如果BTC达到100万美金

作者:刘教链

在目前活跃的BTC市场领导者中,当属方舟基金(Ark Invest)的木头姐(Cathie Wood)给出的目标最为大胆:2030年BTC 138w美刀。(参考教链2023.10.15文章《方舟基金预测2030年BTC或达最高148w美刀》)

四舍五入取个整,就是1 BTC = 100w刀。

木头姐的论证,是偏向于基本面的方法。列举了可能的可触达市场,并逐一估算规模和渗透率。然后各项相加,得出相对科学的估计结果。这种方法比较符合科学主义的审美观。思维范式比较偏向于由外而内的,更侧重于外因。

而与之相反的一种方法,则是纯技术面的分析。从历史价格中寻找规律,并相信未来会重复这个规律。典型的比如教链曾多次介绍的,双对数价格走廊模型。根据该模型,BTC中性地达到100w刀的时间是2032年10月,而鲁棒地达到100w刀的时间则是2037年4月。这种就比较由内而外,更侧重内因。(参考教链2021.7.24文章《比特币的价格走廊》,教链内参2023.12.24《年度私董会干货总结》)

其实还有与上述两种都不同的方法,来估计BTC达到某个高度的可能性。这办法就是:人心的称量。

这个办法不需要你去调研,了解其他人的心里是怎么称量BTC的。而只需要反求诸己,扪心自问一下,如果BTC达到100w刀,各方各面的人或机构是否衬得上。

咱们有个哲学,德须配位。

假设你现在持有X枚BTC。那么便不妨在心里设想一下,如果BTC达到100w刀,自己现在的各方各面,能否配得上持有X百万刀的财富。

如果有难度,那么往前走只有三种可能:

一、BTC达不到100w刀。

二、BTC达到了100w刀,但你手里的BTC数量减少了,从X减小到了(X - y),从而使得(X - y) x 100w刀就是一个你配得起的财富。

三、你持续修炼,和BTC一起快速成长,待到BTC 100w刀时,你已经成长到配得起X百万刀的财富了。

我们还可以把一些打明牌的典型囤饼者拉出来,称量称量。

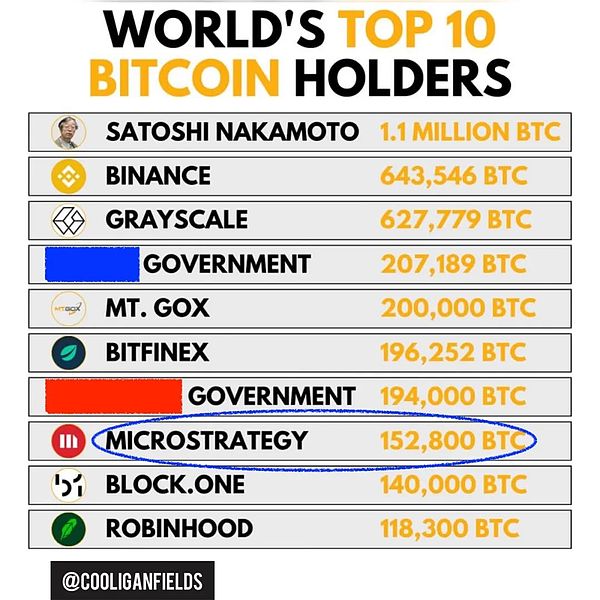

注:图中数据并非最新

比如号称永不卖饼的微策略创始人Michael Saylor。在他的领导下,微策略目前囤积了大约18.9万枚BTC,当前总价值约为43k x 18.9w ~= 81亿刀。(参考教链2023.12.28文章《已囤积189150枚BTC,微策略的策略会暴雷吗?》)

如果BTC增长到了100w刀,那么这一仓位的总价值将上升到惊人的1890亿美刀。大概相当于中国移动或者阿里巴巴目前的市值,在全球资产排行榜里能够排到70名以上。

其实不算太惊人。美股第一名苹果的市值那可是13.795万亿刀。

即便BTC增长到Hal Finney早年曾设想过的1000w刀,微策略的仓位价值也不过区区1.89万亿刀而已,仅相当于苹果的十分之一强。但足以跻身前五,超越谷歌。

有趣的是,微策略公司的美股溢价几乎很小,公司总市值基本和它持有的BTC总价值相当。目前微策略美股总市值也只有86.3亿刀而已,比BTC持仓价值的81亿刀仅多了5亿刀。

所以,别说100w刀的BTC,就是1000w刀的BTC,看起来都不算太离谱。

另外一个案例是Winklevoss兄弟。这俩哥们就是那个和Facebook的扎克伯格打官司赢了6500w美刀赔偿的,他们牛逼的地方在于,拿到赔偿后,发现了当时仅有100刀左右的BTC,于是果断大手笔买入,前后花了1100w刀,据信买入了大概1%也就是约21万枚BTC(非明牌,无法精确得知其具体持仓数量)。

这个规模和微策略的持仓量半斤八两。你可以参考上述测试,掂量掂量这俩兄弟是否配得上这泼天富贵。

最后,我们以早已隐退江湖的聪哥——中本聪的持仓再来衡量一下。据后人根据链上开采模式分析,推测大约有110w枚BTC乃是中本聪开采。他将其留在那里,岿然不动,矗立成一座精神丰碑。(参考刘教链2022.9.30文章《中本聪的传奇宝藏》)

这110w枚BTC,按照当前44k左右的现价计算,约相当于484亿刀。

根据维基百科,现在世界首富是卖LV包包的Bernald Arnault家族,约为2110亿美刀。紧随其后就是特斯拉的老板Elon Musk,1800亿美刀。第10名是微软的联合创始人Steve Ballmer,800亿美刀。

中本聪的传奇宝藏,也仅仅相当于鲍尔默的一半多点儿而已。

如果BTC 100w刀,那么中本聪留下的这份财富将价值1.1万亿美刀。如果这份财富属于中本聪个人,那么这将使他成为地球上最富有的人,身价将会是当今世界首富的5倍。

如果BTC 1000w刀呢,那么这笔财富将价值11万亿美刀,比肩苹果公司——当今地球上最成功的科技公司的市值。

所以,为什么中本聪从一开始就明白,自己必须隐退,也必然隐退。因为今天的世界,不容许任何一个个人,独立担起如此巨大的财富重担。

只有一个没有历史、没有过去、也没有未来的拟人的化名、代号,一个留在人们心中的传奇,一个不具有现实存在性、也无法被打倒的“神”,才能无惧这可敌一国的富贵加身。

人人都是中本聪。

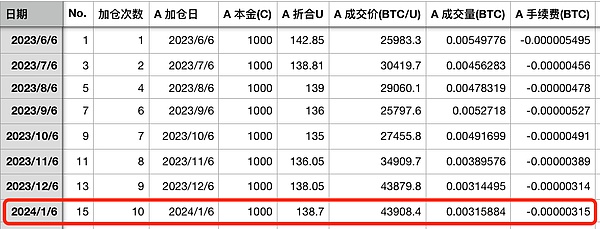

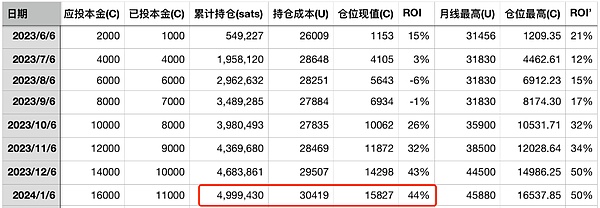

今天又到了《十年之约》实盘见证的加仓点。本次是第15次记录,第10次加仓。以市价单无压力加仓。加仓价43908.4刀。

加仓后,累计持仓约500w聪(sats)。持仓成本30419刀。浮盈44%。

向上走,总归是轻松的。越走天越亮,谁都会有信心。

Among the active market leaders at present, the author Liu Jiaolian is the most daring target given by Mujie of Ark Fund. The Ark Fund predicts that the year will reach the highest value. Rounding off the whole value means that Mujie's argument is biased towards fundamentals. The possible accessible markets are listed, and the scale and permeability are estimated one by one, and then the estimated results are relatively scientific. This method is more in line with the scientific aesthetic thinking paradigm and more biased towards the outside. The inside pays more attention to the outside, so the opposite method is purely technical analysis to find the law from the historical price and believe that this law will be repeated in the future. For example, the double logarithmic price corridor model introduced by the teaching chain many times, according to this model, the time to reach the knife neutrally is the year and the time to reach the knife robustly is the year and the month. This kind of comparison focuses more on the internal factors from the inside out, referring to the teaching chain article Bitcoin's price corridor, and the annual private board meeting dry goods summary is actually the same as the above two. There are different ways to estimate the possibility of reaching a certain height, which is the weighing of people's hearts. This method does not require you to investigate and understand how other people's hearts are weighed, but only needs to ask yourself if people or institutions in all sides of the knife are worthy of our philosophy and morality. Assuming that you have one now, you might as well imagine in your mind whether all sides of yourself are worthy of holding millions of knives if it is difficult. There are only three possibilities to go forward: one can't reach the knife, the other can reach the knife, but the number in your hand has decreased from reduced to, which makes the knife a wealth you can afford. Third, you continue to practice and grow rapidly together, and by the time the knife comes, you have grown up to be worth a million dollars. We can also pull out some typical cake hoarders who hit winning numbers and weigh them. The data in the note is not up to date. For example, the founder of Micro Strategy, who claims to never sell cakes, has accumulated about 10,000 pieces under his leadership. The former total value is about $100 million. Will the strategy of hoarding micro-strategies be thunderous? If it grows to $100 million, the total value of this position will rise to an astonishing $100 million, which is probably equivalent to the current market value of China Mobile or Alibaba. It is not too surprising that the US stock market ranks first in the global asset list. The market value of Apple is $100 million. Even if it grows to the position value of the knife micro-strategy envisioned in the early years, it is only a trillion dollars, which is only equivalent to Apple. It is interesting that the premium of US stocks of Microstrategy Company is almost small, and the total market value of the company is basically equivalent to the total value it holds. At present, the total market value of Microstrategy US stocks is only 100 million dollars, which is only 100 million dollars more than the position value of 100 million dollars, so let alone the knife, it doesn't look too outrageous. Another case is that the two brothers are the Zuckerberg who won the compensation for the US dollar in a lawsuit. What is awesome about them is that they found out after getting the compensation. At that time, there were only about knives, so I spent a lot of money before and after I bought them decisively. It is believed that I bought about 10,000 pieces, that is, it is impossible for winning numbers to accurately know the specific number of positions. This scale and micro-strategic positions are half as bad as eight ounces. You can refer to the above test to see if these two brothers deserve this extravagant wealth. Finally, we will measure it with the position of Cong Ge Satoshi Nakamoto, who has long retired from the rivers and lakes. According to the analysis of the mining model on the chain, it is speculated that about one is mined by Satoshi Nakamoto, and he left it there. There stands motionless as a spiritual monument. Refer to Liu Jiaolian's article Satoshi Nakamoto's legendary treasure. According to Wikipedia, the richest man in the world is a family selling bags, which is about 100 million dollars, followed by Tesla's boss, whose first name is Microsoft's co-founder, 100 million dollars. The legendary treasure of Satoshi Nakamoto is only a little more than half of Ballmer's. If it is a knife, then the wealth left by Satoshi Nakamoto will be worth one trillion dollars. This wealth belongs to Satoshi Nakamoto personally, so it will make him the richest man on the earth, and his value will be twice that of the richest man in the world today. If it is a knife, then this wealth will be worth trillions of dollars, which is comparable to the market value of Apple's most successful technology company on the earth today. So why did Satoshi Nakamoto understand from the beginning that he must retire and must retire? Because today's world does not allow any individual to shoulder such a huge burden of wealth independently, only one has no history, no past and no future. The personified alias code is a legend left in people's minds, a god who has no real existence and can't be defeated. This can be the enemy of a country's wealth. Everyone is the jiacang point that Satoshi Nakamoto has witnessed for ten years today. This is the first time to record the jiacang at the market price, no pressure, no price, and accumulated positions after jiacang. The cost of holding positions is about smart. It is always easy to go up, and everyone will have confidence. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。