15大预测速览Coinbase 2024加密展望

作者:Prithvir,Loch联创兼CEO 翻译:比特币买卖交易网xiaozou

本文将为你带来Coinbase对2024年的加密预测,我们将探讨:Coinbase的加密市场概述、专业分析、值得关注的叙事、宏观和监管利好和加密货币的未来。

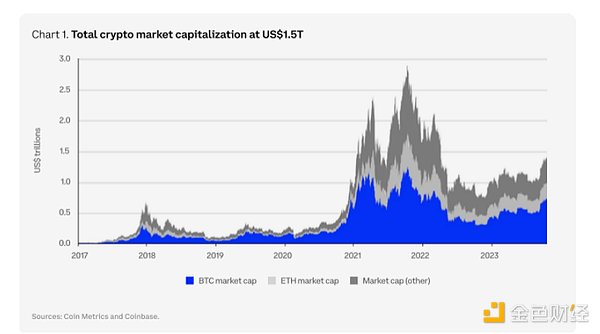

1、2023年市场复苏

加密货币总市值在2023年经历了大幅复苏,实现了真正的市值翻番。这被视为一个明确的信号,表明市场正在从漫长的“加密寒冬”中走出。

2、比特币的主导地位

比特币重新夺回加密货币主导地位,其市值自2021年4月以来首次超过加密货币总市值的50%。这一转变表明,散户和机构投资者对比特币的兴趣越来越浓厚。

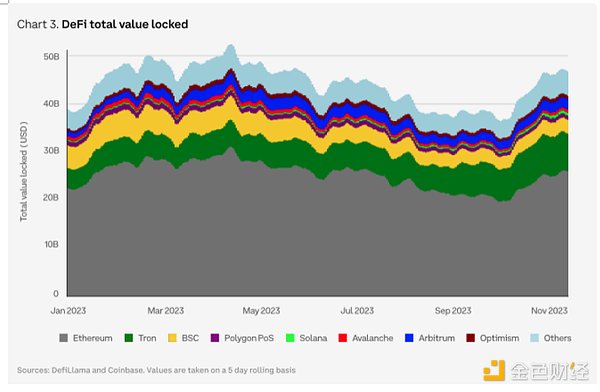

3、以太坊的当前地位

以太坊继续在智能合约平台中处于领先地位,占据相当大一部分市场。DeFi总锁定价值中约有57%的TVL在以太坊网络上。

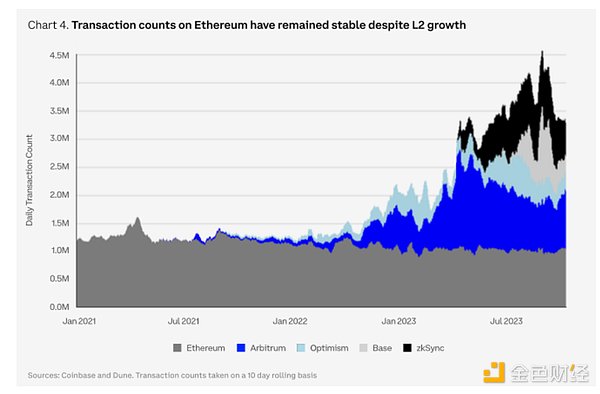

4、L1和L2格局

重心明显转向特定领域区块链平台和模块化区块链架构。尽管以太坊的L2扩展解决方案有所增长,但主网仍然是主要的活动中心。

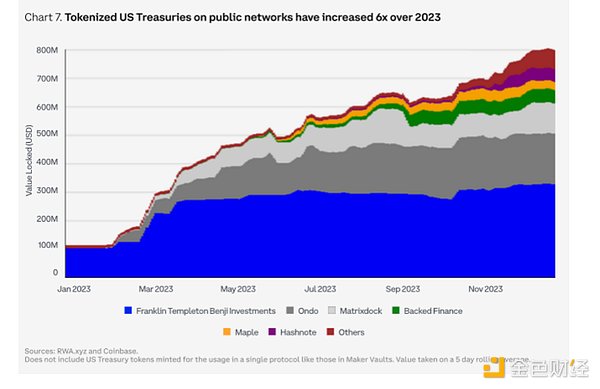

5、代币化

围绕代币化的兴趣日益浓厚,尤其是在传统金融领域。美国国债等资产的代币化大幅增加就是佐证。

6、去中心化身份验证

去中心化身份验证解决方案和去中心化基础设施网络的发展越来越被重视。这些技术将为身份验证和资源管理提供安全高效的系统。

7、监管发展

Coinbase的2024加密报告还详细描述了美国的重大立法进展,包括可能批准现货比特币交易所交易基金(ETF),并预测2024年监管环境将更加明晰。

8、机构采用

机构对加密货币的兴趣持续快速增长。该报告指出,参与加密市场的机构投资者类型多样,跨宏观基金和高净值人群。

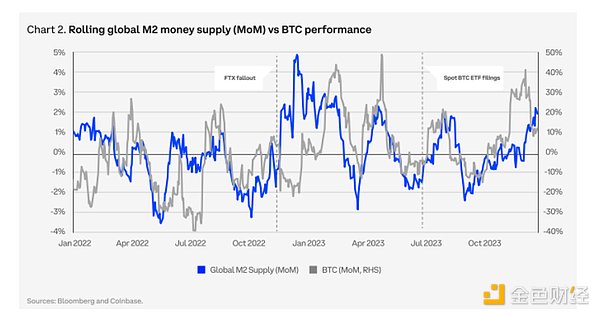

9、宏观经济因素与去美元化

该报告讨论了全球去美元化和货币制度转变的潜在长期影响。报告认为,加密货币可以在一个更加多极化的金融世界中发挥重要作用。

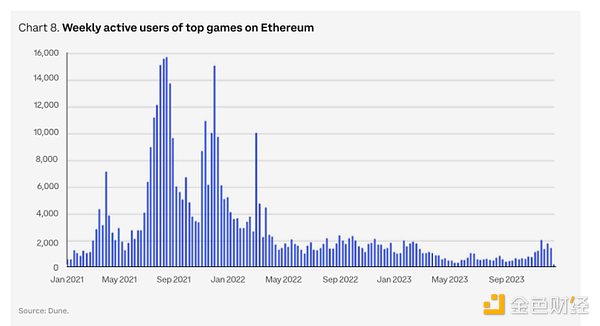

10、Web3游戏

游戏行业的当前市场规模约为2500亿美元,预计还将大幅增长。区块链技术可以占据游戏市场相当大的份额,主要是因为区块链技术为游戏开发和促进玩家粘性提供了创新模式。

11、去中心化的现实世界资源

DePIN是关注焦点。报告强调了区块链变革这些领域现有范式的颠覆性潜力,表明未来区块链技术将在管理和分配物理资源方面发挥核心作用。

12、优化加密用户体验

报告还提到了为优化加密货币领域的用户体验所做的努力。诸如账户抽象和“无gas交易”的实现等发展被认为是旨在降低加密货币访问门槛的关键进步。

13、Validator(验证者/器)中间件和可定制性

报告探讨了关于Validator中间件的创新解决方案,包括再质押(restaking)和DVT。这些发展对于区块链网络的可扩展性和安全性来说非常重要,表明了底层技术已发展成熟。

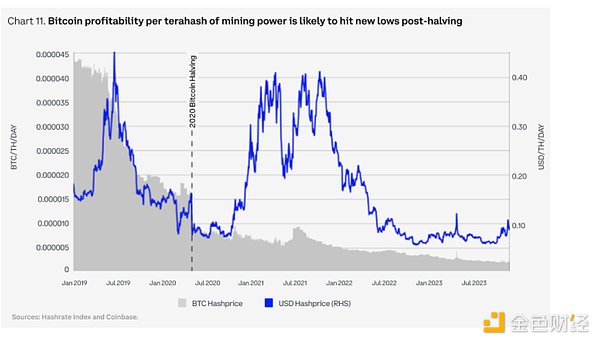

14、比特币减半事件

2024年4月即将到来的比特币减半被视为一个重要里程碑。这一事件预计将对比特币的供应动态带来相当大的影响,由于比特币更加稀缺,将影响其价格和市场认知。

15、预期抛售压力

2024年避不开抛售压力,例如Mt. Gox债权人还款和FTX的持仓清算。这些事件可能会让大量比特币和其他加密货币流入市场,影响价格走势。

The author co-founded and translated the Bitcoin trading network. This article will bring you an encryption forecast for 2008. We will discuss the encryption market overview, professional analysis, narrative macro and regulatory benefits worthy of attention, and the future market recovery of cryptocurrency. The total market value of cryptocurrency experienced a sharp recovery in 2008, and the real market value doubled. This is regarded as a clear signal that the market is getting out of the dominant position of Bitcoin and Bitcoin is regaining the dominant position of cryptocurrency. The change that the value exceeds the total market value of cryptocurrency for the first time since January shows that retail investors and institutional investors are increasingly interested in Bitcoin. The current position of Ethereum continues to be in the leading position in the smart contract platform, occupying a considerable part of the total market lock-in value. Some of the total market lock-in value is on the Ethereum network and the focus of the pattern has obviously shifted to the specific domain blockchain platform and modular blockchain architecture. Although the expansion solutions of Ethereum have increased, the main network is still the main activity. There is a growing interest in central tokenization around tokenization, especially in the traditional financial field. The substantial increase in the tokenization of assets such as US Treasury bonds is evidence that decentralized authentication, decentralized authentication solutions and decentralized infrastructure networks have been paid more and more attention. These technologies will provide safe and efficient system supervision for authentication and resource management. The encryption report also describes in detail the major legislative progress in the United States, including the possible approval of the trading base of spot bitcoin exchanges. Jin He predicted that the regulatory environment will be clearer in 2008, and the interest of institutions in adopting cryptocurrencies will continue to grow rapidly. The report pointed out that there are various types of institutional investors participating in the cryptocurrency market, macro-economic factors across macro-funds and high-net-worth people and the de-dollarization. The report discussed the potential long-term impact of global de-dollarization and the transformation of monetary system. The report believes that cryptocurrencies can play an important role in a more multipolar financial world, and the current market size of the game industry is about 100 million US dollars. It is expected that the blockchain technology will increase significantly, which can occupy a considerable share of the game market, mainly because the blockchain technology provides an innovative model for game development and promotes player stickiness. Decentralized real-world resources are the focus of attention. The report emphasizes the subversive potential of the existing paradigm in these fields, indicating that blockchain technology will play a central role in the management and allocation of physical resources in the future. The report also mentions the optimization of encrypted user experience in the field of cryptocurrency. The efforts made, such as the abstraction of accounts and the realization of non-transaction, are considered to be the key progress aimed at lowering the access threshold of cryptocurrency. The report on verifier middleware and customization discusses the innovative solutions of middleware, including re-pledge, and these developments are very important for the scalability and security of blockchain network, indicating that the underlying technology has matured. The upcoming bitcoin halving event in October is expected to be regarded as an important milestone. It will have a considerable impact on the supply dynamics of bitcoin. Because bitcoin is more scarce, it will affect its price and market perception. It is expected that selling pressure will be unavoidable in years, such as creditor repayment and liquidation of positions. These events may cause a large number of bitcoin and other cryptocurrencies to flow into the market and affect the price trend. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。