ETH迈向1万美元之路 以太坊2024年路线图

作者:Thor Hartvigsen,Defi分析师 翻译:善欧巴,比特币买卖交易网

介绍

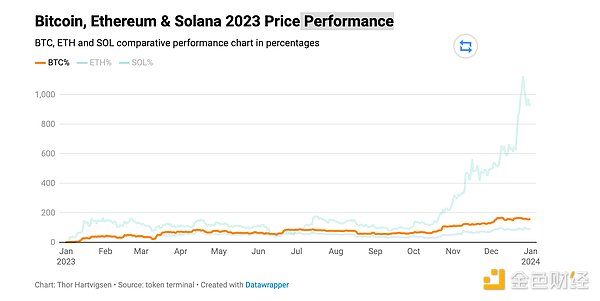

尽管以太坊的表现优于标准普尔 500 指数、纳斯达克指数和黄金,但去年的大部分时间,以太坊都处于其同行的阴影之下,这些同行的价格升值幅度更大,生态系统也有所增长。

令人惊讶的是,比特币的回报率几乎翻了一番,而 Solana 的回报率在 2023 年底一度达到了四位数。

令人惊讶的是,比特币在2023年底几乎翻倍,而Solana短暂地触及了四位数的回报率。

进入新年时,Twitter上对以太坊的情绪也不是很好。公众支持和士气达到了一个历史新低,看涨的人被认为是反对派和异教徒。但似乎情况即将发生变化,今年以太坊生态系统有几个催化剂。

以2024年路线图为指南,让我们看看以太坊未来有什么规划。

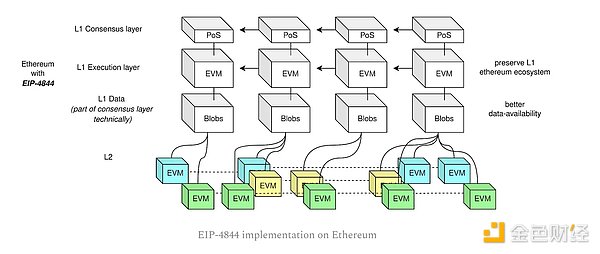

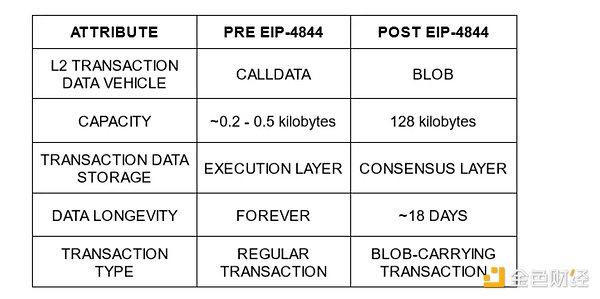

1、EIP-4844

在即将到来的 Dencun 升级中,EIP-4844(也被称为 Proto-Danksharding)引入了新颖的机制,极大地有益于 Layer 2。

这个 EIP 的相关特性包括:

1. blobs(数据块)

- 高效存储大量交易数据的低成本手段;

2. blob-carrying transactions(携带数据块的交易)

- 包含对其中包含的数据块的引用列表的交易。

利用数据块的使用允许创建一个伪层,提高数据可用性,从而简化 L2 和以太坊之间的通信。

这些新概念将彻底改变滚动聚合(roll-up)序列化程序将交易数据发布到以太坊的方式。

当前的方法是在交易的“备注部分”(calldata)中添加捆绑的交易数据,并将其发送到 L1,这相当昂贵。

然而,使用携带 blob 的交易将数据发布到以太坊会显著降低gas费用,因为只有指向包含 L2 交易的 blob 的引用可供执行层使用,这意味着 blob 数据不能被重新执行。blob 中包含的所有数据都存储在共识层(信标节点)中,时间有限。更便宜的交易的一个小权衡是增加了块大小,需要节点有更大的存储容量。

以太坊 Rollup 上交易成本的大幅降低有几个好处。首先,它允许新的用例,这些用例目前在 Rollup 上运行太昂贵,比如某些订单簿交易协议、web3 游戏等等。其次,将交易发布到以太坊主网的成本降低也导致了 Rollup 的利润率增加。因此,这也是 L2 代币(如 ARB、OP、METIS 等)的直接催化剂。

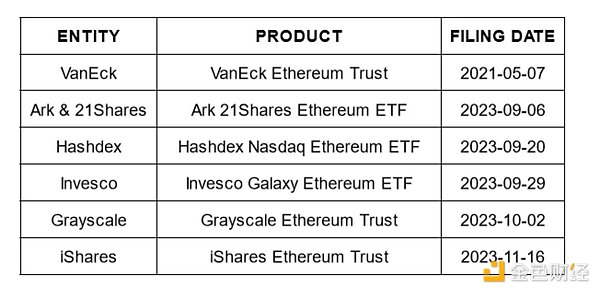

2、ETH 现货 ETF

尽管现货比特币 ETF 似乎有可能获得批准,但以太坊类似产品的情况仍处于模糊状态。美国证券交易委员会推迟了对其中几只 ETF 的决定,很可能会在比特币对应产品向公众开放后做出决定。

尽管以太坊期货ETF表现令人失望,资金流入也不理想,但机构对现货ETF的兴趣依然清晰可见。许多知名机构都在积极寻求利用这一新的投资工具,它与传统金融中当下流行的ESG理念相契合。

目前,所有上市申请都处于待批状态,尽管存在延误,但仍预期会有积极的成果。鉴于2023年下半年现货BTC ETF申请对BTC价格的影响,仅以太坊ETF申请本身就可能在未来几个月推动ETH在市场上表现优异。

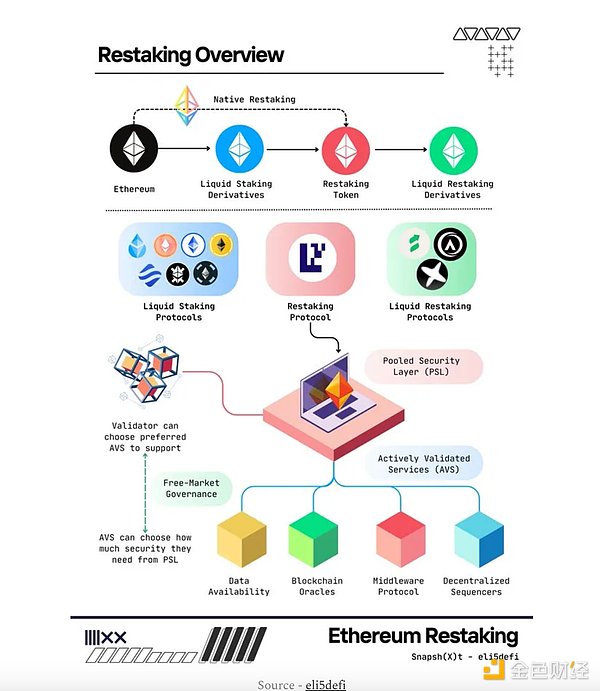

3、重新质押

重新质押 (Restaking) 是 EigenLayer 引入的一个新颖概念,服务可以通过它利用以太坊的安全和共识机制。EigenLayer 是一个连接 ETH 重新质押者和 "积极验证服务" (AVS) 的市场平台。AVS 可以是任何类型的服务,从预言机网络到侧链再到桥接,都希望继承以太坊的安全性。ETH 质押者可以通过重新质押他们的 ETH 将其委托给 AVS,从而获得更高的质押收益。本质上,ETH 质押者除了块验证之外,还可以参与数据存储、计算或其他额外的服务。

除了 EigenLayer 即将主网上线,这是今年以太坊和 ETH 的一个重要叙事之外,平台还正在进行一个积分计划,早期 ETH 存款人可以通过该计划挖取即将到来的空投。EIGEN 代币有可能以数十亿美元的估值上市,因此这次空投可能会成为一个重大的财富创造事件,并可能成为以太坊原生协议的积极催化剂。

由于 Dencun 升级带来资本效率的提升,目前可用的 L2 解决方案将变得更加便宜,这将使 L2 在快速且廉价的替代方案充斥的领域中更具竞争力。此外,以前无法实现的用例现在也值得探索了。

预计未来一年 L2 的用户群将大幅增长,前景十分乐观,催化剂也层出不穷。

4、L2 增长

由于 Dencun 升级带来资本效率的提升,目前可用的 L2 解决方案将变得更加便宜,这将使 L2 在快速且廉价的替代方案充斥的领域中更具竞争力。此外,以前无法实现的用例现在也值得探索了。

预计未来一年 L2 的用户群将大幅增长,前景十分乐观,催化剂也层出不穷。

Optimistic Roll-ups

在 L2 领域最受关注的 Optimistic Roll-ups 近期公布了即将到来的令人兴奋的开发细节。

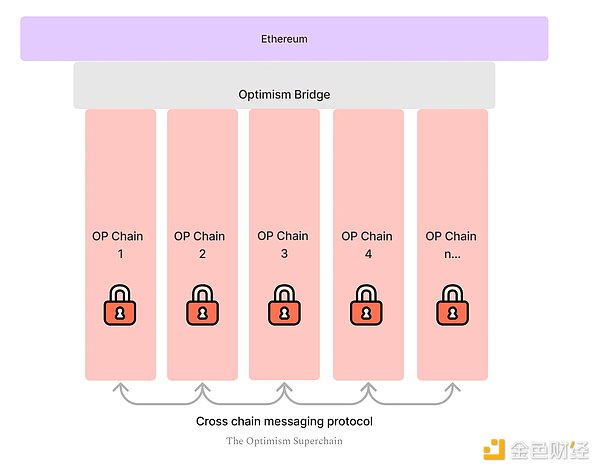

Optimism

为了统一所有原本孤立的 L2,Optimism 决定加大对基础设施提供商的投入,尝试基于其开源技术栈创建一个相互连接的链网络。

“超级链”中包含的所有链都遵守同一标准,这确保了所有链之间的最大互操作性,并允许开发人员构建可以被所有子链使用的协议。

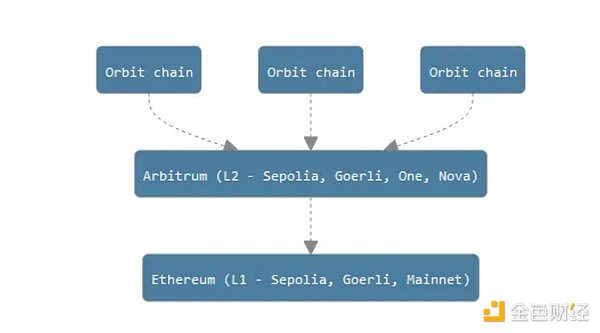

Arbitrum:

通过使用 Arbitrum 链之一作为结算层,开发者可以轻松部署具有可定制配置的专用链。

Orbit 链非常适合构建拥有特定网络需求的应用,同时还能利用 Arbitrum 的技术和额外功能,适用于各种用例:

权限访问控制 - 链的数据读取或合约部署可以由所有者限制。

自定义 gas 代币 - 交易费用可以收取任何代币。

自我治理 - Orbit 链不受 Arbitrum DAO 的监管,这意味着所有者对网络拥有完全控制权。

Metis

为了解决大多数使用单个排序器的 L2 集中化和安全问题,Metis 正在尝试创建一个去中心化排序器池的概念。 利用其现有的点对点验证器,这种方法将大大降低集中化,并让其原生代币的质押者有机会运行自己的排序器。

Coinbase > Base 漏斗

由于繁琐的桥接过程和必须与以太坊交互,吸引新用户一直是 L2 的一个挑战,这对希望避免昂贵交易和简单用户体验的用户来说是不可接受的。

作为世界上最大的交易所之一,Coinbase 每年都会吸引来自全球的大量新用户到他们的平台。

这是 Coinbase 向其主要集中式交易所的本地受众宣传其 L2 Base 的完美场景。拥有巨大的潜在市场有助于提高链上应用程序的知名度和认知度。再加上交易所和汇总之间的简单桥接解决方案,即使很小的转化率也会对生态系统产生巨大的净积极影响。

Eclipse

rollup 领域的另一个有趣的发展是Eclipse ,这是在第一季度晚些时候推出的以太坊 L2。Eclipse 的独特之处在于它使用 Solana 虚拟机作为执行环境,使用 Celestia 提供数据可用性,使用 Risc Zero 进行证明。由于专注于将 Solana dapp 吸引到以太坊,这可能成为今年以太坊生态系统的另一个催化剂。

5、ETH 作为货币

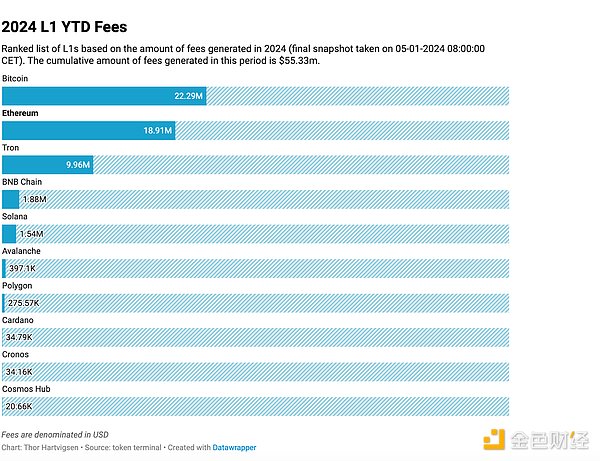

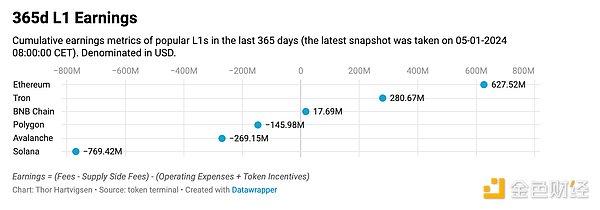

在费用产生方面,仅以太坊就占到 2023 年 L1 产生的总费用的 50% 以上。它的主导地位现在已经减弱,这主要是由于铭文热潮之后比特币生态系统的出现。

严格来看财务报告,以太坊是少数几个实现正收益的主要区块链之一。

由于以太坊网络产生的手续费收入超过发行新币造成的稀释,ETH 的实际质押收益可以为正,名义质押收益不会被通胀抵消。 由于伦敦升级引入的代币燃烧机制以及 2022 年转向权益证明机制,以太坊的供应量每年以约 -0.215% 的速度缩减,处于净通缩状态。

随着新的升级旨在进一步扩展以太坊,现有概念继续稳步发展,“超声波货币”的理论或许并非空穴来风。

总结

总而言之,经历了 2023 年的平静之后,以太坊将在 2024 年迎来多事的一年。技术和叙事无疑看涨,但价格是否会同步上涨还有待观察。历史上,网络升级通常会带来积极的涨势。

Although the performance of Ethereum is better than that of Standard & Poor's index, Nasdaq index and gold, it was in the shadow of its peers for most of last year, and the price appreciation of these peers was greater, and the ecosystem also grew. Surprisingly, the rate of return of Bitcoin almost doubled, and the rate of return reached four digits at the end of the year. Surprisingly, Bitcoin almost doubled and briefly touched four digits at the end of the year. When the return rate entered the new year, the public support and morale of Ethereum were not very good, and reached a record low. The bullish people were considered as opposition and heretics, but it seems that the situation is about to change. This year, there are several catalysts in the Ethereum ecosystem. Guided by the annual road map, let's take a look at what plans Ethereum has in the future. It is also called the introduction of a novel mechanism in the upcoming upgrade, which is greatly beneficial to this related features, including the efficient storage of a large amount of transaction data in data blocks. The use of data blocks allows the creation of a pseudo-layer to improve the availability of data, thus simplifying the communication with Ethereum. These new concepts will completely change the way the rolling aggregation serializer publishes transaction data to Ethereum. The current method is to add bundled transaction data in the remarks part of the transaction and send it to it, which is quite expensive, but to publish the data with the carried transaction. Going to Ethereum will significantly reduce the cost, because only references to transactions are available to the execution layer, which means that all data contained in the execution can not be re-executed and stored in the consensus layer beacon nodes. A small trade-off of cheaper transactions with limited time is to increase the block size, which requires the nodes to have more storage capacity. The substantial reduction of transaction costs in Ethereum has several advantages. First, it allows new use cases to be too expensive to run on the Internet at present, such as some order book transaction protocols. Games, etc. Secondly, the lower cost of publishing transactions to the main network of Ethereum has also led to an increase in profit margin, so it is also a direct catalyst for tokens, etc. Although spot bitcoin seems likely to be approved, the situation of similar products in Ethereum is still in a vague state. The US Securities and Exchange Commission has postponed the decision on several of them, and it is likely to make a decision after the corresponding products of Bitcoin are opened to the public. Although the performance of Ethereum futures is disappointing and the inflow of funds is not ideal, the institutions are not satisfied with it. Interest in goods is still clear, and many well-known institutions are actively seeking to make use of this new investment tool, which is in line with the current popular concept in traditional finance. At present, all listing applications are in a state of pending approval, but despite the delay, positive results are still expected. In view of the impact of spot applications on prices in the second half of the year, Taifang applications alone may promote outstanding performance in the market in the next few months, and re-pledge is a novel concept service that can be introduced through it. The security and consensus mechanism of Ethereum is a market platform connecting the re-pledgers and the active verification service, which can be any type of service, from the Oracle network to the side chain to the bridge. The pledgers hope to inherit the security of Ethereum, and they can obtain higher pledge income by re-pledging theirs and entrusting them to. In essence, in addition to block verification, the pledgers can also participate in data storage calculation or other additional services, in addition to going online on the main network, which is an important thing for Ethereum this year. In addition to the narrative, the platform is also carrying out an integral plan, through which early depositors can dig up the upcoming airdrop tokens, which may be listed at a valuation of billions of dollars. Therefore, this airdrop may become a major wealth creation event and may become a positive catalyst for the original agreement of Ethereum. Due to the upgrade, the currently available solutions will become cheaper, which will make them more competitive in areas flooded with fast and cheap alternatives. Use cases that could not be realized before are now worth exploring. It is expected that the user base will increase substantially in the coming year, and the prospects are very optimistic, and the catalysts are also growing endlessly. As the upgrade will bring about the improvement of capital efficiency, the currently available solutions will become cheaper, which will make them more competitive in the field full of fast and cheap alternatives. In addition, use cases that could not be realized before are now worth exploring. It is expected that the user base will increase substantially in the coming year, and the prospects are very optimistic, and the catalysts are also emerging. Recently, the most concerned domain has announced the exciting details of the upcoming development. In order to unify all the originally isolated decisions, it has increased investment in infrastructure providers, and tried to create an interconnected chain based on its open source technology stack. All the chains contained in the network super chain abide by the same standard, which ensures the maximum interoperability among all the chains and allows developers to build protocols that can be used by all the sub-chains. By using one of the chains as the settlement layer, developers can easily deploy. The customized dedicated chain is very suitable for building applications with specific network requirements, and the technologies and additional functions that can be utilized are suitable for various use cases, access control chains, data reading or contract deployment. The transaction cost of customized tokens can be limited by the owner, and any tokens can be charged. The self-governance chain is not regulated, which means that the owner has complete control over the network. In order to solve the centralization and security problems of most single sorters, he is trying to create a decentralization. The concept of sorter pool, using its existing peer-to-peer verifier, will greatly reduce centralization and give the pledgee of its original token a chance to run its own sorter funnel. It has always been a challenge to attract new users because of the cumbersome bridging process and the need to interact with Ethereum, which is unacceptable for users who want to avoid expensive transactions and simple user experience. As one of the largest exchanges in the world, it attracts a large number of new users from all over the world to their platforms every year. Promoting its perfect scene to the local audience of its major centralized exchanges has a huge potential market, which helps to improve the popularity and recognition of online applications. Coupled with the simple bridging solution between exchanges and aggregation, even a small conversion rate will have a huge net positive impact on the ecosystem. Another interesting development in the field is that this is the unique feature of Ethereum, which was launched late in the first quarter. It uses virtual machines as an execution environment to provide data availability and use for proof. This may become another Ethereum ecosystem this year because of its focus on attracting it to Ethereum. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。