现在的比特币价格 到底是高还是低?

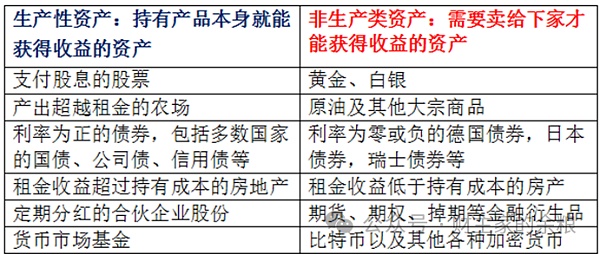

整体来说,当前可投资的大类资产分为两类:

自己可以创造现金流的生产型资产;

自身无法创造现金流的商品型资产。

很显然,比特币与股票、地产、债券等不同,不是生产型资产,而是类似于黄金一样的商品型资产。

生产型资产的估值,主要依赖于其当前或未来所产生的现金流,但商品型资产,几乎每一类商品都有着自己的独特的供需估值逻辑。

在前天的文章《2024年,应该买什么》一文中,我已经用存量/流量稀缺性估值思路,从而为比特币的价格建立起一套公允价格的逻辑模型——当然,所有模型都是历史数据的反映,但至少,从过去10年比特币价格的波动历史来看,这一套模型和逻辑是符合现实的。

(说明:该文章已被删除,这两天本人会将纯理论探讨的内容,重新整理后再发表)。

所以,判断比特币价格到底是高还是低,我遵循三个步骤:

第一,需要弄懂比特币的价格逻辑;

第二,判断宏观金融环境,这可能决定了所谓的“牛市”或“熊市”;

第三,当前短期的市场情绪状况。

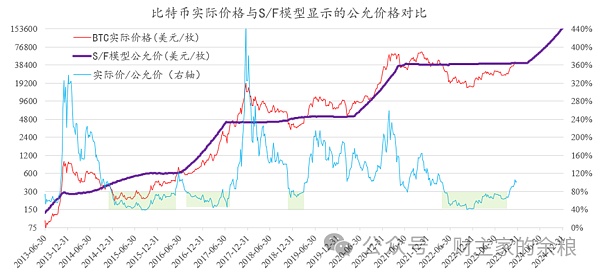

不考虑宏观金融环境,也不考虑市场情绪,从比特币价格逻辑模型的角度,我们可以直接用比特币的实际价格/公允价格,来表征当前的比特币价格,到底是高估还是低估。

最近10年,有四个阶段比特币的实际价格/模型公允价格低于80%(图中绿色阴影区):

2015年1月-2016年5月,币价在200-400美元之间波动;

2016年9月-2017年7月,币价在600-1600美元之间波动;

2018年12月-2019年3月,币价在3500-5000美元之间波动;

2022年6月-2023年10月,币价在15000-26000美元之间波动。

其中,最低点出现在2015年9-10月以及2022年11月-12月,当时的实际价格/公允价格的比值只有40%左右。

昨天的文章留言中,有人还质问我,为什么币价最低的时候,没有给大家推荐比特币,现在已经涨起来了,却来写文章,这不是坑大家么?

我不知道这些人是否经常看我文章——

看我文章比较多的人,应该不会说这样无知的话,我多次写文章唱多某类资产的时候,一定不会是那个资产价格的高点,这一条上,不管A股、美股、港股、黄金、比特币乃至原油,极高位唱多、极低位唱空,我从来都没有干过这样的事儿。

实际上,就在2022年11-12月,我连续梳理了币圈金融机构的连环破产潮,写下了6篇文章,解释为什么在当时币价下跌如此惨烈,并且在2023年1月初明确的告诉大家,币价现在到底了:

币圈连环破产潮;

币圈大地震持续;

致命的杠杆;

最大的破产;

真正的大麻烦;

只有比特币了

问题是,那个时候我拼命的在推荐,你买了么?你是不是还是觉得我在坑大家?

当然,我知道,那个时候一定有人根据我的判断,下手买了,当时币价在2万美元以下,现在他们赚了钱,会告诉你么?

根据我最新模拟的S/F模型,当前的公允币价,约为4.1万美元,所以,你可以理解,现在实际4.4万美元的币价并不低,但也没有高估,尚在合适区间。

我们再来看宏观的金融环境。

2023年,可谓是美联储最近15年来货币政策最紧缩的一年,即便在这种情况下,比特币的年度涨幅仍然达到了140%的水平,这很显然说明2022年底比特币一定是相当低的价位。

2024年,美联储基本不大可能紧缩也不大可能大放水的情况下,比特币理论上说应该处于牛市期间,价格与其公允模型的价格接近,可能也算是比较合适的结果。

最后,我们再来看市场情绪。

自2023年10月底以来,因为一系列比特币ETF在申请SEC(美国证监会)获批,因为憧憬在ETF通过之后,会有大批接盘侠到来,所以,最近两个月比特币持续暴涨,这种市场情绪一直蔓延至今,到现在都没有消退,而且还在继续演绎……

从市场情绪来看,当前肯定位于情绪沸点,也就意味着,价格有可能处于短期内相对高位。

S/F模型的公允价来看,比特币处于合理区间;

宏观金融环境来看,比特币处于合理区间;

市场情绪来看,比特币处于情绪高点;

以上三条,就是我对当前比特币价格的判断。

Generally speaking, there are two types of assets that can be invested at present: production assets that can create cash flow by themselves, and commodity assets that cannot. Obviously, bitcoin is different from stocks, real estate bonds and other commodities, but the valuation of production assets is a commodity asset similar to gold, which mainly depends on its current or future cash flow, but almost every commodity asset has its own unique logic of supply and demand valuation. What should I buy in the previous article? In this paper, I have used the idea of scarcity valuation of stock flow to establish a logical model of fair price for bitcoin price. Of course, all models are the reflection of historical data, but at least from the fluctuation history of bitcoin price in the past year, this model and logic are realistic, which shows that the article has been deleted. In the past two days, I will rearrange the content of pure theoretical discussion before publishing it, so I have to follow three steps to judge whether bitcoin price is high or low. First, I need to understand it. The price logic of bitcoin is the second to judge the macro-financial environment, which may determine the so-called bull market or bear market. Third, the current short-term market sentiment does not consider the macro-financial environment or market sentiment. From the perspective of bitcoin price logic model, we can directly use the actual price fair price of bitcoin to indicate whether the current bitcoin price is overvalued or underestimated. There are four stages in recent years. The actual price model of bitcoin is lower than the month, month and year currency price in the green shaded area in the figure. Fluctuation between US dollars Year Year Year Year Currency Price Fluctuation between US dollars Year Year Currency Price Fluctuation between US dollars Year Year Currency Price Fluctuation between US dollars, of which the lowest point appears in the year month and the year month, and the ratio of the actual price to the fair price is only about yesterday's article. In the message, someone also asked me why I didn't recommend Bitcoin to everyone when the currency price was the lowest, but I wrote an article instead. This is not cheating everyone. I don't know if these people often read my article. Many people should not say such ignorant words. I have written articles many times to sing about certain assets, but it will not be the high point of that asset price. In this article, no matter whether stocks, US stocks, Hong Kong stocks, gold, bitcoin or even crude oil are extremely high, they sing about multipolarity and low position. I have never done such a thing. In fact, in June, I combed the serial bankruptcy tide of financial institutions in the currency circle and wrote an article explaining why the currency price fell so sharply at that time and clearly told everyone about the currency price at the beginning of June. Now in the end, the serial bankruptcy of the currency circle, the tide of the currency circle earthquake, and the deadly leverage, the biggest bankruptcy is only bitcoin. The question is, at that time, I was desperately recommending you to buy it. Do you still think that I was in the pit? Of course, I know that someone must have bought it at that time according to my judgment. Now they will tell you if they make money. According to my latest simulation model, the current fair currency price is about $10,000, so you can understand that it is actually $10,000 now. The currency price of the US dollar is not low, but it is not overvalued, and it is still in the appropriate range. Let's look at the macro financial environment again. It can be said that the year of 2008 is the tightest year of the Federal Reserve's monetary policy in recent years. Even in this case, the annual increase of Bitcoin has reached a new level, which obviously shows that the price of Bitcoin must be quite low at the end of the year. In the case that the Federal Reserve is basically unlikely to tighten and release water, it is theoretically possible that the price of Bitcoin should be close to the price of its fair model. Finally, let's look at the market sentiment. Since the end of last year, because a series of bitcoins have been approved by the US Securities and Exchange Commission, and because of the expectation that a large number of takers will arrive after the approval, the market sentiment has continued to soar in the last two months. This market sentiment has spread to this day and has not subsided until now, and it is still continuing to be interpreted. From the market sentiment, it must be at the boiling point of sentiment at present, which means that the price may be at a relatively high level in the short term. The currency is in a reasonable range. From the macro-financial environment, Bitcoin is in a reasonable range. From the market sentiment, Bitcoin is above the emotional high point. Three are my judgments on the current bitcoin price. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。