加拿大比特币挖矿业:回望2023展望2024

2023年,全球比特币挖矿行业逐渐从2022年“加密冬季”的谷底中恢复。各种经济指标呈现出积极的转变:比特币价格上涨154%,上市矿企股票指数上升246%,而网络交易费用(自2021年中期以来基本处于休眠状态)也再次成为矿工收入的重要组成部分。此外,能源、托管和硬件相关的成本均有不同幅度的下降。

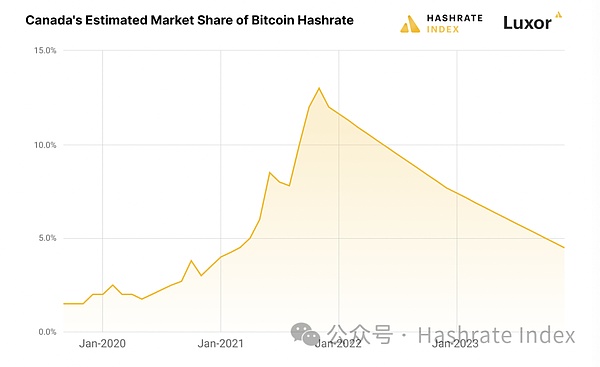

然而,加拿大比特币挖矿的局面却略显混乱。政府在2022年进行施压,实施了明确针对和歧视该行业的一些政策,这些政策在2023年仍然存在。如此一来使得整个行业被动处于防御姿态(阿尔伯塔省例外)。也正因如此,行业主要参与者们开始将目光转移到海外,寻求更有利的机会。对此,预计加拿大在比特币全球网络算力中的份额将从2022年末的7%-8%下降到4%-5%,相比2021年,降幅更是高达13%。

图一:加拿大比特币算力占比全球份额

经济大幅改善的2023年和“黑云”笼罩下的2024年

全球比特币挖矿行业在经历了艰难的2022年后,终于在2023年出现转机。下图显示比特币价格上涨了154%,几乎拉平了2022全年跌幅。

图二:比特币价格和挖矿难度走势图

真正的惊喜来自比特币网络交易费用的复苏。由于序数和铭文的开发,矿工在交易费用部分获得的收益大大提高。数据显示,2023年交易费用占比区块奖励达到了7.6%,而2022年仅为可怜的1.5%。

图三:交易费用占比区块奖励变化图

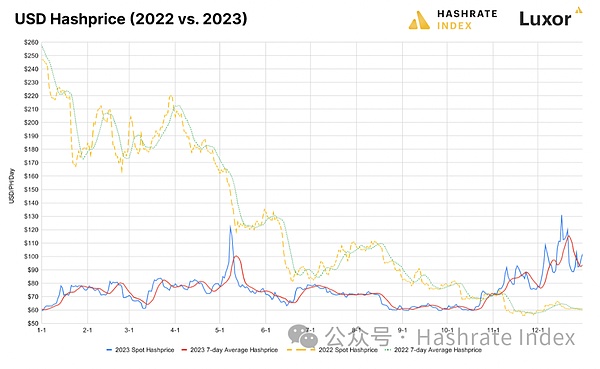

作为比特币矿工单位算力收益的综合度量,算力价格从59美元/PH/天升至至101美元/PH/天,幅度高达70%,原因是交易费用在五月和十二月出现显著波动。2023年的平均算力价格为75美元/PH/天。

图四:美元本位下算力价格变化一览

尽管2023年相对来说运势不错,但2024年的天空似乎并非那么晴朗,一朵“黑云“正飘在空中——比特币减半。这是一个每四年发生一次的事件,直接影响是会将区块补贴收入减半,二阶影响充满不确定性和争议性,无论是对比特币价格、网络难度还是交易费用来说。有人认为减半事件会推高币价;而其他人则指出,网络难度会因为算力的下降(由于部分利润较低的矿工关停业务导致)而降低。如果交易费用能够持续在较高水平(像在上一个减半事件中一样)那么这也可以抵消部分由区块补贴减半导致的收入损失。

然而,减半的主要影响是确定的。即比特币矿工将在短期内遭受重大的负面收入冲击。目前预计减半事件将在2024年4月21日左右发生。

政府监管继续危害挖矿业,加拿大各地发展受阻

2022年卡车司机抗议事件的发生,加上当时正值加密冬季的谷底,加拿大的矿业公司被特别针对,受到了极其不公平的行业政策监管。实质上,各级政府的政策制定者做的决定是错误的,他们将矿机与其他类型的计算机区分开来,对其征收特定税费、电费,以及互连规定。因此,在2023年,加拿大挖矿行业转变完全防御性立场,开始致力于建立认真、长期和协调的倡导挖矿行业的相关机构。

不幸的是,对于加拿大经济来说,糟糕的公共政策造成了该国的就业、投资和税收收入的损失。在国家层面上,加拿大政府在创造不确定性方面表现出了“高超”的技巧,从而在过程中对就业和投资造成了破坏。2022年2月,财政部在未事先通知挖矿行业的情况下,提出了一项“澄清”修正案,宣布数字资产挖掘在加拿大不属于“商业活动”。该提议将使所有数字资产挖掘公司无法获得所有其他出口企业可获得的输入销售税抵免。这项前所未有的提议将在加拿大比特币挖矿成本中产生5%-15%的隐性税收,并对在全球竞争市场中竞争的加拿大公司造成无法挽回的伤害。

幸运的是,在新成立的数字资产商务委员会和Hut8、Hive、Bitfarms、Iris Energy、Argo和DMG等成员公司的努力下,对应的解决方案出炉。尽管该提议成为法条,但立法者进行了修正,修正后矿工或将有权获得输入销售税抵免,前提是加拿大税务局在案件逐案审查中确定他们以与常规数据中心销售计算服务类似的方式向海外矿池出售算力,这应该适用于加拿大几乎所有的行业参与者。由于数亿美元的税收抵免、就业和投资均悬而未决,该行业当前仍在等待加拿大税务局的反馈和以及对于这些问题的逐案决定。预计将在2024年年初发布更新。

在不列颠哥伦比亚省、曼尼托巴省、魁北克省、新不伦瑞克省和纽芬兰和拉布拉多省,2022年的新互连禁令仍然有效。这些地区拥有世界上最清洁、最便宜和最丰富的电力资源,吸引了来自全球挖矿行业的投资。但这些省份却意外地选择关闭这扇业务的大门,而不是利用这个机会进行必要工作以简化申请评估并提高电网系统的灵活性。各省均表示担心用电量达到峰值,却忽略了(或是不理解)挖矿行业在能源使用方面的固有灵活性。但无论能源使用情况如何,这些禁令均没有用于任何其他类型的计算行业。

在不列颠哥伦比亚省,Conifex Timber寻求投资于挖矿行业,并对该省的禁令采取了法律行动。在一份公开发布的白皮书中,Conifex概述了省内内阁的行动违反了法律,干扰了监管体系,并实际上违反了政府自己制定的经济、碳减排和和解目标。

在这个具有挑战性的环境中,阿尔伯塔省成为了明显的异类。该省的选举官员认识到数字资产挖掘行业的好处,尤其是在创造高科技就业机会方面(特别是对农村和偏远地区而言),另外在环境和能源系统可持续方面也极具潜力。他们正在积极争取投资并鼓励经济发展。7月,总理Danielle Smith和部长Dale Nally参加了Stampede加拿大区块链联盟的比特币挖掘贸易交流会,而Nate Glubish部长在“Bitcoin Rodeo”上讲述了挖矿的好处。Dale Nally部长更是参加了加拿大区块链联盟的第二届年度德克萨斯贸易交流会。

在安大略省,能源部似乎已经放弃了2022年排除加密货币挖掘者参加ICI的计划。ICI是一项电力节能计划,允许参与者在五个峰值用电小时内减少用电需求,从而降低其全球调整成本。

加拿大矿工韧性十足,开拓新市场

政策管理不善无法阻止加拿大公司进行创新并进入新市场。

也许最值得注意的是,Hut8在11月完成了行业历史上最大的并购交易,与US Bitcoin Corp进行了全股票合并。合并后的公司New Hut将设在美国,并凭借大约825兆瓦的总发电量成为北美最大的自主挖矿和高性能计算设施运作者之一。

其他以清洁能源为重点的矿企,如Hive和Bitfarms在加拿大以外进行了业务扩张。Bitfarms获得了在阿根廷使用100兆瓦挖矿设施的许可,并获得了在巴拉圭可使用高达150兆瓦的水力发电合同,而Hive在年底完成了对瑞典一家水力发电数据中心的收购。

在硬件方面,我们在2023年看到了一些值得注意的合作。在经过数月的规划、工程开发、实施工厂流程、现场测试和全球协作后,Hive在1月部署了由英特尔的Blockscale ASIC提供动力的BuzzMiner。在今年晚些时候,总部位于多伦多的ePIC Blockchain宣布与Chain Reaction合作,生产ePIC的下一代挖矿系统以用于比特币开采。

矿业公司在2023年进入了新的收入增长领域。DMG通过涉足铭文和序数领域扩大了其业务,并成为该市场的领导者。Hut8与不列颠哥伦比亚省南部的Interior Health签订了一项协议,为其提供安全的合租服务,展现了其比特币开采领域外的扩张。与此同时,Iris Energy开始进军人工智能市场,展示了其扩大其产品和扩展其高性能计算数据中心战略的承诺。

BlockLAB引入了一种创新系统,自2022年开始试点以来,通过利用比特币开采过程中产生的多余热量,为温室运营提供了一种环保和低成本的供暖解决方案。此外,像Upstream Data、CryptoTherm、Bit-Ram和Intelliflex这样的集装箱制造商在北美继续保持其创新的风冷和水冷系统的领导地位。

图五:2023年加拿大比特币挖矿行业要闻

2024年,比特币矿工须迎接挑战并寻求机会

尽管比特币价格和交易费用的反弹为矿工提供了急需的缓解,但即将到来的减半事件将使行业的注意力集中在最终盈亏上。尽管比特币价格、网络难度和交易费用的走向仍不确定,但区块奖励减半是确定的,这将是一个重大的负面收入冲击。为了生存,公司需要降低成本,提高效率并保护利润。

在政策方面,除了阿尔伯塔省以外,其他地区情况改善的可能性不是很大。不幸的是,联邦自由党并不认为数字资产行业是经济机会,而是将其视为攻击其对立党的机会。比特币价格的反弹或将改变选举计算,但根据民意调查,Justin Trudeau和自由党将继续攻击Pierre Poilievre和保守党对数字资产行业的支持。在省级层面上,官僚惯性将使得在2024年推翻禁令变得不太可能。要想省级政府和电网运营商了解到该行业的好处仍将需要投入大量的时间和精力。

尽管如此,我们认为,在加拿大建立认真、长期和协调的倡导机构是一项值得投资的事业。归根结底,凭借丰富、低成本和可持续的能源;高度熟练的劳动力;寒冷的气候;未充分利用的工业基础设施(特别是在农村地区);以及相对稳定、安全的政治环境,加拿大被自然地定位为加密货币开采行业和其他功率密集型计算行业的领导者。

如果要说民意调查是否表明任何迹象,那应该就是政治变革的即将到来。为了利用好这一机会,挖矿行业要继续表明其价值,矿工应创造更多就业机会,包括硬件制造商、基础设施提供商和软件工程师等。他们将为当地社区带来投资,尤其是在机会有限和行业基础设施未被充分利用的农村或偏远地区。另外,矿工们对被燃烧或排放的废弃天然气进行充分利用、通过需求响应支持电网稳定和实现新的可再生能源发电资产的建设,这无疑提高了环境和能源系统的效率和可持续性。也许最重要的是,他们将加拿大被困的能源输送到国际市场,而无需物理输电线或管道基础设施,因为算力是通过互联网出售的。

2024 年及以后,加拿大在加密货币开采方面能否取得成功,将取决于该行业能否通过降低成本、提高效率来实现收益,以及能否继续教育公众和政策制定者,让他们了解合理进行加密货币开采的好处并试着去接受。

In, the global bitcoin mining industry gradually recovered from the bottom of the encrypted winter in, and various economic indicators showed a positive change. The price of bitcoin rose, the stock index of listed mining enterprises rose, and the online transaction cost was basically dormant since the middle of the year, which once again became an important part of miners' income. In addition, the costs related to energy custody and hardware decreased in different degrees. However, the situation of bitcoin mining in Canada was slightly chaotic, and the government put pressure on and implemented clear targeting and discrimination in. Some policies of the industry still exist in 2008, which made the whole industry passive in a defensive posture, except Alberta. It is precisely because of this that the main participants in the industry began to look overseas for more favorable opportunities. It is expected that Canada's share of bitcoin global network computing power will drop from the end of the year to the year compared with the previous year, and the decline is even higher. Figure 1 shows that Canada's bitcoin computing power accounts for a significant improvement in the global share economy and global bitcoin mining in 2008 under the shadow of black clouds. After a difficult year, the industry finally took a turn for the better in 2008. The following figure shows that the price of bitcoin has risen, which almost leveled the annual decline. Figure 2 shows the trend of bitcoin price and mining difficulty. The real surprise comes from the recovery of bitcoin network transaction costs. Due to the development of ordinal numbers and inscriptions, the miners' income in the transaction costs has greatly increased. The data shows that the annual transaction costs account for the proportion of block rewards, but the year is only poor. Figure 3 shows the change of transaction costs as a bitcoin miner unit. A comprehensive measure of the income of computing power, the computing power price rose from USD to USD. The reason is that the transaction cost fluctuated significantly in May and December. The average computing power price in the year was USD. The list of the changes of computing power price under the standard of USD 4. Although the year was relatively lucky, the sky in 2008 did not seem so clear. A black cloud was floating in the air, and Bitcoin was halved. This is an event that happens every four years. The direct impact is that the subsidy income in the block will be halved. The second-order impact is full of uncertainty. Some people think that halving the price of bitcoin will push up the price of bitcoin, while others point out that the difficulty of the network will be reduced because of the decrease of computing power and the closure of some miners with low profits. If the transaction cost can continue to be at a high level, as in the last halving event, it can also offset some of the income losses caused by halving the block subsidies. However, the main impact of halving is certain, that is, bitcoin miners will be in the short term. At present, it is expected that the event of halving the income will occur around June, and the government supervision will continue to endanger the mining industry. In addition, the truck drivers' protests occurred in the year when the development of various parts of Canada was blocked. At that time, the mining companies in Canada were particularly targeted at the extremely unfair industrial policy supervision. In fact, the decision made by policy makers at all levels of government was wrong. They distinguished mining machines from other types of computers and imposed specific taxes and electricity charges on them. As well as interconnection regulations, Canada's mining industry changed its completely defensive stance in and began to devote itself to establishing serious, long-term and coordinated institutions to advocate the mining industry. Unfortunately, for the Canadian economy, poor public policies caused the loss of employment, investment and tax revenue in the country. At the national level, the Canadian government showed superb skills in creating uncertainty, which caused damage to employment and investment in the process. In September, the Ministry of Finance did not notify the mining industry in advance. A clarification amendment is proposed to declare that digital asset mining is not a commercial activity in Canada. This proposal will make it impossible for all digital asset mining companies to obtain the import sales tax credit available to all other export enterprises. This unprecedented proposal will generate hidden taxes on the cost of bitcoin mining in Canada and cause irreparable harm to Canadian companies competing in the global competitive market. Fortunately, in the newly established Digital Asset Business Committee and other member companies, Thanks to the efforts of our company, the corresponding solution is released. Although the proposal has become a law, the legislators have amended it, and the miners will have the right to get the import sales tax credit, provided that the Canadian Taxation Bureau determines in the case-by-case review that they sell computing power to overseas mining pools in a way similar to that of the conventional data center. This should apply to almost all industry participants in Canada, and the industry is still waiting for Canada because hundreds of millions of dollars of tax credits for employment and investment are pending. The feedback from the Inland Revenue Department and the case-by-case decisions on these issues are expected to be updated at the beginning of the year. The new interconnection bans in Manitoba, British Columbia, Quebec, New Brunswick and Newfoundland and Labrador are still in effect. These areas have the cleanest, cheapest and richest power resources in the world, attracting investment from the global mining industry, but these provinces unexpectedly choose to close the door of this business instead of taking this opportunity to carry out necessary work to simplify it. Apply for evaluation and improve the flexibility of the power grid system. All provinces expressed concern about the peak of electricity consumption, but ignored or did not understand the inherent flexibility of the mining industry in energy use. However, regardless of the energy use situation, these bans were not used in any other type of computing industry. In British Columbia, they sought to invest in the mining industry and took legal action against the ban in the province. In a publicly released white paper, they summarized that the actions of the cabinet in the province violated the law and interfered with supervision. The system actually violates the government's own economic carbon emission reduction and reconciliation goals. In this challenging environment, Alberta has become an obvious heterogeneous province. The election officials in this province realize the benefits of the digital asset mining industry, especially in creating high-tech employment opportunities, especially in rural and remote areas, and also have great potential in environmental and energy system sustainability. They are actively striving for investment and encouraging the Prime Minister and ministers to participate in the Canadian block. The Bitcoin Mining Trade Fair of the Chain Alliance and the Minister talked about the benefits of mining in the forum. The Minister even participated in the second annual Texas Trade Fair of the Canadian Blockchain Alliance. In Ontario, the Ministry of Energy seems to have given up the plan of excluding cryptocurrency miners in 2008. It is an energy-saving plan that allows participants to reduce the demand for electricity within five peak hours, thus reducing their global adjustment costs. Canadian miners are resilient, open up new markets, and poor policy management cannot prevent Canadian companies from innovating and entering new markets. Perhaps the most notable thing is that they completed the largest in the history of the industry in June. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。