Helium 之前的 DePIN 往事 比特币、Arweave 和 STEPN

Helium 之前的 DePIN 往事,比特币、Arweave 和 STEPN

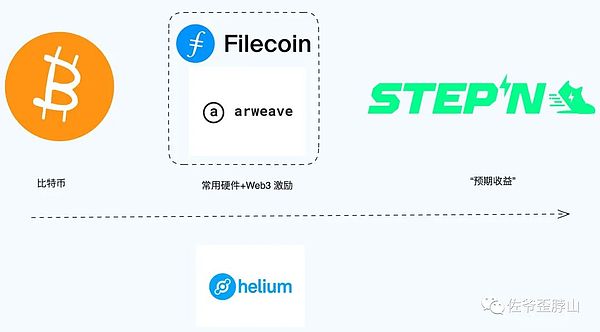

Helium 代表着专用的 DePIN 叙事,但是在此之前,至少还有三种重要贡献,它们将和专用硬件一道,构成下一个 DePIN 叙事的主要部分。

物理硬件的神圣性:比特币和 PoW 机制

FIL&AR:普通硬件+ Web3 激励层

STEPN:出圈机制+“预期现金流折现”售卖机制

Messari 追封:考古 DePIN 之名由来

Helium 重新发际并不是 12 月,而是 7 月份上线 Coinbase,在此之前,DePIN 受到一些市场关注,但 Helium 已经被币价下跌和矿工轮番控诉过多次,旁氏的感觉一如既往的重。

在今天,谈论 Helium 离不开 5G 移动套餐,这成功吸引了有真实需求的用户,而非单纯将其视为一种金融游戏,足够的用户形成足够多的持币群体,才能压住抛售带来的倾轧,传闻中的火星人跟孙哥换币被割,本质上也是抛售和挤兑的变种。

类比于 StepN 和各类 X2E 的关系,是先有的 “IoT/ICT/AIoT + 链改”项目,才有的 DePIN(去中心化物理基础设施)之名,而 Helium 起到的是承上启下的作用,如果 Helium 就此沦亡,那么 DePIN 也难翻身,但是 Helium 鲤鱼打挺越活越精神,那么后来者只需要略加改进便能生存:

微创新:在项目龙头 Helium 的基础上改进,如 WIFI 之于 5G,卫星之于地面;

换场景:照搬 Helium 模式,但是切换至不同领域,比如 VPP(虚拟电厂)Starpower、绿色能源 Arkreen 皆是如此。

考古完 DePIN 的名字,还需继续追封实在的项目,DePIN 最重要的是硬件,而不是区块链(软件),所以粗暴划分,有硬件还有链的都算上:

2007/8/9:比特币各类矿机成型,从个人 CPU 一路发展到 ASIC 等,奠定了耗电大户的美名~

2014:Filecoin 模式问世,逐步开始吸引华强北,价格一路攀升,跟最初设计的数据存储关系越来越小,跟挖矿赚币关系越来越大;

2017:IoTeX 成立,当然,在当时众多公链中不算突出,更多是一种链改狂潮时代的余韵,现在能被提起纯纯是歪打正着;

2021:Helium 达到 ATH,50 美元的高位,虽然不及同时代的以太坊,但是现在能跟以太坊拿出来比,就知道这多可怕;

2022 年底,Messari 开始封神,DePIN 之名算是被正式定下。

Messari 将其分为服务器网络、无线网络、传感器网络、能源网络四大板块,基本上是链下数据生成结合链上数据确认两大模块,核心是确权和规模效应,对于匿名、去中心化和极端“全链运行”的要求并不高。

并且,里面的分类过于庞杂,比如去中心化数据库(DDB),虽然底层也会涉及硬盘,但是现代数据库跟底层硬件的关系解耦已经非常严重,强行归类,严重怀疑有凑字数之嫌。

如果让我来分,DePIN 要满足两个要求,第一种是定制专用硬件,比如 Helium ;第二种是专用激励层,将常用硬件转化或加入为 Web3 网络,比如 Render Network,将个人闲置 GPU 组网出售给他人。

物理硬件的神圣性

比特币虽然常年被外部指责为耗电,但是反向来想,这有一种基础定价的基准效应,消耗的电力,便是燃烧的文明,一度电是一束光,照耀比特币的价值。

在以太坊转型 PoS 之时,争论便日益浓重,环保不仅正确,而且政治正确,但是 PoW(特指物理硬件的工作量)具备 PoS 无法产生的优势——和现实世界的物理联系,并且可以迁移的联系。

OFAC 虽然并不一定能控制住以太坊网络,但是 OFAC 一定不能控制比特币网络,这就是两者的差距。我将其称为物理硬件的神圣性,在虚拟化技术当道之下,也只有比特币还能坚持。

Arweave&FIL:长期主义 VS 短期爆炒

其次是对 FIL&Arweave 基于现有物理硬件创造激励层的伟大魔力认可,FIL 的疯狂自不必多说,如果对此有兴趣,可以找个矿工讲讲一把辛酸泪,被 FIL 反复收割的悲惨历史。

Arweave 的重要性则长期未被市场认可,在我看来,AR 代表着一种不太成功的项目也能活下去的经典模式,虽然 AR 近期因为内战上了下头条,但是从节点数量、网络规模和存储数据上,都和 FIL 有数量级的差异,但是 AR 却能持续的生存下去,本质上是因为目前的 Web3 仍旧是小众需求+大量热钱的虚幻之境,维持成本并不高。

只要项目方不是穷奢极欲,大部分项目,尤其是公链级项目,活下去本身不难。

难的是出圈,在这一点上,Helium 成功“收割”过一波老矿工,现在火的是Helium 5G ,并不是最早的Helium WIFI 模式,而能做到出圈到 Web 2 的,除了比特币,恐怕只有一个 STEPN,STEPN 和 DePIN 以及 比特币矿机类似,都是“预期现金流折现 +硬件标的”,区别无非是矿机还是鞋的区别。

但有个道理是通用的,DePIN 矿机 99 美元,999 美元,9999 美元的定价肯定不是因为华强北的技术含量高,而是矿工预计未来回本周期短或被动收益很长,这和 STEPN 的模式不是类似,而是完全一致,但是 STEPN 有一点是专用 DePIN 硬件不同:健身不仅是 Web3 人群需求,这在全球都是大市场,哪怕没有收益,也会有健身需求:

STEPN:健身市场,日常健身外额外提供激励

专用 DePIN:Web3 矿工市场,挖了币只能卖,硬件只能干一件事;

通用硬件+额外激励:能炒叫 FIL,慢慢来叫 Arweave。

这里并非是推崇某种模式,而是说“在矿工参与之前,自己想明白,除了炒和挖,你的需求是什么”,如果真的有健身需求,那么现在参与 STEPN 都不晚,如果花 $999 买 Web3 WIFI,那危险是自己的,因为正常人不会这么干。

Bitcoin and the previous events represent a special narrative, but before that, there are at least three important contributions, which will form the main part of the next narrative together with the special hardware. Bitcoin and the mechanism of physical hardware are sacred, and the mechanism of ordinary hardware incentives emerge in circles. The mechanism of expected cash flow discounting and sales is pursued. The origin of the archaeological name is not a month, but a month. Before that, it received some market attention, but it has been repeatedly accused by the currency price drop and miners. The most important thing in today's discussion is that we can't leave the mobile package, which has successfully attracted users with real needs rather than simply regarded it as a financial game. Enough users can form enough money-holding groups to suppress the dumping caused by selling. The rumored exchange of money between Martians and Sun Ge is essentially a variant of selling and running. Analogously, the relationship with various types is the name of decentralized physical infrastructure that existed in the previous chain reform project, and it plays a connecting role. If it dies, it will be difficult to turn it over. However, the carp is getting more alive and more energetic, so the latecomers can survive only with a little improvement. Micro-innovation is improved on the basis of the project leader, such as changing the scene from satellite to the ground, but switching to different fields, such as virtual power plants and green energy. The name of the archaeological project needs to continue to be sealed. The most important thing is hardware rather than blockchain software, so the rough division of hardware and chains is counted as bitcoin, and all kinds of mining machines have developed from individuals to others, which has laid a foundation for consumption. The appearance of the reputation model of a big electricity company gradually began to attract the price of Huaqiang North to climb all the way. The relationship between it and the original data storage is getting smaller and smaller, and the relationship between it and the mining and making money is getting bigger and bigger. Of course, it was not prominent in many public chains at that time, but it was more a lingering charm of the era of chain reform frenzy. Now it can be mentioned that purity is not as high as the dollar, although it is not as good as the contemporary Ethereum, but now it can be compared with Ethereum to know how terrible it is. For the server network, wireless network, sensor network and energy network, the four major modules are basically data generation under the chain and data confirmation on the chain. The core of the two modules is confirmation of rights and scale effect. The requirements for anonymous decentralization and extreme full-chain operation are not high, and the classification inside is too complicated. For example, although the decentralized database will also involve hard disks at the bottom, the relationship between modern databases and the underlying hardware has been seriously decoupled, and it is seriously suspected that there are too many words to collect. There are two requirements. The first one is to customize special hardware, for example, the second one is to use special incentive layer to convert or join common hardware into a network, for example, to sell personal idle networking to others. Although Bitcoin has been accused of power consumption by the outside world all the year round, on the contrary, it has a benchmark effect of basic pricing. The power consumed is a burning civilization. At one time, electricity was a beam of light, and the debate became increasingly strong during the transformation of Ethereum. Environmental protection is not only correct but also politically correct. In particular, the workload of physical hardware has the advantages that cannot be generated and the physical connection in the real world and the connection that can be migrated. Although it may not control the Ethereum network, it must not control the Bitcoin network. This is the gap between the two. I call it the sacredness of physical hardware. Under the prevailing virtualization technology, only Bitcoin can persist in long-term short-term speculation, followed by the madness of recognizing the great magic of creating incentives based on existing physical hardware. Needless to say, if this is the case, If you are interested, you can talk to a miner about the tragic history of repeated harvesting of bitter tears, but the importance has not been recognized by the market for a long time. In my opinion, it represents a classic model that a less successful project can survive. Although it has made headlines recently because of the civil war, there are orders of magnitude differences in the number of nodes, the scale of the network and the stored data, but it can continue to survive. Essentially, it is still an illusory environment where a small number of people need a lot of hot money. As long as the maintenance cost of the project is not high. It is not difficult for most projects, especially public chain-level projects, to survive. At this point, it is not difficult to harvest a wave of old miners. Now it is not the earliest model, but I am afraid there is only one that can be circled except Bitcoin, which is similar to Bitcoin mining machines. The difference between the expected cash flow discount hardware targets is nothing more than the difference between mining machines and shoes, but there is a truth that the pricing of universal mining machines is definitely not because of the high technical content of Huaqiang North. However, the miners expect that the future return period will be short or the passive income will be long, which is not similar to the model, but it is completely consistent. But one thing is that different fitness for special hardware is not only the demand of the crowd. This is a big market all over the world, and even if there is no income, there will be fitness demand. The fitness market will provide extra incentives for daily fitness. The special miners' market can only sell hardware and do one thing. The extra incentives for general hardware can be called slowly. This is not to admire a certain model, but to say that they want to do it before miners participate. Understand what your needs are except speculation and digging. If you really have fitness needs, it's never too late to participate. If you spend money on it, the danger is your own, because normal people don't do it. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。