探讨跨链质押衍生品协议的未来

作者:Kyle Liu,Bing Ventures投资经理

随着以太坊Merge的成功,以太坊也从POW正式转向了POS,而在 POS 网络中,Staking是一直绕不过去的一个话题。用户可以通过将 token 质押在网络中为网络提供安全来获得 Staking 收益,但是 Staking 中的资产却在一定锁定期内无法使用。而Staking 衍生品可以将 Staking 资产的流动性释放出来,提高资产利用率。本文将带大家了解聚焦Staking的衍生品项目,看看它们如何构建多链未来下的 Staking 经济设想。

跨链流动性的基础

跨链流动性是当前加密货币市场上备受关注的话题,它涉及到PoS共识下DeFi收益和Staking收益的冲突、跨链成本以及PoS共识下安全性和流动性的平衡问题。为解决这些问题,Staking衍生品应运而生。

Staking衍生品本质上是对参与Staking的原生代币发放对应凭证,持有该凭证可以获得Staking收益。在Staking周期结束后,该凭证可以刚性承兑回原生通证。这样的设计能够解决PoS共识下的DeFi收益和Staking收益相冲突的问题,通过将Staking收益转化为可以交易的衍生品,让用户在DeFi中进行交易,从而同时实现Staking代币的流动性和收益。

同时,Staking衍生品还可以解决跨链成本的问题。传统的跨链交易需要支付一定的手续费和时间成本,这会降低用户的体验。通过将代币转化为跨链资产,并将其绑定到一个单一的跨链衍生品上,用户可以直接在不同的区块链之间交易这些衍生品,而不必支付高昂的跨链手续费和等待时间。

此外,Staking衍生品还可以解决PoS共识下的安全性和流动性相冲突的问题。在PoS共识下,为了保证网络的安全性,必须尽可能地鼓励用户将代币锁定在Staking中,但这也会降低代币的流动性,使得用户难以将其用于其他目的。通过将代币转化为跨链衍生品,用户可以将代币质押并获得相应的收益,同时也可以在需要时将其转换为可用于DeFi交易的衍生品,从而实现了安全性和流动性的平衡。

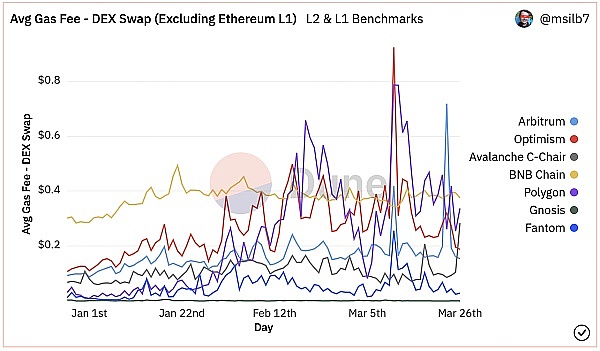

Source: Dune

衍生品的价值捕获

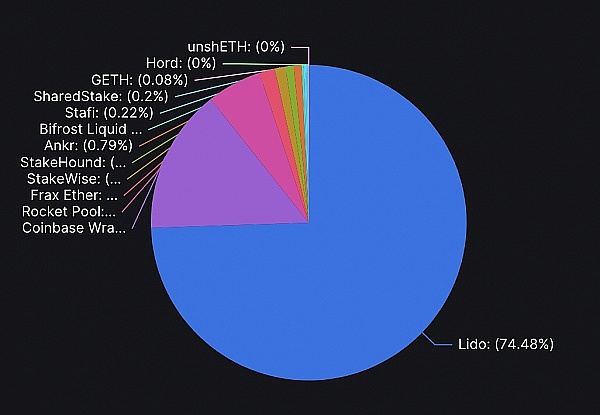

当谈到 Staking 衍生品时,我们认为这个领域将成为不可或缺的基础设施,并从底层链和上层应用中捕获价值。随着 PoS 网络的发展,Staking 协议的价值将越来越大。以太坊 2.0 最大的 Lido 是一个成功的案例,随着以太坊的 Merge 成功,Lido 的市值迎来了新高。

在用户方面,Staking 衍生品为用户带来了新的 DeFi 玩法。例如,衍生品的套利机会。如果衍生品出现折价,长期持有者可以通过购买衍生品获得更高的利润,比直接购买现货更有优势。用户只需购买衍生品,然后以 1:1 的比例赎回原生资产,这个折价区间实际上是一个低风险高收益的套利空间。因此,如果用户了解衍生品的机制,就有机会在生态中获得更高的收益。

在整个公链生态 DeFi 发展方面,Staking 衍生品为生态带来了 DeFi 收益率优势。如果 Layer1 生态未来都采用衍生品来实现 DeFi,那么在不考虑项目补贴的情况下,基础的 Staking 收益率结合 Staking 衍生品的 DeFi 收益率会高于普通 DeFi 收益率。例如,以太坊头部 DeFi 项目目前长期稳定收益率能超过 5% 就很不错了。但是,如果将 DeFi 与 Staking 衍生品结合起来,5% 的利息加上 15% 的 Staking 收益,这个 DeFi 产品就会有 20% 长期稳定的年化收益,从而吸引更多用户来到生态中。目前主流的跨链质押协议包括:

Bifrost 是一个为 Staking 提供跨链流动性的 Web 3.0 基础设施,通过跨链通信协议(XCMP)为多链提供去中心化、可跨链的Liquid Staking服务。Bifrost 的使命是通过跨链衍生品来聚合超过 80% PoS 共识链的 Staking 流动性,为波卡中继链、平行链,以及与波卡桥接的异构公链提供标准化可跨链的带息衍生品,降低用户 Staking 门槛、提升多链质押比例、提高生态应用收益基础,打造用户、多链、生态应用三方赋能、正向循环的 StakeFi 生态。

StaFi是一个跨链Staking解决方案,其创新包括基于提名的权益证明(NPoS)机制、代币锁定和提高流动性。NPoS是从DPoS中衍生出来的机制,可以解决DPoS的倾向性问题,提高公平性和安全性。代币锁定机制可以让StaFi用户将代币锁定在协议中,获得Staking收益。同时,StaFi还提供了流动性解决方案,将锁定的代币转换成等价的rTokens,可以随时交易和使用。StaFi通过实现多链跨链和资产代币化来提高流动性和灵活性,支持主流公链和DeFi生态系统,并为用户提供安全可靠的收益方式。

Kine Protocol 是一个跨链衍生品交易平台,旨在提供高效、低成本的去中心化交易解决方案。Kine Protocol 支持质押、铸造、销毁、奖励和流动性挖掘等功能,并支持与多个公链的跨链交易。Kine Protocol 的主要特点是采用 Kine Oracle 等技术来实现快速、高效的价格预言机,并且可以实现任意资产之间的衍生品交易,如借贷、合成资产和期权等。此外,Kine Protocol 采用了 AMM+Limit Order 的交易机制,使得交易者可以更灵活地选择交易方式。Kine Protocol 还提供了多种奖励机制,如 LP 奖励、流动性挖掘奖励和 KineDAO 奖励,以吸引更多用户参与到平台中来。

Source: Bing Ventures

跨链质押赛道的未来

从可组合性和互操作性的角度来看,目前一些主流公链在 DeFi 领域具有很大的拓展空间和潜力。相比以太坊,这些公链有着更多样化的设计,使得在跨链资产的可组合性和互操作性方面,它们能够提供更灵活的选择。而随着 Staking 衍生品的兴起,这些公链上的 DeFi 项目将会更加活跃,这些项目将通过提高流动性、增加参与者等方式,不断提高自身的竞争力。为此,这些项目也需要更多流动性来支持其发展。

除此之外,在跨链资产的可组合性和互操作性方面,中心化金融的产品形式非常多样,这是源于统一价值标准的认可。当多链解决了技术的限制后,各大区块链的价值共识将更趋向于去中心化的本质。在这一前提下,跨链资产的玩法和应用将不仅由项目方、公链所决定,用户在各个智能合约、共识机制中运用跨链资产的自由度更高、操作性更强、主权也更大。

因此,跨链质押赛道的未来非常明确,将会是一个属于用户和社区的实现真正 “Web3” 的多链未来。这个未来将会给用户带来更多自主选择和更大的操作空间,也将促进整个 DeFi 生态的发展,为生态的繁荣做出更大的贡献。在这个未来中,Staking 衍生品将会作为不可或缺的中间件存在,从底层链和上层的其他应用中捕获价值,并且通过不断提高用户的收益率来吸引更多的用户参与其中。

Source: DefiLlama

总结

跨链质押衍生品是一种新型的PoS网络解决方案,旨在提高资本效率和流动性,并为用户提供更广泛的DeFi应用机会。然而,这种创新工具也存在一些潜在风险,需要项目方采取措施来加强市场流动性、提升安全性、确保算法公平性和优化产品体验。

市场流动性不足可能导致价格波动剧烈和交易成本高昂。为此,项目方可以加强市场宣传和吸引更多用户和资本,从而提升项目声誉和品牌价值。此外,项目方还应该采取措施保障用户资产安全,如多重签名、冷热钱包分离和定期安全审计。

同时,跨链质押衍生品算法的不公平性和产品体验的不佳也可能影响用户参与度和忠诚度。为此,项目方应该采取公平的算法设计和优化的运营流程,提供高效的交易执行和低成本的交易手续费,并设计用户友好的界面。随着DeFi和PoS区块链的不断发展,跨链质押衍生品将成为更广泛应用的工具。在保障用户安全和提升产品体验的基础上,这种新型解决方案有望成为DeFi中被广泛使用的被动储蓄工具。

With the success of Ethereum, the investment manager of Ethereum has also changed from formal to unavoidable in the network. Users can gain profits by providing security for the network by putting the pledge in the network, but the assets in it can't be used within a certain lock-up period, and derivatives can release the liquidity of assets and improve the asset utilization rate. This paper will take you to understand the focused derivatives projects and see how they can build the foundation of cross-chain liquidity in the multi-chain future. Chain liquidity is a hot topic in the cryptocurrency market at present, which involves the conflict between income and income under consensus, the cross-chain cost and the balance between security and liquidity under consensus. In order to solve these problems, derivatives came into being. In essence, derivatives issue corresponding certificates to participating primary tokens, and they can obtain income by holding the certificates. At the end of the cycle, the certificates can be rigidly accepted back to the primary pass. This design can solve the problem of conflict between income and income under consensus. The benefits are converted into tradable derivatives, so that users can trade in the Internet, thus realizing the liquidity and benefits of tokens at the same time. At the same time, derivatives can also solve the problem of cross-chain cost. Traditional cross-chain transactions need to pay a certain fee and time cost, which will reduce the user's experience. By converting tokens into cross-chain assets and binding them to a single cross-chain derivative, users can directly trade these derivatives between different blockchains without paying high cross-chain fees and waiting. In addition, derivatives can also solve the conflict between security and liquidity under consensus. Under consensus, in order to ensure the security of the network, users must be encouraged to lock tokens in as much as possible, but this will also reduce the liquidity of tokens, making it difficult for users to use them for other purposes. By converting tokens into cross-chain derivatives, users can pledge tokens and obtain corresponding benefits, and at the same time, they can also convert them into derivatives that can be used for trading when necessary, thus achieving security and liquidity. When it comes to derivatives, we think that this field will become an indispensable infrastructure and capture the value from the underlying chain and the upper application. With the development of the network, the value of the agreement will become larger and larger. The biggest case of Ethereum is a successful case. With the success of Ethereum, the market value has reached a new high. On the user side, derivatives have brought new ways of playing, such as arbitrage opportunities for derivatives. If derivatives are discounted, long-term holders can buy derivatives. It is more advantageous to get higher profits than to buy the spot directly. Users only need to buy derivatives and then redeem the original assets at a certain proportion. This discount range is actually a low-risk and high-yield arbitrage space, so if users understand the mechanism of derivatives, they will have a chance to get higher returns in the ecology. Derivatives have brought a yield advantage to the ecology in the whole public chain ecological development. If the future of ecology is realized by derivatives, then the basic yield will be realized without considering the project subsidies. For example, the long-term stable rate of return of Ethereum Head Project will be better than the ordinary rate of return, but if the interest combined with derivatives is added, this product will have long-term stable annualized income, thus attracting more users to the ecology. At present, the mainstream cross-chain pledge agreement includes an infrastructure to provide cross-chain liquidity, and the mission of providing decentralized cross-chain services for multiple chains through cross-chain communication protocols is to Cross-chain derivatives are used to aggregate the liquidity beyond the consensus chain, which provides standardization for the parallel chain of Boca relay chain and the heterogeneous public chain bridged with Boca. Cross-chain interest-bearing derivatives can lower the user threshold, increase the proportion of multi-chain pledge, improve the income base of ecological application, and create a multi-chain ecological application for users. The ecology of three-party empowerment and positive circulation is a cross-chain solution, and its innovation includes the nomination-based rights proof mechanism, from which token locking and liquidity improvement are derived. The tendency question can be solved. Improving fairness and security The token locking mechanism allows users to lock tokens in the agreement to gain benefits, and at the same time, it also provides a liquidity solution to convert locked tokens into equivalents that can be traded and used at any time. By realizing multi-chain cross-chain and asset tokenization, it improves liquidity and flexibility, supports mainstream public chains and ecosystems, and provides users with a safe and reliable way of income. It is a cross-chain derivatives trading platform, aiming at providing efficient and low-cost decentralized trading solutions. Holding the functions of pledge casting, destroying rewards and liquidity mining, and supporting cross-chain transactions with multiple public chains, the main features are that technologies are adopted to realize fast and efficient price prediction machines and derivative transactions between any assets, such as borrowing and synthesizing assets and options. In addition, the adopted trading mechanism enables traders to choose trading methods more flexibly, and provides a variety of reward mechanisms, such as rewards, liquidity mining, rewards and rewards, to attract more users to participate in the platform to cross-chain quality. From the perspective of composability and interoperability, some mainstream public chains have great expansion space and potential in the field. Compared with Ethereum, these public chains have more diversified designs, which enable them to provide more flexible choices in the composability and interoperability of cross-chain assets. With the rise of derivatives, these projects on public chains will become more active, and these projects will continuously improve their competitiveness by increasing liquidity and increasing participants. The purpose also needs more liquidity to support its development. In addition, the product forms of centralized finance are very diverse in terms of composability and interoperability of cross-chain assets, which is due to the recognition of unified value standards. When multi-chain solves the technical limitations, the value consensus of major blockchains will tend to be decentralized. Under this premise, the gameplay and application of cross-chain assets will not only be determined by the public chain of the project side, but also the users will have higher freedom to use cross-chain assets in various intelligent contract consensus mechanisms. Therefore, the future of cross-chain pledge track is very clear, and it will be a real multi-chain future that belongs to users and communities. This future will bring users more independent choices and more operating space, and will also promote the development of the whole ecology and make greater contributions to the prosperity of the ecology. In this future, derivatives will exist as indispensable middleware to capture value from the bottom chain and other applications in the upper layer, and attract more users to participate by continuously improving the yield of users. It is concluded that cross-chain pledge derivatives are a new network solution aimed at improving capital. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。