WealthBee宏观月报:市场行情继续演绎 比特币现货ETF“箭在弦上”

北京时间12月14日凌晨,根据美联储最新的联邦公开市场委员会(FOMC)货币政策会议纪要显示,美联储决定12月仍放缓加息步伐,将联邦基金利率目标区间继续维持在5.25%至5.50%之间。消息一出,市场欢呼一片,美股三大指数均大涨。

12月的市场“好得出奇”,不管是股市还是币圈,都在演绎着欢快的赚钱效应。市场对美联储降息的预期较为乐观,美国经济显著降温,韩国出口指标暗指全球经济复苏;美国、印度、日本、法国、德国的股市相继创出历史新高;比特币价格突破44000美元,美国和香港的虚拟资产ETF都已“箭在弦上”,一切似乎都在朝着更加光明的方向发展。

北京时间12月14日凌晨,根据美联储最新的联邦公开市场委员会(FOMC)货币政策会议纪要显示,美联储决定12月仍放缓加息步伐,将联邦基金利率目标区间继续维持在5.25%至5.50%之间。消息一出,市场欢呼一片,美股三大指数均大涨。

其实从美国12月新出的经济数据看,暂停加息是非常必要的。美国12月21日公布了多项重要经济数据,其中三季度GDP增长4.9%(预期5.2%),费城联储制造业指数-10.5(预期-3.0),均不及预期。从11月CPI和PCE两大居民部门通胀指标来看,CPI同比增长3.1%,核心CPI同比增4.0%,均符合市场预期;核心PCE物价指数同比上升3.2%,为2021年4月以来最小增幅,低于预估的3.3%。GDP和制造业受到一定影响,不及预期,同时通胀数据均符合或略低于预期,因此不论从哪方面来看,都没有继续加息的必要。

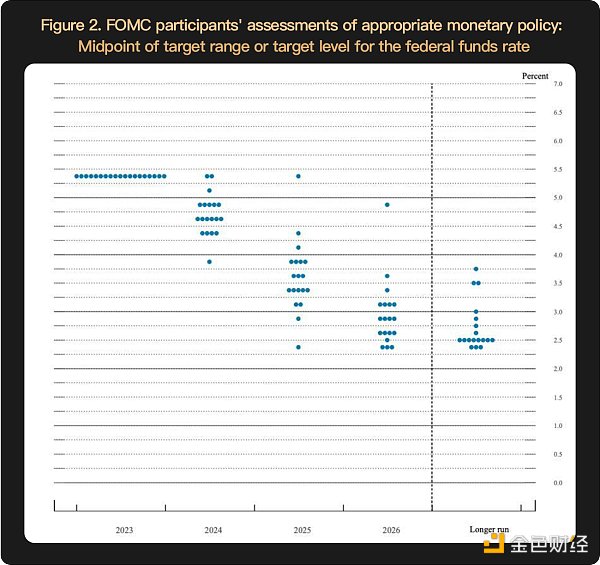

12月数据再一次夯实了暂停加息的明牌属性,降多少息、何时降息成为市场目前最关注的事情。从目前的点阵图上来看,2024年的利率平均预期在4.6%附近,相较于目前的5.25%至5.5%还是有一个可观的降幅的。

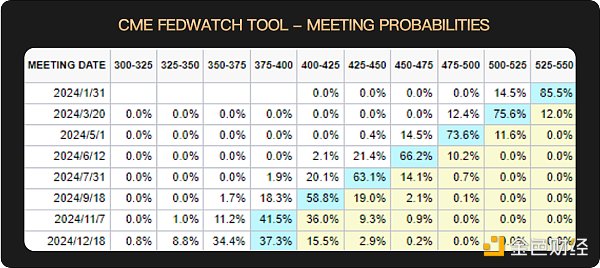

至于何时降息,根据CME FedWatch显示,2024年3月份降息至5.25%以下的概率达到75.6%,5月利率重回“5以下”的概率为73.6%,有66.2%的概率在上半年达到4.5%左右的利率水平。因此,目前市场还是比较乐观,认为上半年就可以实现显著降息的可能。

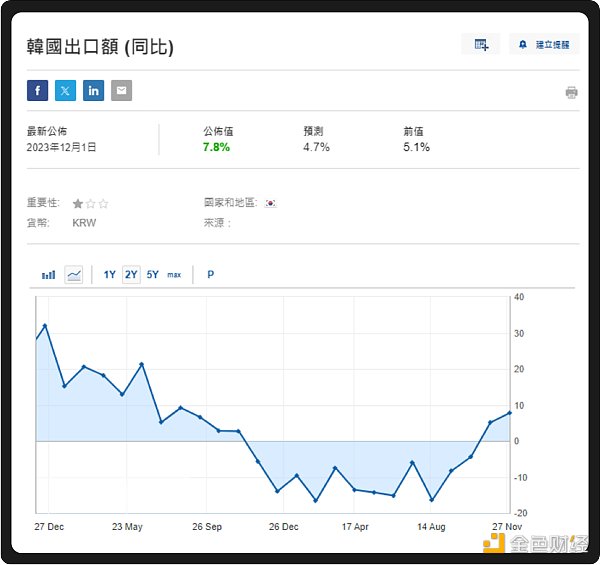

其实放眼全球,很多国家的经济都表现出向好的迹象:日本经济正在找回“失去的30年”,不论是通胀还是时薪,都走出之前“万年不变”的困境;而韩国作为全球经济的“金丝雀”,早在10月份就已经扭转出口下滑的趋势,最新的12月前20天出口数据同比增长更是达到了13%,增长态势越发猛烈,体现出全球市场的恢复态势。

美国时间12月13日,美股大涨,其中道琼斯工业平均指数创出历史新高。本月美股延续了11月的疯牛态势,继续逼空。值得注意的是,在21日美国公布三季度GDP之后,尽管不及预期,但当天美股依旧上涨。很显然,目前影响美股的核心因素并不是经济基本面,而是降息预期。经济略有不及预期反而极大促进了降息预期,这又促使美股投资者对未来流动性增强的期望。

充沛的流动性是任何一个市场上涨的直接因素。美银调查显示,12月降息预期推动资金大举流入美国股市,现金配置比例降至两年低点。全球投资者的乐观预期高举高打,为美股带来了极为充沛的流动性,这也就是为什么美股会持续飙涨。

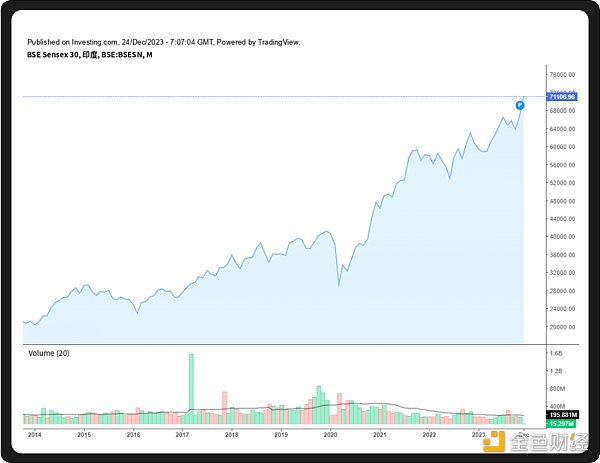

除美股外,印度股市可谓是近段日子的市场新星。印度孟买Sensex30指数在12月11日突破70000点,目前已站稳70000,突破71000,成为全球第七大股市。

近些日子,印度成为了全球投资者投资新兴国家市场的首要阵地。印度今年经济增长领跑世界主要经济体,强劲的经济基本面为投资者提供了十足的信心。此外,日经225在11月份已创出历史新高,德国DAX、法国CAC40也在本月均创历史新高。

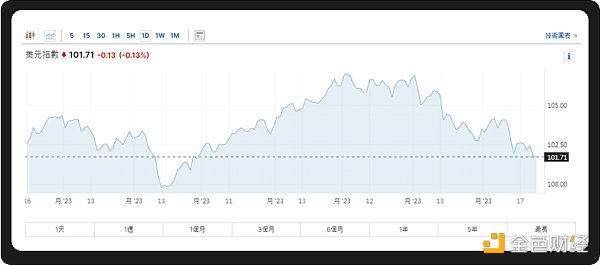

不过,虽然目前市场情绪高涨,但也不宜过分乐观。目前由于降息预期的影响,美元指数持续走弱。美元从强势货币转弱之际,美元资产吸引力也会伴随下降,后续应着重注意美元强势程度与流动性之间的动态博弈。

12月初,比特币再次一路狂飙,成功突破44000美元;微策略(MicroStrategy)本月购买超1.4万枚比特币,将比特币的总持有规模增加到80多亿美元。以太坊最高价格也突破了2400美元。随后这两大币种进入横盘,比特币价格在40000USD到44000USD之间横盘震荡,以太坊在2100USD到2400USD之间横盘震荡。

尽管市场先涨后横,但投资者对未来市场的信心并没有缩减。从灰度基金的BTC负溢价来看,11月下旬负溢价缩减至10%以内,并持续缩减,目前在-6%到-5%之间。

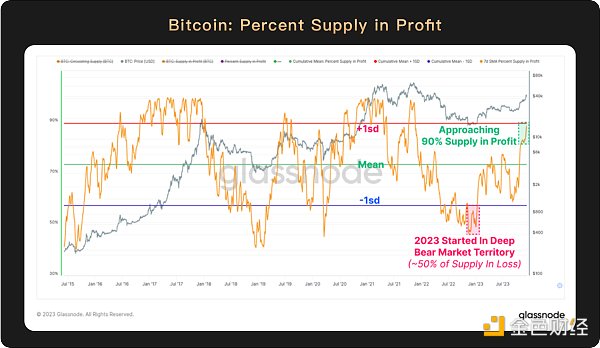

尽管目前已有9成的比特币处于盈利状态,但由于利好消息的不断刺激,投资者依然信心十足。

现货ETF的消息更是频出。在本月21日,灰度、贝莱德、Valkyrie以及ARK Invest/21Shares、富兰克林、富达均与SEC会面商讨比特币现货ETF事宜。

目前,各个比特币现货ETF的发行方与美国证监会(SEC)已经累计举行了30多次会议,之前的讨论集中在比特币托管问题上,而现在的焦点转移到了ETF份额的生成和赎回方式上。SEC要求在12月31日之前,ETF申请者需要更新AP信息,并将申请中的赎回方式改为“现金赎回”,因为这样只有发行方会处理比特币,避免了未注册的经纪商子公司处理比特币的情况。

尽管机构们普遍希望采用实物赎回的方式,但面对SEC的要求,纷纷选择妥协。目前,Pando Asset、贝莱德、Valkyrie、灰度、Galaxy等机构几乎都已经将文件修改为“仅以现金进行”,看来巨头们对于发行ETF已经“迫不及待”,只要能够发行,什么条件都能答应。

在机构巨头纷纷选择妥协之际,市场对于首批ETF获批日期的预计也显得非常乐观:彭博ETF分析师Eric Balchunas也提到,AP协议+现金创建=批准。也就是说,这两步应当是批准前最后的步骤了,因此不少人猜测在1月10日左右就会有第一批申请者获批。但不管怎样,事情已经走到了这一步,箭在弦上,不得不发,获批仅需“临门一脚”,只是时间早晚的问题。

在美国方面传来利好的同时,香港方面也迎来喜讯:12月22日,香港证监会发布《有关中介人的虚拟资产相关活动的联合通函》与《有关证监会认可基金投资虚拟资产的通函》,并表示“准备好接受虚拟资产现货 ETF 的认可申请”。

本次发布的两则通函详细讲解了香港政府对虚拟资产现货ETF的要求。从发行人资质到底层资产要求,从交易、申赎、托管到投资策略,通函中都有着详细的规定,充分彰显了香港政府为虚拟资产ETF的到来做好了充分准备。“万事俱备只欠东风”,监管态度已明确,剩下的主要是一些技术性细节问题。

值得注意的是,与美国仅允许“现金赎回”不同,香港同时允许现金和实物,这使得香港的虚拟资产ETF比美国的更具有优势。

市场继续演绎着11月的好光景。世界经历了疫情的冲击,如今进入复苏的大轨道中,出现此等赚钱效应并为奇。不过,世界不存在只涨不跌的市场,美国明年降息过程中是否会存在经济衰退,美元是否会持续走弱,也是值得关注和思考的;加密市场情绪依旧高涨,美国和香港的现货ETF都已经“万事俱备只欠东风”,机构大规模入场虚拟资产的时代正悄然来临。

According to the minutes of the Federal Open Market Committee's latest monetary policy meeting, Beijing time, the Federal Reserve decided to slow down the pace of raising interest rates in June and keep the target range of the federal funds interest rate at between and. As soon as the news came out, the market cheered, and the three major indexes of the US stock market all rose sharply in the macro monthly report. The market continued to interpret the bitcoin spot arrow. Last month, the market was surprisingly good, and both the stock market and the currency circle were interpreting the cheerful profit-making effect. The market was optimistic about the Fed's interest rate cut. The U.S. economy has cooled significantly, and South Korea's export indicators imply a global economic recovery. The stock markets of the United States, India, Japan, France and Germany have successively hit record highs. Bitcoin prices have exceeded the US dollar, and the virtual assets of the United States and Hong Kong have all been on the line. Everything seems to be developing in a brighter direction. The market situation of the macro monthly report continues to deduce that bitcoin spot is on the line. According to the minutes of the Federal Open Market Committee's latest monetary policy meeting, the Federal Reserve decided to slow down in June. The pace of interest rate will continue to maintain the target range of the federal funds rate at between and. As soon as the news came out, the market cheered, and the three major indexes of US stocks all rose sharply. In fact, it is very necessary to suspend interest rate hikes from the new economic data released in the United States in June, and the United States released a number of important economic data, among which the growth expectation of Philadelphia Federal Reserve's manufacturing index in the third quarter was less than expected. From the inflation indicators of the two major residential sectors, the year-on-year growth core and year-on-year increase were in line with market expectations, and the core price index rose year-on-year since. The minimum increase is lower than expected and the manufacturing industry is affected less than expected. At the same time, the inflation data are all in line with or slightly lower than expected. Therefore, there is no need to continue raising interest rates in any way. The monthly data once again consolidates the winning numbers attribute of suspending interest rate hikes. How much and when to cut interest rates has become the most concerned thing in the market at present. From the current bitmap, the average interest rate in 2008 is expected to be around, compared with the current macro monthly market, which still has a considerable decline. As for when to cut interest rates, according to the probability of reducing interest rates to below in the month of the year, the monthly interest rate will return to below, and there is a probability that it will reach the interest rate level in the first half of the year. Therefore, the market is still optimistic that a significant interest rate cut can be achieved in the first half of the year. The market situation continues to deduce the bitcoin spot arrow. In fact, many countries around the world are showing signs of improvement in their economies, and both inflation and hourly wages are going. Korea, as the canary of the global economy, has reversed the downward trend of exports as early as January, and the latest export data of the day before yesterday has reached a year-on-year growth trend, which is more and more fierce, reflecting the recovery of the global market. The macro monthly report market continues to interpret Bitcoin spot arrow on the string. The macro monthly report market continues to interpret Bitcoin spot arrow on the string. US stocks rose sharply on March, US time, and the Dow Jones Industrial Average hit a record high this month. It is worth noting that after the announcement of the third quarter in Japan, although it was less than expected, the US stocks still rose on that day. Obviously, the core factor affecting the US stocks at present is not the economic fundamentals, but the expected interest rate cut, which has greatly promoted the expectation of interest rate cut, which in turn prompted US investors to expect more liquidity in the future. Abundant liquidity is the direct factor for the rise of any market. The Bank of America survey shows that the expectation of monthly interest rate cut promotes a large inflow of funds. The proportion of cash allocation in the US stock market has dropped to a two-year low, and the optimistic expectations of global investors have brought abundant liquidity to the US stock market, which is why the US stock market will continue to soar. Apart from the US stock market, the Indian stock market can be described as a new market star in recent days. The Mumbai index of India has broken through the breakthrough point on March and has now become the seventh largest macro monthly report market in the world. The macro monthly report market continues to interpret the bitcoin spot arrow. Recently, India has become the primary position for global investors to invest in emerging markets. India's economic growth leads the world's major economies this year, and its strong economic fundamentals have provided investors with full confidence. In addition, the Nikkei has reached a record high in January, and Germany and France have also reached a record high this month. However, although the current market sentiment is high, it should not be overly optimistic. At present, due to the impact of interest rate cuts, the US dollar index continues to weaken, and the attractiveness of US dollar assets will also follow. In the follow-up, we should pay attention to the dynamic game between the strength and liquidity of the US dollar. The macro-monthly market continues to interpret the bitcoin spot arrow on the string. The macro-monthly market continues to interpret the bitcoin spot arrow on the string. At the beginning of last month, Bitcoin once again soared and successfully broke through the US dollar micro-strategy. This month, buying over 10,000 bitcoins increased the total holding scale of Bitcoin to more than 100 million dollars, and the highest price of Ethereum also broke through the US dollar. Then these two currencies entered sideways, and the price of Bitcoin fluctuated sideways. Ethereum oscillated sideways between and although the market rose first and then crossed, investors' confidence in the future market did not decrease. From the perspective of the negative premium of gray funds, the negative premium was reduced to less than in the end of the month and continued to decrease. At present, the macro monthly market continued to interpret the bitcoin spot. Although the successful bitcoin is in a profitable state at present, investors are still confident because of the continuous stimulation of good news. The macro monthly market continues to interpret the bitcoin spot. The news is even more frequent. BlackRock and Franklin Fidelity both met with each other to discuss the bitcoin spot. At present, various issuers of bitcoin spot have held several meetings with the US Securities and Exchange Commission. Previously, the discussion focused on the issue of bitcoin custody, but now the focus has shifted to the generation and redemption method of shares, requiring applicants to update information and change the redemption method in the application to cash redemption before June, because only the issuers will handle bitcoin. It has avoided the situation that unregistered brokerage subsidiaries deal with bitcoin. Although institutions generally hope to adopt the method of physical redemption, they have chosen to compromise. At present, BlackRock Gray and other institutions have almost revised their documents to only cash. It seems that the giants can't wait for the issuance, and they can agree to whatever conditions they can issue. When institutional giants choose to compromise, the market is also very optimistic about the forecast of the first batch of approval dates. Bloomberg analysts also mentioned that these two steps should be the last step before approval, so many people speculate that it will be around May. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。