Solana 二次翻红:高性能、营销和 DePIN

祭司神殿征战,是 Solana 的从前,和 FTX 好过爱过恨过离别过,靠着高性能、DePIN、DeFi 和以太坊平替,Solana 重新又回来了!

在整个L0/L1/L2公链竞争中,Solana 是仅次于以太坊的存在,我们能想到的一切赛道,Solana 都交出了 90 分以上的答卷,除了 ZK 和 L2,但是根据创始人 Anatoly 的说法,“Solana 本身就是超快的、超安全的公链,并不需要继续叠床架屋,基于 Solana 主网开发便已足够”。

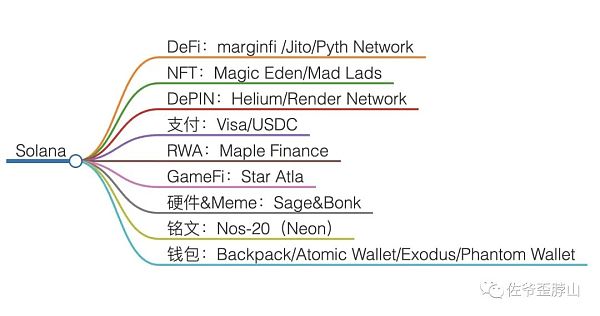

可以数一下 Solana 的战绩:

DeFi:marginfi /Jito/Pyth Network

NFT:Magic Eden/Mad Lads

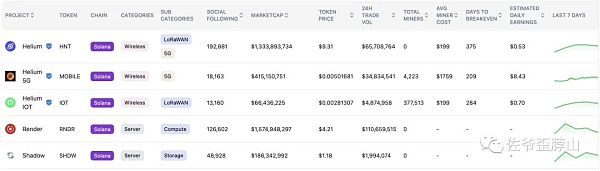

DePIN:Helium/Render Network

支付:Visa/USDC

RWA:Maple Finance

GameFi:Star Atla

硬件&Meme:Sage&Bonk

铭文:Nos-20(Neon)

钱包:Backpack/Atomic Wallet/Exodus/Phantom Wallet

Solana 不仅有老品牌,如 Magic Eden、Render Network,还有新势力 Jito 和 Bonk 等,甚至还有 Helium 这种老树开新芽的二次翻红产品。

在经历 FTX 震荡后的诸多项目中,Solana 不仅活了下来,还活的越来越好,2022 年 12 月,SOL 价格跌到 10 美元左右,不及 250 最高点的 4%,目前已经涨到 70 美元,相当于回血了三分之一。

性能极致路线,Solana 独家秘籍

打造了加密世界第二完整的生态系统,并且有隐约超越 EVM 生态圈的迹象,这是笔者对 Solana 的个人主观看法,这个印象最早不是从 Solana 生态繁荣得来,而是从 Mable Jiang 的后浪播客中感受而来,在播客中,Mable 说 Solana 创始团队很看重市值管理,草蛇灰线,无比真诚,愿意迎接币圈最底层的逻辑,这才是 Solana 的本色。

当然,顺着 Solana 的故事讲下去,Solana 的 POH(Proof of History,历史时间证明) 和宕机曾经一度让其成为加密圈笑话月经贴,时不时就要来一下。

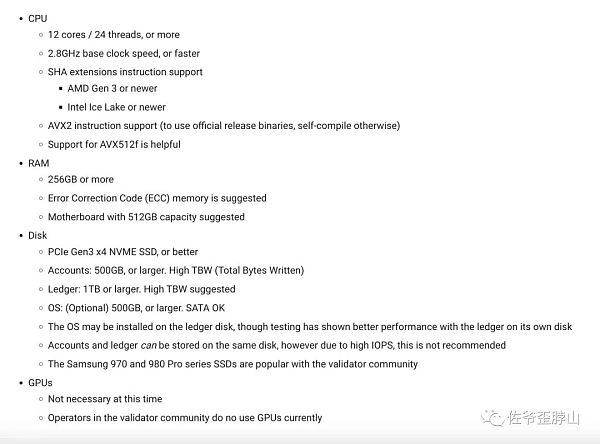

但是就像 Solana 能从最低点爬上来一样,每次宕机都能缓过来,得益于依靠物理时间验证区块状态,Solana 真正实现了性能极致路线,代价是“机房链”和不可拓展性。

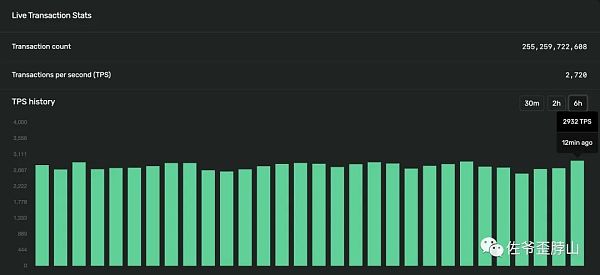

以太坊有 7000+ 的节点,而 Solana 不到 3000,但是以太坊的主网 TPS 只有 12~15 之间,Arbitrum One 能勉强突破 20,这时候就看到 Solana 的恐怖了,官方宣称 6.5 万,日常运行也有 2500-3000。

在这次铭文测试中,Solana 几乎是唯一扛得住人工 DDOS 的 Layer 1,比 Cosmos 系要强出不少,并且,在未来的 Firedancer 升级后,理论 TPS 能到 100 万+,日常 TPS 估计也能到 10 万+,这也是 Visa、DePIN 选择 Solana 的最主要因素。

展颜消宿怨:Solana 可堪回首的往事

我们不过多讨论价格,但是 Solana 能从 FTX 崩溃后挺过来,这件事本身就是奇迹。抛去凑字数的常规分析,我认为只有三点促成了 Solana 的抢救成功。

1.多点布局,生态守住下限。在突遭横祸后,Solana 受到冲击,Maple Finance 离开,Magic Eden 试水多链布局,但是市场都知道,这不是 Solana 的问题,并且 Solana 并不特别依赖某一项目,最终缓了过来;

一年后的 2023 年 12 月,Solana 流通市值不到 300 亿,约为以太坊的 10%,并且在 9 月份,SOL 交易量仅有 ETH 同期的 3%,也能看出来,Solana 是缓过来了,但是杀掉以太坊还属于梦里啥都有的状态。

2.软性联合,资本支持,自动锁仓,到点生效。Solana 和 FTX 不是 Binance 和 BSC 这样的交易所自研公链,而是外部生态联合,FTX 买的都是需要解锁期限的 SOL,只要不是立刻宣告死亡,那就有辗转腾挪的时间,Solana 的投资方是 a16z 和 Multicoin 这些顶级资本,融资 3 亿美元,他们不会干看着 SOL 直接归零,能抢救总会抢救一下。

3.对 Mass Adaption 的不可替代性,尤其是 DePIN 和 Web2 应用。这一点被很多人忽略,Solana 成功撑住了 STEPN 的需求,这也是 Web3 真正出圈了一把的项目,值得一提的是,Mable 也曾在 STEPN 任职,全都连起来了。

而最早认识到 Solana 对 DePIN 的重要性,并不是 Mobile 暴涨的今天,而是 Render network 准备从 Polygon 迁往 Solana,这是 3 月的提案,那时候 Solana 并不被人看好,在 RNDR 社区也引起激烈争论,那个时候,我就感觉,Solana 对于 DePIN 之类项目重要性无法被取代。

DePIN 这类项目,不同于高价值的 DeFi 应用,更接近于传统的边缘计算等 IoT(物联网)概念,更看重稳定和低价,Solana 天然在同步速度上具备优势,以目前最火的 Helium 为例,IoT 数量达 30 万以上,5G 设备也有 3000 以上,大量硬件的调配只有 Solana 能满足。

营销至上,Meme 和 DeFi 同频

Solana 其实是很特别的公链,一方面,LSD 等高大上的 DeFi 项目,如 Jito 等经济机制很巧妙;另一方面,我在很长时间内无法理解为什么要做手机,而且是粗制滥造的公模机,现在Solana 竟然用 Bonk 作为手机营销手段,用 Helium 做移动套餐。

Bonk:Web 3 营销手法,以前的你对 Meme 和 Sage 爱答不理,现在直接卖断货,硬件设备会持续产生使用时长,这在 Web3 里独一无二;

Helium:廉价版移动套餐,在美国运营商极端强势的情况下,来自 Web3 世界的套餐靠的是价格战,并且本身还能升值,可以预感传统用户会受到一点小小的 Web3 震撼;

dApp:手续费和 DeFi 推广内置在 Sage 之内,摆脱 Web3 无效内卷,让传统老钱来接盘,这就叫格局。

反正 Solana 这类项目最好的定义不是公链,而是一种文艺气质的商品,以前只有苹果等硬件起家的硅谷公司能玩得转,Solana 和谷歌、微软类似,都希望从软件切入,谷歌的 Pixel 不能算失败,只能说不成功,微软是实打实失败,Solana 能突破这个魔咒吗?

单纯靠 Meme/NFT/旁氏流量套餐迟早是不行的,但是 Solana 会玩出什么新花样确实值得期待。

危险预测,SOL 能超越以太坊吗

如果认为,SOL 是下一个以太坊,那么目前两者差距在 10 倍左右,那么 SOL 能涨到 700 美元,但是世界不是决定论的、也不是线性的,EVM 生态包含了一条3000 亿的主网公链,十几条 L2,数十条兼容 EVM 链,1600+的常用 dapp,数百万的活跃用户。

而 SOL 目前只有自己,这注定是条艰难的路,但是在以太坊之外提供第二种选择,这本身就是一种独特性。

It's better to fight in the Temple of Priests than to love and hate to leave, and it's second only to the existence of Ethereum in the whole public chain competition. All the tracks we can think of have handed over more than points of answers except and, according to the founder, the super-fast and super-safe public chain itself doesn't need to continue to overlap, and the development based on the main network is enough to count the achievements. There are not only old brands such as wallets, but also new ones. Power and equality, and even this kind of twice-turned-red product, which has sprouted from old trees, not only survived in many projects after the shock, but also survived better and better. The monthly price fell to about US dollars, which is less than the highest point. At present, it has risen to US dollars, which is equivalent to returning one third of the blood. The exclusive cheats have created the second complete ecosystem in the encrypted world and there are signs of vaguely surpassing the ecosystem. This is the author's personal subjective view. This impression is not from the ecological prosperity at first, but from it. I feel from Houlang Podcast that the founding team attaches great importance to market value management, and the grass snake gray line is extremely sincere and willing to meet the logic at the bottom of the currency circle. This is the true color. Of course, the historical time proof and downtime that followed the story once made it a joke in the encryption circle, but it is like climbing from the lowest point. Every downtime can be slowed down, thanks to relying on physical time to verify the block state and truly realize the ultimate performance. The price of the route is the computer room chain and The inextensible configuration requires that there are nodes in the Ethereum, but the main network of the Ethereum can barely break through the horror seen at this time. The official claims that the daily operation is almost the only one in this inscription test, which is much better than the system, and the theory can reach 10,000 in the future after the upgrade. This is also the most important factor to choose. We can look back on the past without much discussion on the price, but we can survive the crash. The body is a miracle. I think only three points contributed to the successful rescue. The lower limit of multi-point layout and ecological protection was impacted after the sudden disaster. However, the market knows that this is not a problem and does not rely on a certain project to finally slow down. After one year, the monthly circulation market value is less than 100 million, and the monthly transaction volume is only the same period. It can be seen that it has slowed down, but killing the Ethereum is still a soft state with everything in the dream. Joint capital supports automatic warehouse locking to take effect, and it is necessary to unlock the goods jointly bought by external ecology instead of self-developed public chain with such exchanges. As long as it is not immediately declared dead, investors will have time to toss and turn. They will not just wait for the direct return to zero to rescue the irreplaceable unlocking countdown pair, especially the demand that many people ignore and successfully support it. This is also a truly circled item. It is worth mentioning that all of them were connected when they were in office, and they were the first to realize that the importance of right is not soaring today, but the proposal to move from this month was not optimistic at that time, and it also caused heated debates in the community. At that time, I felt that the importance of such projects could not be replaced, and switching to such projects was different from high-value applications, closer to traditional edge computing and other concepts of the Internet of Things, paying more attention to stability and low price, and naturally having an advantage in synchronization speed, with the most popular at present. For example, there are more than 10,000 devices with more than a large number of hardware configurations. It is actually a very special public chain only if it can meet the requirements of marketing supremacy and the same frequency. On the one hand, the economic mechanism of such tall projects is very clever. On the other hand, I can't understand why I want to make a mobile phone for a long time, and it is a shoddy public model machine. Now it is actually used as a mobile phone marketing method and a mobile package marketing method. You ignored your love before, and now selling out of stock hardware devices directly will continue to produce a long service life, which is unique in the company. In the case of extremely strong American operators, the packages from all over the world rely on price wars and can appreciate in itself. It can be predicted that traditional users will be slightly shocked, and the fees and promotion will be built in to get rid of the invalid involution and let the traditional old money take over the offer. This is called the pattern. Anyway, the best definition of such projects is not a public chain, but a kind of literary and artistic commodity. In the past, only Silicon Valley companies that started with hardware such as Apple could play well, and they all hoped to start with software. It's not a failure to cut into Google, but it can only be said that Microsoft is a real failure. Can it break through this spell? It's not possible to rely solely on Ponzi's traffic package sooner or later, but what new tricks will be played? It's really worth looking forward to. If it's the next Ethereum, then the gap between the two is about times, so it can rise to US dollars. But the world is not deterministic or linear. It contains a billion main network, public chains, dozens of compatible chains, and millions of active users. At present, it is doomed to be a difficult road, but providing a second choice 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。