加密行业复盘及展望:2024年哪些赛道值得关注?

撰文:Zixi.eth,321 DAO成员 来源:X,@Zixi41620514

延续我在去年12月写的文章,我们再开一篇文章来总结一下2023年发生了什么,并展望一下2024年的未来。2023年是一个从低开高走,二级市场不断往上攀升的过程,但同时一级市场继续冷清,给我的感觉是一级市场可能比2022年还要冷清。这可能来源于:

1.一级市场滞后于二级市场半年左右,新的创业者还没进场;

2.老的创业者不断流逝(做AI去了);

3.新故事极度缺乏,目前市场上的故事大多都是老故事炒现饭。

整篇文章和去年一样,分为三个部分,主要讲解今年看好的什么被打脸了,明年看好什么以及明年需要观察什么。

1.今年看好的什么被打脸了?

1.1 开发者工具——天下攘攘皆为利往

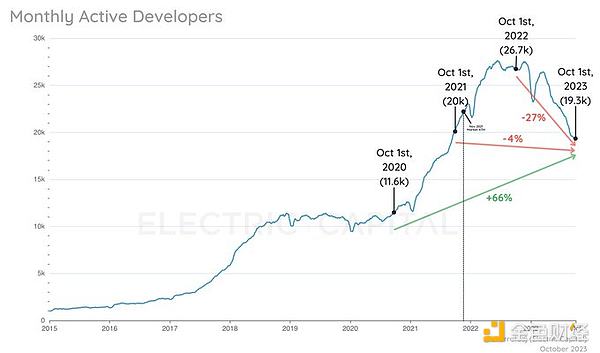

相比2022年同期,crypto MAD同比下跌了27%,但是值得庆幸的是,相对于两年前还是有66%的增长。受限于新开发者的减少以及老项目的流失,今年开发者工具市场市场规模出现了一定的下滑。此外,由于AI的一级市场在北美和中国市场实在是太好了,不少工程师选择了加入AI掘金。

因此整体来看,今年的开发者工具市场规模出现了一定的下滑。这在Alchemy的一级半市场估值中有所体现——相对于105亿美金的上轮估值,目前估值仅有30亿美金左右。Consensys的70亿美金估值,现在一级半也只有30亿左右。 但这个市场我们在2024-2025年还是富有信心。

我们也看到了国内开发者工具数据的增长,例如Chainbase平台上去年的开发者人数为800,今年12月增长至6000。作为开发者进入的最直接受益赛道,假如24-25年会是下一个牛市,那么开发者工具赛道的增量在24-25年会非常显著。而且我也相信,在24-25年会出现一系列的开发者工具的MA机会。

1.2 NFT——除了PFP,它还可以是什么?

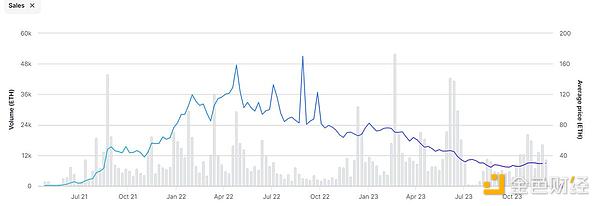

传统的PFP的故事已经很难让大家买单了。下图是BAYC的最近一两年的价格走向。在2022年Yugalabs还推出了APE+猴地的组合拳,让市场fomo一时。但是今年的NFT市场非常冷清,大户已经很难再来为NFT支付几万几十万美金。此外Azuki也让市场再寒心一波,今年推出的AZuki Elemental等也相当于直接复制粘贴一键生成就开始印钱,很难感受到团队的走心。

但值得注意的是,今年的NFT市场还是有一些有意思的项目出现,例如小企鹅走NFT+线下玩具的路线,确实获得了北美市场的一致好评,让我们看到了pfp NFT的新路线。

虽然NFT今年处于热度不断下降的趋势,但是我们也看到了NFT除了PFP以外的用途,例如实体+NFT的商业价值(李宁/adidas+猴子),品牌pass卡(星巴克),歌剧/演唱会ticketing等。NFT在明年后年可能会逐渐演变成传统行业的一种“技术”。

2.明年看好什么?

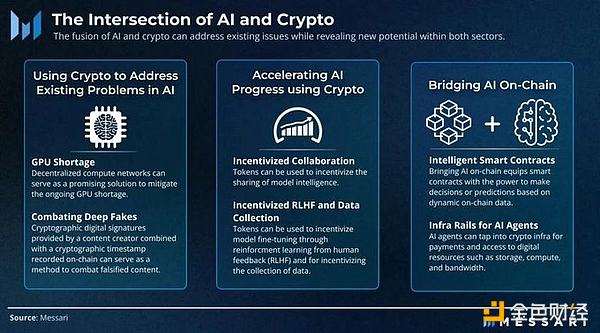

2.1 AI+Crypto——2B还是2C?

先摆一个有意思的观点,假如2024-2025有牛市,我们将会看到一定量2C的游戏/社交/C.AI/Chatbot类web2 AI项目走上web3发币的道路。这个观点是来源于我们今年看到的不少2C的AI项目本身的同质化比较高,收入天花板相对不高,并且受限于现在算力成本逐渐高昂,利润表很难打平,拿到了投资人的资金后,也要考虑退出的渠道。

当收入/玩法/增长出现停滞后,其实发Utility token增加玩法是一个可以考虑的idea——一方面发token拉盘就是一个很好的mkt策略,其次也可以带web2的用户进场(现在钱包和账户抽象的技术已经发展的不错了),所以可能是一个web2/3双赢的方式。此外,这批AI 2C创业者也非常年轻,对新鲜事物的接受程度很高,也是有可能促成这一点的原因。

言归正题,我把crypto+AI简单分成2C和2B两类。2C的类似于Myshell,NFprompt,Worldcoin等,2B的更多,例如Modulus Labs,ChainML,EZKL,Questlab, http://Flock.ai, Gensyn等。2C的AI产品不赘述,不管是游戏还是http://C.AI类的产品在web2都已经验证了成功,在web3中我们也看到了。

Myshell类似的语音机器人社区在蓬勃发展。因为Crypto+AI还是早期,因此目前还是以2B为主,例如服务项目方,给他们做链上Agent;服务项目方和公司,来做ZKML验证;服务LLM/Text to Video模型或者是AI related的公司,众包做数据标注等等。

2B的AI公司还有一个有意思的点,尤其是数据和算力侧,均是平台型业务——上游是算力/数据标注的需求方(例如各种模型公司),中游是算力/数据标注的分发平台,下游是各种大中小C。区块链通过奖励机制将下游的长尾散户调度起来,但目前看下来,数据标注的调度更容易实现,团队也BD到众多大模型公司的标注单子。算力的调度很难,尤其是涉及到大范围的异构GPU调度。

我们在2B的众多方向都看到了项目的茁壮成长,也期待各位AI+Crypto在明年业务和发币的表现。

2.2 监管合规——机构进场了

监管合规是个永恒的主题,其实今年年底涨幅很大一部分是来源于大家对于Blackrock BTC ETF的通过pricein,最近一个多月的涨幅就已经很好的证明了——“光是想像传统资金能有一部分进场,就能有很大的增长”。

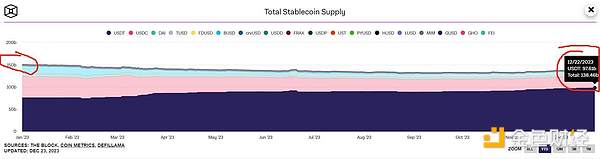

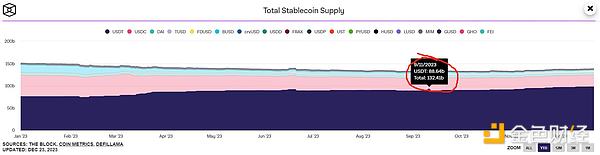

23年年初稳定币市值1500亿美金,23年9月是稳定币近一两年最少的时候,市值1324亿美金,市场流出了近180亿美金。但是BTC从17000美金涨到了26000美金,这意味着主流资金撤退,市场上的流动性从山寨土狗吸血到了比特币。但是在今年9-12月,稳定币在3个月只流入了40亿美金,BTC就从26000涨到了44000。

我们假设传统资金进场的不多(毕竟传统资金都觉得区块链要骗局了,一级市场都没怎么投资了),那么这部分钱就可能是币圈老人+知道ETF的传统资金老鼠仓拉盘。那么BTC ETF一旦通过,市场一年两年再流入主流机构的100亿美金200亿美金,那么crypto能涨到多少?这里的分析等到2024年年终总结再复盘。

有几个主题我认为是很好的监管合规相关:

1.稳定币 2.交易所(Onchain/Offchain,especially for Perpetual) 3.资管。这部分不再赘述。

2.3 DePIN——如何用Crypto做分发

最近看了很多有趣的项目,其中要属DePIN最有意思。可以总结为,XX+Crypto。XX是主营业务,Crypto是分发手段。例如Helium的主营业务是Wifi,Crypto/token是分发手段;Hivemapper的主营业务是用户拿地图数据喂给需要数据的供应商,但是利用Crypto来做分发;Questlab的主营业务是帮助有数据需求的AI公司做数据标注,只不过是用Crypto来分发。为什么要用Crypto做分发?我认为这和交易/炒币的逻辑一样,与其直接告诉用户一年能赚100块,不如给用户一个觉得能赚钱的希望。而且用Token做结算手段能比现金更方便,尤其是在更广泛的用户的跨境结算上。

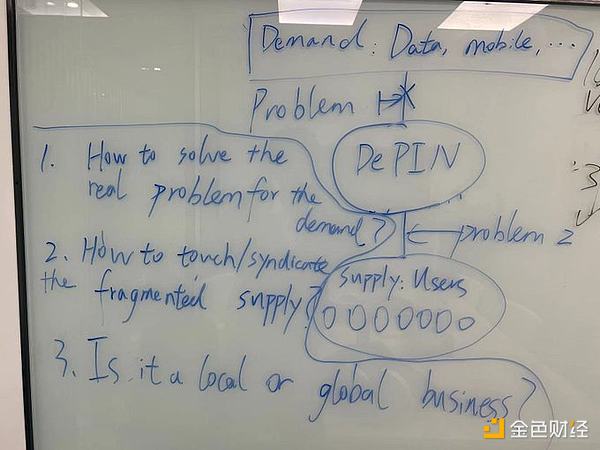

要做好一个DePIN项目,我分为灵魂三大问。

第一大问是,上游的真实需求存在什么问题?例如在Helium和Helium mobile中真实需求就是通讯数据很贵,而且信号不好,铺好4G5G基站要花很多钱,老美没有一个中心化的大公司能做类似的事情,所以我们需要去中心化的铺开;数据标注是AI公司的真实需求,需要有人来帮忙解决数据标注的问题;渲染是真实的需求,所以需要闲置的GPU来做离线渲染;推理和训练也是真实的AI需求,因此需要闲置算力为AI公司服务。

第二大问是,如何接触并且让这些碎片化的资源能够syndicate起来,接到DePIN平台,来为B端服务。快速地推C端在之前其实是很难得问题,在传统的web2生意中,例如电商,社区团购,打车等,本质都是烧VC的钱去做增长地推。但在Web3中,就变成了ponzi来做增长地推,社区靠ponzi(其实就是烧后面的人的钱)来替代烧VC的钱来做增长,这已经在Axie/YGG/Stepn/Helium等众多案例中已经是成熟的模式。

此外,对于接触下游来说,越是简单的产品,越容易接触,例如在网上打游戏GameFi,跑步Stepn,数据标注,装个智能插座等都是很简单的事情;但如果要把一个原本生活中没有的东西来做推广,例如在家装个信号盒,就会相对难一些。

对于如何syndicate下游来对接上游需求,有的是相对简单用调度学的方式解决,比如离线渲染,数据标注,带宽爬虫等;但有一些复杂的上游需求,比如异构GPU的调度推理/训练等,就是很难实现的。

第三大问是,这是一个Local还是Global的生意?这方面就不多解释了,Global的生意触达B和C的手段会更快,Local的生意触达会更慢,这就反映在最后能有多少用户和多少需求,以及最后项目能做到多大。

3.明年观察什么

3.1 GameFi√/SocialFi?

首先要理解Crypto和token市值,是一个很好的情绪放大器,也是一个很好的Mkt tool。

在2022/2023年我们看到了东西方都有很不错的团队在下场做游戏,例如东方有Funplus/Xterio,Matr1x等,西方也有bigtime。再加上12月22日突发的网络游戏意见稿,我相信这会(强迫)帮助东方的游戏创业者出海。对于Web3 Game是一个非常大的利好。我们很期待在2024年能否再次看到Axie/Stepn类的东方现象级别的游戏产品。

我们之前讨论过,社交产品可能不适宜做web3,因为社交网络在web2已经非常固化,大家不需要重塑社交关系。但今年http://Friend.tech给出了非常好的玩法,交易朋友的Key,其实和IEO发铭文发资产没什么区别(都是盘子)。在web3社交这块我们还是持相对保守的态度。

3.2 L2——内忧外患

2022年的Infra主题叙事就是Modular blockchain,大家看好execution, consensys, settlement和DA的可组合型。并且在2020-2022年,L2的技术壁垒确实很高,所以Arbitrum,Op以及几大ZK项目的估值非常高。还记得2021年在分析L2时,我们觉得参考L1的发展,生态的先发优势非常重要,因此会在3-5年先看好OP L2,但后面由于技术迭代未来几年还是看好ZK L2。

但是技术的迭代貌似远远超乎我们预期,OP Stack可以一键发OP L2;现在的Rollup as a service公司甚至能一键发ZK L2,可组合性非常高,因此L2开发壁垒目前很低。22年还只能说出4个ZK L2,现在23年市场上至少有10多家ZK L2,还有至少5家以上的RAAS公司,L2的厮杀在2024年将会非常惨烈。甚至Blur/Blast还告诉VC以及散户,NFT Mktplace不仅可以吸血鬼攻击Opensea,还tm能攻击其他L2。

此外,现在还能存活的EVM Competitor都有一技之长,例如Tron做支付,BSC做游戏,Solana有DePIN。未来L2如何在内部厮杀中胜出,也如何在外部和EVM Competitor竞争,将会是非常非常残酷的战役。可能不弱于百团大战,电商大战,大模型大战。

现在已经不再是2020/2021年,公链的技术壁垒已经低了很多。2024年已经不再是公链主宰的环境,头部Dapp可以随便挑头部公链,但是头部公链很难选择头部DAPP(除非砸钱)。目前公链验证的生态路径是:发挥自己的特长,走别人从来没走过的路,不能copycat,只有发挥特长才能差异化竞争胜出。

3.3 比特币生态——是价值回归,还是泡沫?

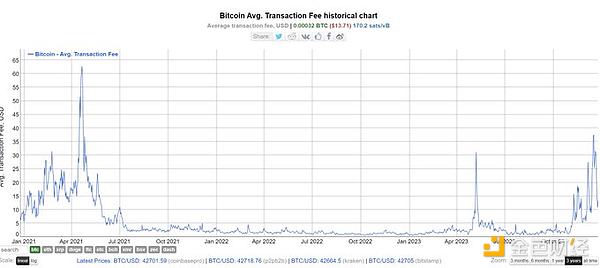

首先我非常认可新加坡某位前辈的观点:比特币资金1%的溢出,都会造成一个巨大的生态,并且由于比特币网络卡顿,导致资金溢出的速度和效应会更大。

2023年我们看到比特币生态的狂欢,比特币生态一年确实也走过了以太坊生态四年的老路。但是是否真的能做出独特的生态,而不是复刻以太坊的老路(DeFi三件套+预言机+发meme)?对于机构还需要观察,对于个人可梭。

今年市场主打一个触底反弹,在今年9月token2049结束的时候,我都感觉行业快完了,尤其是投完了一遍ai+crypto后,都很难看到有意义的新故事了。但是10月以后市场回暖,以涨服人又给大家带回来了信心。

其实仔细想想,这个市场已经在2022-2023发生了太多的迭代,DeFi市场中dex从现货逐渐过渡到了衍生品,并且机构越来越接受DeFi;游戏市场中web2大厂下海的开发者已经基本研发完毕,2024年将开始发行;L2已经攻克了很多技术难度,我们已经可以一键发OP和ZK L2;AI+Crypto也有很多市场可以来做,例如数据,算力;社交也出现了http://Friend.tech;比特币生态也有不少的开发者涌入;Solana涅槃再生,depin发展迅速。

2024可能会比2020/2021的牛市更精彩。明年的文章再继续更新。

The source of the author continues the article I wrote last month. Let's open another article to summarize what happened in 2008 and look forward to the future of 2008. The secondary market is going from low to high, but at the same time, the primary market continues to be cold and cheerless, which gives me the feeling that the primary market may be even colder than that in 2008. This may come from the fact that the primary market lags behind the secondary market for about half a year, and new entrepreneurs have not yet entered the market. The old entrepreneurs have passed away and made new stories, which are extremely lacking in the current market. Most of the stories are old stories. Like last year, the whole article is divided into three parts, mainly explaining what we are optimistic about this year, what we are optimistic about next year and what we need to observe next year. The developers' tools are all bustling and profitable, which is a year-on-year decline. Fortunately, compared with two years ago, some growth was limited by the decrease of new developers and the loss of old projects. The market size of developers' tools has declined this year. In addition, because the primary market in North America and China is so good, many engineers chose to join Nuggets, so overall, the scale of the developer tool market has declined this year, which is reflected in the first-and-a-half market valuation of $ billion. Compared with the last round of valuation of $ billion, the current valuation of $ billion is only about $ billion, and now the first-and-a-half market is only about $ billion, but we are still confident in this market in, and we have also seen the growth of domestic developer tool data, for example, flat. Last year, the number of developers on the stage increased to the most direct benefit track for developers to enter. If the annual meeting is the next bull market, the increase of the developer's tool track is very significant in the annual meeting, and I also believe that the opportunity for a series of developer's tools to appear in the annual meeting can be a traditional story. It is difficult for everyone to pay the bill. The following picture shows the price trend in the last one or two years. In 2008, the monkey land combination boxing was launched to make the market temporarily, but this year's market is very deserted. It is difficult for large households to pay tens of thousands of dollars again, and it also makes the market chilling again. This year's launch is equivalent to directly copying and pasting and starting to print money with one click. It is difficult to feel the team's heart, but it is worth noting that there are still some interesting projects in this year's market, such as the route of little penguins taking off-line toys, which has indeed won unanimous praise in the North American market. Although it is in a downward trend this year, we have also seen the new route. Other uses, such as the commercial value of entities, such as Li Ning Monkey Brand Card, Starbucks Opera Concert, may gradually evolve into a technology of traditional industries in the next year and the year after next. What should we be optimistic about next year or put an interesting point of view first? If there is a bull market, we will see a certain amount of games and social projects on the road of making money. This point of view comes from the fact that many projects we have seen this year are relatively homogeneous, and the income ceiling is relatively low and limited by the increasing cost of computing power. It's difficult to level the income statement. After getting the investors' funds, we should also consider the exit channel. When the growth of income gameplay stagnates, it's actually a good idea to increase the gameplay. On the one hand, it's a good strategy to make a bid, and secondly, it can bring users into the market. Now the technology of wallet and account abstraction has developed well, so it may be a win-win way. In addition, these entrepreneurs are also very young and have a high degree of acceptance of new things, which may also contribute to this. To get to the point, I will divide the simple products into two categories, such as games and similar products. I won't go into details. Both products have been verified successfully. In the process, we also see that similar voice robot communities are booming, because it is still in its early days. For example, companies that provide services to them on the chain, projects and companies do verification service models, or companies crowdsource data annotation, etc. There is another interesting point, especially the data and computing power side. Both are platform-based businesses, and the upstream is the demander of computing power data labeling. For example, the midstream of various model companies is the distribution platform of computing power data labeling, and the downstream is all kinds of large, medium and small blockchains, which dispatch the long tail retail investors downstream through the reward mechanism. But at present, it is easier to realize the scheduling of data labeling, and it is difficult for teams to schedule computing power, especially when it comes to a wide range of heterogeneous scheduling. We have seen the vigorous growth of the project in many directions and expect you to be there. Next year, the performance of business and currency issuance, supervision and compliance institutions enter the market, which is an eternal theme. In fact, a large part of the increase at the end of this year comes from everyone's concern. It has been well proved by the recent increase of more than a month that just imagining that some traditional funds can enter the market, there will be great growth. At the beginning of the year, the market value of stable currency was US$ billion, and the year of stable currency was the lowest in the last year or two. The market value of stable currency was US$ billion, but it rose from US$ to US$, which means the mainstream. The liquidity in the market retreated from the cottage dog to the bitcoin, but in this month, the stable currency only flowed into the US$ 100 million in the next month, and it rose from there. We assume that there are not many traditional funds entering the market. After all, the traditional funds all think that the blockchain is going to cheat, and the primary market has not invested much, so this part of the money may be the traditional funds known by the old people in the currency circle. So once it passes through the market and then flows into the mainstream institutions for one year or two years, how much can it rise? Wait until the end of the year to make a summary. There are several topics that I think are good regulatory compliance related to stabilizing the asset management of the currency exchange. I won't go into details on how to use them for distribution. Recently, I have seen many interesting projects, among which the most interesting ones can be summarized as the main business is the means of distribution. For example, the main business of the means of distribution is that users feed map data to suppliers who need data, but the main business of using them for distribution is to help companies with data needs to mark data. I think it's the same as the logic of trading speculative coins. Instead of directly telling users that they can make money a year, it's better to give them a hope that they can make money, and it's more convenient to use it as a means of settlement than cash, especially in the cross-border settlement of a wider range of users. I divide it into three questions: the first question is what is the real demand of the upstream, for example, in the middle of peace, the real demand is that communication data is very expensive and the signal is not good. It takes a lot of money to set up the base station, so there is no centralized big company in America that can do similar things, so we need 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。