加密市场2023年终盘点(上):回顾上半年那些值得纪念的大事件

作者:小岩,世链投研

转眼间,2023年已经接近尾声,再过20天的时间,我们就要给这一年彻底画上句号。

对于整个加密货币行业而言,这一年尤为特殊,大家会有“过得既慢又快”的矛盾感。说它过得慢,是因为2023年行情并没有到达自己心里预期的位置,对于每个币圈人而言,这样的日子实属难熬;说它过得快,是因为2023年的热点接踵而至,你还没有消化完这一个新闻,下一个新闻就已经在路上了,让人目不暇接,甚至都没有反应和消化的时间。

今天,我们就来进行一个年终总结,看看在过去的每个月里,币圈都有哪些大事发生。

一月(比特币价格:$23125.13)

开年首雷!SEC对Genesis母公司DCG展开深度调查

2023年1月,有媒体报道,纽约联邦检察官和美国证券交易委员会(SEC)正在调查数字货币集团(DCG)在其借贷子公司Genesis的内部转账问题。根据知情人士的说法,DCG收到了纽约东区检察官关于提供文件和面谈的要求。更有不愿意透露姓名的内部人士透露,SEC同样在调查DCG。

除了Gensis,DCG还是加密货币新闻网站CoinDesk,加密货币交易所Luno,加密资产管理公司Grayscale Investments以及加密采矿服务提供商Foundry Digital的母公司。或许是因为旗下子公司太多,形成了尾大不掉之势,DCG陷入了财务危机。

早在FTX事件发生之前,加密对冲基金三箭资本(3AC)的内爆就已经让Genesis元气大伤。根据2022年7月公布的三箭资本清算文件,Genesis的经纪子公司Genesis Global Trading向3AC提供了23.6亿美元贷款。Genesis向3AC提出了12亿美元的索赔,随后这个窟窿被DCG补上。

值得一提的是,开年发生的这场风波到年底有了最新进展。Genesis在2023年11月28日向纽约破产法院提交的文件中表示,DCG 同意在明年4月之前支付未偿还的 3.245 亿美元贷款,并且Genesis可以追缴任何未付金额。

Coinbase被要求支付5000万美元的罚款

同样是在1月,纽约州金融服务部(NYDFS)在表示,Coinbase将支付因违反纽约金融服务和银行法产生的5000万美元的罚款,并投资5000万美元用于合规运作。根据NYDFS的说法,Coinbase存在诸多与反洗钱(AML)要求有关的合规“缺陷”,并且在用户登录和监控交易过程中也存在问题。

或许是因为FTX的暴雷,美国监管机构对加密领域的关注越来越多。

二月(比特币价格:$23141.57)

Blur代币上线,为NFT市场注入极大流动性

2月,NFT市场迎来了一波喜人的涨势。究其原因,是因为Blur 代币的上线。

Blur最特别的地方在于它的出价挖矿机制。所以,它的出现让一大波用户获得了BLUR的空投,也为NFT市场注入的极大的流动性。这波NFT市场的高潮对后续NFT赛道的发展产生了深远的影响。因为Blur造成了订单密集的情况,给了NFT“巨鲸”及时退出市场的机会(这些大机构,KOL往往以极低的成本大量持有NFT蓝筹)。

在此之后,随着他们的退场,利益关联减少,Blur的宣传热度也有所衰退。

三月(比特币价格:$27511.71)

银行暴雷,相继破产

3月,对于美国的银行业来说注定是个多事之秋,因为美国的银行业遭遇了严重的挤兑危机,股价暴跌,甚至出现银行相继倒闭的可怕景象。

其中,加密友好银行Silvergate Bank, Silicon Valley Bank和Signature Bank相继倒闭。令人唏嘘的是,Silicon Valley Bank和Signature Bank的倒闭被视为美国历史上第2大和第3大的银行崩溃事件。

连锁反应很快就来。3月11日,稳定币服务商Circle 承认有部分资金存在硅谷银行中,引发市场恐慌,USDC脱钩,数字货币价格暴跌。有趣的是,这一次银行危机让币圈人重新想起了中本聪发明比特币的初衷。

四月(比特币价格:$29233.21)

多项利好政策出台,香港展现出了发展Web 3.0的决心

4月,全球区块链大会在香港召开,与此同时,香港颁布了多项利好政策。这些举动不仅体现出了香港对于拥抱Web 3.0的决心,更让全世界范围内的币圈人士感受到了香港对于加密货币的友好态度。随后,有更多的企业开始在香港申请正规的持牌经营。

以太坊迎来上海升级

4月12日,在以太坊“合并”升级7个月后,以太坊同时进行上海升级与Capella升级。所谓Capella升级,就是使初始存款时没有提供提款凭证的质押者有了提供凭证的能力,从而实现提款。将质押提现功能带到了执行层,使质押者能够将他们从2020年以来锁定的1800万枚ETH从信标链提现到执行层,实现可选择的全额提现或者质押收益提现,释放了质押代币的流动性。

上海升级虽然不能降低Gas费,但实施的EIP-3651,EIP-3855和EIP-3869减少了以太坊开发人员和区块创建者的Gas费用。更重要的是,这是以太坊从工作量证明(PoW)向权益证明(PoS)转型的最后一个重要步骤。

上海升级实施完成后,虽然有部分早期质押者进行了提款操作,但总体来看,质押的净流入仍大于净流出,质押量和验证者数量呈现出加速上升的趋势。

五月(比特币价格:$27210.35)

“MeMe”与“土狗”大行其道

从4月下旬开始,整个加密货币市场变成了MeMe和土狗币的秀场,大盘复苏,全线回调,更在5月上旬达到了高潮。其中表现最为亮眼的当属Pepe币。

Pepe项目在4月5日发布了首条推文,在4月15日上线了Pepe代币。Pepe的优势是十分明显。首先,Pepe代币没有预售,所有人都可以平等的机会参与项目。其次,Pepe代币没有燃烧税,这意味着在交易过程中不会有代币被销毁。此外,Pepe放弃了合约权限,使得代币的发行和交易更加去中心化。

5月6日,Pepe成功上线Binance,市值达到历史最高价,随后逐渐回落。

六月(比特币价格:$29500.06)

SEC对赵长鹏和币安发起起诉

6 月 5 日,SEC向Binance,Binance US,CEO赵长鹏提起诉讼,称其涉嫌违反联邦证券法,非法向美国投资者提供和出售证券。

6月6日,就在起诉币安和赵长鹏之后的第2天,SEC向 Coinbase提起诉讼,声称Coinbase在从未注册为经纪人,国家证券交易所或清算机构的情况下提供多项被视为证券的数字货币交易。

对于这两起诉讼之间存在的联系和区别,我们在前面的内容中有过详细的介绍,在这里就不赘述了,感兴趣的小伙伴们可以自行翻阅。

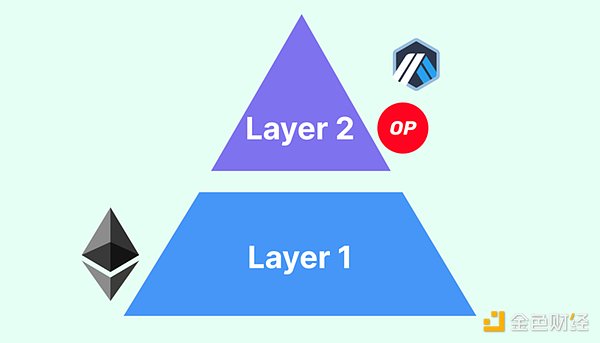

Layer2逐渐走上崛起之路

6月12日,以太坊联合创始人Vitalik Buterin在最新的博客文章中指出,以太坊要想长期可持续发展, Layer 2的扩展是重要的技术转变之一。如果以太坊是一个王国,那么Layer2就是这王国下的城邦,城邦的发展关系到王国的兴衰。

以Layer 2下面的Arbitrum为例。Arbitrum作为Layer 2生态里面目前锁仓量最大的项目,占据了整个Layer 2锁仓量的50 %以上。随着Layerv2的不断成熟,我们有理由相信,Layer 2的锁仓量将会越来越大。

由于篇幅有限,2023年的盘点将分成上下两部分。

The author Xiaoyan World Chain Investment Research has come to an end in a blink of an eye. In a few days, we will put an end to this year completely. For the whole cryptocurrency industry, this year is particularly special. Everyone will have a contradictory feeling that it is slow because the annual market has not reached the expected position in their hearts. For everyone in the currency circle, such a day is really difficult. It is fast because the hot spots of the year are coming one after another. You have not digested this news yet, and the next news is already there. Today, we will make a year-end summary to see what major events have happened in the currency circle in the past month. In January, the price of bitcoin opened in the first year, and in-depth investigation was carried out on the parent company. The year-end inventory of the encryption market was reviewed. In the first half of the year, there were media reports that the federal prosecutor of new york and the US Securities and Exchange Commission were investigating the internal transfer of digital currency Group in its lending subsidiary. The insider's statement has received the request of the prosecutor of new york Eastern District for providing documents and interviews, and some insiders who do not want to be named have revealed that they are also investigating the cryptocurrency news website, cryptocurrency exchange, cryptocurrency asset management company and the parent company of crypto mining service provider, perhaps because there are too many subsidiaries, they have fallen into a financial crisis, and the implosion of crypto hedge fund Sanjian Capital has already weakened their vitality. The brokerage subsidiary of Sanjian Capital Clearing Document released in May filed a claim of $ billion for providing a loan of $ billion, and then this hole was filled in. Looking back at the memorable events in the first half of the year, it is worth mentioning that the storm that happened at the beginning of the year made the latest progress by the end of the year. In the document submitted to the bankruptcy court in new york in May, it was agreed to pay the outstanding loan of $ billion before next month, and any unpaid amount could be recovered, and it was required to pay $ million. Looking back on the year-end inventory of the fine encryption market, the memorable events in the first half of the year were also in June. The New York State Department of Financial Services said that it would pay a fine of $ million for violating new york's financial services and banking laws and invest $ million for compliance operation. According to the statement, there are many compliance defects related to anti-money laundering requirements and there are also problems in the process of user login and monitoring transactions. Perhaps it is because of the thunder that American regulators pay more and more attention to the encryption field in February. The year-end inventory of the currency price token injected great liquidity into the market. Looking back on those memorable events in the first half of the year, the market ushered in a gratifying rise. The reason is that the most special thing about the token's launch lies in its bidding and mining mechanism, so its appearance made a wave of airdrops for users and injected great liquidity into the market. The climax of this market has had a far-reaching impact on the development of the subsequent track, because it caused a dense order situation and gave it to the giant whale. Opportunities to exit the market in time. These large institutions often hold a large number of blue chips at a very low cost. After that, with their exit, the popularity of publicity has also declined. In March, bitcoin prices, banks' violent thunder went bankrupt one after another, and the year-end inventory of the encrypted market was reviewed. Those memorable events in the first half of the year were destined to be an eventful autumn for the American banking industry, because the American banking industry suffered a serious run crisis, and its stock price plummeted and even there was a terrible scene of banks closing down one after another. Cipher-friendly banks and their successive bankruptcies are sadly regarded as the biggest and biggest bank collapse in American history, and the chain reaction will soon come. On April, stable currency service providers admitted that some funds were in Silicon Valley banks, causing market panic and decoupling. digital currency's price plummeted. Interestingly, this banking crisis reminded people in the currency circle of Satoshi Nakamoto's original intention of inventing bitcoin. In April, a number of favorable policies on bitcoin prices were introduced, and Hong Kong showed its determination to develop the encryption market at the end of the year. Looking back at those memorable events in the first half of the year, the Global Blockchain Conference was held in Hong Kong. At the same time, Hong Kong promulgated a number of favorable policies. These actions not only reflected Hong Kong's determination to embrace, but also made people in the currency circles around the world feel Hong Kong's friendly attitude towards cryptocurrency. Later, more enterprises began to apply for formal licensed operation in Hong Kong to welcome Shanghai to upgrade the encryption market. The year-end inventory review of those memorable events in the first half of the year was held on March. After Taifang merged and upgraded for months, Ethereum upgraded and upgraded in Shanghai at the same time. The so-called upgrade means that the pledgee who did not provide the withdrawal voucher at the time of initial deposit has the ability to provide the voucher, thus realizing the withdrawal. It brings the pledge withdrawal function to the executive layer, enabling the pledgee to withdraw the 10,000 pieces they have locked since 2000 from the beacon chain to the executive layer, realizing the optional full withdrawal or pledge income withdrawal, and releasing the liquidity of pledged tokens. Although the Shanghai upgrade cannot reduce the fees, it has been implemented and reduced. More importantly, this is the last important step in the transformation of Ethereum from workload certification to equity certification. After the implementation of the upgrade in Shanghai, although some early pledgers made withdrawals, overall, the net inflow of pledge is still greater than the net outflow. The amount of pledge and the number of verifiers showed an accelerated upward trend. In May, bitcoin prices and local dogs became popular. The year-end inventory of the encryption market reviewed those memorable events in the first half of the year from the end of last month. At the beginning, the whole cryptocurrency market turned into a show with local dog coins, and the full-line callback reached its climax in the first half of the month. Among them, the most eye-catching performance was the coin project, which released its first tweet on March, and the advantages of tokens were very obvious. First, there was no pre-sale of tokens, and everyone could participate in the project on an equal footing. Secondly, there was no burning tax on tokens, which meant that no tokens would be destroyed during the transaction. In addition, the contract authority was abandoned, which made the issuance and transaction of tokens more moderate. The market value of Heartwarming successfully went online on June, and then gradually fell back. In June, the price of Bitcoin sued Zhao Changpeng and Bi 'an for the year-end inventory of the encrypted market. In the first half of the year, those memorable events brought a lawsuit against Zhao Changpeng, claiming that he was suspected of violating the federal securities law and illegally providing and selling securities to American investors. On June, he filed a lawsuit against Bi 'an and Zhao Changpeng, claiming to provide a number of digital currency transactions regarded as securities without being registered as brokers, national stock exchanges or clearing institutions. We are in front of these two lawsuits. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。