比特币现货ETF申请获批倒计时一天:美国不会轻易放手

在比特币现货ETF申请获批消息落地前1天,SEC主席Gary Gensler在X上发推文警示虚拟资产所存在的风险,也正是这一则声明让市场认为比特币现货ETF申请获批概率增大,比特币价格于今早突破47,000美元的高点。

来源: Bloomberg

不仅市场情绪如此高涨,申请方也在做着充足的准备。由Catherine Wood创立的资产管理公司ARK Invest(ARK)将会成为第一家获得SEC最终回复的比特币现货ETF申请方,去年末,ARK已出售其全部剩余的GBTC头寸,并用约1亿美元的一半资金购买了BITO,“可能作为流动性过渡工具,以保持对比特币的贝塔值”,并将其纳入ARKW(ARK Next Generation Internet ETF)或ARKB(Ark 21Shares Bitcoin ETF,ARK正在申请的比特币现货ETF)。市场各方已蓄势待发,若美国SEC批准比特币现货ETF,这也代表着自2013年机构就在向SEC申请的比特币现货ETF却一直被拒的10年持久战有望结束!

美国不会轻放来自华尔街的议价权,ETF通过将带来议价权叠加效应

若现货ETF放开了门槛,公募、私募基金和个人投资者将可以像购买股票一样在传统证券交易所轻松参与虚拟资产市场,直接持有比特币,解除了合规渠道的限制。短期内资金量所带来的市场效应只是一方面,更关键的是美国将会通过ETF增强在加密市场的议价权力,成为行业规则制定者。

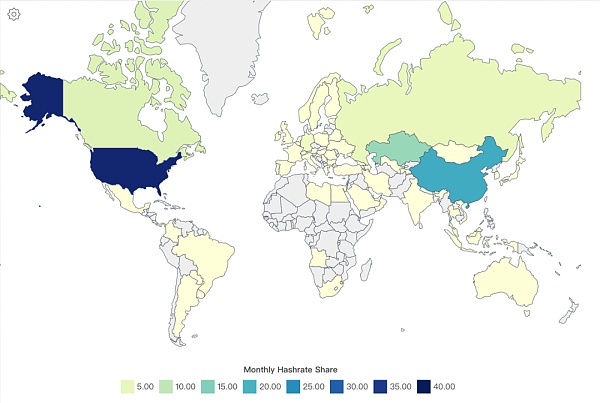

随着比特币挖矿算力从中国转移到美国,美国的比特币算力占据了全球40%的份额,已世界排名第一。这就意味着在供给端,美国已经掌握其议价权。

图:全球比特币算力图

来源:worldpopulationreview.com

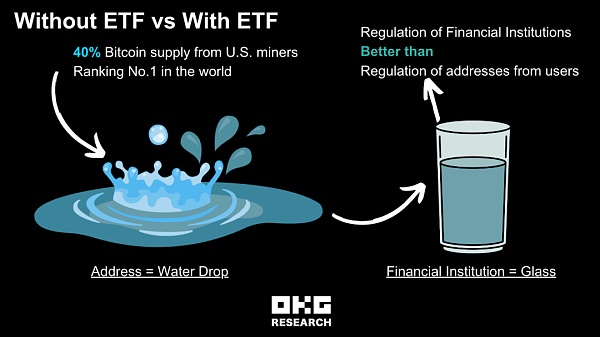

若现货ETF通过,就意味着以机构为单位,持仓和交易数据将被披露,这将为监管机构和市场参与者提供更多的市场透明度。通过这些信息,监管机构可以更好地监督市场活动,减少市场操纵和欺诈行为的风险。如下图,我们做一个比喻,虽然知道“每一滴水滴”可以在链上轻松做溯源、追踪和验证,但对于监管机构来说,监管“每一滴水滴”的难度是较大的。如果我们把这些水滴集中起来,用玻璃容器装起来,并下放这样的监管要求给到每一只“玻璃杯”,这样监管机构会更好制定规则和进行管理。

对美国来说,ETF若通过,更是奠定了美国在加密市场规则制定者和市场主导者的地位。无论比特币现货ETF通过与否,美国不会轻易放弃这一巨大优势。

图:OKG Research - 有ETF合规通道VS没有ETF合规通道

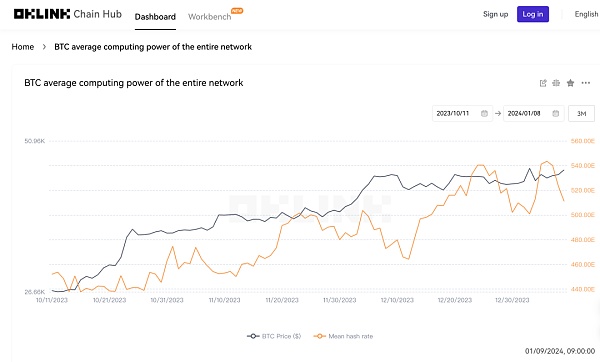

此外,比特币现货ETF的通过预期在供给端体现也十分明显:供给端的矿工竞争也十分激烈,如火如荼。根据欧科云链OKLink数据分析,哈希率(Hash Rate)在过去三个月以平均5.17%的增长率在上升,对比去年同期的月平均增长率1.76%,可以看出矿工(供给端)竞争是更为激烈。

图:比特币算力

来源:OKLink

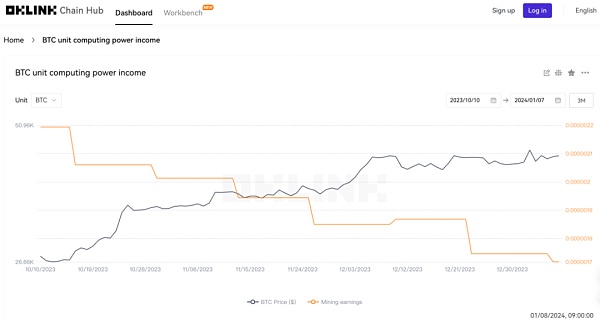

从运营成本的角度来看,OKLink数据显示,矿工的单位算力收益在过去三个月持续以8%的速度下降(图2),同期月平均反而是增长,约为1.55%的增长率。供给端在单位收益降低的情况下,还在抛售去维持运营成本。

图:比特币矿工单位算力收入

来源:OKLink

新市场蓄势待发,原有市场更坚定

尽管ETF的消息已经在市场上期盼已久,从OKLink链上数据看出由于时间和风险偏好不同,新投资者忍受等待合规渠道便捷性的机会成本意愿度较大,放弃早期埋伏链上持有的获利潜在收益。而原有的市场参与者 —— 长期投资者、比特币支持者以及早就看好比特币的机构投资者更看重的还是比特币的长期价值。

由于一些早期看好比特币的机构已通过其他方式参与其中,例如ARK已出售其全部剩余的GBTC头寸,并注入BITO(Bitcoin Strategy ETF,BITO 投资于比特币期货,并不投资于比特币),灰度也在寻求将GBTC转为ETF。他们可能更专注于比特币的基本面、技术发展和市场需求,相对来说,并不太受短期市场波动和ETF批准消息的影响。

根据欧科云链OKLink链上数据观察来看,可以看到对于这些消息并未给链上生态带来太多的热闹。近三个月(10月10日至1月7日),比特币(BTC)链上总地址数呈直线上升趋势,平均月增长率为1.16%。与去年同期相比,增长率持平。

图:比特币生态总地址数

来源:OKLink

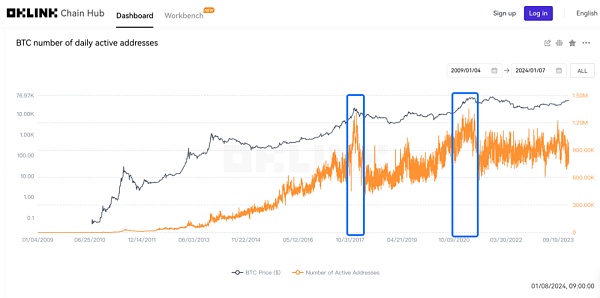

此外,通过活跃地址数的观察,我们发现并非是比特币ETF相关新闻爆出时活跃地址数达到高点,而是在2017年12月和2021年3月这两个时间段相对较高。

图:比特币每日活跃地址数

来源:OKLink

繁花似锦,野蛮生长时代已不复存在

“你打算重新开始?”

就算美国BTC现货ETF未通过,市场也不会再回到“野蛮生长时代”了。据CoinGecko称,全球目前已有八个市场允许现货加密货币ETF的运营包括加拿大、德国、瑞士,以及开曼群岛和泽西岛等避税天堂。不过,并未激起市场像等待美国现货ETF获批一样的激情,这也再次证明美国将供给端和渠道打通所带来的叠加效应对市场影响之大。

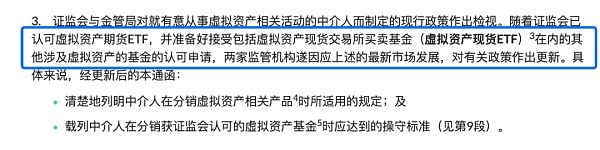

就在美国的ETF剧情“扑朔迷离”之际,2023年备受瞩目的香港已然迈出那一步。在2023年12月22日,SFC更是连发多则通函,表示“准备好接受虚拟资产现货 ETF 的认可申请”。以香港为例,根据KPMG 2023年私人财富管理报告,截至2022年底,香港私人银行及私人财富管理资产管理总值为89650亿港元。若有1%资金通过比特币现货ETF,将有约116亿美元资金涌入市场。

据欧科云链研究院了解,目前已有几家金融机构在计划在上半年发行比特币现货ETF。这样的百亿级别的竞争力度,也会迫使美国SEC不会轻易拒绝蓄势待发的现货ETF。

对比香港与美国有关于比特币现货ETF的差别点,有以下两点值得市场关注:

12月22日的通函中,香港SFC表示会支持现金与实物两种模式,给投资者提供更多选择;美国SEC采取强制现金申赎的策略,使用现金申赎也是为了减少市场操纵的风险,通过现金申赎也是变相地对AP进行控制,也将挤压其赚取无风险套利的利润空间。因为如果AP通过在一级和二级市场的操作试图操纵市场价格,可能引发市场不稳定性。此外,采用实物申赎中,做市商可收到比特币来换取ETF股份,提高税收效率。太平洋彼岸的金融机构也希望达成多元渠道,据CBNC报道,Fidelity和BlackRock已寻求现金和实物申赎的批准,以照顾那些已持有比特币但在市场交易和税务方面寻求便捷性的投资者。

目前,美国已经提交了8个比特币ETF的申请,计划在Nasdaq(纳斯达克)、Cboe BZX(芝加哥期权交易所 BZX)和NYSE Arca(纽约证券交易所 Arca)这三个交易所之一进行交易。其中,占据最大比例的交易所是Cboe BZX,占了申请总数的5/8。与美国申请方申请的交易场所均为已经有过其他金融工具交易经验的交易平台不同,香港在12月22日的通函中仅表示了证监会与金管局列明中介人在分销ETF时需要达到的规定和操守。

若美国BTC 现货 ETF通过后并按照申请材料在三家交易平台之一进行交易,有了这样的案例参考,港交所HKEX会更有动力考虑为由香港公司发行的比特币现货ETF提供交易平台。

图:12月22日,SFC发布多则通函

来源:SFC

无论美国ETF明日是否通过,时光逝,“西部世界”一般的加密市场,一去不复返。2024,加密市场一定是“繁花似锦”。

The day before the news of the approval of the bitcoin spot application landed, the Chairman sent a tweet warning about the risks of virtual assets. It was this statement that made the market think that the probability of the approval of the bitcoin spot application increased, and the bitcoin price broke through the high point of the US dollar this morning. Not only was the market sentiment so high, but the applicant was also making adequate preparations. The established asset management company will be the first bitcoin spot applicant to get a final reply. At the end of last year, it sold all its remaining positions and used about 100 million US dollars. Half of the funds purchased may be used as a liquidity transition tool to keep the beta value of bitcoin and bring it into the bitcoin spot market or the one being applied for. All parties are ready to go. If the United States approves the bitcoin spot, it also means that since 2000, the organization has been applying for the bitcoin spot but has been rejected. It is expected that the United States will not relax the bargaining power from Wall Street, which will bring the superposition effect of bargaining power. If the spot is released, public private equity funds and individual investors will be able to look like. Just like buying stocks, it is easy to participate in the virtual asset market in the traditional stock exchange. Holding bitcoin directly removes the restriction of compliance channels. The market effect brought by the amount of funds in the short term is only on the one hand. More importantly, the United States will become an industry rulemaker by enhancing its bargaining power in the encryption market. With the transfer of bitcoin mining computing power from China to the United States, the global share of bitcoin computing power in the United States has ranked first in the world, which means that the United States has mastered its bargaining power on the supply side. Figure The source of the global bitcoin calculation plan, if the spot passes, means that the position and transaction data of the institution will be disclosed, which will provide more market transparency for the regulators and market participants. Through this information, the regulators can better supervise market activities and reduce the risk of market manipulation and fraud. Let's make an analogy as follows. Although we know that every drop of water can be easily traced and verified on the chain, it is more difficult for the regulators to supervise every drop of water. If we collect these water droplets, put them in glass containers and put them down, such regulatory requirements will be given to each glass, so that the regulatory agencies will better formulate rules and manage them. For the United States, if it passes, it will lay the foundation for the United States to be a rulemaker and market leader in the encryption market. Regardless of whether Bitcoin passes the spot or not, the United States will not easily give up this huge advantage. There is a compliance channel, but there is no compliance channel. In addition, the expected passing of Bitcoin spot is also very clear on the supply side. The competition among miners on the obvious supply side is also very fierce. According to the data analysis of Ouke Cloud Chain, the hash rate has increased at an average growth rate in the past three months. Compared with the average monthly growth rate in the same period last year, it can be seen that the competition among miners on the supply side is more intense. From the perspective of operating costs, the data shows that the unit computing income of miners has been declining at a constant rate in the past three months. In the same period, the average monthly growth rate is about, but the supply side is decreasing in unit income. The market is still selling to maintain the operating cost. The new market of bitcoin miners' unit computing power income source is ready to go, and the original market is more firm, although the news has been waiting for a long time in the market. From the data on the chain, it can be seen that because of the different time and risk preferences, new investors are more willing to endure the opportunity cost of waiting for the convenience of compliance channels, and they are more willing to give up the potential profits held in the early ambush chain, while the original market participants, long-term investors, bitcoin supporters and institutional investors who have long been optimistic about Bitcoin are more. What is important is the long-term value of Bitcoin, because some institutions that are optimistic about Bitcoin in the early days have participated in it in other ways, for example, they have sold all their remaining positions and invested in Bitcoin futures instead of investing in Bitcoin gray scale, and they are also seeking to change to the fundamental technology development and market demand that they may be more focused on Bitcoin, which is relatively unaffected by short-term market fluctuations and approval news. According to the data observation on the chain of Ouke Cloud, we can see that these news are not. It has brought too much excitement to the ecology on the chain. In the past three months, the total number of addresses on the bitcoin chain has shown a linear upward trend. The average monthly growth rate is the same as that of the same period of last year. In addition, through the observation of the total number of active addresses, we find that it is not the high number of active addresses when the news about bitcoin broke out, but the relatively high number in the two time periods of year, month and year. The source of daily active addresses of bitcoin is blooming, and the era of barbaric growth has ceased to exist. Now that you plan to start again, even if the spot in the United States fails to pass the market, it will not return to the era of barbaric growth. It is said that there are currently eight markets in the world that allow the operation of spot cryptocurrency, including Canada, Germany and Switzerland, as well as tax havens such as Cayman Islands and Jersey, but it has not aroused the same passion as waiting for the spot approval in the United States. This also proves once again that the superposition effect brought by the opening of supply terminals and channels in the United States has a great impact on the market, which attracted much attention in the year when the story in the United States is confusing. Hong Kong has already taken that step, and on October, a number of circulars were issued to express that it is ready to accept the application for the recognition of virtual assets. Taking Hong Kong as an example, according to the annual private wealth management report, by the end of the year, the total value of assets managed by private banks and private wealth management in Hong Kong was HK$ 100 million. If there are funds through bitcoin spot, about US$ 100 million will flood into the market. According to Ou Ke Cloud Chain Research Institute, several financial institutions are planning to issue bitcoin spot in the first half of the year. The degree will also force the United States not to easily reject the ready-to-go spot comparison. There are two differences between Hong Kong and the United States about bitcoin spot, which are worthy of market attention. In the circular letter dated March, Hong Kong said that it would support the cash and physical models to provide investors with more choices. The United States adopts the strategy of compulsory cash redemption to reduce the risk of market manipulation. Cash redemption is also a disguised form of control, which will also squeeze its profit margin for risk-free arbitrage, because if. Trying to manipulate market prices through operations in the primary and secondary markets may lead to market instability. In addition, in the application for physical redemption, market makers can receive bitcoin in exchange for shares to improve tax efficiency. Financial institutions on the other side of the Pacific also hope to reach multiple channels. It is reported that they have sought approval for cash and physical redemption to take care of investors who already hold bitcoin but seek convenience in market transactions and taxation. At present, the United States has submitted an application for bitcoin, and plans to trade it in one of the three exchanges, Nasdaq Chicago Board Options Exchange and new york Stock Exchange, which accounts for the largest proportion. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。