已囤积189150枚BTC 微策略的策略会暴雷吗?

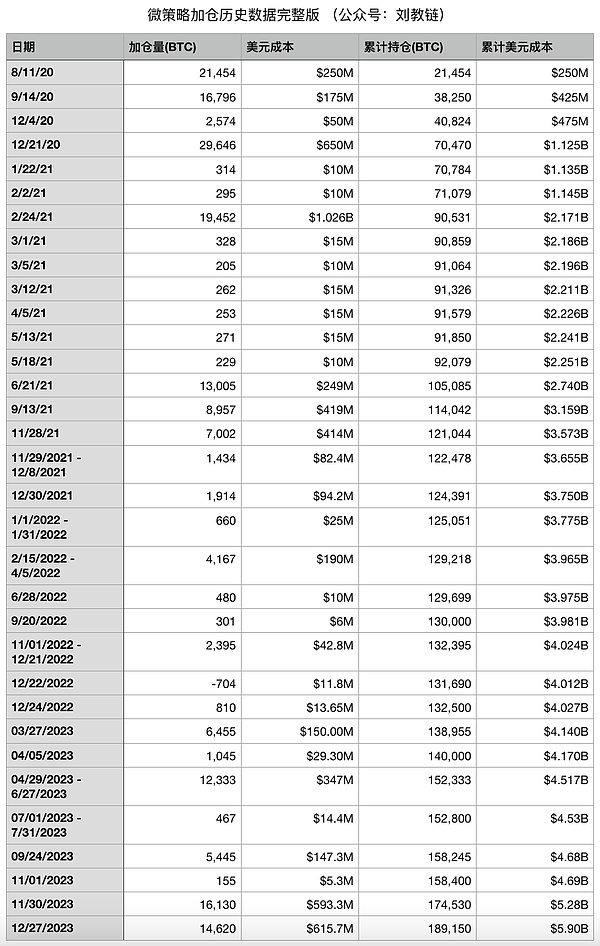

日前,微策略(Microstrategy)创始人Michael Saylor发推称,微策略再次出手,以均价约42110刀再次加仓14620枚BTC。截至2023.12.26,微策略累计已囤积189150枚BTC,总成本约为59亿刀,平均加仓成本约为31168刀。

简单计算可知,按照目前BTC现价约43k计算,微策略的仓位浮盈(43000-31168)/31168 = 38%,净利润约22亿多美刀。

教链整理了一下微策略自2020年8月初至2023年12月底全部加仓历史数据如下:

从2020年底买入第一批BTC以来,微策略持续加仓,穿越牛熊,经过了2021的牛市高点加仓,也经历了2022年底熊市低点加仓,爬过雪山,走过草地,历经艰险,终于初步修成正果。

拉长视角看,牛市的唯一作用,就是拉高了加仓成本。所以对于持续加仓的长线囤积者而言,宽厚的高原牛(2021年那种)和尖尖的高山牛(2017年那种),哪一种才是更好的旅途呢?

有趣的是,微策略的无论牛熊坚持加仓BTC的策略,也是唯一适合于绝大多数小白的加仓策略。参考教链2021.8.21文章《从投资小白到财务自由》。

特别值得注意的是,这个策略的三个基本要点:一、只加不减,只买不卖。二、分批加仓,不梭哈。三、只加BTC,不碰山寨和土狗。

但是,深入地看,其实微策略还做了一些超出小白的“更专业”的操作。

第一,出借持仓。

Michael Saylor曾经不止一次地说过,微策略将永远持有他们的BTC仓位,永不卖出。

但是,他也曾在2021年底披露过,微策略会把自己的BTC借给对冲基金。

也就是说,微策略自己永不卖币,但是借走BTC的对冲基金可是肯定要卖币的,来回买卖,进行套利。

这就和美国财政部/美联储不会卖出所持有的黄金,但是会把黄金借给JP Morgan这样的投行去黄金市场“做市”类似。

于是这里就有一层额外的风险,就是借走BTC的对冲基金搞砸了,把BTC亏掉了,对冲基金赔付不起破产清算,微策略收不回币本位等量的BTC,就会净亏损BTC的数量。

从长期来看,对冲基金亏币是一个必然事件。这个问题,教链在2021.1.1文章《为什么你的投资跑不赢比特币?》中已经有详细论述。

有些朋友可能会把手里的数字资产放到理财平台去“存币生息”,这就是和微策略做的事情有些类似了。风险点自然也就是理财平台亏损甚至跑路了。

第二,场外杠杆。

微策略在前些年发行过一些长期垃圾债。有一些甚至是不用付息的,而到期日长达数年,多数在2027-2028年左右到期。Michael Saylor坚信,数年后BTC的价格将愈发地高,这将使得微策略足以偿还债务并支付到期收益。

据称,微策略目前共持有约22亿刀债务,而其目前BTC仓位现值就有约81亿刀,也就是每100刀BTC对应27刀债务。这未计入微策略其他业务资产。而这些债务是场外债务,除非在到期日也就是2027-2028年前后BTC跌破11000刀,否则其BTC将足以覆盖这些债务。

但是,如果微策略被迫变卖如此大量的BTC去偿债,对市场将可能会是重重一击。

很多身有房贷的囤饼人可能情况会类似于微策略这种场外杠杆。当然,房贷要月月还息,而且利息率还挺高,而且是浮动的(LPR),比微策略的杠杆要差许多。不过,房贷已经几乎是普通打工人能够运用的最优质的杠杆了。关于这个问题的探讨,教链曾写过一篇《存了50万,还贷还是囤币?》(2023.6.3文章)。

第三,融资加仓。

就在今年前段时间,微策略在美股二级市场增发股票(MSTR),从二级市场融资,用美股股民的钱加仓BTC。受益于BTC今年的行情,有力推动了MSTR股票的上升,使得Michael Saylor得以采用增发股票的方式来融资加仓。

有人质疑如果BTC转入下行,或者MSTR与BTC表现脱钩,微策略是不是会被迫抛售BTC来救市?

但是,要知道股票融资和债券融资的不同点,股票是不承诺偿付的,所以就算MSTR跌到零,微策略都可以不管不顾。当然,不清楚Michael Saylor有没有做股权质押融资,如果有的话,那么股票跌到一定程度会导致股票爆仓,相关的质押股票会被券商清算。但是,券商无法强迫微策略或者Michael Saylor抛售BTC来补充保证金。

2022年灰度持续负溢价已经做出了一定的示范。纵使在最糟糕的时候,GBTC的负溢价一度高达-50%左右,但是灰度依旧岿然不动。当时有很多人FUD市场,称灰度要暴雷。但是,灰度是一个信托,不能被任何追索击穿。不了解的小伙伴可以温习一下教链2023.1.12文章《Gemini撕DCG诉感情被骗,灰度百亿大饼持仓却不会爆雷?》

63万枚BTC的灰度信托,规模是微策略持仓的3倍多。

从法律防火墙的角度说,灰度信托肯定要比微策略更加铜墙铁壁。

但无论如何,即使如有网友说的,比特币现货ETF上市后,抢走了MSTR的用户,导致用户抛售MSTR,那也只不过是美股MSTR下跌,甚至与BTC的相关性脱钩,但是,并不必然会导致微策略被迫抛售BTC持仓。灰度都不承诺GBTC的表现和BTC一致,微策略更不会承诺MSTR的表现永远和BTC一致。

此处就需要提醒部分在美股市场上把MSTR当作比特币ETF持有的朋友,注意脱钩负溢价的风险。

这种玩法,本质上是通过游戏规则,把风险转嫁给了外部投资者。比如,灰度GBTC负溢价,风险被信托防火墙挡在了外面,爆掉了炒作GBTC溢价套利的三箭资本等投机者(参考教链2023.1.13编写的舞台剧《钱花花》)。那么,微策略MSTR也同样可能出现负溢价,而股权融资本身斩断了收益承诺,把风险隔离在了美股市场,由美股投资者为此买单。

对于普通人而言,可能并没有这种无需承诺的融资渠道来获得资金加仓BTC。

第四,场外收入。

别忘了,微策略本身是有业务,也就有业务收入的。它有源源不断的场外现金流来支撑其加仓行为。

当然这一点和大多数普通囤饼人差不多。最好的策略也是场外赚钱,用场外赚到的收入来加仓BTC。

综上所述,可以看到,微策略能够运用一些普通人拿不到,或者比普通人能拿到的更为优质的金融工具,来帮助它更好地囤积BTC,那么,微策略能够跑赢大部分普通囤饼人,也就是一个大概率的事情了。人家赚得超额收益,来自于结构性的优势。

经过分析,微策略可能因为其激进的杠杆策略,而在极端黑天鹅风险时,可能会损失其BTC仓位,导致其跑输币本位,但是,只要BTC还在持续跑赢传统世界,那么微策略大概是很难暴雷的。

A few days ago, the founder of Microstrategy said that Microstrategy has made another move at an average price and added positions again. As of the end of Microstrategy, the accumulated total cost of accumulated positions is about 100 million dollars. The average cost of adding positions is about 100 million dollars. A simple calculation shows that the net profit of the positions of Microstrategy is about 100 million dollars according to the current price. The teaching chain has compiled the historical data of all the positions of Microstrategy from the beginning of March to the end of June. Since the first batch was bought at the end of the year, Microstrategy has continued to add positions, crossing the bull market high point of bulls and bears, and adding positions The bear market's low-point jiacang climbed over the snow-capped mountains and walked through the grassland. After hardships and dangers, it finally became a positive result. The only function of the bull market is to raise the cost of jiacang. So for long-term hoarders who continue to jiacang, which is a better journey, the generous plateau year of the ox or the sharp mountain year of the ox? Interestingly, it is micro-strategic. No matter whether the bull and bear insist on jiacang, it is the only jiacang strategy suitable for the vast majority of Xiaobai. The article from investing in Xiaobai to financial freedom is particularly noteworthy. It means that there are three basic points of this strategy: one is to add or not to reduce, only to buy or not to sell, two is to add positions in batches, and three is to add or not to touch cottages and local dogs. But in-depth look, in fact, Microstrategy has done some more professional operations than Xiaobai. First, it has been said more than once that Microstrategy will hold their positions forever and never sell them, but he also disclosed at the end of the year that Microstrategy will lend its own money to hedge funds, that is to say, Microstrategy will never sell its own money, but the borrowed hedge funds are certain. Arbitrage by buying and selling coins back and forth is similar to the fact that the Federal Reserve of the US Treasury will not sell the gold it holds, but will lend it to such an investment bank to make a market in the gold market. Therefore, there is an additional risk here that the borrowed hedge fund is screwed up, and the lost hedge fund can't afford to pay the bankruptcy liquidation micro-strategy. If the currency standard is not recovered, the amount of net loss will be an inevitable event in the long run. Not winning bitcoin has been discussed in detail. Some friends may put their digital assets on the wealth management platform to deposit money to earn interest. This is somewhat similar to what micro-strategies do. The risk point is naturally that the wealth management platform loses money or even runs away. The second off-exchange leverage micro-strategy issued some long-term junk bonds in previous years, some of which even have no interest, and the maturity date is as long as several years. Most of them are sure that the price will be higher and higher after several years, which will make micro-strategies enough to repay debts and. It is said that Microstrategy currently holds about 100 million dollars in debt, and the present value of its current position is about 100 million dollars, that is, each knife corresponds to a knife debt. This is not included in other business assets of Microstrategy, and these debts are off-site debts, which will be enough to cover these debts unless they fall below the knife on the maturity date, that is, around the year. However, if Microstrategy is forced to sell such a large amount of debt repayment, it will probably be a heavy blow to the market. Many cake hoarders with mortgages may be similar to the off-site leverage of Microstrategy. Of course, the mortgage has to pay interest every month, and the interest rate is quite high, and it is floating, which is much worse than the leverage of micro-strategy. However, the mortgage is almost the best leverage that ordinary workers can use. The discussion on this issue has written an article about saving 10,000 yuan to repay the loan or hoarding money. Just some time ago this year, micro-strategy issued more shares in the secondary market of US stocks. Financing from the secondary market benefited from this year's market, which strongly promoted the rise of stocks. It is necessary to adopt the way of issuing additional shares to raise funds and increase positions. Some people question whether the micro-strategy will be forced to sell to save the market if it goes down or decoupled from performance, but we should know that the difference between stock financing and bond financing is that stocks do not promise to pay, so even if it falls to zero micro-strategy, it is not clear whether there is equity pledge financing. If there is, the pledged stocks related to stock explosion will be liquidated by brokers, but brokers cannot force micro-financing. Strategy or selling to supplement the deposit, the annual negative premium of gray scale has been demonstrated to some extent. Even at the worst time, the negative premium was as high as about once, but the gray scale remained unchanged. At that time, many people said that the gray scale would be thunderous, but the gray scale was a trust that could not be penetrated by any recourse. Little friends who don't understand can review the teaching chain articles and tear up their feelings and accuse them of being cheated, but the gray scale of tens of billions of pie positions will not explode. The scale of gray scale trust is more than that of micro-strategy positions from the legal firewall. From the point of view, gray trust is definitely more impregnable than micro-strategy, but in any case, even if some netizens say that the users who robbed Bitcoin after the spot listing caused users to sell, it would only be that the US stock market fell or even decoupled from the correlation, but it would not necessarily lead to the micro-strategy being forced to sell positions, and the gray level would not promise and the micro-strategy would not promise forever and consistently. Here, we need to remind some friends who hold bitcoin to pay attention to decoupling and negative spillover. The risk of price is essentially passed on to external investors through the rules of the game. For example, the risk of gray-scale negative premium is blocked by the trust firewall, and the three arrows capital, which is a speculation premium arbitrage, and other speculators refer to the stage play written by the teaching chain. The strategy of spending so little money may also have a negative premium, while equity financing itself cuts off the income commitment and isolates the risk in the US stock market. For ordinary people, there may not be such a commitment-free financing. Capital channels to obtain funds to increase the fourth OTC income. Don't forget that micro-strategy itself has business and business income. It has a steady stream of OTC cash flow to support its warehousing behavior. Of course, this is similar to that of most ordinary cake hoarders. The best strategy is to make money off-site to increase the position with the income earned off-site. In summary, we can see that micro-strategy can use some financial tools that ordinary people can't get or are better than ordinary people can get to help it better hoard such micro-strategies. It is a high probability that people can beat most ordinary cake hoarders. The excess income earned by others comes from structural advantages. After analysis, micro-strategy may lose its position when extreme black swan risks because of its radical leverage strategy, which may lead to its losing currency standard. However, as long as it continues to beat the traditional world, micro-strategy is probably difficult to storm. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。