比特币现货 ETF 上蹿下跳 但矿工已无处可悲鸣

比特币现货 ETF 会是矿工末日吗?

比特币现货 ETF 来去之间,SEC 已经成功拿捏住市场情绪,人们的焦点聚集在贝莱德和多空大战上,但是矿工的悲伤却被人无视。

铭文火热,矿工大赚

2023 年,在比特币减半的背景下,矿工选择支持铭文,以增加挖矿之外的手续费收入,但是现货 ETF 的到来,并不会在币价上伤害矿工利益,甚至是帮助他们增加被动收益:

现货 ETF 通过,更多的传统投资方和个人散户可以合法方式购买比特币,支撑比特币的市场价格;

闪电网络等二层协议会得到合法化助推,小额、高频链上活动会持续增加主网手续费,进而稳固生态。

不同于以太坊转 PoS 时,矿工们无力抵抗,ETHW 等项目最终也是不了了之,比特币矿机制造商 + 矿工 + 矿池三位一体的力量并不弱小,在以往的区块扩容战争和最近的铭文大战中,矿工对比特币的支配力不逊于比特币制造商和核心开发组。

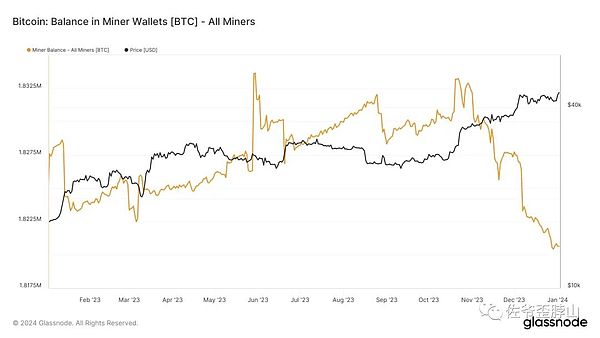

但是在贝莱德等资管巨头面前,整个加密市场万亿级的规模就不够看了。比特币矿工虽然表面不说,但是从持币数据走势来看,近两月都是在不断抛售中度过。这虽然有 ETF 逾期通过,利好出尽价格下跌的担忧,但是从长期来看,矿工已经意识到问题。

定价权将从链上 + 矿工的组合转移到链下 + 华尔街手中。

迁移的定价权:东方-->西方,中本聪-->矿工-->华尔街?

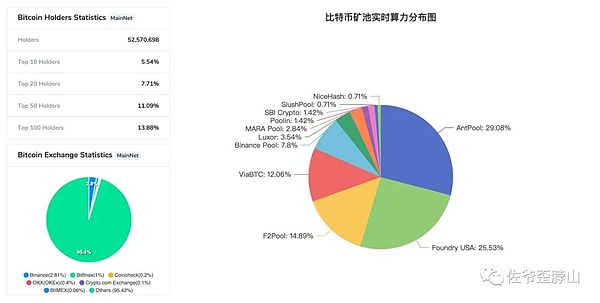

比特币的定价权核心是算力。

在 2021 年的决策后,算力不可避免转移向西方,尤其是美国,这个不再多言,而和地域分布相对的是矿池的持续集中,在资本效率的驱动下,矿工和矿池达成结盟,矿工仍然具备矿机的控制权,而矿池负责日常维护,运作逻辑非常简单:

矿工收益 = (矿机成本 - 电费 - 矿池费用)X 矿机数量 X 折旧率

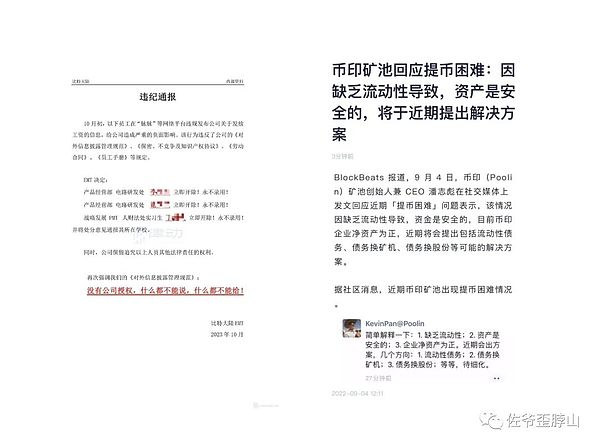

在整个牛熊期间,常说的关机价对矿池和矿机制造商最为危险,因为矿工至多浮亏,只要撑到牛市,总能卖币回本,但是矿机制造商和矿池干的是“卖水”的服务业,一旦收不抵支,则面临经营危机。

本质上,矿工的损失属于卖币收益不能覆盖现有支出,但是实际支出大头只有电费,实在不行卖币也会回笼部分资金。

矿池集中,群氓上岸

比特币第一个区块至今 15 年,比特币大规模使用矿机至今 10 年左右,中本聪留下的 PoW 机制虽然不环保,但是靠着鲁棒性帮助矿工撑过了至少 5 轮牛熊,堪称居功至伟。

最初的矿工并不完全是资本游戏,更多参与者是来自于社会底层的“赌徒”,包括网吧老板、加密极客以及莫名其妙的先行者,这个市场初期的粗粝与混乱造就了最初的暴富神化,微策略的建仓成本四位数或五位数,他们的成本甚至是个位数,怎么都是大赚特赚。

但现在一切都将发生改变。

比特币价格将由算力驱动,转向市场 + 情绪 + 华尔街驱动。

比特币现货 ETF 和期货 ETF,甚至是加密矿企的 ETF 都不相同,这将从本质上改变比特币的定价和运行逻辑。

在资本增值的动力下,现有比特币的筹码集中趋势将进一步恶化,相较于其他币种,比特币持币集中度已经相当分散,叠加比特币算力的庞大,攻击或控制比特币网络达成的 51% 几乎不可达成。

但这是 PoW 的逻辑,如果大量资本巨头涌入,比特币网络将在某种程度上变为 PoS 机制,当然,这不是说比特币的产生会变为质押机制,而是说筹码过度集中,可能会倒果为因,理论上现货是衍生品的定价基础,但是在过长的传导链条下,调节和定价机制存在失衡的可能。

可以回想下 07 年的次贷危机,次贷的意思是不断的基于前提条件去打包垃圾债券,进行售卖,最初的房贷反而不再对市场具备明显调节作用,比特币也存在重演这种情况的客观条件。

现货上架,财团火并,矿工暴死,听着多么顺耳

比特币仍旧缺乏生态

铭文的火爆和二层的火热,仍旧是基于旧有机制的缝缝补补。

比特币最初的作用,已经被反复说,说到大家已经不耐烦——点对点的电子现金,在熊市期间,基于闪电网络的小额支付创新在阿根廷等拉美国家有过尝试。

但现在,人们拾起了比特币的神圣性,但是用填鸭的方式滥用区块空间。

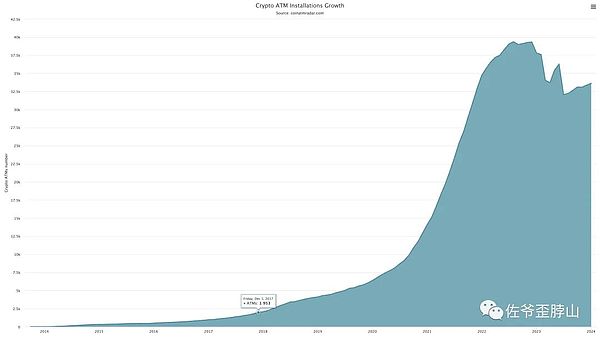

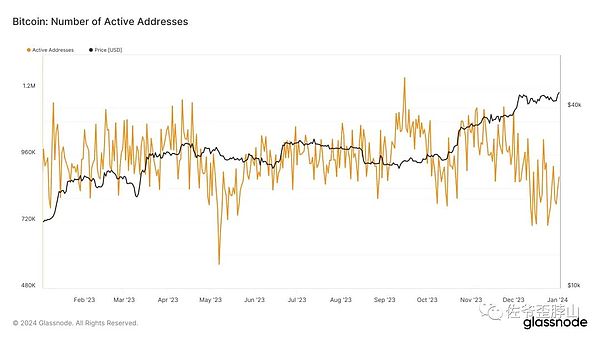

在比特币的普及上,近期,比特币 ATM 机和链上活跃地址均在小幅下降,比特币需要实体硬件,来从物理上建立起人和人、点对点的链接,这一点可能会随着 ETF 而大幅扩张。

而在活跃地址上,比特币反而逐渐偏离 1 百万的心理预期,呈现出“链上开花链下热”的奇异景象,人人都在谈论比特币,但是反而在逐渐远离使用比特币,一种货币,一种电子货币如果没有人使用如何流通呢?

这里存在一个逻辑怪圈:生态缺乏导致无人使用,无人使用导致币价缺乏支撑,币价乏力导致矿工抛币,矿工抛售导致场外资金囤币,场外资金逐渐掌握定价权。

这在本质上和互联网的烧钱占领市场别无二致,只要在前期烧钱占领市场,那么在取得垄断市场后,则可以持续收取“地租”,吃尽一个个行业的红利,从外卖的千团大战,到打车的快滴合并,莫不如是。

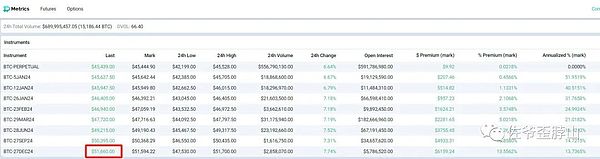

现如今,在 ETF 利好情绪下,比特币的年末期权一路到过 51000 美元以上,严重偏离现货市场价格,比特币的价格和其作用以及矿工算力,已经没有太大关系,可以说是最大的 Meme Coin,天大地大,情绪最大。

而在转瞬之间,比特币的价格从 45000 美元快速下跌至 4 万,币价波动之大堪比山寨币。

结语:神圣性一定会破产

现货 ETF 还未到来,基本上已经击碎了矿工多年建立的算力定价体系,人们常说比特币和其他币种都不一样,是独特的烟火,逐步在信徒中建立起宗教般的神圣性,如今,一朝梦碎,尘归尘土归土,君不见,你连一个矿工的声音都听不到,也许他们还沉浸在铭文的火热和出币变现的欢笑中。

比特币现货 ETF 进退自如,但是最后的 PoW 矿工力量会就此走入历史吗?

Will bitcoin spot be the end of miners? Bitcoin spot has successfully grasped the market sentiment between coming and going. People's focus has been on BlackRock and the long and short wars, but the miners' sadness has been ignored. In the context of halving bitcoin, miners choose to support the inscription to increase the fee income other than mining, but the arrival of the spot will not hurt the miners' interests in the currency price, or even help them increase their passive income. Spot through more traditional investors and individual retail investors. You can buy bitcoin legally to support the market price of bitcoin. Two-layer agreements such as lightning network will be legalized. Activities on the small high-frequency chain will continue to increase the fees of the main network, thus stabilizing the ecology. Unlike projects such as the inability of miners to resist when the Ethereum turns, the trinity of bitcoin mining machine manufacturers and miners' mine pools is not weak. In the past block expansion wars and the recent inscription wars, miners' dominance over bitcoin is no less than that of bitcoin manufacturers and nuclear companies. Heart development group, but in front of BlackRock and other asset management giants, the trillion-dollar scale of the entire encryption market is not enough to see the bitcoin miners. Although they don't say it on the surface, from the trend of holding money data, they have spent the past two months in continuous selling. Although they are worried that the price will fall after the deadline, in the long run, miners have realized that the pricing power of the problem will shift from the combination of miners in the chain to the pricing power transferred from Wall Street in the chain. East and West, Satoshi Nakamoto miners have the pricing power of bitcoin on Wall Street. The core is that computing power will inevitably shift to the west, especially the United States, after the decision in 2000. Contrary to the geographical distribution, the continuous concentration of mining pools is driven by capital efficiency. Miners still have the control of mining machines, while mining pools are responsible for daily maintenance. The logic of operation is very simple. Miners' income, mining machine cost, electricity fee, mining machine quantity depreciation rate, which is often said during the whole bull-bear period, is the most dangerous to mining pools and mining machine manufacturers, because miners float at most. As long as it lasts until the bull market, it can always sell money back, but the mining machine manufacturers and mining pools are engaged in the service industry of selling water, and once they fail to make ends meet, they will face a business crisis. In essence, the loss of miners belongs to the income from selling money, which cannot cover the existing expenses, but the actual expenditure is too big. Selling money will also bring back some funds. The mining pool will concentrate on the crowds to go ashore. From the first block of Bitcoin this year to the large-scale use of mining machines this year, the mechanism left by Satoshi Nakamoto is not environmentally friendly, but it relies on robustness to help miners. After surviving at least one round of bull and bear, the original miners were not entirely capital games, but more participants came from the bottom of society, including internet cafe owners, encryption geeks and inexplicable pioneers. The rough and chaotic market in the early days created the initial opening cost of the micro-strategy of deifying wealth, which was four or five digits. Their cost was even single digits, but now everything will change. Bitcoin prices will shift from computing power to market sentiment on Wall Street. The drivers of bitcoin spot and futures and even encrypted mining enterprises are different, which will essentially change the pricing and operation logic of bitcoin. Under the impetus of capital appreciation, the trend of chip concentration of existing bitcoin will further deteriorate. Compared with other currencies, the concentration of bitcoin currency has been quite scattered, and it is almost impossible to achieve the huge attack of superimposing bitcoin computing power or controlling bitcoin network. However, this is the logic. If a large number of capital giants flood into bitcoin network, it will become a mechanism to some extent. However, this does not mean that the emergence of bitcoin will become a pledge mechanism, but that excessive concentration of chips may lead to consequences. Theoretically, spot is the pricing basis of derivatives, but under the long transmission chain, there may be an imbalance between regulation and pricing mechanism. We can recall the subprime mortgage crisis next year, which means that junk bonds are constantly packaged for sale based on preconditions. The initial mortgage will no longer have an obvious regulatory effect on the market, and there are objective conditions for Bitcoin to repeat this situation. How pleasant it sounds that the consortium fires and miners die suddenly. Bitcoin still lacks the popularity of ecological inscriptions and the popularity of the second floor is still based on the old mechanism. The initial role of Bitcoin has been repeatedly said that everyone is impatient with peer-to-peer electronic cash. During the bear market, micropayment innovation based on lightning network has been tried in Latin American countries such as Argentina, but now people have picked up the sacredness of Bitcoin, but they have abused the block space in the popularity of Bitcoin by stuffing ducks. Both the coin machine and the active address on the chain are declining slightly. Bitcoin needs physical hardware to physically establish a point-to-point link between people, which may expand greatly with it. On the active address, Bitcoin gradually deviates from the psychological expectation of one million, showing a strange scene of blooming on the chain and being hot under the chain. Everyone is talking about Bitcoin, but on the contrary, it is gradually moving away from using Bitcoin, a currency and an electronic currency. If no one uses it, how to circulate it? There is a logical cycle and ecological lack. This leads to no one using it, no one using it, no support for the currency price, weak currency price, miners throwing coins and miners selling them, and OTC funds gradually mastering the pricing power. This is essentially the same as the Internet burning money to occupy the market. As long as it burns money in the early stage and occupies the market, it can continue to collect land rent and eat up the dividends of various industries after obtaining the monopoly market. From the thousand-group battle of take-out to the quick merger of taxis, it is better to have the year-end option of Bitcoin all the way in a good mood. The price of bitcoin has little to do with its function and miners' computing power. It can be said that the price of bitcoin is the biggest, and the mood is the biggest. In a blink of an eye, the price of bitcoin has dropped rapidly from the dollar to the price of 10,000 yuan, which is comparable to the conclusion of the cottage currency. The sacredness will definitely go bankrupt. The spot has basically shattered the computing power pricing system established by miners for many years. People often say that bitcoin is different from other currencies, and it is a unique fireworks gradually among believers. Establish a religious sacredness. Now, once the dream is shattered, the dust will return to the earth. You can't even hear the voice of a miner. Maybe they are still immersed in the fiery inscription and the laughter of the realization of coins. But will the final miner's power go into history? 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。