比特币 ETF 格局的新兴动态

作者:Pedro M. Negron 来源:medium 翻译:善欧巴,比特币买卖交易网

加密货币行业一直围绕着比特币现货 ETF 可能获得批准的猜测。这提供了直接获取资产的机会以及通过传统金融渠道获得曝光的机会。传统金融和加密生态系统不断增长的兴趣引起了传统金融主要参与者的注意,他们现在正在寻求抓住这个机会。申请的批准过程既漫长又乏味。许多源自加密货币领域的公司,例如 Grayscale,一直是该领域的先驱,但他们的申请仍在等待批准。

其他产品申请的最后期限即将到来,围绕该主题的猜测和兴趣正在迅速增加。

在做出批准或拒绝的最终决定之前,美国证券交易委员会有权将其对申请的决定最多推迟三次。Ark Invest 将成为第一个在 2024 年 1 月 10 日达到最终截止日期的公司。10 月 2 日星期一同时上市 9 只以太坊期货 ETF,暗示 SEC 可能会考虑采用类似的方法来评估是否批准比特币现货 ETF。SEC 可能会选择同时颁发更广泛的批准,而不是在各自的截止日期前批准每项申请,以防止对任何特定实体表现出偏好。

2022 年初,熊市导致 GBTC 交易价格相对于其持有的比特币价值有折扣。在灰度母公司数字货币集团旗下 Genesis 垮台后,GBTC 的折价在 2022 年底加剧,创下近 50% 的历史新高。

尽管如此,在 2023 年夏天,贝莱德申请比特币 ETF,加上其 576 份 ETF 申请中的 575 份获得批准的骄人记录以及管理的资产近 10 万亿美元,重新燃起了人们对 ETF 最终获得批准的乐观情绪,导致GBTC 折扣减少。不久之后,灰度在针对 SEC 否认其转型为 ETF 的诉讼中取得重大胜利。这次胜利进一步证实了该领域的动态变化。

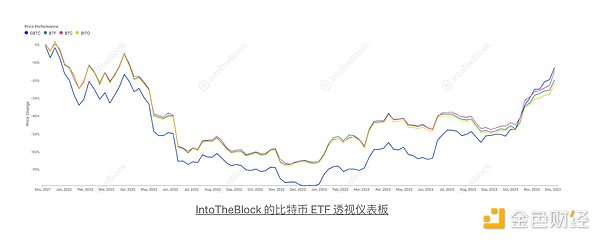

由于这些发展,灰度(GBTC)产品已成为反映市场对 ETF 批准可能性评估的晴雨表。2023 年 GBTC 价格飙升 320%,超过了比特币同期 165% 的涨幅,这一点就很明显。这些不断上涨的价格变化以及 GBTC 和 BTC 之间的差异在资产与其不同波动水平之间的相关性中变得尤为明显。

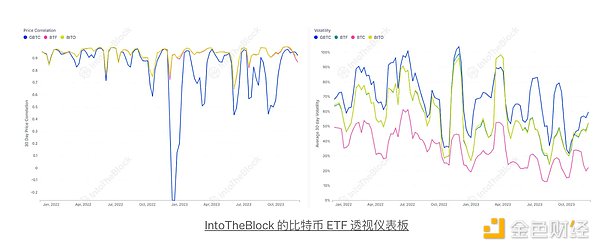

在 GBTC 和比特币价格差异最大时,两种资产之间的相关性为 -0.27。如此低的相关性表明,在这一特定时期,GBTC 的交易几乎与比特币的价格走势相反。过去两年,GBTC 的波动率达到了 103% 的峰值,大幅超过了比特币最高波动率的 61%。

此外,值得关注的是已批准的比特币期货 ETF、BTF 和 BITO 的趋势分析。过去两年,这两只 ETF 的 30 天波动率一直高于它们想要追踪的实际资产 BTC。这些期货 ETF 的波动性加剧可归因于其基础结构,即资产合约按月展期。通常,当发行新的期货合约时,它通常会产生溢价,但随着到期日的临近,这种溢价开始减少。在从一个月合约到下一个月合约的重新平衡过程中,期货 ETF 通常会以溢价购买比特币,从而导致表现更差和波动性更高。

这种动态是潜在即将推出的现货 ETF 成为更具优势的产品的原因之一。由于现货 ETF 中的资金可以赎回,因此与基础 BTC 资产的更紧密一致可能会导致更准确的跟踪,从而减少与期货 ETF 相关的较高波动性。

虽然比特币现货 ETF 的概念多年来一直是人们讨论的话题,但掌握其深层意义至关重要。与 2021 年底获得批准并涉及衍生品合约的比特币期货 ETF 不同,现货 ETF 将涉及直接购买实际比特币。现货ETF将为传统市场参与者直接投资比特币铺平道路。尽管比特币现货 ETF 的批准前景不明朗,但最近发生的事件表明,传统金融体系和加密货币市场之间的格局正在发生变化,并且日益趋同。这些发展凸显了加密货币作为重要资产类别的不断发展和人们对加密货币的日益认可。

The cryptocurrency industry has been surrounding the speculation that bitcoin spot may be approved, which provides opportunities for direct acquisition of assets and exposure through traditional financial channels. The growing interest of traditional finance and encryption ecosystem has attracted the attention of major participants in traditional finance, who are now seeking to seize this opportunity. The approval process for applications is long and boring, and many companies from the cryptocurrency field, for example, have always been the one. Pioneers in the field, but their applications are still waiting for approval of other product applications. The deadline is coming, and the speculation and interest around this topic are increasing rapidly. Before making a final decision on approval or rejection, the US Securities and Exchange Commission has the right to postpone its decision on the application for up to three times, and will become the first company to reach the final deadline on Monday, March, and only Ethereum Futures hinted that it might consider adopting a similar method to evaluate whether to approve bitcoin spot. It may choose to issue more extensive approvals at the same time instead of approving each application before their respective deadlines to prevent showing preference for any specific entity. At the beginning of the year, the bear market led to a discount on the transaction price relative to the value of bitcoin held by BlackRock. After the collapse of its parent company digital currency Group, the discount intensified at the end of the year, reaching a near-record high. Nevertheless, BlackRock applied for bitcoin in the summer of last year, plus a proud record of being approved in one of its applications, and managed assets of nearly one trillion dollars. Yuan rekindled people's optimism about the final approval, which led to the reduction of discounts. Soon after, Gray won a major victory in the lawsuit against denying its transformation. This victory further confirmed the dynamic changes in this field. Because of these developments, gray products have become a barometer reflecting the market's evaluation of the possibility of approval, and the annual price soared more than the increase of Bitcoin in the same period. It is obvious that these rising price changes and the difference between them are in assets and their different fluctuation levels. The correlation between the two assets becomes particularly obvious when the price difference with Bitcoin is the largest. The correlation shows that the transaction in this specific period is almost contrary to the price trend of Bitcoin, and the volatility in the past two years has reached the peak, which greatly exceeds the highest volatility of Bitcoin. In addition, it is noteworthy that the approved bitcoin futures and the trend analysis of these two assets have been higher than the actual assets they want to track in the past two years. The increase in volatility can be attributed to its infrastructure, that is, the monthly extension of asset contracts. Usually, when a new futures contract is issued, it will generate a premium, but as the maturity date approaches, this premium will begin to decrease. In the process of rebalancing from one month contract to the next month contract, futures will usually buy bitcoin at a premium, which will lead to worse performance and higher volatility. This dynamic is one of the reasons why the potential spot will become a more advantageous product. Because the funds in the spot can be redeemed, Closer consistency with the underlying assets may lead to more accurate tracking, thus reducing higher volatility related to futures. Although the concept of bitcoin spot has been a topic of discussion for many years, it is very important to grasp its deep significance. Unlike bitcoin futures approved at the end of the year and involving derivative contracts, the spot will involve direct purchase of actual bitcoin, paving the way for traditional market participants to directly invest in bitcoin. Although the approval prospect of bitcoin spot is uncertain, it has recently occurred. The event shows that the pattern between the traditional financial system and the cryptocurrency market is changing and converging day by day. These developments highlight the continuous development of cryptocurrency as an important asset class and people's increasing recognition of cryptocurrency. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。