解读2023比特币上涨三大原因

2023年比特币上涨真实原因是什么?

如果说今年哪一个资产最值得关注,答案无疑是比特币,要知道,其价格从年初的19,000美元左右一路上涨至年底的45,000美元左右,涨幅超过136%。通常而言,比特币上涨无非几个原因,比如美联储降息刺激宏观环境向好、比特币区块奖励减半等,但这次可能有所不同,因为比特币的“特质”似乎正在发生改变,从单纯吸引投资者的价值存储,逐步转移到应用层,Koala考拉财经将在本文中进行深度分析解读。

铭文“刺激”比特币生态用例大爆发

最近比特币生态中最受人关注的无疑是“ORDI”,最近几天,随着比特币价格冲破44,000美元,ORDI价格上涨的令人惊讶,但随着ORDI的崛起,让人们第一次看到比特币并不是只能扮演价值存储的角色,还有更多实际用例。

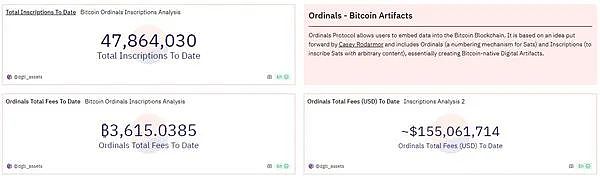

根据Dune Analytics最新数据显示,当前Ordinals铭文铸造量已接近5000万枚,费用收入已超过3600枚BTC,约合1.55亿美元。

事实上,ORDI这波热潮不仅单纯促进了铭文赛道的发展,甚至可能推动比特币区块链二层网络的发展,用户在二层网络执行层创建链下交易通道,通过链下计算方式的处理交易,在提高可扩展性和吞吐量的同时降低交易成本。

我们知道,现阶段铭文协议使用比特币一层网络铸造NFT,允许用户将数据嵌入到比特币区块链中,并包括Ordinals(聪的编号机制)和Inscriptions(用任意内容刻写聪),本质上是创建比特币原生的非同质代币(NFT),虽然这会增加比特币网络的交易量,但同时也可能给比特币网络带来一定负担,为解决这些问题,基于比特币主区块链构建的二层网络可能会因此兴起。

在当下“初牛”上涨势头迅猛的市场背景下,铭文热潮带动了更多人关注比特币生态建设,推动比特币生态构建更多的可能性,为比特币生态带来新的活力,促进比特币生态的进一步发展,如果能够推出更具创新性和吸引力的Layer 2或其他新形式叙事,无疑对整个加密行业有利。

生态用例增多并未削减比特币“价值存储”属性

比特币自诞生之日起就被视为一种价值存储资产,其稀缺性和不可篡改性是其价值基础。在2023年,全球经济面临着通货膨胀、地缘政治冲突等风险,投资者对传统金融资产的信心有所下降,转而将目光投向了比特币等数字资产。

事实上,比特币不仅是一种价值存储资产,还具有多种生态用例。在2023年,比特币在支付、金融、保险等领域的应用得到了进一步拓展。在支付领域,越来越多的商家开始接受比特币支付。据统计,目前全球接受比特币支付的商家已超过了100万家。在金融领域,比特币衍生品市场也得到了快速发展。截至2023年底,比特币衍生品市场规模已超过了1万亿美元,另外在保险领域,比特币保险也开始受到了越来越多的关注。

毫不夸张地说,生态用例的拓展并未削减比特币“价值存储”属性,反而为比特币的价格提供了支撑。随着比特币在更多领域的应用,其需求将会进一步增加。

机构投资者的入场

近年来,越来越多的机构投资者开始布局比特币等数字资产。有分析指出,今年全球机构投资者在比特币等数字资产上的投资总额超过了1,000亿美元。机构投资者的入场,为比特币市场注入了新的活力,也提升了比特币的价格。而随着比特币价值属性的不断提升,以及在全球金融体系地位的进一步提升,价格也将会保持相对稳定的增长趋势,而机构投资者选择在这个时间点入场归纳起来主要有以下几个原因:

机构投资者对比特币的价值属性有了更深入的理解。

机构投资者希望通过投资比特币来分散风险。

机构投资者希望通过投资比特币、以及比特币ETF来获得更高的收益。

截至目前,多家全球资管巨头都向美国证券交易委员会提交了现货比特币ETF的申请,其中包括贝莱德(BlackRock)、富达(Fidelity)和Invesco、Bitwise、灰度(Grayscale)、Valkyrie等,此举势必为未来与加密资产相关的金融产品开创先例,一旦监管批准将被视为比特币更广泛应用的一步,也是主流金融市场的重大创新。

传统的证券交易市场具有成熟的交易制度和基础设施,能够为比特币提供更高效的交易环境。此外,现货比特币ETF的交易价格将会更加透明,这将有助于投资者更好地了解比特币的价格走势,随着美国证券交易委员会在2024年1月对现货BTC ETF开放申请的最后期限即将到来,这些利好因素进一步驱动了比特币价格在年底走高。

总结

可以说,生态用例的拓展为比特币上涨提供了支撑,价值存储属性是比特币上涨的重要因素,而机构投资者入场是2023年比特币上涨行情的最大推动力。

当然,2023年比特币上涨行情也存在一些不确定性,例如,如果全球经济形势进一步恶化,投资者对比特币的需求可能会下降;如果监管机构收紧对加密货币的监管,也可能会对比特币市场产生负面影响。

但总体而言,市场正朝着光明的方向发展。

What is the real reason for the rise of Bitcoin in 2008? If we say which asset is most worthy of attention this year, the answer is undoubtedly Bitcoin. You should know that its price has risen all the way from about US dollars at the beginning of the year to about US dollars at the end of the year. The increase is more than usual. There are only a few reasons for the rise of Bitcoin, such as the Federal Reserve's interest rate cut to stimulate the macro environment to reward the good Bitcoin block by half, but this time it may be different, because the characteristics of Bitcoin seem to be changing from the value storage that simply attracts investors to the application. Layer Koala Finance will conduct in-depth analysis and interpretation in this article. Inscriptions stimulate the explosion of bitcoin ecological use cases. Undoubtedly, the most popular concern in bitcoin ecology in recent days is that the price of bitcoin has broken through the surprising rise of the dollar in recent days. However, with the rise of, people have seen for the first time that bitcoin can not only play the role of value storage, but there are also more practical use cases. According to the latest data, the current inscription casting volume is close to 10,000 pieces, and the cost income has exceeded 100 million dollars. In fact, this wave of fever. Tide not only promotes the development of the inscription track, but may even promote the development of the second-tier network of the bitcoin blockchain. Users create offline trading channels on the second-tier network executive layer. Dealing with transactions through offline computing improves scalability and throughput while reducing transaction costs. We know that at this stage, the inscription protocol uses the bitcoin first-tier network casting to allow users to embed data into the bitcoin blockchain, including smart numbering mechanism and writing with arbitrary content, which is essentially to create bitcoin. Although the native heterogeneous tokens will increase the transaction volume of the bitcoin network, they may also bring a certain burden to the bitcoin network. In order to solve these problems, the second-tier network based on the bitcoin main blockchain may rise. In the current market background where the bull is rising rapidly, the inscription boom has driven more people to pay attention to the bitcoin ecological construction and promote the bitcoin ecological construction. More possibilities will bring new vitality to the bitcoin ecology and promote the further development of the bitcoin ecology. The introduction of more innovative and attractive narrative or other new forms is undoubtedly beneficial to the whole encryption industry. The increase in ecological use cases has not reduced the value storage property of bitcoin. Bitcoin has been regarded as a value storage asset since its birth. Its scarcity and non-tampering are its value basis. In 2000, when the global economy faced inflation and geopolitical conflicts, venture investors' confidence in traditional financial assets declined and turned their attention to digital assets such as Bitcoin. In fact, Bitcoin is not only. A value storage asset also has a variety of ecological use cases. In 2008, the application of bitcoin in payment, finance and insurance was further expanded. In the payment field, more and more merchants began to accept bitcoin payment. According to statistics, at present, there are more than 10,000 merchants in the world who accept bitcoin payment. In the financial field, the bitcoin derivatives market has also developed rapidly. By the end of the year, the scale of bitcoin derivatives market has exceeded one trillion US dollars, and in the insurance field, bitcoin insurance has also begun to receive more and more attention. It is no exaggeration to say that the expansion of ecological use cases has not reduced the value storage property of bitcoin, but has provided support for the price of bitcoin. With the application of bitcoin in more fields, its demand will further increase the admission of institutional investors. In recent years, more and more institutional investors have begun to lay out digital assets such as bitcoin. Some analysts pointed out that the total investment of global institutional investors in digital assets such as bitcoin this year exceeded 100 million US dollars, and the admission of institutional investors injected into the bitcoin market. The new vitality has also raised the price of Bitcoin, and with the continuous improvement of the value attribute of Bitcoin and the further promotion of its position in the global financial system, the price will also maintain a relatively stable growth trend, and institutional investors choose to enter the market at this time point. To sum up, there are several main reasons why institutional investors have a deeper understanding of the value attribute of Bitcoin. Institutional investors hope to spread risks by investing in Bitcoin, and institutional investors hope to invest in Bitcoin and Bits. Up to now, many global asset management giants have submitted applications for spot bitcoin to the US Securities and Exchange Commission, including BlackRock Fidelity and Grayscale, which is bound to set a precedent for future financial products related to encrypted assets. Once approved by the regulatory authorities, it will be regarded as a step for the wider application of bitcoin and a major innovation in the mainstream financial market. The traditional securities trading market has a mature trading system and infrastructure, which can provide a more efficient trading ring for bitcoin. In addition, the transaction price of spot bitcoin will be more transparent, which will help investors to better understand the price trend of bitcoin. With the approaching deadline of the US Securities and Exchange Commission's application for spot opening in June, these favorable factors have further driven the price of bitcoin to rise at the end of the year. To sum up, it can be said that the expansion of ecological use cases has provided support for the rise of bitcoin, and the storage property is an important factor for the rise of bitcoin, and the admission of institutional investors is the most important factor for the rise of bitcoin in 2008. Of course, there are some uncertainties in the rising market of Bitcoin in, for example, if the global economic situation worsens further, investors' demand for Bitcoin may decline, and if regulators tighten supervision over cryptocurrencies, it may also have a negative impact on the Bitcoin market, but overall, the market is developing in a bright direction. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。