Web3投资周报:我的币什么时候暴涨?

作者:何太极投研

本周BTC终于彻底突破了38000美元的阻力位,并在几天内直冲44000美元,市场主导率也创了年内新高,超过55%,目前回落至53.47%。至此,比特币市值已经超过特斯拉、Meta,成为全球市值第9大的资产,距离超越黄金还有8级台阶,我相信它终有一天会登顶。我一直在周报里说,牛市来了,这回是真的来了!不容置疑!

BTC日线

正如以往的周期规律那样,牛市通常始于比特币的大幅上涨。这是资金流入加密市场的第一阶段,现货ETF的预期和传言促使每个投机者都试图进入加密市场,推高BTC的价格和主导地位。我们现在正处在这一阶段。

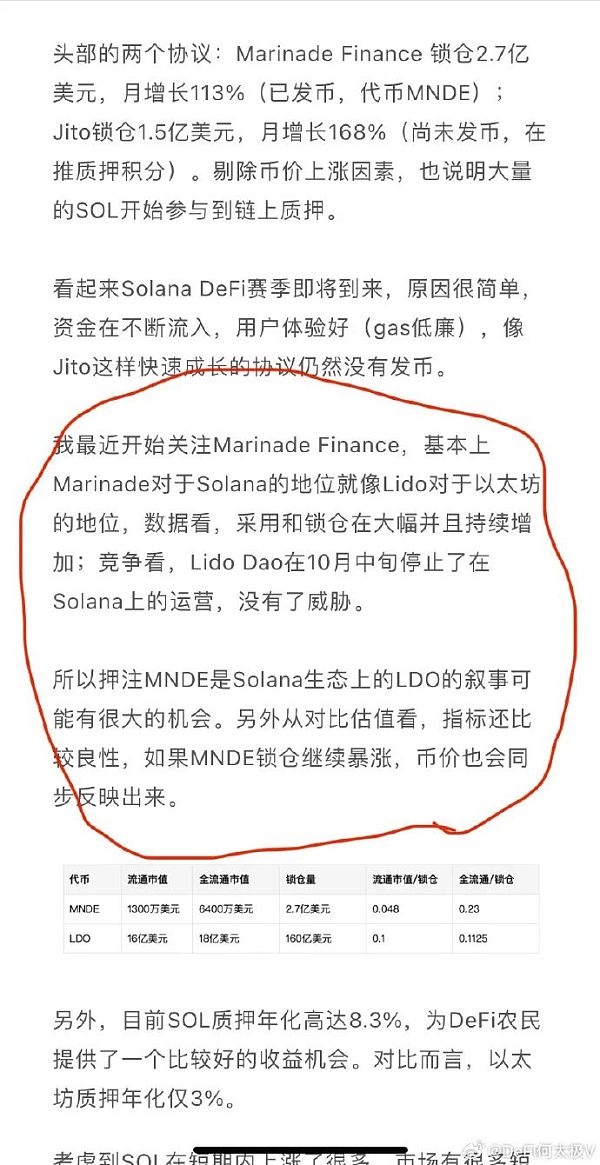

在BTC暴涨之后,大家会开始觉得BTC已经没有多少回报潜力了。获利者也想将部分BTC挪仓到回报更高的项目。之后资金会流入ETH,使其超过BTC的表现。这是第二阶段。接着资金会流入大盘股代币,使它们呈现抛物线走势。这是第三阶段。最后资金会流入中小型代币和其他垃圾币。这是第四阶段。当市场过热时,一些人会开始撤出,加密货币价格进入下行螺旋。这是理解加密货币资金流动的一个简化模型,并不严格,不要较真,心里有个谱就行。每个阶段可能会有重叠或暂时反转,关键是要领先资金流动的总体方向。

推特上有人对这个模型整理了一个图,比较清晰,供参考。

本周的主导叙事还是比特币铭文和Solana空投季。ORDI持续暴涨,成为第一个市值过10亿美元的BRC20代币。Solana生态质押协议Jito向质押用户空投了9000万枚代币,按目前3.8美元一枚,总价值超过3.4亿美元。符合条件的用户最少可以拿到4941枚JTO代币,在撰写本文时价值近2万美元。巨大的财富效应让整个市场都慕了,开始蜂拥至Solana撸毛。Web3奖励用户的方法就是这么粗暴,壕无人性。在上期周报中我说,Web3史诗级空投季来了,这绝对不是夸大,本周好几个巨无霸项目方也都决定不装了,开始透露空投计划,后文我们继续展开。

最新内容我一般会第一时间在我个人的社交媒体账号上更新,如果你不想错过实时分享,可以移架关注微博账号【DeFi何太极】或者 推特 @allindefi。

本周的看点

01、铭文代币的FUD

本周BRC20铭文代币达到了一个新的里程碑,ORDI在 30 天内上涨 600% 后,成为第一个市值超过10 亿美元的BRC-20 代币。但是铭文也正在成为比特币上一个越来越有争议的问题。由于铭文交易量巨大,网络目前高度拥堵。

本周,Bitcoin Core 开发者 @LukeDashjr 扬言要禁止铭文的推文引起激烈讨论,他的主要理由是这是个 Bug,会影响比特币网络的安全。此观点直接导致了铭文地震,铭文代币齐刷刷从高点暴跌。很多人担心铭文会不会真的被禁止而归零。这种FUD的产生真的是对比特币原理的误解,开发者的个人观点和他能采取的行动是两码事,比特币的基础是大家的强共识,任何个人都不能单方面改变比特币什么。目前我仍然坚持长持ORDI和SATS,作为对铭文代币的最大押注。

SATS因为没有上大所,主要交易限制在比特币网络上,参与人数和资金量有限。近期的表现一直弱于ORDI,市值相差了一倍多。但是我认为二者会长期角逐龙头地位,而从长期看,SATS有更好的故事性和实用性。本周,铭文交易平台UniSat于X平台发文表示,UniSat索引器将于明年1月开放使用,brc20-sats作为服务费。SATS目前兼具meme币(比特币的单位聪)和实用代币(用作平台手续费)双重叙事,配置一点不会让你失望。有很多人留言说UniSat是SATS背后的大庄家,不知道,反正我从它诞生那一刻就持有了,也会一直持有下去。

02、新空投时代

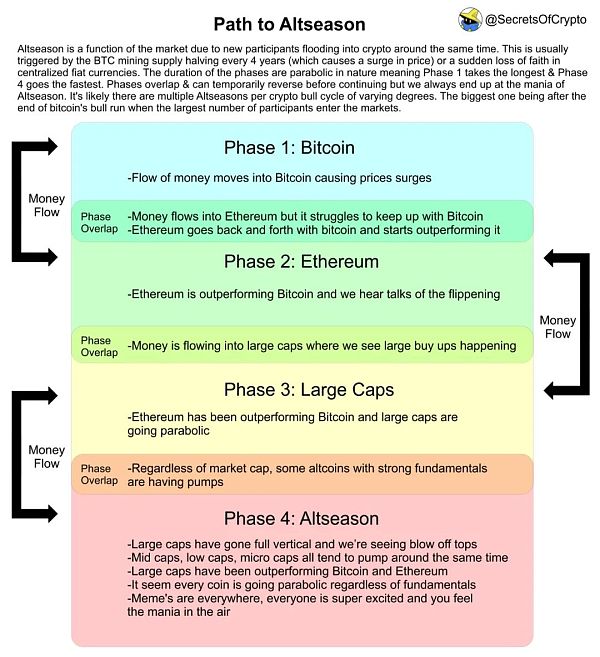

在Solana生态高调空投如火如荼之际,以前对我们爱搭不理的明星项目方也终于坐不住了,纷纷公布即将空投的计划。最引人关注的当属zkEVM公链Starknet,计划空投18亿枚代币,奖励早期用户。另外一个大毛是跨链龙头LayerZero,也确认了代币。在熊市期间辛苦撸毛快要弹尽粮绝的撸党,即将满血复活。有更多的富余资金和精力可以投入更多项目,制造牛市“繁荣”。

LayerZero在X上的明确声明

在上一轮,空投几乎是以太坊生态专属玩法。Solana,Cosmos部分项目想玩但是毛都不大,没造成轰动一时的赚钱效应,也就没有形成正向飞轮。这一轮,以太坊二层空投、Solana生态空投、Cosmos生态空投正强势来袭。在这三个生态上做一点布局,总会有意外惊喜。

举个例子更能说明问题。

本周,融资 6750 万美元的Namada空投公布,Namada(原 Anoma)是一个使用 zk 证明技术的隐私L1 ,而ATOM, OSMO的质押者就有空投资格。包括不久前的模块化公链Celestia的代币空投,也给了ATOM, OSMO的质押者空投资格。所以,参与Cosmos生态质押一些ATOM, OSMO,就是金铲子。(从过往的门槛设置来看,建议单账号至少质押100U以上的资产。)

对于潜在空投的策略,我个人会更关注以太坊二层机会,重点撸公链级别的或者融资额特别巨大的项目。Solana生态目前重点在头部几个未发币项目:比如借贷协议 marginfi.com;合约协议 drift.trade。

人的精力有限,生态越来越庞杂,要做减法,不能什么都去追。最重要的是摆正心态,以学习的目的去探索新事物,空投是顺带手的事情。大部分人都不具备靠空投暴富的职业撸毛素质,因为那也需要大资金投入,要承担亏损风险和长期无收益的心理煎熬,很多人其实做不到。临渊慕鱼不如退而结网,做好自己能做的事情。

03、当前最热门的加密叙事

当下好像好多项目都在暴涨,是不是可以闭眼买?但是为什么当你一买进去,突然他就不涨了,你开始疑惑,我买的币什么时候开始暴涨?后视镜炒币总容易得出闭眼买的结论,但是任何一个币都不会一直涨,会起伏,会横盘,甚至会暴力洗盘,而人性会焦虑,会恐惧,守币如守寡,大部分人都耐不住寂寞,会不断追逐快车,最后被割的体无完肤,在牛市亏了钱。web3投资,最需要掌握的技能是叙事交易。因为叙事引导资金流向,决定价格何时会上涨。但是抓住加密叙事具有挑战性,因为它们常常变化迅速。

当前,值得关注的有四个大的叙事,会不断虹吸市场最多的关注度:

1、比特币铭文生态。牛市起始于比特币上涨,这导致围绕基于比特币构建或以任何方式与其直接相关的项目出现了一种新的强有力的叙事。只要 BTC 的主导地位继续增加,并且在我们获得现货 BTC ETF 之前,我预计基于比特币构建的项目仍将成为关注的焦点。之后,注意力才会转移。在追逐铭文热点的时候,要注意什么时候叙事可能会减弱,及时退出叙事。会买不是能力,会卖的才是高手。

2、Crypto AI。AI作为世界性的宏大叙事,是全世界资本持续追逐的焦点,围绕人工智能的炒作也将是史诗级的,加密人工智能可能会成为牛市中表现最好的叙事之一。而且会不断出现黑马标的,因为格局未定,现在的龙头未必是明年的龙头。尤其马斯克也入局了AI,话题人物和话题事件结合,隔三差五冒出来整个大活,都可能导致AI概念币暴涨暴跌。波动性才是当前加密市场最大的卖点和投机者的真实需求。

3、Solana和OPOS叙事。作为ETH的竞争对手,Solana的优势在于性能好、手续费低,加上坚实的社区支持,生态系统也在蓬勃发展。随着各种空投机会,Solana很可能成为本轮牛市的头号大赢家。另外,大家要特别关注Solana社区的一个新价值主张,声称很多应用程序将 “只能在 Solana 上实现”(即Only Possible On Solana,简写OPOS)。这也被称为 “OPOS叙事”。去中心化的物理基础设施网络(DePIN)和小额支付就是这样的例子。布局DePIN潜力币是我接下来的重点关切。

4、GameFi。随着散户投资者的回归,GameFi有望像上轮牛市那样爆发式增长。这是一个值得关注的赛道,因为游戏更容易被年轻韭菜理解并追捧。在我认识的很多90后甚至00后币圈VC中,特别热衷投资web3游戏项目。对很多宅男来说,游戏比嘿咻更有吸引力。但游戏确实是我不擅长的,所以我投入的研究也很少。事实上,并不是每一个潜力叙事你都需要去追逐。老话说,同时追两只兔子的人,注定两手空空!

总的来说,加密市场是叙事驱动的,抓住热点趋势并早早入场,是获得丰厚收益的关键。(如果你对叙事交易感兴趣,但是不擅长如何操作,可以参与我们的链上投资特训营,在文末有相关介绍)

04、Solana是否能超越以太坊?

在FTX事件后,很多人以为Solana已经不行了,这一轮几乎没太关注。我在往期的周报里一直在说Solana,作为重点关注的叙事和版块。随着Solana的复兴和本周超级空投引发的强烈关注,很多人也在问Solana跟以太坊和其他公链对比到底有什么优势?L1公链竞赛怎么还没结束吗?Solana是否能超越以太坊?

虽然从2017年以来出现了数百个以太坊的L1竞争对手,但以太坊在可预见的未来仍将保持L1空间的领导地位。它在去中心化、开发者数量、流动性等关键指标上遥遥领先。

以太坊2层解决方案在过去几年获得了很大发展,但就目前而言,L2区块链相比于Solana等L1区块链,在可扩展性和成本上仍然较为逊色。L2正在不断改进中,但想要达到支持大规模商业应用还需要几年时间。因此,L1区块链叙事最近再次引起关注。Solana是最大的受益者,其代币价值在过去40天里上涨了3倍。

Solana成功的原因包括:优秀的技术和超低的交易费用、坚实的社区支持、繁荣的生态系统,以及即将到来的协议升级带来更高性能。除此之外,生态系统中多个顶级项目宣布空投吸引了巨额流动性。Solana有潜力成为本轮牛市最强劲的公链之一。

当然我并不是断言Solana会超越以太坊,未来很难预测。在现有的alt L1中,Solana确实是最能打,最有希望赶超以太坊的,因为它在架构上有明显的差异。作为投资者,我们秉持中庸态度,去押注新的可能性,Web3创新绝对不会止于以太坊。更何况,链上数据不会说谎,当Solana各项链上指标开始暴涨的时候,说明赚钱的机会来了。

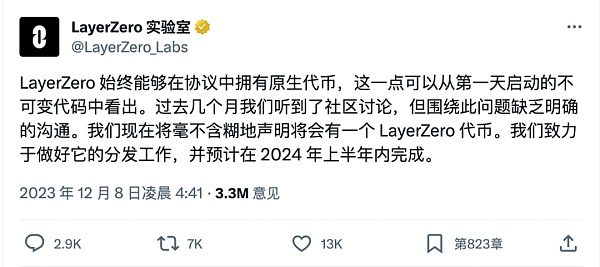

目前随着大量资金和关注度转向Solana,生态价值已经开始重塑,会产生很多机会。比如本周发空投的质押协议Jito,上市后暴涨,完全摊薄后的市值其实已经远远超过以太坊质押龙头Lido,而锁仓连Lido的零头都不到。这都是关注度和新叙事带来的流动性溢价。加密市场的反身性极强,这会进一步引发对Solana生态其他项目的重新估值,当然也包括SOL本身的重新估值。如何你能识别这种元游戏机制,在JTO上市暴涨之后,很容易判断出SOL及生态相关项目的价格也会跟随暴涨,比如Solana生态的另一个质押协议MNDE价格原地起飞,直接翻倍。MNDE在我们10月30日周报里第一次介绍的时候,到现在一个月左右,已经完成了10倍增长。这些都是基于理性和数据分析之后的判断,也是链上投研的价值所在。

Author He Taiji Investment Research finally broke through the resistance of the US dollar this week and went straight to the US dollar in a few days. The market dominance rate has also reached a new high in the year, surpassing the current level. The market value of Bitcoin has surpassed Tesla to become the largest asset in the world. I believe it will reach the top one day. I have been saying in the weekly newspaper that the bull market is coming, and this time it is really coming. There is no doubt that the daily line, like the previous cycle law, usually starts with the sharp rise of Bitcoin, which is capital. The expectation and rumors of the spot flowing into the encryption market in the first stage have prompted every speculator to try to enter the encryption market and push up the price and dominant position. We are now at this stage. After the skyrocketing, everyone will begin to feel that there is not much return potential. The profit-makers also want to move some of their positions to projects with higher returns, and then the funds will flow into them to make them show a parabolic trend. This is the third stage. Finally, the funds will flow. Entering small and medium-sized tokens and other junk coins is the fourth stage. When the market is overheated, some people will start to withdraw from cryptocurrency prices and enter the downward spiral. This is a simplified model to understand the flow of cryptocurrency funds. It is not strict. Just have a spectrum in your heart. There may be overlap or temporary reversal in each stage. The key is to stay ahead of the overall direction of capital flow. Someone on Twitter has compiled a clear picture of this model for reference. Is this week's dominant narrative or the bitcoin inscription and airdrop season continuing? Soaring up to become the first token with a market value of over 100 million US dollars, the ecological pledge agreement airdropped 10,000 tokens to pledge users. According to the current US dollar, a qualified user with a total value of over 100 million US dollars can get at least 10 tokens. At the time of writing this article, the huge wealth effect made the whole market admire and began to flock to reward users. This is so rude and inhuman. In the last weekly report, I said that the epic airdrop season is coming, which is definitely not an exaggeration. This week, several Big Mac projects are also involved. We all decided not to install it, and began to reveal the later part of the airdrop plan. We will continue to develop the latest content. I usually update it on my personal social media account as soon as possible. If you don't want to miss the real-time sharing, you can move to pay attention to Weibo account He Taiji or Twitter this week's highlights. This week's inscription of tokens has reached a new milestone. After rising in the day, it has become the first token with a market value of more than 100 million US dollars, but the inscription is also becoming an increasingly controversial issue on Bitcoin. The network with huge transaction volume is highly congested at present. This week, the developer threatened to ban the tweet of the inscription, which caused heated discussion. His main reason was that it would affect the security of the bitcoin network. This view directly led to the inscription earthquake, and the inscription tokens plummeted from the high point. Many people worried that the inscription would really be banned and returned to zero. This kind of production is really a misunderstanding of the principle of bitcoin. The developer's personal opinion and the actions he can take are two different things. Bitcoin is based on everyone's strong consensus. I can't change bitcoin unilaterally. At present, I still insist on long-term holding and taking it as the biggest bet on the inscription token, because there is no restriction on the number of participants and the amount of funds on the bitcoin network. Recently, the performance has been weaker than the market value, which is more than double, but I think the two will compete for the leading position for a long time and have better story and practicality in the long run. This week, the inscription trading platform issued a document on the platform saying that the indexer will be opened for use as a service fee in next year. The dual narrative configuration of bitcoin's unit intelligence and practical tokens used as platform fees will not disappoint you at all. Many people leave messages saying that the big bookmaker behind it doesn't know. Anyway, I have held it from the moment it was born and will continue to hold it. In the new airdrop era, when the ecological high-profile airdrop was in full swing, the star project parties who ignored us before finally couldn't sit still and announced their plans to airdrop. The most interesting thing is that the public chain plans to airdrop 100 million tokens to reward early users. Heavy hair is a cross-chain leader, and it is also confirmed that the token is exhausted during the bear market. The party will soon be resurrected with blood, and more spare funds and energy can be invested to create a bull market. It is clearly stated that the last round of airdrops was almost the exclusive game of the Ethereum, but some projects wanted to play, but the hair was not big enough to cause a sensational profit-making effect, and there was no positive flywheel. This round of airdrops on the second floor of Ethereum, ecological airdrops, are attacking these three ecosystems strongly. There will always be unexpected surprises when making a little layout. For example, this week's airdrop announcement of financing of 10,000 US dollars was originally a private announcement of using proof technology, and the pledger was entitled to airdrop, including the token airdrop of modular public chain not long ago, which was also given to the pledger. Therefore, some of them participated in ecological pledge. From the past threshold setting, it is suggested that a single account should at least pledge more assets. Personally, I will pay more attention to the strategy of potential airdrop. At present, the project ecology at the chain level or with a particularly huge financing amount focuses on the first few uncollected projects, such as loan agreements and contracts. The energy of the negotiators is limited, and the ecology is becoming more and more complicated. To do subtraction, we can't pursue everything. The most important thing is to set a correct attitude and explore new things for the purpose of learning. Airdrop is a by-product thing. Most people don't have the professional quality of getting rich by airdrop, because it also requires a lot of capital investment, and many people actually do it. It's better to retreat from the net and do what you can. The most popular encrypted narrative at present seems that many projects are skyrocketing. Can you buy them with your eyes closed? But why did they suddenly stop rising as soon as you bought them? You began to wonder when the coins I bought began to skyrocket. It's always easy to come to the conclusion that it's easy to buy them with your eyes closed, but any coin will not keep rising, it will fluctuate sideways and even violently wash dishes, and human nature will be anxious and afraid of keeping it. Most people can't stand silence. I will keep chasing the express train, and I will lose money in the bull market. The most important skill for investment is narrative trading, because narratives guide the flow of funds to determine when the price will rise, but it is challenging to grasp encrypted narratives because they often change rapidly. At present, there are four major narratives that are worthy of attention, which will siphon the most attention from the market. Bitcoin inscriptions, the ecological bull market, started with the rise of Bitcoin, which leads to a new powerful narrative around projects built on Bitcoin or directly related to it in any way, as long as the dominant position continues to increase and I predict before we get the spot. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。