot. The first financial instrument to create shares with bitcoin as the target is Gray Bitcoin Trust Fund made its debut in 2008 and was officially publicly traded in 2008. It was approved and registered as the first standard investment tool for encrypted assets. However, it is not an exchange-traded fund, but a closed-end fund. Although the fund share allows investors to obtain the benefits of Bitcoin without directly holding it, as a closed-end fund, the price of its fund share depends on the supply and demand relationship in the secondary market rather than holding it with the fund. As a result, there is often a price difference between the share value and the position bitcoin value. We have been actively communicating with each other, hoping to convert it into bitcoin spot, but it has not been passed until June, when things turned around. The Washington DC Circuit Court of Appeals ruled that it was wrong to refuse to convert the application into bitcoin, and it was necessary to re-examine the application without appealing to this ruling. This ruling does not mean that the application must be approved, but the approval process conveyed extremely positive news to the market. Simply speaking, an institution. After confirming the relevant materials submitted to the application, the document will be published in the Federal Gazette, and then it will enter a one-day examination and approval process, and the application result will be publicly replied on day, day or day, or the announcement will be postponed to the next day. For a long time, it has expressed concern about the lack of supervision in the cryptocurrency market, which is also the main reason for its rejection of the cryptocurrency asset application. In the previous reasons for rejection, it was insisted that due to the lack of supervision and supervision in the cryptocurrency market, it was difficult to ensure the transparency of assets. Factors such as assurance lead to concerns about potential fraud and manipulation, and emphasize that the market needs sufficient information sharing and supervision. After losing the case, the court ruled that the potential fraud and manipulation could not be used as an excuse to refuse the passage of bitcoin spot, but it is still possible to find other reasons to refuse the application of bitcoin spot. In addition to the gray level that has been applied for, many institutions applied for the application of bitcoin spot, such as BlackRock, in. Please wait. It is worth noting that most of these institutions are not applying for the first time. After several years of games, they submitted their applications for bitcoin spot again at almost the same time this year. Among them, BlackRock, which applied for the first time, is famous for issuing index tracking funds. Its ace product has a market share of nearly 50% in the US market, and its application success rate is close. This is also an important factor for the market to think that bitcoin spot will pass next year. Irresistible and represented by BlackRock, these institutions have fully adjusted their strategies. In order to alleviate their concerns, BlackRock and other institutions have put forward a supervision sharing agreement, which is a way to reduce the risk of market manipulation and fraud. The supervision sharing agreement is an agreement between cryptocurrency exchanges and market regulators, which allows both parties to share transaction data and information to monitor transactions. If suspicious transaction data or information appear, these information will be pushed to the regulators, issuers and encryption at the same time. BlackRock and DuDu, the currency exchange, have chosen as their own bitcoin custodians and Bank of New York Mellon as their own cash custodians. From the past, the approval of bitcoin spot is usually not approved in advance, and they all choose to announce the results on the final approval date. At present, the one closest to the final approval date is the application, and the final approval date of BlackRock and several other institutions is on the date of Reuters, citing sources and applying for asset management of bitcoin spot. The discussion between the institutions has gone deep into the key technical details, including the regulatory arrangements, subscription and redemption mechanism, which indicates that these products may be approved soon. We may see the market impact of bitcoin spot as early as next year, taking the gold spot as a mirror. After the first gold spot was approved in Australia on June, the world's largest gold spot was approved in the United States on June, which has a great influence on the global gold market. In the next ten years, the price of gold rose from US$ ounce to US$ ounce. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。