超越 ETF:2024 年值得关注的加密货币创新

作者:Colton Dillion,coindesk 翻译:善欧巴,比特币买卖交易网

Hedgehog 首席执行官 Colton Dillion 表示,虽然目前大多数市场观察人士都关注比特币 ETF,但去中心化物理基础设施网络 (DePIN) 和真实世界资产 (RWA) 拥有很多长期前景。

新年伊始,万物焕新,一切皆有可能。然而,如果你四处打听,所有人都在谈论即将到来的现货比特币 ETF 批准。我们理解,这确实令人兴奋,并为散户投资者提供了接触数字资产的机会,而不必学习加密货币的任何艰涩部分。但此时,所有潜在的超额收益已被完全挖掘殆尽。

那么,我们还应该在哪里寻找生态系统的价值呢?

如果像我们 Hedgehog 一样相信各种数字资产的基础,那么围绕代币组合构建叙事并尝试识别将推动潜在资产需求的关键绩效指标可能会很有帮助。虽然过去的业绩并不能保证未来的回报,但 2023 年为我们在即将到来的年份识别未被认识的超额收益提供了经验教训。

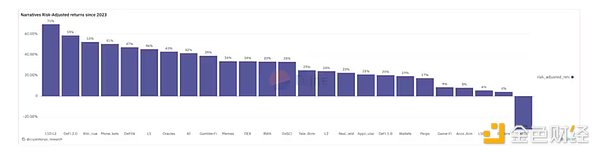

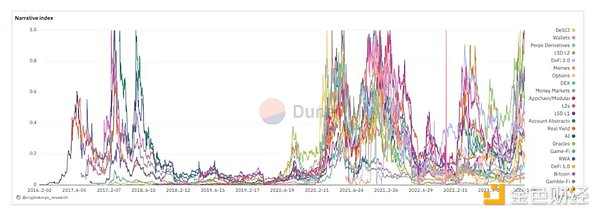

@cryptokoryo 的优秀团队完成了一项令人惊叹的工作,他们制作了一个 Dune 仪表盘,可以轻松监控各种资产篮子的表现,并选择了一些合理的默认设置,可以帮助您可视化您自己的叙事会是什么样子。

2023 年的主要赢家包括二层协议上的流动质押衍生代币 (例如 ALCX、ASX、PNDLE),紧随其后的是 DeFi 2.0 协议 (例如 DYDX、FXS、INST),这是唯一超越单纯持有比特币的叙事。然而,货币市场协议 (例如 AAVE、COMP、QI) 和去中心化物理基础设施网络 (“DePIN”,例如 FIL、RNDR、DIMO) 也紧随其后。

有人可能会推测,这些叙事统一的特点是杠杆和流动性的结合,这是为了产生比去年看到的 5% 国债利率更高的收益所必需的元素,也是在像区块链这样的共享数据库和运行时访问时本质上更优越的特征。

然而,DePIN 并不完全符合这一论点。也许,与去中心化科学 (“DeSci”,例如 VITA、HAIR、GROW) 和现实世界资产 (“RWAs”,例如 MKR、MPL、CPOOL) 等更具技术和监管敏感性的应用一起,这些应用最终开始随着主要硬件部署和许可里程碑的实现而加速发展,从而实现现实世界的采用。

关注开发者部署合约和周转代币库存的地方也很有帮助。许多以太坊交易量开始迁移到其 L2 链,那里的交易更快更便宜,许多人甚至开始宣扬 AppChain 论点,即未来将属于拥有自己的 L2 的独立应用程序,例如 Coinbase 的 BASE。根据最热门资产的价格走势,Avalanche、Arbitrum 和 Optimism 似乎显示出强劲的增长潜力。

无论你选择支持哪种论点,请记住,研发工作可能需要数年时间才能成熟并转化为终端消费者的采用。尽管我们像投机者一样喜欢猜测,但长期来看,稳健耐心的策略可以大幅提高你的收益。想想看,你需要持有比特币长达 15 年才能看到它整个增长轨迹!也许你的下一个论点也有类似的故事。

The CEO of Shanouba Bitcoin Trading Network said that although most market observers are concerned about bitcoin at present, decentralized physical infrastructure networks and real-world assets have many long-term prospects, and everything is possible at the beginning of the new year. However, if you ask around and everyone is talking about the upcoming spot bitcoin approval, we understand that this is really exciting and provides retail investors with opportunities to access digital assets without having to learn cryptocurrency. Any difficult part, but at this time all the potential excess returns have been completely excavated, so where should we look for the value of the ecosystem? If we believe in the foundation of various digital assets as we do, it may be very helpful to build a narrative around the token portfolio and try to identify the key performance indicators that will promote the demand for potential assets. Although past performance does not guarantee future returns, 2008 provides us with experience to identify the unrecognized excess returns in the coming year. The excellent team of Xun has done an amazing job. They have made a dashboard that can easily monitor the performance of various asset baskets and selected some reasonable default settings that can help you visualize what your own narrative will look like. The main winners in 2008 include the floating pledge derivative tokens on the second-tier agreement, for example, followed by the agreement, for example, which is the only narrative that goes beyond simply holding bitcoin. However, money market agreements such as decentralized physical infrastructure networks such as. Some people may speculate that the characteristics of these narrative unification are the combination of leverage and liquidity, which is an essential element to generate higher returns than the national debt interest rate seen last year, and it is also an essentially superior feature in shared databases and runtime access like blockchain, but it does not completely conform to this argument. Perhaps these applications, together with decentralized science and real-world assets, are more technically and administratively sensitive, and these applications finally begin to follow the main hardware. It is also helpful to accelerate the development by realizing the milestone of deployment and licensing, so as to realize the adoption of the real world. It is also helpful to pay attention to the developer's deployment contract and turnover token inventory. Many Ethereum transactions begin to migrate to its chain, where transactions are faster and cheaper. Many people even begin to preach the argument that the future will belong to their own independent applications, for example, according to the price trend of the hottest assets and it seems to show strong growth potential. No matter which argument you choose to support, please remember the research and development work. It may take several years to mature and transform into the adoption of end consumers. Although we like to guess like speculators, a steady and patient strategy can greatly improve your income in the long run. Think about it. You need to hold Bitcoin for years to see its entire growth trajectory. Maybe your next argument has a similar story. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。