2023年大事回顾:从扼喉、9万亿贝莱德申请比特币ETF、Ripple案判决到加密市场起飞

作者:Kyle Waters & Tanay Ved,Coin Metrics研究员;翻译:比特币买卖交易网xiaozou

本文采取数据驱动视角,回顾了2023年影响数字资产行业的重要事件。

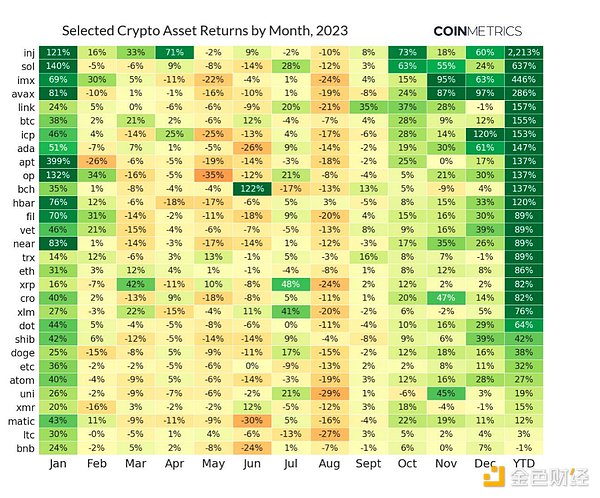

在经历了艰难的2022年后,2023年为整个生态系统带来了许多积极的发展,例如新机构的加入、关键性技术升级等等。虽然监管环境可以说是有史以来最具挑战性的,尤其是在美国,但一轮轮的对抗应该会迫使一些悬而未决的问题变得更加明晰。货币紧缩时期貌似即将结束,加密货币和股票在2023年都经历了飙升,许多数字资产涨幅超过一倍,其中就包括比特币(BTC),比特币在2023年上涨了150%。下表可见datonomyTM中市值超过10亿美元的全部资产的表现。

Q1:扼喉

2023年初,在FTX崩盘的阴霾下,数字资产市场迅速好转,1月份比特币从1.6万美元攀升至2.3万美元,这一增长将为全年设定节奏。越来越多的人开始认为最糟糕的时候已经结束,FTX作为一个中心化实体的垮台并没有玷污影响公共区块链技术的核心原则和潜力。

然而,2023年初的一系列事件也催生了这一年备受关注的主题:美国不断升级的监管压力。第一季度的一系列执法行动引发了数字资产行业的关注,例如美国证券交易委员会向稳定币运营商Paxos就币安稳定币BUSD发出Wells通知,导致BUSD停止发行。BUSD供应量在这一年里从160亿美元的峰值暴跌至10亿美元,在通知发布后的一周内就减少了40亿美元。强制BUSD停止发行标志着美国监管机构开始采取更广泛的行动遏制离岸交易所巨头币安(Binance)。按现货交易量计算,币安是全球最大的交易所。当年3月份,美国商品期货交易委员会(CFTC)公布对币安及其创始人赵长鹏(CZ)涉嫌多起监管违规操作实施民事执法。

在岸运营商也要接受新的监管审查,很多从第一季度开始就面临越来越大的压力,银行监管机构发布了非正式的指导文件,将加密货币和加密货币客户列为银行系统风险,一些业内人士甚至将这些行动称为“运营瓶颈2.0”——可以说是一场由政府主导的协调行动,旨在阻碍美国数字资产行业的发展。

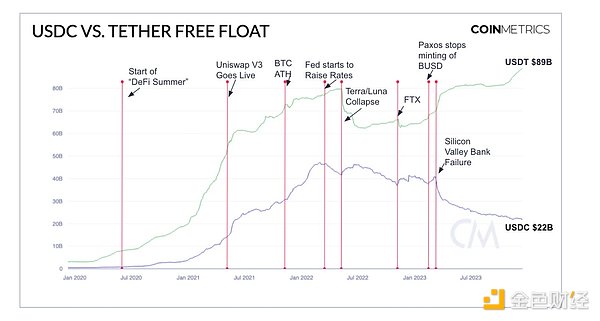

放眼宏观经济环境,银行开始面临一个平常但令人不安的局面:在利率快速上升的环境下,美国国债贬值,受影响最大的是科技友好型的硅谷银行(SVB)。SVB在3月份的一场银行挤兑之后宣布破产,这不仅引发了人们对美国银行业健康状况的担忧,也考验了USDC稳定币的稳定性,Circle在SVB就持有33亿美元的储备金。USDC的价格曾一度下跌,多亏了联邦存款保险,价格才回升至1美元挂钩。

这场动荡导致了超1000亿美元的稳定币市场的重新洗牌,引发从USDC到离岸发行的Tether (USDT)的显著转变。这也标志着Tether和USDC之间的分歧越来越大,这一趋势将持续2023年一整年。银行业危机进一步影响了加密资产的流动性,扰乱了实时支付系统,如Silvergate Exchange Network和Signature Bank的Signet,因为这两家加密银行也被关闭了。

尽管面临诸多挑战,BTC和ETH在SVB危机后立即经历反弹。像比特币这样的数字无记名资产的核心特征——易于自我托管、缺乏中介和链上透明度——变得比以往任何时候都更加明显,这与2008年10月金融危机期间导致中本聪(Satoshi Nakamoto)推出比特币的最初情绪产生了共鸣。

这种势头延续到了第二季度,触发了机构共鸣,这些机构开始对比特币的独特品质表示出更大的肯定和欣赏。

Q2:9万亿美元的到来

自2013年以来,美国市场一直在寻求现货比特币ETF,美国证券交易委员会(SEC)一直拒绝向美国金融市场引入现货ETF产品的提议。现货ETF的重要意义在于,它有望为投资者提供一种熟悉的、可能更节税的方式,将比特币纳入他们的经纪账户和投资组合。21世纪初第一批黄金ETF(例如众所周知的GLD)的巨大影响力是许多人希望在比特币现货ETF上看到的。尽管美国证券交易委员会(SEC)在2021年为期货支持的比特币ETF开了绿灯,但这些产品并不适合长期持有,因为随着时间的推移,现货价格会出现严重的跟踪误差,此外还有高昂的手续费和应税分配。

但今年6月,事态迅速发生了变化,管理着超过9万亿美元资产的全球最大资产管理公司贝莱德(BlackRock)于6月15日申请成立iShares比特币信托。此举立即为围绕ETF的相关努力注入了新的合法性,贝莱德首席执行官Larry Fink承认比特币是一种可以“超越任何一种货币” 的全球资产。继贝莱德迈出大胆的一步后,富达(Fidelity)、WisdomTree、Bitwise、VanEck、Invesco、Valkyrie和ARK等之前的申请者也重新加入竞争,再一次点燃了比特币现货ETF的热潮,这表明机构对比特币的兴趣日益浓厚,并且认识到了比特币在多元化投资组合中的潜在作用。

Coinbase与贝莱德达成了重要的合作伙伴关系,作为贝莱德选中的ETF申请托管人,Coinbase成为了一个关键的加密原生盟友,但今年6月,美国证交会(SEC)也对这家领先的美国交易所提起了具有里程碑意义的诉讼。SEC指控Coinbase作为一家未注册的证券交易所运营,并将包括SOL、MATIC和ADA在内的各种资产标记为所谓的证券。这一举动使长期以来关于加密证券和商品之间区别的行业争论成为焦点。作为回应,Coinbase迅速采取行动反驳了这些指控,整个行业现在正准备迎接一个可能会极大影响美国数字资产行业未来发展轨迹的结果。

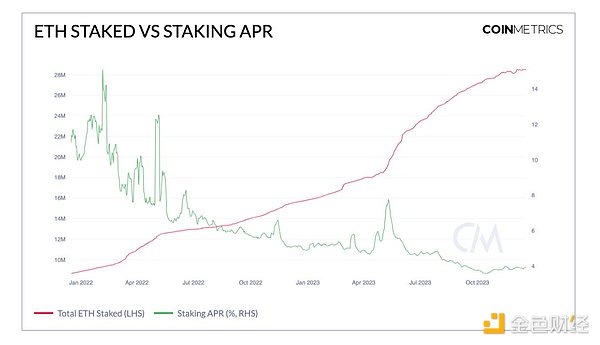

尽管有一些列这样那样的外部事件,有好有坏,但该行业在2023年继续向前发展,推进了关键的计划升级。4月份,以太坊完成了“Shapella”硬分叉,激活了质押ETH和验证者累积的质押奖励的提款功能。升级成功消除了之前与质押相关的流动性风险,并立即吸引了新一轮的质押存款激增,这一趋势将在2023年的大部分时间里持续下去。尽管目前的质押APR年利率徘徊在4%左右,但ETH质押量已达到2800万枚,略低于整个ETH供应量的四分之一。

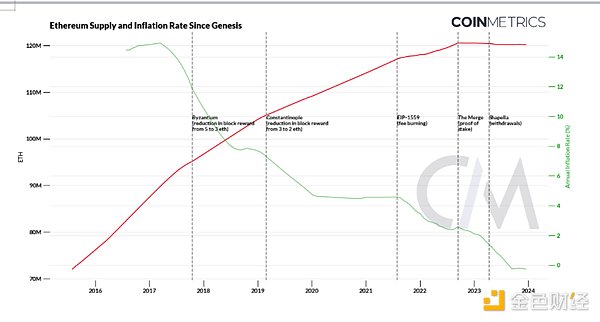

这次升级为质押ETH的以太坊验证者提供了急需的保证,以太坊从工作量证明转为权益证明系统的长达数年的旅程的最后一阶段完成了,主要是通过以太坊合并完成的,而且没有任何问题。合并后以太坊的发行量下降了90%,即使考虑到费用销毁(burning)相关因素,2023年也是以太坊供应量下降的第一个完整的一年。

Q3:Ripple案判决

2023年下半年的转变具有强化趋势,下半年取得了重大的法律胜利,金融机构的重新加入抗衡了前几个月的监管压力。

值得注意的是,Ripple在与美国证券交易委员会旷日持久的法律大战中取得了胜利,具有里程碑意义。7月13日,联邦地区法院发布部分简易判决,认定交易所的XRP二次销售不构成证券交易。这一裁决不仅维护了Ripple,还开创了一个先例,挑战了SEC对数字资产的分类方法,在整个行业引起巨大反响,并且影响了监管机构对其他被控为证券的数字资产的监管处理。

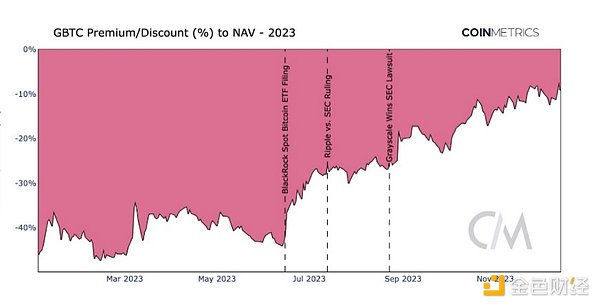

与这一法律分水岭同期出现的是Grayscale对战SEC的胜利,标志着另一个重要的转折点。该事件主要关于Grayscale试图将其比特币信托(GBTC)转换为现货比特币ETF,但SEC最初拒绝了这一申请。然而,8月29日,上诉法院推翻了这一决定,认为此否决是“武断的”,体现出SEC对类似产品的处理不一致,特别是考虑到比特币期货ETF的存在。这一胜利极大地推动了市场对比特币现货ETF发布的预期,这种情绪从比特币相对于其净资产价值(NAV)的折扣率从40%缩小至10%就可看出。

这些监管里程碑体现出美国证券交易委员会对加密货币监管的态度有所缓和,为加密货币更广泛的访问和发展成熟铺平了道路。与此同时,这种转变还强调了确立更明晰监管的必要性,尤其是在更具活力的离岸监管环境推动了阿联酋、香港、欧盟和英国等市场活动的情况下。

新产品的发布也增加了市场兴奋度,特别是激发了关于稳定币的热烈讨论,这是整个2023年的一个关键主题。PayPal和Visa等支付巨头也加入了这场竞争,前者在以太坊区块链上推出了PayPal USD (PYUSD),后者则推出了稳定币结算计划。美联储即时支付系统FedNow的推出,也重新点燃了围绕其对当前稳定币格局的潜在影响以及央行数字货币计划方向的讨论。

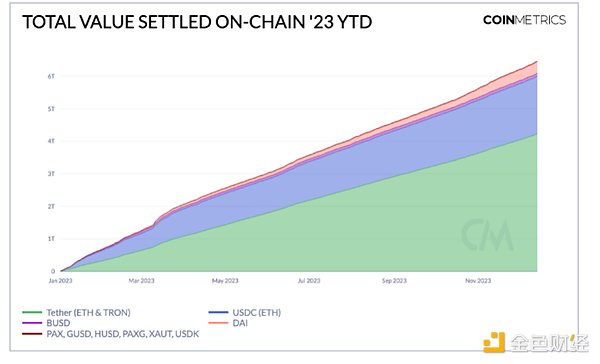

然而,FedNow的国内业务强调了稳定币的价值主张,稳定币作为全球交换媒介,促进了跨境支付,连接了链上和链下经济。这种切实的影响力在上图中明显可见,最大的法币支持稳定币USDT和USDC的结算额分别为4.2万亿美元和1.7万亿美元。这些发展,以及协议原生稳定币和计息稳定币等新进入者,描绘了稳定币在更广泛的金融生态中日益增长的多样性和不断发展的作用。

在稳定币领域之外,Coinbase的L2网络Base的推出引起了极大关注,并引发了该平台上新兴应用活动的浪潮。这标志着L2解决方案发展的关键一步(特别是在以太坊即将推出的EIP-4844升级的背景之下),旨在增强网络的可扩展性。尽管金融环境紧缩,以及像Curve Finance所经历的智能合约漏洞这样的行业特定事件带来了更多挑战,但第三季度为未来的增长奠定了重要基础。

Q4:准备起飞

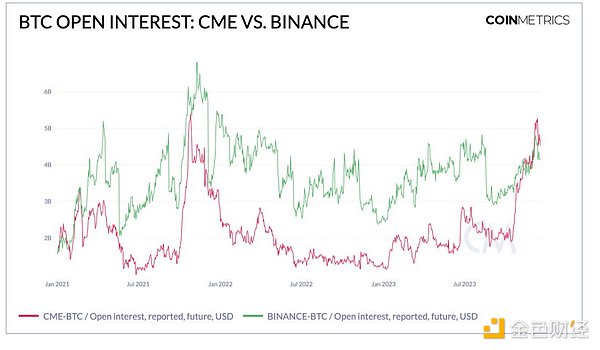

数字资产市场的复苏在第四季度展开,比特币飙升超50%,标志着市场情绪和估值的复苏。这一反弹是由机构兴趣上涨推动的,从芝加哥商品交易所(CME)比特币期货未平仓合约接近创纪录水平(超过50亿美元)就可看出这一点,芝加哥商品交易所是机构参与者喜欢的交易场所。这为比特币市场结构的发展演变提供了更清晰的佐证,因为投资者积极地准备迎接比特币现货ETF和下一次比特币减半的到来。伴随着衍生品市场活动的激增,现货交易量升至年度高点。供应趋势也加强了看涨预期,自由流通供应量达到2017年3月以来的最低水平,过去一年只有30%的比特币在流通,反映出坚定强劲的持有者群体。

这次反弹呈周期性方式扩大到比特币以外,提振了加密生态的其他领域。Grayscale信托产品的折扣率大幅减少,在某些情况下,GSOL和GLINK等产品的溢价在11月份分别达到了869%和250%。Alt L1区块链也经历了强劲的复苏,Solana (SOL)脱颖而出,因为它已从之前的FTX关联关系中脱离出来。活跃的社区、不断增长的应用程序生态和网络上的基础设施加强了Solana作为L1平台的可信度,并在数量不断壮大的模块化区块链和L2网络中引发了围绕单体区块链的讨论。这种飙升不仅仅局限于估值。链上活动也出现了反弹,比特币和以太坊网络的费用市场都有所上涨,而稳定币供应在经历了一段时间的下降后上涨,表明了流动性回归迹象。

这场审判最终以Sam Bankman Fried被定罪而告终,也为行业最动荡的一段时期画上了句号。与此同时,币安的和解涉及40亿美元的罚款和赵长鹏(CZ)的下台,结束了围绕这家最大交易所的长期指控。另一个未被注意到的重要公告是财务会计准则委员会(FASB)对加密会计准则的修改。这一改变将允许在资产负债表上持有数字资产的公司以“公允价值”确定资产,而不再将其视为无形资产,从而减少这些公司目前面临的摩擦,同时激励更大的所有权。例如,这将使Microstrategy (MSTR)(一家持仓超过17,500比特币的上市公司)在其资产负债表上按计量期间实现利润或亏损。

这些发展共同结束了笼罩该行业的不确定性篇章,为加密资产更加成熟和乐观的未来铺平了道路。

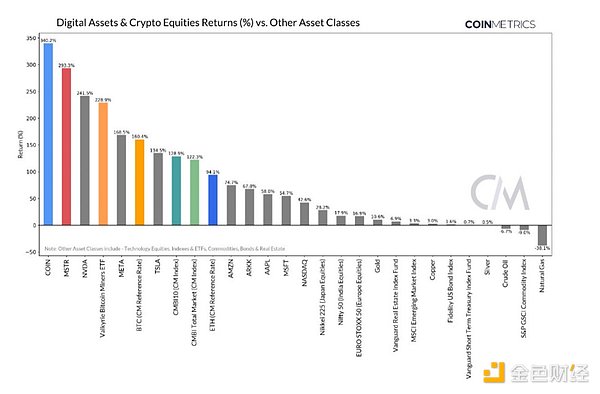

在十年来的高通胀、金融紧缩和地缘政治紧张局势加剧的背景下,数字资产市场一直在努力应对重大的宏观经济挑战。然而,利益相关者已经熟练地驾驭了这些复杂性,带来代币化国债和现实世界资产(RWA)等新领域的增长。我们回顾2023年可投资领域主要资产类别的回报,会发现数字资产的优势非常明显。加密相关股票和数字资产表现出色,Coinbase (COIN)是市场反弹的主要受益者。宏观经济趋势在接下来的几个月里可能发生变化,数字资产行业将进入成熟和扩展阶段。

This paper takes a data-driven perspective to review the important events that affected the digital asset industry in, and after a difficult year, it brought many positive developments to the whole ecosystem, such as the participation of new institutions and the upgrading of key technologies. Although the regulatory environment can be said to be the most challenging in history, especially in the United States, a round of confrontation should force some unresolved issues to become clearer, and the period of monetary tightening seems to be coming to an end. Cryptographic currency and stocks experienced a surge in 2008, and many digital assets more than doubled, including bitcoin, which rose in 2008. The following table shows that the performance of all assets with a market value of more than 100 million US dollars is choking. At the beginning of the year, under the shadow of the crash, the digital asset market improved rapidly. This growth will set the pace for the whole year. More and more people are beginning to think that the worst is over, and the collapse as a centralized entity has not tarnished the public. The core principles and potential of blockchain technology, however, a series of events at the beginning of this year also gave birth to a topic of great concern this year. The escalating regulatory pressure in the United States caused a series of law enforcement actions in the first quarter, which attracted the attention of the digital asset industry. For example, the US Securities and Exchange Commission issued a notice to the stable currency operators, which led to the suspension of issuance. In this year, the supply plummeted from the peak of $ billion to $ billion, and it was reduced by $ billion within one week after the notice was issued. It marks that American regulators have begun to take more extensive actions to curb the offshore exchange giant Bi 'an, which is the largest exchange in the world according to spot trading volume. In that month, the US Commodity Futures Trading Commission announced that Bi 'an and its founder Zhao Changpeng were suspected of multiple regulatory violations, and the onshore operators also had to accept new regulatory review. Many banks have been under increasing pressure since the first quarter. The regulatory authorities issued informal guidance documents to encrypt money and add it. Secret currency customers are listed as banking system risks, and some people in the industry even refer to these actions as operational bottlenecks. It can be said that it is a coordinated action led by the government to hinder the development of the digital asset industry in the United States. Looking at the macroeconomic environment, banks are beginning to face an ordinary but disturbing situation. In the environment of rapid interest rate rise, the depreciation of US Treasury bonds is most affected. The technology-friendly Silicon Valley Bank declared bankruptcy after a bank run in June, which not only triggered people's concern for Bank of America. Concerns about the health of the industry have also tested the stability of the stable currency. Thanks to the federal deposit insurance, the price of the reserve holding US$ 100 million once fell back to the US dollar peg. This turmoil led to the reshuffle of the stable currency market with over US$ 100 million, which also marked a significant shift from offshore issuance. This trend will continue throughout the year. The banking crisis further affected the liquidity of encrypted assets and disrupted the real-time payment system. Because these two crypto banks have also been closed, despite facing many challenges and experiencing a rebound immediately after the crisis, the core features of digital bearer assets such as Bitcoin are easy to be self-hosted, lack of intermediary and transparency on the chain have become more obvious than ever, which resonated with the initial emotions that led to the launch of Bitcoin in Satoshi Nakamoto during the financial crisis in September. This momentum continued to resonate with institutions in the second quarter, and these institutions began to show greater concern for the unique quality of Bitcoin. The US Securities and Exchange Commission has refused to introduce spot products to the US financial market since. The significance of spot is that it is expected to provide investors with a familiar and possibly more tax-saving way to incorporate bitcoin into their brokerage accounts and portfolios. For example, the first batch of gold at the beginning of the century is known to have great influence, which many people hope to see in the spot of bitcoin, despite the American certificate. The Securities and Exchange Commission gave the green light to futures-backed bitcoin in, but these products are not suitable for long-term holding, because there will be serious tracking errors in spot prices over time, in addition to high handling fees and taxable distribution. However, the situation changed rapidly this month, and BlackRock, the world's largest asset management company with assets of more than one trillion dollars, applied for the establishment of a bitcoin trust on, which immediately injected new legitimacy into the surrounding related efforts. Recognizing that bitcoin is a global asset that can surpass any currency, after BlackRock took a bold step, Fidelity and other applicants also re-entered the competition, once again igniting the craze of bitcoin spot, which shows that institutions are increasingly interested in bitcoin and realize the potential role of bitcoin in diversified portfolios, and have reached an important partnership with BlackRock, which has become a key original ally of encryption as the application custodian selected by BlackRock, but this month, The SEC has also filed a landmark lawsuit against this leading American exchange, accusing it of operating as an unregistered stock exchange and marking various assets, including and, as so-called securities. This move has focused the long-standing industry debate on the difference between encrypted securities and commodities, and responded by taking prompt action to refute these allegations. The whole industry is now preparing for a knot that may greatly affect the future development track of the American digital asset industry. Although there were some external events, the industry continued to develop and advanced a key plan upgrade in. In January, Ethereum completed a hard fork, which activated the pledge and the withdrawal function of the pledge reward accumulated by the verifier. The upgrade successfully eliminated the previous liquidity risk related to pledge and immediately attracted a new round of pledge deposits surge. This trend will continue for most of the year. Although the current annual interest rate of pledge hovers around, the pledge volume has reached 10,000. The upgrade is slightly less than a quarter of the total supply, which provides a much-needed guarantee for the pledged Ethereum verifiers. The last stage of Ethereum's multi-year journey from workload certification to equity certification system has been completed, mainly through the merger of Ethereum, and there is no problem. After the merger, the circulation of Ethereum has decreased, even considering the related factors of cost destruction, it is the first complete one-year case that the supply of Ethereum has decreased. The transformation in the second half of the year has a strengthening trend, and the second half of the year has achieved a major legal victory. The re-entry of financial institutions has counterbalanced the regulatory pressure in previous months. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。