比特币价格为何陷入停滞?

作者:Yashu Gola,cointelegraph 翻译:善欧巴,比特币买卖交易网

比特币价格陷于盘整,市场氛围呈现拉锯状态,一方面机构投资增加带来乐观情绪,另一方面矿工潜在抛售的担忧则构成压力。

比特币 (BTC) 价格区间震荡,反映出市场参与者对上周现货比特币 ETF 批准后的不确定性和犹豫不决。

截至 1 月 16 日,BTC 价格一直徘徊在 41,550 美元和 43,000 美元之间。这种停滞状态一直持续,尽管月初曾短暂突破49,000 美元高点,随后又回落至当前区间。

比特币价格的平稳可归因于下面讨论的几个因素。

对比特币 ETF 批准反应平淡

比特币突破 49,000 美元似乎是美国批准了包括 BlackRock 和 Fidelity 在内的 11 个现货 BTC ETF 之后出现的。然而,此后价格下跌了约 10%,这是部分分析师预期到的情况。

这表明市场已经大体将获批计入价格。ETF 批准后没有出现明显的反弹,表明投资者已经相应调整了预期。

比特币市场主导地位下滑

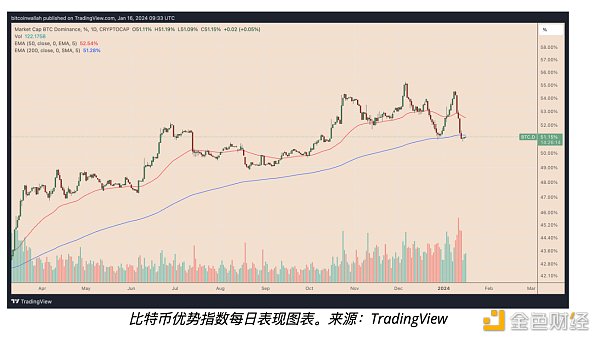

比特币的市场主导地位指数在一周内从 54.56% 的局部高点下降到 51.14%。

以太坊上涨

比特币主导地位下降的主要原因是 ETH 上涨 8.5%,其他山寨币也出现了类似涨幅。这表明,在 ETF 批准后,交易员可能将资金从比特币转移到山寨币市场,他们认为其他地方的风险回报率更高,尤其是在以太坊 ETF 即将面市的情况下。

基本面前景喜忧参半

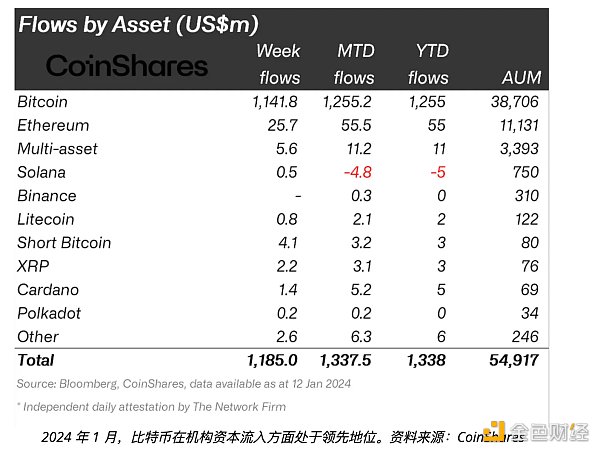

比特币的一个重要的积极市场指标是流入比特币投资基金的资本不断增加,特别是在人们对现货比特币 ETF 日益兴奋的情况下。

这些比特币基金在 2024 年前两周吸引了机构投资者的 12.5 亿美元,几乎是上一年全年的 55%。这种涌入凸显了机构参与者对比特币长期价值和潜力的强烈信心。

然而,抵消这一看涨基本面的是矿商。

人们越来越担心比特币挖矿哈希率的提高可能会导致矿工更快地出售他们的比特币。 一些人预计, 2024年4月减半后, 比特币挖矿成本将大幅上升,可能会给比特币价格带来压力

截至目前,比特币矿工已将价值超过 10 亿美元的比特币转移到加密货币交易所。

韩国人买,美国人卖

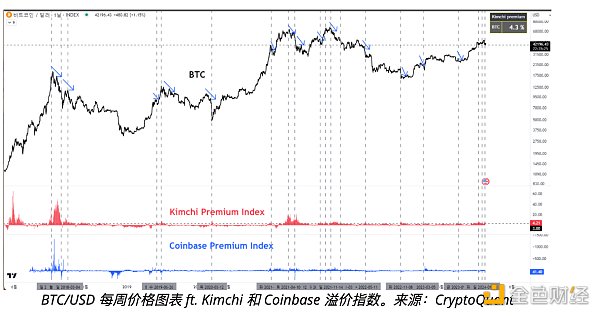

当前比特币价格横盘走势与韩国增加购买以抵消美国抛售的明显趋势同时发生。泡菜溢价指数是衡量韩国和全球加密货币交易所之间比特币价格差异的指标,表明比特币在韩国的交易溢价为 3-4%。

与此同时,Coinbase 溢价指数(该指数将 Coinbase Pro 上的美元比特币价格与 Binance 上的 USDT 价格进行比较)已转为负值,表明美国卖家多于买家。

中性相对强弱指数

从技术角度来看,比特币的区间价格走势与其每日相对强弱指数(RSI)回归中性区域一致。

当同时观察这两种情况时,通常表明市场情绪正在达到平衡,多头(买方)和空头(卖方)都无法控制。

投资者可能会在采取重大举措之前等待更多信息,从而导致波动性降低和价格方向性波动减少。

On the one hand, the increase of institutional investment brings optimism, on the other hand, the fear of potential selling by miners constitutes pressure. The fluctuation of bitcoin price range reflects the uncertainty and hesitation of market participants after the approval of spot bitcoin last week. As of March, the price has been hovering between the US dollar and the US dollar, and this stagnation has continued, although it briefly broke through the high point of the US dollar at the beginning of the month and then fell back. The stability of bitcoin price in the current range can be attributed to the following factors: the reaction to bitcoin approval is flat. Bitcoin broke through the US dollar, which seems to have appeared after the US approved 20 spot, including and. However, since then, the price has dropped by about, which is what some analysts expected. This shows that the market has been generally approved and included in the price approval, and there has been no obvious rebound, which indicates that investors have adjusted the expected decline of bitcoin market dominance accordingly. In a week, the index dropped from a local high to the rise of Ethereum. The main reason for the decline of Bitcoin's dominant position is the rise, and other counterfeit coins have also experienced similar increases. This indicates that traders may transfer their funds from Bitcoin to the counterfeit currency market after approval. They think that the risk return rate in other places is higher, especially when Ethereum is about to go on the market. An important positive market indicator of Bitcoin is the increasing capital flowing into Bitcoin investment funds. However, under the circumstance that people are increasingly excited about spot bitcoin, these bitcoin funds attracted hundreds of millions of dollars from institutional investors in the first two weeks of last year, almost the whole year of last year. This influx highlighted the strong confidence of institutional participants in the long-term value and potential of bitcoin. However, to offset this bullish fundamentals, miners are increasingly worried that the increase in the hash rate of bitcoin mining may lead miners to sell their bitcoins faster. Some people expect that the cost of bitcoin mining will be greatly increased after the year is halved. Up to now, bitcoin miners have transferred more than $100 million worth of bitcoin to cryptocurrency exchanges. Koreans buy Americans and sell them. The current sideways trend of bitcoin prices coincides with the obvious trend of increasing purchases in South Korea to offset the selling in the United States. The kimchi premium index is an indicator to measure the difference in bitcoin prices between South Korea and global cryptocurrency exchanges, indicating that the transaction premium of bitcoin in South Korea is US dollars at the same time. The price of Bitcoin has turned negative compared with the price on the Internet, indicating that there are more sellers in the United States than buyers. From a technical point of view, the interval price trend of Bitcoin is consistent with its daily relative strength index returning to the neutral region. When observing these two situations at the same time, it usually indicates that the market sentiment is reaching a balance, and both long buyers and short sellers can't control it. Investors may wait for more information before taking major measures, resulting in reduced volatility and price directional fluctuations. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。