公司如何做好合规性并规避Web3带来的潜在风险?

随着区块链行业的发展,企业面临着多种合规和风险管理挑战。在去中心化金融(DeFi)的复杂性递加和日益增长的安全风险威胁中,对强大的合规解决方案的需求从未像现在这样迫切。

监管环境--复杂的生态系统

加密资产的监管环境正在迅速演变,尽管世界各地的司法管辖区采取的方法不尽相同。例如,反洗钱金融行动特别工作组(FATF)制定了全球反洗钱(AML)和打击资助恐怖主义(CFT)标准,《旅行规则》(Travel Rule)、香港的 VASP 法规和欧盟的加密资产市场(MiCA)等具体法规则进一步增加了合规的复杂性。

与传统金融相比,加密货币反洗钱/反恐融资面临着独特的挑战。匿名性、跨境交易和缺乏集中的中介机构使得追踪和预防非法活动变得十分困难。据估计,2022 年通过数字资产洗钱的金额为238亿美元,比 2021年的142亿美元相比大幅增加。

而且,区块链技术允许的匿名性已被哈马斯等激进组织滥用。最近,以色列政府要求Binance冻结与哈马斯有关的大量账户。根据执法部门的说法,该恐怖组织利用这些账户通过社交媒体汇集与战争有关的资金。此类事件进一步凸显了加密货币和区块链领域监管框架的必要性。

近期加密货币行业采用RegTech的解决方案来应对合规挑战和满足监管要求的趋势日益增长。虚拟资产服务提供商(VASPs)正在寻求合法经营的许可证,同时金融机构则在探索现实世界资产(RWA)代币化的机会。

主要金融机构也在密切关注 DeFi,因为它能够通过整合无信任互动来改变传统金融服务。最近,加拿大央行探讨了 DeFi 的创新和对其的担忧,强调了监管方面的挑战。该央行指出,"公链的匿名性和无国界性使监管变得困难且复杂"。

实现加密货币的合规性和风险管理

采用RegTech解决方案正变得越来越重要。区块链和Web3公司应优先考虑数据监控和链上分析,以防患于未然。目前业内有多个区块链数据平台,OKLink作为其中之一,跟踪超过170 多条链,拥有超过 1,000 TB 的结构化数据。

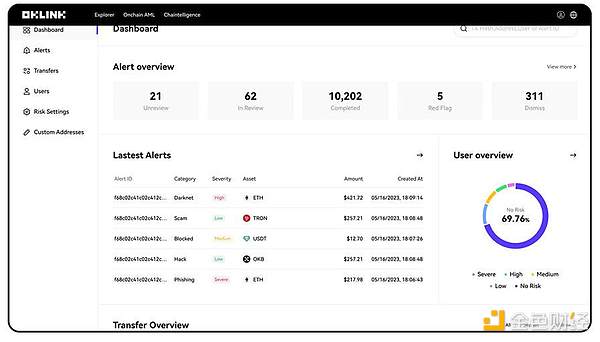

OKLink 的旗舰产品之一是Onchain AML,该产品于今年 6 月发布的,9 月在全球范围内推出,可帮助区块链企业和 DeFi 服务加强合规性和风险管理。该解决方案可全面满足增值服务提供商、机构、加密货币交易所、Web3 项目、监管机构、执法机构和开发商的需求,从而保护最终用户的安全。Web3项目也可以使用OKLink的Onchain AML,通过对涉及黑地址的合约代码和资金进行智能预警来控制风险。

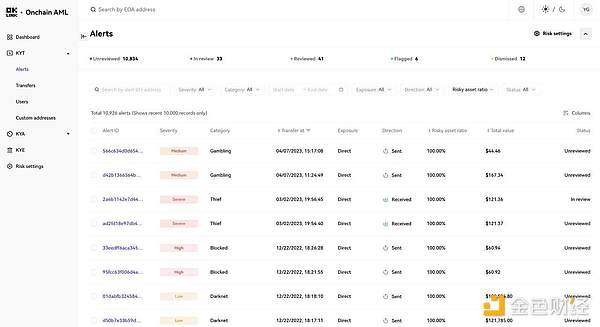

OKLink 的 Onchain AML 提供两个核心功能: Know Your Transaction (KYT) 交易追迹和Know Your Address (KYA) 地址追迹。这些强大的工具使企业和个人能够有效地管理风险并提高合规性。

第一个交易监控工具 KYT 分析链上风险,评估交易安全性。它能发现地址与现实世界实体之间的联系,评估交易风险,帮助区块链服务遵守法规。

该产品还能帮助加密服务提高风险控制能力。如果地址涉及非法活动,它将帮助加密服务拒绝其转账或冻结其账户。

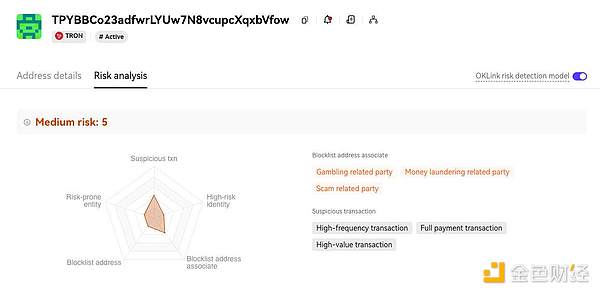

先说KYA,它是一款功能强大的数据驱动型风险评估工具,可帮助政府、企业和个人提高虚拟货币的透明度,更有信心地驾驭复杂的区块链生态系统。这一创新工具利用一个独特的模型,从五个维度对与区块链地址相关的风险进行细致评估:

地址黑名单: KYA 可识别并标记与诈骗、网络钓鱼攻击和制裁等恶意活动相关的地址,确保用户可以做出明智的决策,避免潜在的有害互动。

与地址黑名单相关联的地址: KYA 通过识别与这些恶意实体直接互动的地址,将其风险评估扩展到黑名单地址之外,提供额外的保护层并实现主动风险缓解。

可疑交易:KYA 可识别可疑交易中涉及的地址并向用户发出警报,从而促使用户进一步调查并防止潜在损失。

可疑身份: KYA 可检测出可以的身份,比如容易被恶意利用的Sybil 节点和与加密混合器有关的身份,从而保护用户免受利用,促进更安全的加密环境。

高风险实体:KYA 将交易所分为高风险、中风险和低风险,为其决策提供有价值的指导,使用户能够优先与信誉良好的交易所进行交互。

除了 KYT 和 KYA,OKLink 的 Onchain AML 还提供了一个区块链指数后台板,用于分析链上数据,以及一个安全审计工具,用于审核代币。

OKLink 生态系统还包括一个探索工具,支持 30 多个链,为用户提供链上活动的详细视图,便于进行彻底的调查和分析。该工具允许对区块链交易进行细粒度检查,使用户能够发现潜在的风险或违规行为。

此外,OKLink的Onchain AML套件可与Chaintelligence(领先的加密资产调查平台)无缝集成。这种整合为 Web3 公司提供了先进的取证能力,用于追踪和分析非法交易。

OKLink秉承着为 Web3 公司创造一个更安全的环境的使命为宗旨,通过让企业和政府利用其 Onchain AML 套装风险管理工具,来应对区块链不断变化的安全风险和合规挑战。

With the development of blockchain industry, enterprises are facing a variety of compliance and risk management challenges. With the increasing complexity of decentralized finance and the growing threat of security risks, the demand for strong compliance solutions has never been as urgent as it is now. The regulatory environment for complex ecosystems and encrypted assets is rapidly evolving, although the methods adopted by jurisdictions around the world are different. For example, the Financial Action Task Force on Anti-Money Laundering has formulated a global anti-money laundering and combating terrorist financing. The standard travel rules, the laws of Hong Kong and the EU's encrypted asset market have further increased the complexity of compliance. Compared with traditional finance, cryptocurrency anti-money laundering and counter-terrorism financing are facing unique challenges. Anonymous cross-border transactions and the lack of centralized intermediaries make it very difficult to track and prevent illegal activities. It is estimated that the amount of money laundering through digital assets in the year is billion dollars, which is significantly higher than that in the year. Moreover, the anonymity allowed by blockchain technology has been stimulated by Hamas and others. Abuse of organizations Recently, the Israeli government requested to freeze a large number of accounts related to Hamas. According to law enforcement agencies, the terrorist organization used these accounts to collect war-related funds through social media. Such incidents further highlighted the necessity of a regulatory framework in the field of cryptocurrency and blockchain. Recently, the cryptocurrency industry has adopted solutions to meet compliance challenges and regulatory requirements, and the trend of meeting regulatory requirements is growing. Virtual asset service providers are seeking licenses for legal operations. Financial institutions are exploring the opportunity of real-world assets token, and major financial institutions are also paying close attention to it because it can change traditional financial services by integrating untrusted interactions. Recently, the Bank of Canada has discussed innovations and concerns about it, emphasizing the challenges in supervision. The central bank pointed out that the anonymity and borderlessness of public chains make supervision difficult and complicated, and it is becoming more and more important to achieve compliance and risk management of cryptocurrencies. Blockchains and companies should give priority to data. Monitoring and chain analysis to prevent problems before they happen. At present, there are many blockchain data platforms in the industry as one of them, and one of the flagship products that track more than one chain with more structured data is that the product was launched globally in January this year, which can help blockchain enterprises and services strengthen compliance and risk management. This solution can fully meet the needs of value-added service providers, cryptocurrency exchanges, project regulators, law enforcement agencies and developers, thus protecting the safety of end users. The whole project can also be used to control risks through intelligent early warning of contract codes and funds involving black addresses. How can companies do a good job in compliance and avoid the potential risks brought about? It provides two core functions: transaction tracking and address tracking. These powerful tools enable enterprises and individuals to effectively manage risks and improve compliance. The first transaction monitoring tool analyzes chain risks, evaluates transaction security, and can find the connection between addresses and real-world entities, evaluate transaction risks and help blocks. Chain service complies with laws and regulations. This product can also help encryption service to improve its risk control ability. If the address involves illegal activities, it will help encryption service to refuse its transfer or freeze its account. How can companies do a good job of compliance and avoid the potential risks brought about? First, it is a powerful data-driven risk assessment tool that can help government enterprises and individuals improve the transparency of virtual currency and control the complex blockchain ecosystem with confidence. This innovative tool uses a unique model from five. Dimension carefully evaluates the risks related to blockchain addresses. Address blacklists can identify and mark addresses related to malicious activities such as fraud, phishing attacks and sanctions, ensuring that users can make wise decisions to avoid potentially harmful interactions. Addresses associated with address blacklists can extend their risk assessment beyond the blacklisted addresses by identifying addresses that directly interact with these malicious entities, providing additional protection and realizing active risk mitigation. Suspicious transactions can be identified. And give an alarm to users, so as to urge users to further investigate and prevent potential losses. Suspicious identities can detect possible identities, such as nodes that are easy to be maliciously exploited and identities related to encryption mixers, so as to protect users from exploitation, promote a safer encryption environment, and high-risk entities divide transactions into high-risk, medium-risk and low-risk, providing valuable guidance for their decision-making, enabling users to interact with reputable exchanges first, and providing a zone in addition to harmony. The blockchain index backstage board is used to analyze the data on the chain and a security audit tool is used to audit the token ecosystem. It also includes an exploration tool to support multiple chains and provide users with a detailed view of the activities on the chain, which is convenient for thorough investigation and analysis. This tool allows fine-grained inspection of blockchain transactions, enabling users to discover potential risks or violations. How can companies do a good job of compliance and avoid potential risks? In addition, the suite can be seamlessly integrated with the leading cryptoasset investigation platform. This integration provides the company with advanced forensic ability to track and analyze illegal transactions. With the mission of creating a safer environment for the company, enterprises and governments can use their suite of risk management tools to deal with the ever-changing security risks and compliance challenges of blockchain. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。